Analysts both in crypto and traditional markets have noted some startling similarities between your recent downturn and also the one the result of a pandemic panic in March 2020.

The question for you is whether it’s the beginning of a bigger downturn or maybe you will see a substantial bounce-back as with 2020 that brought for an extended bull run both in crypto and stocks markets.

Podcaster and author from the Pomp Letter, Anthony “Pomp” Pompliano, is around the permabull side from the ledger, tweeting on Wednesday that since March 1, 2020, when one Bitcoin cost about $8,545, “Bitcoin expires 340%.”

Bitcoin expires 340% since March 1, 2020.

As central banks all over the world devalued their currencies in a historic rate, there’s just one asset that was out of the pack.#bitcoin may be the savings technology that shields vast amounts of individuals from undisciplined financial policy.

— Pomp (@APompliano) May 17, 2022

Among individuals hopeful of the turnaround is investment firm Real Vision’s Chief executive officer Raoul Pal, who believes Bitcoin (BTC) markets happen to be painting a design that shares traits using the March 2020 crash.

In the Friday episode of Raoul Pal Adventures in Crypto, Pal described by using the downward cost action a week ago, Bitcoin may have “shot straight down” to the foot of the present wedge formation and it is now inside a range which will eventually result in another increase in cost. He stated:

“That was exactly the type of pattern we’d in March 2020.”

On March 12, 2020, investors panic-offered many assets, including Bitcoin, as anxiety about the way the market could be influenced by the COVID-19 pandemic and global lockdowns. Tomorrow, Bitcoin fell 45% from $7,935 to $5,142, according to CoinGecko.

The present loss of traditional markets has brought to some lack of $7.6 trillion in market cap in the tech-heavy Nasdaq, in non-inflation adjusted terms, greater than the us dot-com bubble and also the March 2020 sell-offs.

The figures are clearly not adjusted for inflation but nonetheless mind-blowing to determine within this context. pic.twitter.com/aHem93mhpo

— Mati Greenspan (@MatiGreenspan) May 17, 2022

The Crypto Fear and Avarice Index stepped to eight on Tuesday, the cheapest since March 2020.

#Crypto fear & avarice index reaches 8 from 100.

The cheapest number because the COVID-19 crash in March 2020. pic.twitter.com/jKVTcjrXV1

— Michaël van de Poppe (@CryptoMichNL) May 17, 2022

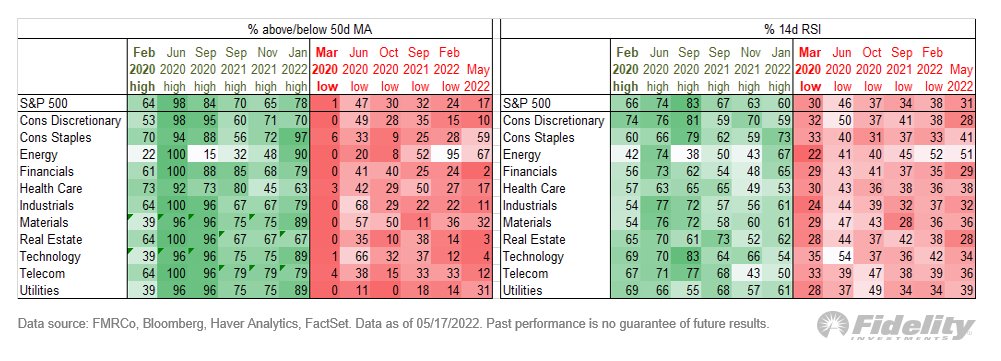

The 50-day moving average (MA) of financials, property and technology investments is near to the overwhelmingly oversold levels seen approximately 2 yrs ago. In March 2020, correspondingly, individuals levels were , , and 1 when compared with 2, 3, and 4 to date in May, according to data from Fidelity Investments. Inside a Wednesday tweet, Fidelity’s own director of worldwide Macro Jurrien Timmer known as March 2020 “one of the very most oversold setups within the good reputation for the marketplace.”

Managing partner in the Future Fund Gary Black stated that Tesla stocks are buying and selling in a 20% discount, the largest from analyst target cost since March 2020. He added that “over the following 12 several weeks, $TSLA rose 660%.”

The final time $TSLA traded only at that wide a price reduction (25%) versus the avg Street PT ($984) is at March 2020, in the height from the Covid crisis. Within the next 12 several weeks, $TSLA rose 660%. Source: https://t.co/5fcVwWX78i pic.twitter.com/z2AHe5zkVi

— Gary Black (@garyblack00) May 16, 2022

The S&P 500 Index also displays similarities, because it recorded a 52-week low of three,930 on May 12 simply to recover to 4,088 by market close . Chief market strategist for financial research firm LPL Research noticed in a Wednesday tweet the before the index tried which was in March 2020.

The S&P 500 just designed a 2% grow in two past 72 hours coming from a 52-week low.

The final occasions that happened?

March 2009 and March 2020.

— Ryan Detrick, CMT (@RyanDetrick) May 17, 2022

Before traders get too excited, market conditions are not the same now, with rising inflation and rates of interest. In those days, governments reacted with unparalleled support packages to support prices. Reuters reported on Saturday the strong bounce on the market in 2020 was fueled in what it known as an “unprecedented Given stimulus.”

Analyst and author from the Rekt Capital E-newsletter, Rekt Capital tweeted that BTC “is entering a time period of outsized opportunity” according to research into the Log Funnel that they states resembles what went down in March 2020. However, he is not obvious if we’ve bottomed out yet.

Related: Fear & Avarice Index hits cheapest since March 2020 even while Bitcoin cost hits $30.5K

Before #BTC lost the Log Funnel is at March 2020

This is where $BTC also dipped underneath the blue 200-SMA

Log Funnel reveals BTC is entering a time period of outsized chance

But does cost have to drop as little as towards the 200-SMA to totally bottom?#Crypto #Bitcoin pic.twitter.com/hTxwfWYdkH

— Rekt Capital (@rektcapital) May 16, 2022

As of times of writing, Bitcoin expires 1.1% in the last 24 hrs buying and selling at $30,545 during the time of writing.