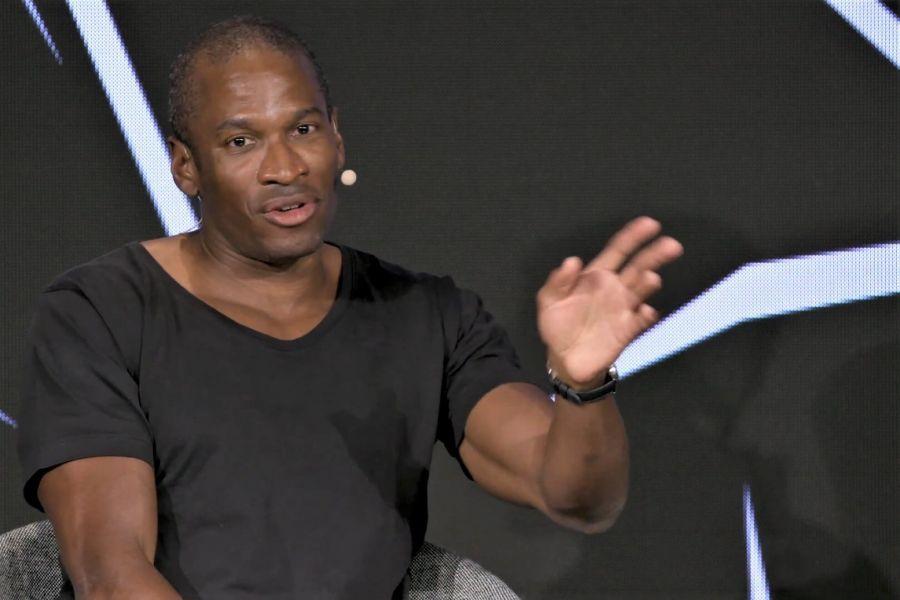

Using the cost of bitcoin (BTC) falling lower, former BitMEX Chief executive officer Arthur Hayes is joining the ranks of the very most bullish bitcoin proponents, having a USD 1m cost conjecture included in what he calls “the disaster loop” that began with sanctioning Russia over its invasion of Ukraine.

“The shock of canceling the world’s largest energy producer in the dominant Western economic climate can’t be un-tied,” Hayes authored inside a new extended essay entitled The Disaster Loop.

He added that policymakers cannot ignore what he known as “the precarious nature” of funds held by means of Western fiat after Western governments made the decision to freeze Russian central bank reserves, and stated the Disaster Loop’s occurrence therefore “is assured.”

“The Disaster Loop will usher in USD a million Bitcoin and USD 10,000 — USD 20,000 gold through the finish from the decade,” Hayes authored.

Explaining exactly what the disaster loop is, the blunt former exchange Chief executive officer stated the loop starts when nations with trade surpluses start to invest their surplus into hard assets for example bitcoin, gold, along with other goods, instead of USD-denominated debt assets.

Hayes predicts this will pressure central banks in countries with deficits – mainly the united states and also the Eu – to take part in so-known as yield curve control.

Yield curve control involves an attempt by central banks to cap yields so the government could purchase itself in nominal fiat currency terms. It’s thus a means for that government to inflate away debt instead of default onto it.

And based on Hayes, it’s yield curve control which get us a bitcoin cost of USD 1m “by the finish from the decade.”

“[Yield curve control] may be the finish game. When it’s finally unconditionally or clearly declared, it’s game over for the need for the USD versus. gold and most importantly Bitcoin,” Hayes authored.

Even though he accepted that lots of readers will probably find to this point-fetched, he stated yield curve control is “coming earlier than you think” because of actions taken by Western governments on sanctions against Russia.

Particularly, Hayes also stated that even when nation-states with surpluses avoid bitcoin and rather invest all their surpluses into gold, this can necessitate yield curve control in Western nations. And when this starts, a bitcoin cost of USD 1m is within play, he repeated.

‘The EU is finished’

Similarly, Hayes pointed to a different scenario that’s and in play that may bring bitcoin towards the USD 1m target: the breakup from the EU.

Based on Hayes, the European Central Bank (ECB) will have to print money to make sure citizens can continue to afford requirements like food and when confronted with a halt in supplies from Russia. Of course, however, money printing results in inflation, which can result in divisions between EU member states within the south and north.

“The ECB is trapped, the EU is completed, and inside the decade we are buying and selling Lira, Drachmas, and Deutschmarks once again,” Hayes authored.

Lira, Drachmas, and Deutschmarks were the nation’s fiat currencies of Italia, A holiday in greece, and Germany before most EU countries adopted the euro his or her single currency.

“As the union disintegrates, money will be printed in glorious quantities inside a pantheon of various local currencies. Hyperinflation isn’t from the table. And again, as European savers smell exactly what the rock is cookin’, they’ll flee into hard assets like gold and Bitcoin. The breakup from the EU = $a million Bitcoin,” Hayes authored.

And not the first USD 1m per BTC call

The most recent predictions from Hayes imply that the previous crypto exchange Chief executive officer has became a member of the ranks of numerous bitcoin proponents who argue for any USD 1m BTC cost target.

Possibly noticably included in this, Ark Investment Management, the fund brought through the well-known technology investor Cathie Wood, states it believes BTC will achieve USD 1m or even more by 2030.

A substantial driver for this is demand from investors within the controlled area of the economy as increasing numbers of bitcoin-based investment products become available, with a lot more demand from use cases like remittances, nation-condition treasuries, corporate treasuries, so that as a currency in emerging markets, the firm stated.

Meanwhile, at 10:45 UTC, BTC traded around USD 39,100 and it was lower 3% per day, 6% per week. Additionally, it dropped 16% inside a month and 28% each year.

____

Find out more:

– Bitcoin Cost Forecast for 2022 Cut Once More as Break ‘Only’ Above USD 80K Now Expected

– Get ‘Mentally Ready’ for Lower Bitcoin Prices as Rates Rise, Bitcoin 2022 Panelists Warn

– When Bitcoin Meets Inflation

– When the Given Pauses, Bitcoin is ‘Going towards the Moon,’ Novogratz States

– Hayes States He Aims to Rebalance Portfolio in support of Ethereum, Sets New Cost Target for ETH

– Freezing Russian Reserve Assets Marks Finish of Financial Regime Gold, Bitcoin to increase – Arthur Hayes