Bitcoin (BTC) “will bust out significantly” within the next month, by having an upside target of $30,000.

Which was the most recent conjecture from Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight.

Analyst on November cost target: “My prediction is most likely $30K”

Inside a tweet on March. 25, Van de Poppe became a member of an increasing number of analysts delivering bullish BTC cost forecasts.

BTC/USD is presently marked with a distinct insufficient volatility, but signs are flowing for the reason that the sideways trend arrives a significant shake-up.

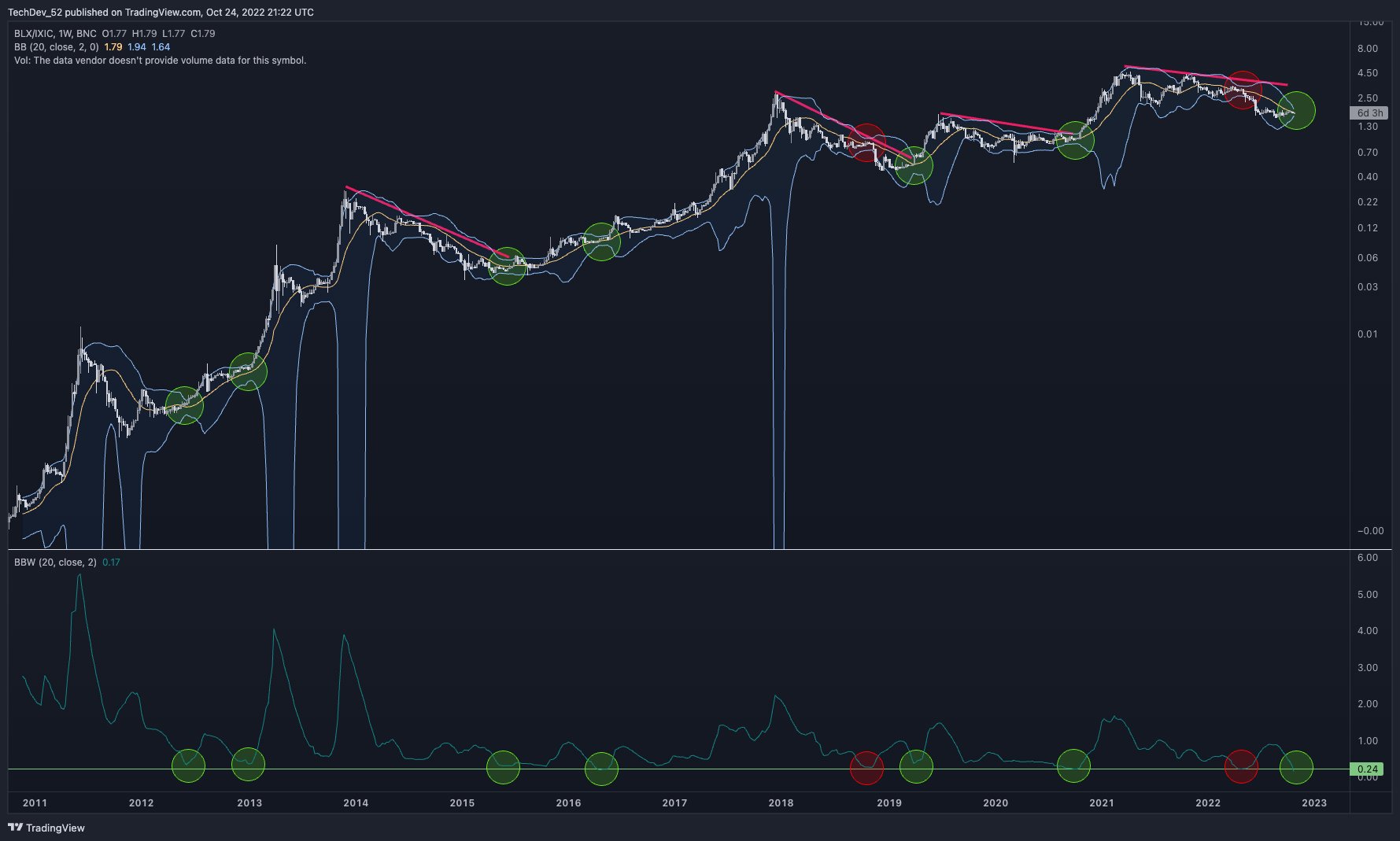

Bitcoin’s Bollinger Bands in comparison to the Nasdaq would be the tightest ever, popular analyst TechDev yet others confirmed in recent days, this basically guaranteeing an explosive proceed to come.

