Bitcoin (BTC) starts probably the most important macro days of the season inside a precarious position below $17,000.

After its latest weekly close, BTC/USD demonstrated little upward momentum before the 12 ,. 12 Wall Street open.

With volatility yet to look, the biggest cryptocurrency is constantly on the exchange a narrow range, and analysts are more and more impatient for brand new catalysts.

These, they agree, may come within the next couple of days — U . s . States economic information is due, and it is content and effect on economic policy will probably possess a significant effect on crypto markets.

Elsewhere, the uneasy established order continues — Bitcoin miners are battling, sentiment lacks inspiration and traders are more and more drawing comparisons towards the pits of previous bear markets.

Where could BTC cost action mind within the coming week? Cointelegraph analyzes five factors set to help trajectory.

“Most significant” CPI print forms key focus

The saying on everyone’s lips now is Consumer Cost Index (CPI) — the important thing way of measuring consumer prices inflation within the U.S.

While coming each month, the most recent CPI print, due 12 ,. 13 for that month of November, has additional importance for that market. With two days to visit before the finish of the season, the likelihood of a danger asset “Santa rally,” for example, now hang within the balance.

It is not only the CPI report itself the government Reserve’s Federal Open Market Committee (FOMC) will choose rate hikes now, and Chair Jerome Powell will provide an address that market commentators will scrutinize for indications of policy change.

“CPI Report Tuesday, Given rate hikes and JPow speaks on Wednesday. Stay tuned in for volatility,” on-chain analytics resource Material Indicators summarized in the weekend.

Popular trader MisterSpread added that further decisions outdoors the U.S. designed for “one of the very most (otherwise probably the most) important” days of the season.

“Tuesday’s CPI will all over again be ‘the most significant CPI release ever’, this time around since the market has arrange it to get along with its epic 2-month short squeeze rally,” buying and selling firm QCP Capital meanwhile authored inside a market update.

QCP ongoing:

“A greater-than-expected CPI print and much more hawkish Given have the possibility to invalidate this rally, like we had within the April and August reversals. However, another disinflationary print often see many chase a continuation from the rally into year-finish.”

Whether or not up or lower, CPI has a tendency to induce market volatility surrounding its release, with calm only coming back following the rates decision Powell’s associated speech.

