Bitcoin (BTC) spending an “unprecedented” period below a vital moving average is really a poor help guide to the 2022 bear market.

Which was the opinion of analyst Superswell, who now championed on-chain metrics as a means of understanding current BTC cost action.

“Business as always so far” for Bitcoin bear market

In a number of tweets on 12 ,. 5, Superswell challenged individuals worried about the 200-week simple moving average (SMA) disappearing as support on BTC/USD.

“Over the final couple of several weeks, I have seen a number of people explain that BTC neglecting to find support in the 200wkSMA is unparalleled and for that reason we are in uncharted territory – especially thinking about the length of time a year below,” part the thread read.

“This is how Personally, i believe that onchain data provides better information regarding where we’re with regards to historic capitulations than TA (ie: 200wkSMA).”

BTC/USD fell underneath the 200 SMA in mid-August, taking its stint using the trend line as potential to deal with nearly four several weeks — an archive, as confirmed by Cointelegraph Markets Pro and TradingView.

As Cointelegraph is constantly on the report, however, on-chain data informs another story, and it has been compiling bear market bottom signals for days or longer.

Superswell highlighted four particularly from on-chain analytics firm, Glassnode: percent supply in profit, percent volume in profit, adjusted spent output profit ratio (aSOPR) and market price versus recognized value (MVRV).

While these have to date not beaten (or in some instances, even matched) previous bear markets, this really is pointless to fear the worst, Superswell ongoing.

“From an on-chain perspective, this really is business as always *to date* for any macro bottom and bear market,” he authored.

“This is not saying that *because* these levels happen to be hit, we’ve therefore bottomed.”