“Price versus. NASDAQ peaked at BTC’s last impulse top in April 2021 and it has been consolidating throughout the 1.5 year correction,” he authored included in commentary.

“Expect upside break and powerful Bitcoin outperformance soon.”

For Van de Poppe, upside potential is really a more appealing bet than further bearish behavior, with BTC/USD set to include around 35% within the coming days.

“Within 2-3 days, Bitcoin will bust out considerably. My take may be the upside,” he mentioned.

“My guess is most likely $30K.”

This type of breakout would exceed the relief rally target from popular pundit Il Capo of Crypto, this being in position for several weeks and hang at $21,000.

Just before Wall Street buying and selling beginning, however, he acknowledged the $21,000 zone may seem “this week.”

“Market searching great for a final advantage. Greater highs and greater lows on ltf and demand being increased,” he tweeted.

Old hands fuel latest Bitcoin bull situation

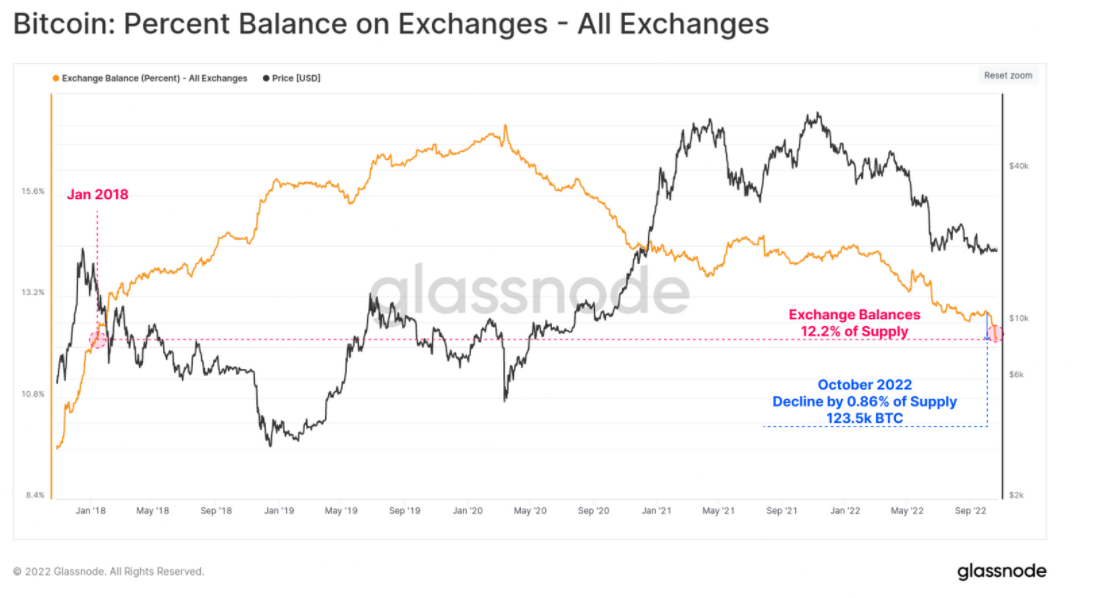

Aiming its very own bull situation for Bitcoin, meanwhile, on-chain analytics firm Glassnode placed the main focus on lengthy-term holders (LTHs) and exchange buyers.

Related: Least volatile ‘Uptober’ ever — 5 items to know in Bitcoin now

Exchanges are seeing significant amounts of BTC leave their books, while hodlers are set on not selling, it described now — reported by Cointelegraph.

“The Bull Situation requires a take on the HODLers of last measure, whereby the availability flows from exchanges, and into HODLer wallets reaches an exciting-time-high,” the most recent edition of Glassnode’s weekly e-newsletter, “A Few Days On-Chain,” summarized.

“Despite being small in relative number, the conviction of Bitcoins die-hard believers is unshaken, as well as their balance keeps growing, through the years.”

Longer-term perspectives on Bitcoin have continued to be high, having a $two million conjecture by 2028 arriving this month.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.