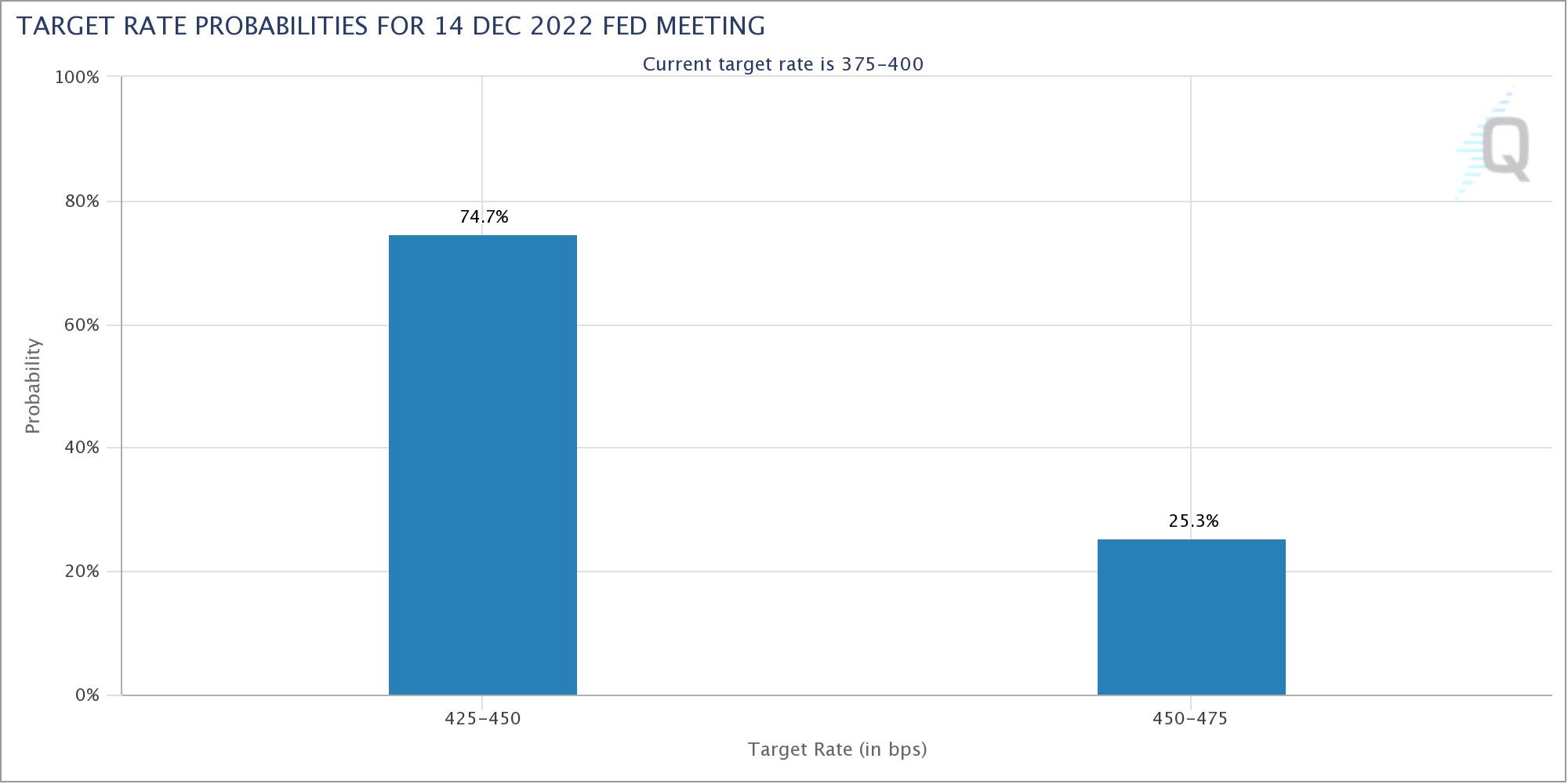

Based on CME Group’s FedWatch Tool, current consensus requires a smaller sized 50-basis-point hike in rates of interest this month, signaling a comedown for that Given with what could yet grow to be a substantial level in policy.

During the time of writing, the prospect of 50 basis points was around 75%.

Also describing now because the “biggest week of the season,” financial commentary resource The Kobeissi Letter nevertheless were built with a warning for investors.

“Imagine the madness when the Given does not pivot or November CPI is above October’s 7.7% print,” a part of a tweet on 12 ,. 8 read.

“This is the reason why you wouldn’t want a Given controlled market.”

BTC place cost waits for doing things

With everybody centered on the Given, traders realize that policy and macro figures will de facto dictate what goes on to BTC/USD within the future.

Apart from pressure majeure, there might be little to complete but sit and watch for data flowing in.

Meanwhile, BTC/USD is constantly on the range in most-too-familiar territory round the $17,000 mark, data from Cointelegraph Markets Pro and TradingView shows.

Unchanged for several days, the happy couple appears directionless because the dust in the FTX implosion is constantly on the settle.

“BTC continues to be bouncing between Recognized Cost (eco-friendly) & Balanced Cost (yellow) since June,” analytics resource On-Chain College summarized around the mid-term trend.

“I’m thinking about a sustained movement outdoors of the range, that has yet to happen.”

Some had more categorical assumes BTC cost performance. Matthew Dixon, founder and Chief executive officer of crypto ratings platform Evai, known as for Bitcoin to “complete the general correction higher” to block out the majority of the losses from FTX.

Simultaneously, popular commentator Profit Blue maintained that $10,000 would reenter the radar before the beginning of 2023.