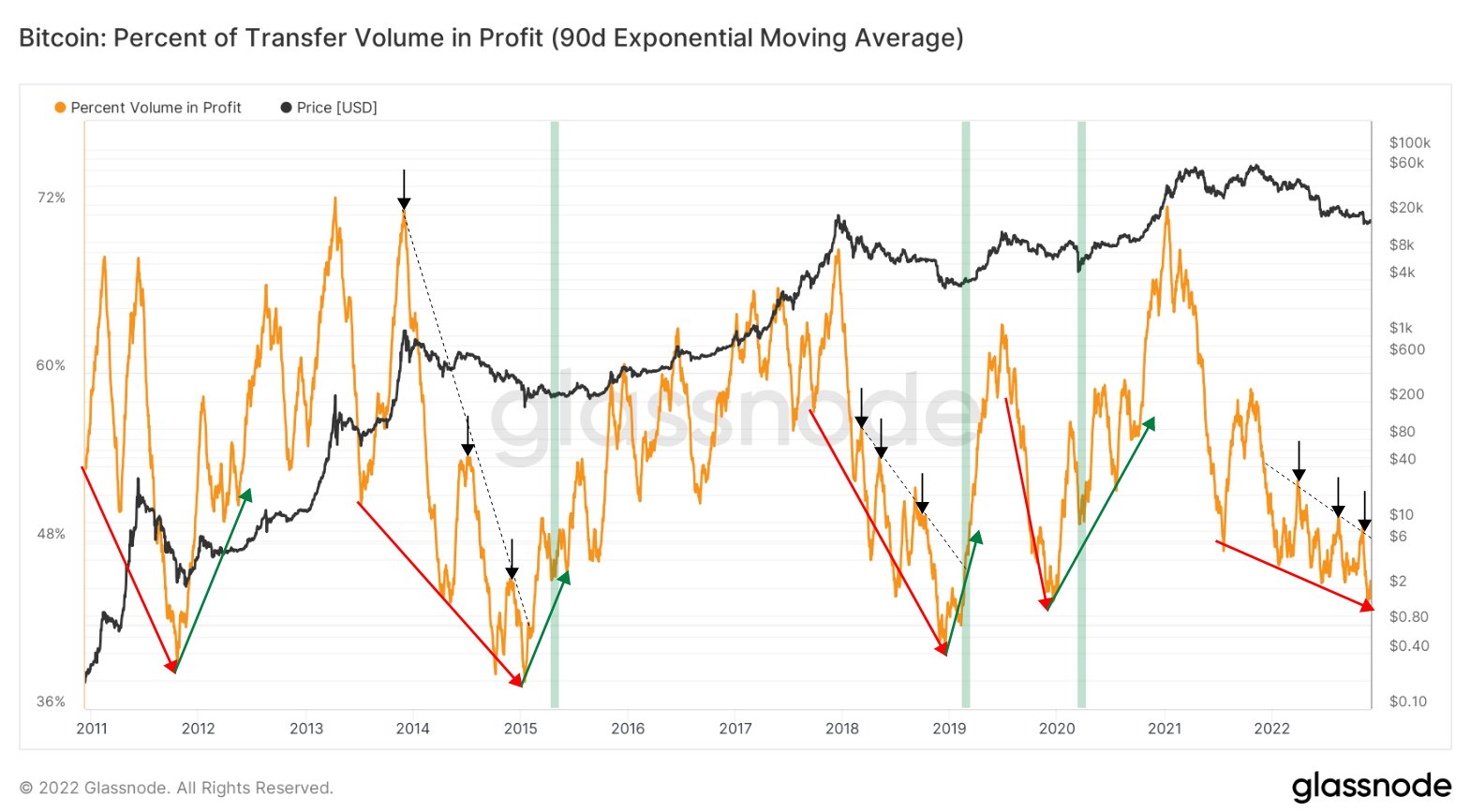

A good example came by means of percent volume in profit — a chart showing what part of transaction volume involved coins moving in a greater cost compared to what they did before.

Presently trending lower, the metric must begin an upward trend — a number of greater swing lows and swing greater highs, which Superswell states would “confirm a macro reversal.”

“This is simply a good example of *one* reversal pattern. There are lots of to consider,” he noted.

About BTC cost “macro regime shift”

Glassnode itself meanwhile also targeted profit and loss, which superswell referred to as “*the* invisible hand” on the market, for macro cues now.

Related: Just how much is Bitcoin worth today?

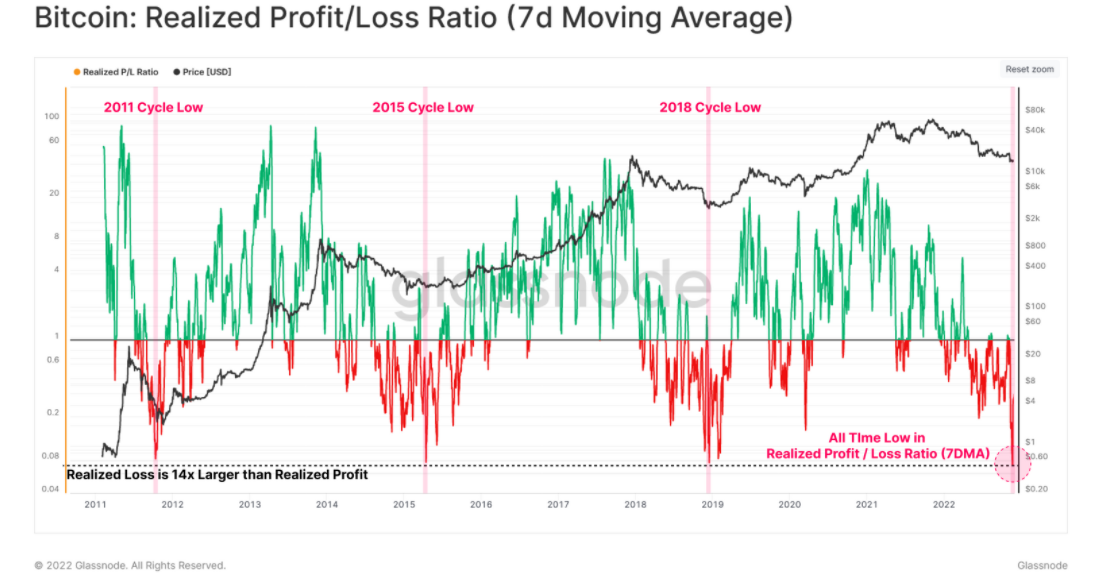

Within the latest edition of their weekly e-newsletter, “A Few Days On-Chain,” researchers noted that losses outpacing gains have “historically coincided having a macro market regime shift.”

An associated chart demonstrated the number of on-chain recognized losses versus recognized gains — quite simply, the number of loss-making on-chain transactions to individuals transported in profit.

“Here we are able to realize that the ratio between recognized profit / loss has recorded a brand new in history low,” Glassnode summarized.

“This signifies that losses kept in through the market were 14x bigger than profit taking occasions. Chances are this partly reflects the way the whole from the 2020-22 cycle cost action is over the place cost.”

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.