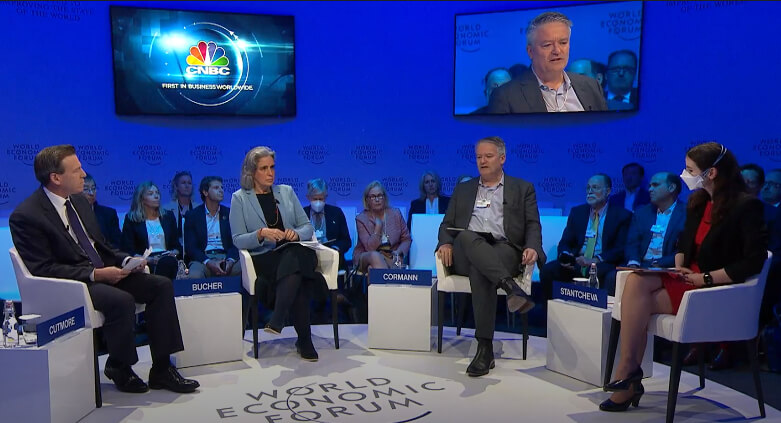

Source: a relevant video screenshot / weforum.org

Civilized world from around the globe are moving towards elevated fiscal cooperation that can lead to tighter taxation of corporations but additionally of private assets underneath the so-known as wealth tax, as shown by the participants of the panel held in this year’s edition from the World Economic Forum in Davos. This development can lead to the tightening from the world’s fiscal regimes on crypto assets and crypto companies, amongst others.

The panel, A Reimagined Global Tax System, was covered with voices in support of greater wealth and capital taxation. The panelists commented around the October 2021 worldwide agreement on base erosion and profit shifting (BEPS) that has to date been became a member of by 141 countries and jurisdictions, all pledging to apply a 15% global minimum corporate tax rate.

Mathias Cormann, Secretary-General from the Organisation for Economic Co-operation and Development (OECD), stated that new regulatory measures are needed to allow the tax administrations around the globe to completely enforce their tax laws and regulations on major players.

“In my estimation, it’s within the rational interest from the U . s . States to participate the offer,” Cormann stated, replying to some question in the audience around the potential implications of the Republican takeover of Congress when Americans elect new lawmakers this November.

Stefanie Stantcheva, Nathaniel Ropes Professor of Political Economy at Harvard College, contended that there’s an increasing drive between states to harmonize their tax policies to shut fiscal loopholes that permit capital to prevent taxation.

“I think this global tax agreement is incorporated in the spirit of taxing capital better,” she stated, adding that elevated fiscal cooperation between various countries “is really important to allow better enforcement.”

Gabriela Bucher, Executive Director at non-governmental organization Oxfam Worldwide, stated that there’s an excuse for a worldwide asset registry that might be transparent, allowing the insightful individuals around the globe to become taxed. There’s several countries that tax individual assets, however in 2017, only 4% from the total collected taxes were generated by wealth taxation, she stated.

“There was once more countries which had them, and … we have seen mostly positives with regards to transparency” in regards to tax on wealth, based on Bucher.

____

Find out more:

– The way the Crypto Market is More and more Having to pay Its Share of Tax

– Crypto Tax Trends in 2022: Elevated Reporting, Updated Rules, along with a Wealth Tax Debate

– A Little Survey Implies that US Crypto Investors Have Big Issues with Taxes

– G7 Keeps Pushing for Crypto Regulation, Here’s What’s Already Happening

– Argentinian Banking Heavyweight to produce Bitcoin, Ethereum Buying and selling, While Tax Body Urges Tighter Crypto Monitoring

– Spanish Crypto Investors ‘Fleeing to Portugal to flee Taxes,’ Say Lawyers