“Bitcoin is headed to $10k and it’ll likely bottom available soon. Take notice of the details,” commentary with an associated chat read.

U.S. dollar teases restored strength

Acutely anticipating a big change of trend for that U.S. dollar, meanwhile, trader Bluntz cautioned that Bitcoin may yet generate a bearish finish towards the year.

The U.S. dollar index (DXY), pressurized for days, has started to close greater lows on daily timeframes, potentially establishing dollar strength for any rebound.

This, because of inverse correlation, would spell difficulties for crypto markets overall.

“quite an unpleasant 4h going to close here, searching just like a lower at the top of 4h time-frame and a lot of catalysts approaching now,” Bluntz authored inside a Twitter at the time.

“dxy also investing in a greater have less daily and searching strong. my gut is saying we are on the way to a brand new low sub 15k for btc that we will happily buy.”

An earlier publish from 12 ,. 5 known as for that $15,000 zone to become arrived at in Q1 the coming year.

Fellow trader Physician Profit meanwhile noted that DXY had came back to some key “breakout” zone from June, which short-term cues should thus be decisive for trajectory.

“DXY effectively retested its June breakout the very first time,” he mentioned a week ago.

“The mother of decisions is originating, expect huge volatility in a few days. The incoming DXY move will decide the fate from the crypto and stock exchange.”

DXY has yet to reclaim its 200-day moving average (MA), however, losing that was lately described as “lights out” for that dollar.

Supply shock ratio gets near 10-year high

Behind the curtain, Bitcoin is delivering subtle hints that might not be so bad with regards to overall network strength.

