From the historic perspective, losing in value recognized over the cryptocurrency market in the last several several weeks continues to be one for that record books and also the total cryptocurrency market cap has declined from $3 trillion to $991 million.

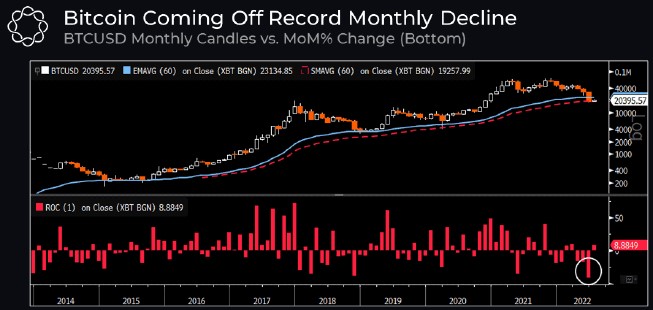

June was especially painful for investors following the cost of Bitcoin (BTC) fell nearly 40% to mark certainly one of its worst calendar several weeks on record based on a current report from cryptocurrency research firm Delphi Digital.

Considering the strong market correction, numerous BTC cost as well as on-chain metrics have started to achieve levels much like individuals seen during previous market bottoms, however this doesn’t mean traders should be expecting a turnaround in the near future because history implies that periods of weakness can continue for several weeks on finish.

Macro headwinds weigh on BTC cost

Probably the most significant factors weighing on cryptocurrencies along with other risk assets continues to be the effectiveness of the U . s . States Dollar.

Coupled with rising inflation and falling economic indicators, DXY strength is really a signal that the economic slowdown is basically inevitable, with forecasts now predicting an economic depression at the begining of to mid-2023.

From this backdrop, BTC now finds itself attempting to create a local bottom round the 2017 cycle high near $20,000, “the last obvious structural support around the high time-frame bitcoin chart.”

This current cycle marks the very first time in Bitcoin’s history that it is cost has fallen underneath the all-time high set throughout a previous bull market cycle. Should BTC neglect to hold support near $20,000, Delphi Digital pointed for an expected “support around ~$15K, after which ~$9K to $12K in the event that level unsuccessful to carry.”

While individuals estimates may appear bleak, it ought to be noted that BTC cost fell roughly 85% from peak to trough during each one of the previous two major bear markets.

When the same would occur throughout the current bear market cycle, that will put BTC at $10,000, marking another 50% drawdown in the current levels and falling using the 2018 to 2019 cost range.

Because of this, analysts at Delphi Digital think that “there’s still more discomfort ahead for risk assets.”

Related: Bitcoin risks new lows as $20K looms among dollar euro parity

Where’s the underside?

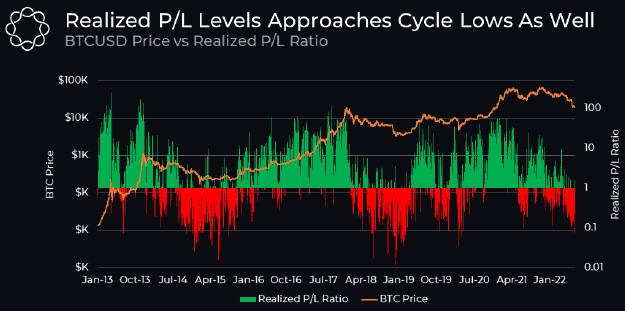

The proportion of Bitcoin supply locked in profit and Bitcoin’s recognized profit/loss ratio are nearing levels seen during previous bear markets, but each one has “a little more room to go” before they achieve their lows with this cycle based on Delphi Digital.

Based on the firm, “momentum indicators and valuation metrics usually stays oversold or undervalued to have an long time,” causing them to be “poor timing tools” that aren’t able to predicting immediate reversals.

Contrarian investors might should also keep close track of the marketplace sentiment along with the Fear and Avarice Index that has now arrived at historic lows.

With regards to a possible proceed to the upside, Delphi Digital established that “BTC has room above because of the previous liquidation cascade within the wake of 3AC,” and identified the following major level of resistance as $28,000.

Delphi Digital stated,

“BTC will probably still consolidate until we obtain some type of macro catalyst.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.