Asset management firm Stone Ridge, the parent company of Bitcoin company NYDIG, has launched the very first startup accelerator that concentrates on the Bitcoin Lightning Network and also the Taro protocol, known as In Wolf’s Clothing (Wolf).

The accelerator includes 8-week programs where the best founders and startup teams from around the globe is going to be introduced to New You are able to City, with accommodation and travel costs covered.

The teams which apply and therefore are recognized in to the program will get an assured investment of $250,000. One team is going to be selected with a panel of idol judges to get yet another $500,000 of funding throughout the demonstration trip to the finish of every program.

The programs will occur four occasions each year, using the first now available to applications and hang to start in April the coming year.

Kelly Brewster, the Chief executive officer of Wolf, pointed to 1-on-one mentorships and use of a variety of specialists to supplement together with your program.

Working alongside experts from Wolf, Stone Ridge, NYDIG, and beyond, founders can get funding, one-on-one mentorship, and use of specialists in bitcoin, cryptography, regulation, engineering, branding, marketing, sales, and much more.

— Kelly Brewster (@kbbrewster) October 26, 2022

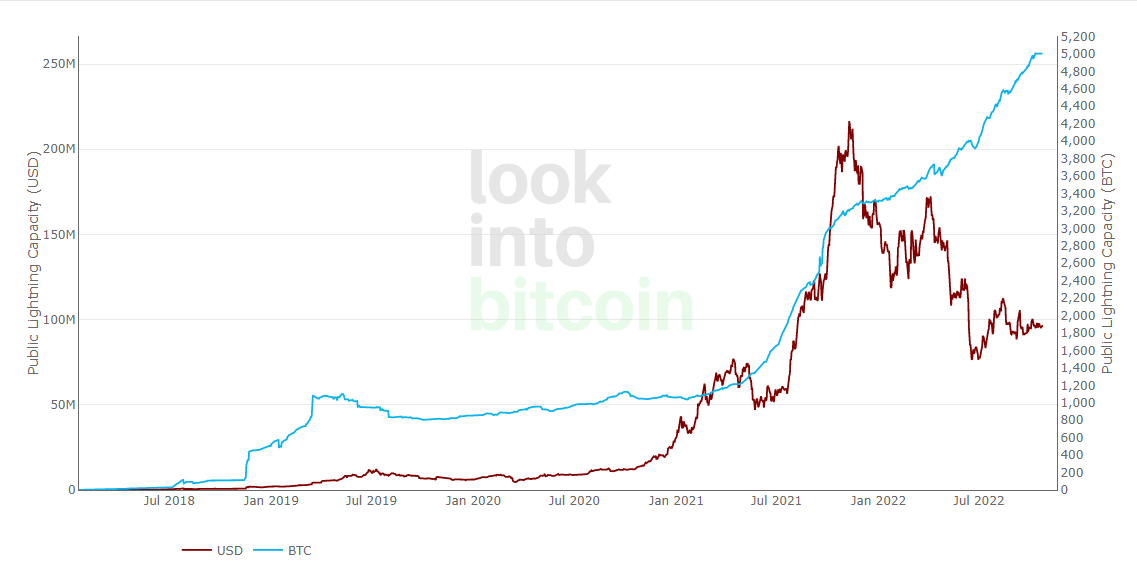

Despite macroeconomic headwinds along with a huge stop by the cost of Bitcoin (BTC), the Lightning Network has ongoing to determine rapid development in its capacity within the this past year, lately breaching the five,000 BTC threshold after getting only hit 4,000 BTC in June.

Related: CashApp adds support for Bitcoin Lightning Network

The Lightning Network is really a layer-2 solution built on the top of Bitcoin that enables users to transmit satoshis, the tiniest quantity of Bitcoin could be split into, with greater speeds minimizing charges.

The Taro protocol is really a Taproot-powered protocol created by the Bitcoin software firm Lightning Labs, which enables assets issued around the Bitcoin blockchain to become used in the Bitcoin Lightning Network.

Quite simply, Taro enables the Lightning Network to become multi-asset network with Bitcoin at its core.

According to data from 1ml, during the time of writing, the network’s capacity is presently sitting at 5,140 BTC, representing a 5.43% increase in the last month, and median transaction charges are very well under 1 millionth of the cent per satoshi.