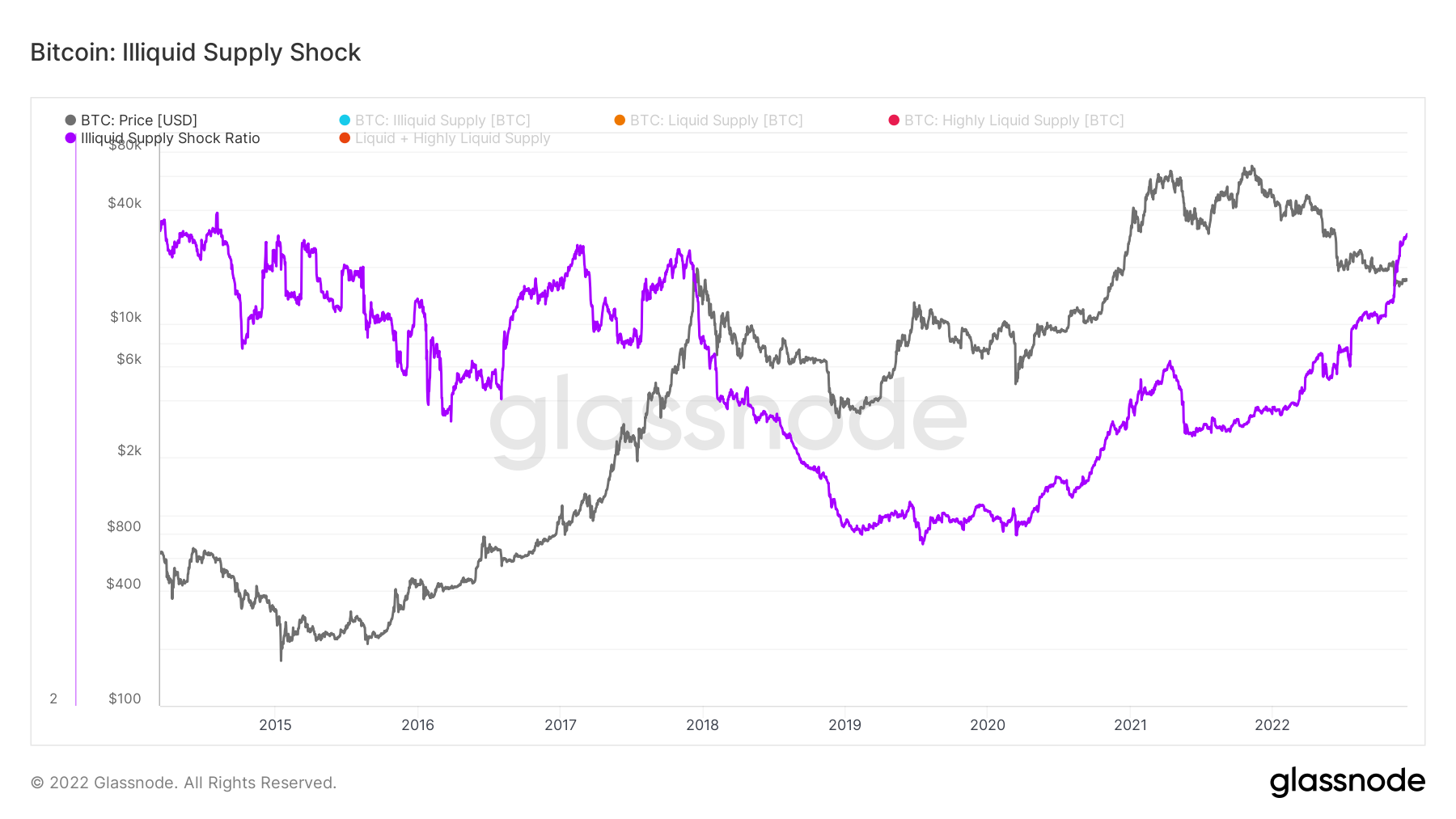

Based on the Illiquid Supply Shock Ratio (ISSR) metric, there’s a greater possibility of a significant supply-caused hurry for BTC than at any time in almost ten years.

ISSR, produced by statistician Willy Woo and crypto investigator William Clemente, “attempts to model the prospect of a Supply Shock developing,” on-chain analytics firm Glassnode explains.

To put it simply, it assesses what amount of the supply can be obtained versus current demand, and because of the ongoing trend of ferreting BTC away into cold storage, the signal is obvious.

By 12 ,. 10, ISSR measured 3.537, its greatest since August 2014.

Hayes states Bitcoin miner selling “has ended”

Your final silver lining for future years comes thanks to Bitcoin mining research from former BitMEX Chief executive officer, Arthur Hayes.

Related: Bitcoin’s boring cost action enables XMR, TON, TWT and AXS to collect strength

In the latest blog publish on 12 ,. 9, Hayes, well-known being an industry commentator, required exception towards the pervading narrative surrounding miners’ financial buoyancy and it is effect on markets.

