Fresh figures on Bitcoin’s (BTC) energy consumption, efficiency and scalability actually expose the banking sector while bathing the earth’s largest cryptocurrency inside a new light.

An investigation report printed by Michel Khazzaka, an IT engineer, cryptographer and consultant, calculates that Bitcoin payments really are a “million occasions more effective” compared to legacy economic climate. Plus, the Banking sector “uses 56 occasions more energy than Bitcoin.”

The report compiles almost 4 years of research and suggests a brand new calculation for estimating Bitcoin’s Proof-of-Work energy consumption. Within an interview, Khazzaka told Cointelegraph:

“Bitcoin Lightning, and Bitcoin, generally, are actually great and incredibly efficient technological solutions that should be adopted on the massive. This invention is brilliant enough, efficient enough, and effective enough to obtain mass adoption.”

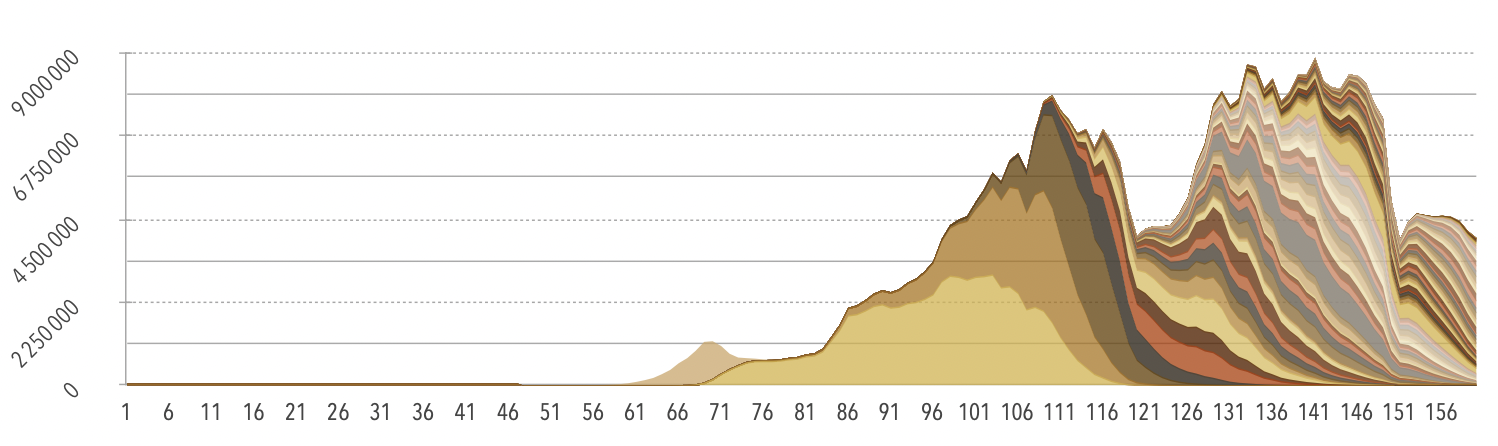

Khazzaka, who founded payments consultancy Valuechain at the end of 2021, proposes an alternative choice to the power estimates supplied by Cambridge Bitcoin Electricity Consumption Index (CBECI). The index, frequently reported by Cointelegraph, estimates that Bitcoin consumes roughly 122 TW/H each year.

Considering the typical lifespan of Bitcoin mining machines along with the rate where new IT materials are produced, Khazzaka shows that Bitcoin consumes 88.95 TWh each year, significantly under Cambridge’s estimate.

A payments specialist who authored his dissertation about cryptography in 2003, determined Bitcoin this year, Khazzaka also puts the banking sector underneath the microscope to be able to effectively compare the 2 financial systems. Khazzaka told Cointelegraph he “really underestimates every facet of the banking sector,” and unlike critics, his report is “biased towards the banking system.”

Nevertheless, considering the development of money, transporting money, physical banking infrastructure energy consumption, etc, he gets to an amount of four,981 TWh. Put together, 5,000 TWh is consumed through the “classical payments” sector each year. Consequently, banking uses 56 occasions more energy than Bitcoin.

The report examines transaction efficiency revealing that “Today, at current block size and when the blocks are filled for their maximum capacity ηmax = 5.7× better energy-efficiency compared to classical system.” However, that’s if you don’t take into account the Lightning Network. Within the interview, Khazzaka described:

“Lightning allows the bitcoin protocol to complete more transactions without eating energy. Which is magic.”

Related: The Lightning Network Lunch: A Bitcoin contactless payment story

The report concludes the mixture of Bitcoin and also the Lightning Network enables Bitcoin to get “194 million” occasions more energy-efficient than the usual classical payment system.

For Khazzaka, the report lays bare the “Banking and payments industry must adopt blockchain and even perhaps Bitcoin.” While Khazzaka’s conclusion has come about as an unexpected towards the cypherpunks and anarchocapitalists who favor the crypto space, Khazzaka believes that Bitcoin could really benefit banking:

“If they’re courageous enough blockchain technology, it’ll enhance their efficiency as well as their scalability.”

Although Bitcoin’s energy me is frequently critiqued, the analysis in to the banking sector can come as welcome news to a lot of.