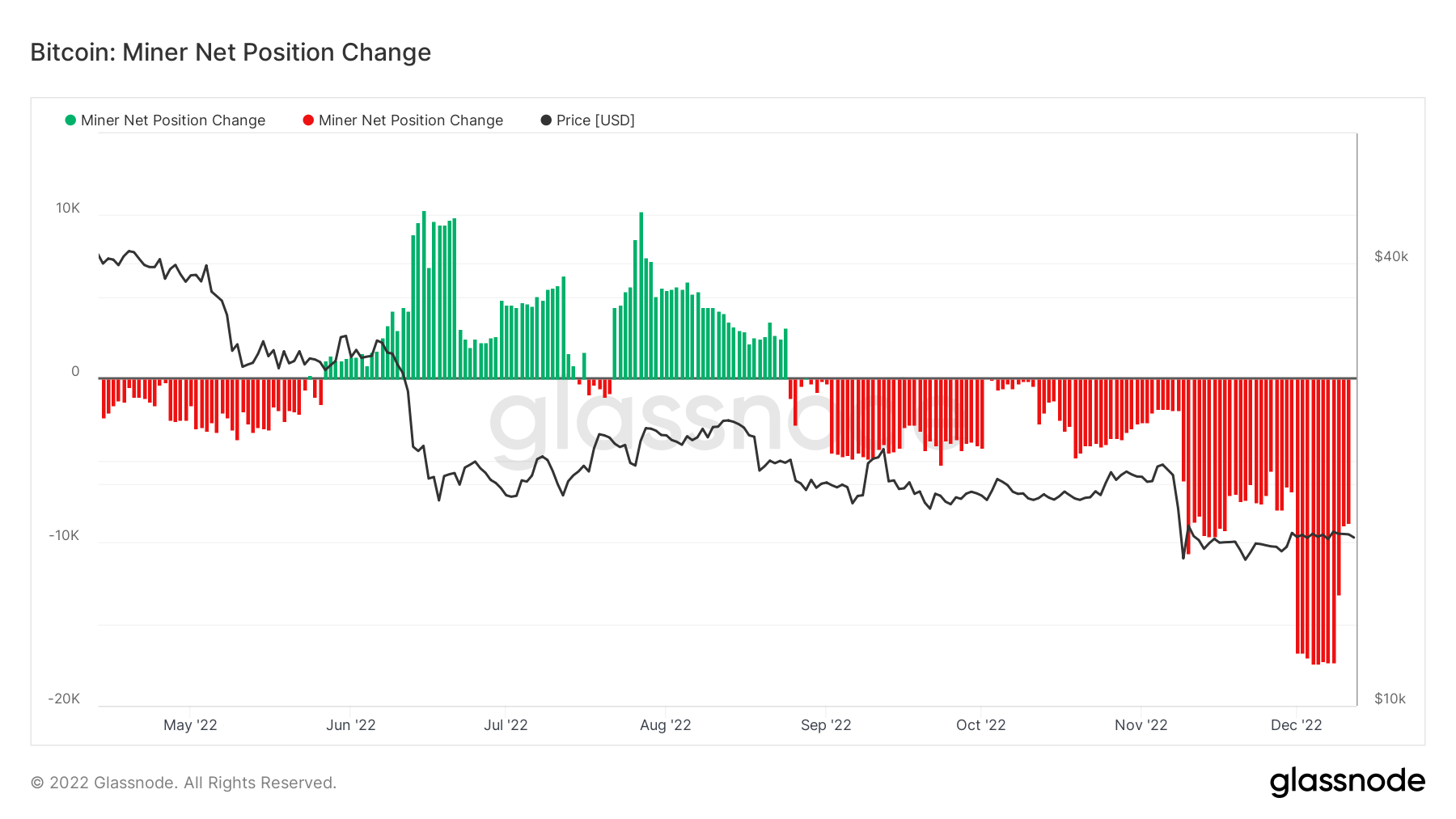

As Cointelegraph reported, growing sales of BTC by miners battling to remain afloat have brought to concerns that the major capitulation event could ton the marketplace with liquidity.

This isn’t the situation, Hayes states, going further to exhibit that “even if miners offered all of the Bitcoin they created every day, it might barely change up the markets whatsoever.”

“Therefore, we are able to ignore this ongoing selling pressure, because it is easily absorbed through the markets,” he determined.

Hayes ongoing that the majority of BTC sales by miners and lenders, referred to as centralized lending firms (CELs), had likely already happened.

“I think that the forced selling of Bitcoin by CELs and miners has ended. When you sell, you’d have previously done this,” he authored.

“There isn’t any reason you’d hang on should you have had a sudden requirement for fiat to stay a going concern. Considering that nearly every major CEL has either stopped withdrawals (pointing to insolvency at the best) or gone bankrupt, there aren’t any more miner loans or collateral to become liquidated.”

Glassnode data meanwhile shows the 30-day alternation in supply held by miners, while still decreasing, is cooling from recent highs, supporting the idea that sales are slowing.

“Fears of distressed bitcoin miners creating selling pressure are inflated,” Bitcoin mining analyst Jaran Mellerud added, answering Hayes’ piece.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.