The Carbon Bankroll Report was launched on May 17 like a collaboration one of the Climate Safe Lending Network, The Outside Policy Outfit and Bank FWD. The collaboration made it feasible to calculate the emissions generated as a result of company’s cash and investments, for example cash, cash equivalents and marketable securities.

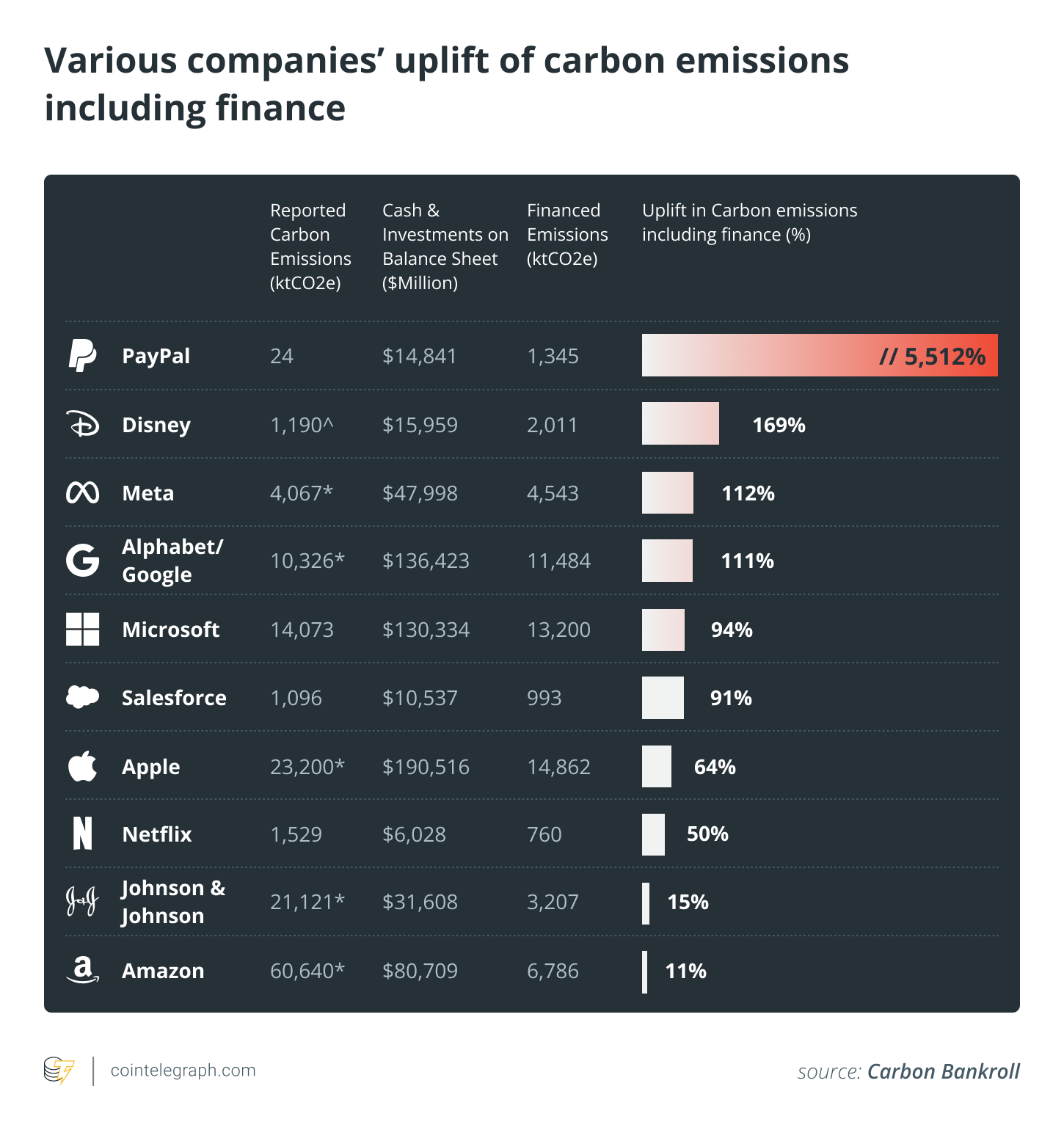

The report says for many large companies, for example Alphabet, Meta, Microsoft and Salesforce, the money and investments are their largest supply of emissions.

The power use of the flagship proof-of-work (Bang) blockchain network, Bitcoin, is a few debate where the network and it is participants, especially miners, are belittled for adding for an ecosystem that could be worsening global warming. However, recent findings also have introduced the carbon impact of traditional investments individually distinct.

Bitcoin is frequently vilified because of “imagery”

The Carbon Bankroll Report was drafted by James Vaccaro, executive director in the Climate Safe Lending Network, and Paul Moinester, executive director and founding father of the Outside Policy Outfit. Concerning the impact from the report, Jamie Beck Alexander, director of Drawdown Labs, mentioned:

“Until now, the function that corporate banking practices play in fueling the weather crisis continues to be murky at its best. This landmark report shines a floodlight. The study and findings found in this report offer companies a brand new, massively important chance to assist shift our economic climate from non-renewable fuels and deforestation toward climate solutions on the global scale. Firms that are seriously interested in their climate pledges will welcome this breakthrough and move urgently toward tapping this lever for systematic change.”

A couple of metrics the report highlighted concerning the weather impact from the banking industry include:

- Because the signing from the Paris Agreement in 2015, 60 from the world’s largest commercial and investment banks have invested $4.6 trillion within the fossil fuel industry.

- Banks for example Citi, Wells Fargo and Bank of the usa have invested $1.2 billion in stated industry.

- The biggest banks and asset managers within the U . s . States happen to be accountable for financing the same as 1.968 billion a lot of co2. When the U.S. financial sector were a rustic, it might be the 5th-largest emitter on the planet, soon after Russia.

- In comparison to the direct operational emissions of worldwide financial firms, the emissions generated through investing, lending and underwriting activities are 700 occasions greater.

Cointelegraph spoken with Cameron Collins, a good investment analyst at Viridi Funds — a crypto investment fund manager — concerning the reasons for the unnecessary vilification from the Bitcoin network. He stated:

“It’s simple to picture a warehouse of high-performance computers sucking lower power, but it isn’t very easy to picture the downstream results of money in circulation financing carbon-intensive activities. Generally, it’s this imagery that demonizes Bitcoin mining. The truth is, the whole banking system uses more electricity in operations compared to the Bitcoin mining industry.”

Additionally towards the portrayed “imagery,” there has been various efforts to trace the precise energy use of operating the Bitcoin network. Probably the most broadly recognized metrics with this complex variable is calculated through the Cambridge Center for Alternative Finance and is called the Cambridge Bitcoin Electricity Consumption Index (CBECI).

During the time of writing, the index estimates the annualized use of energy through the Bitcoin network is 117.71 terawatt-hrs (TWh). The CBECI model uses various parameters for example network hash rate, miner charges, mining difficulty, mining equipment efficiency, electricity cost and energy usage effectiveness to compute the annualized consumption for that network.

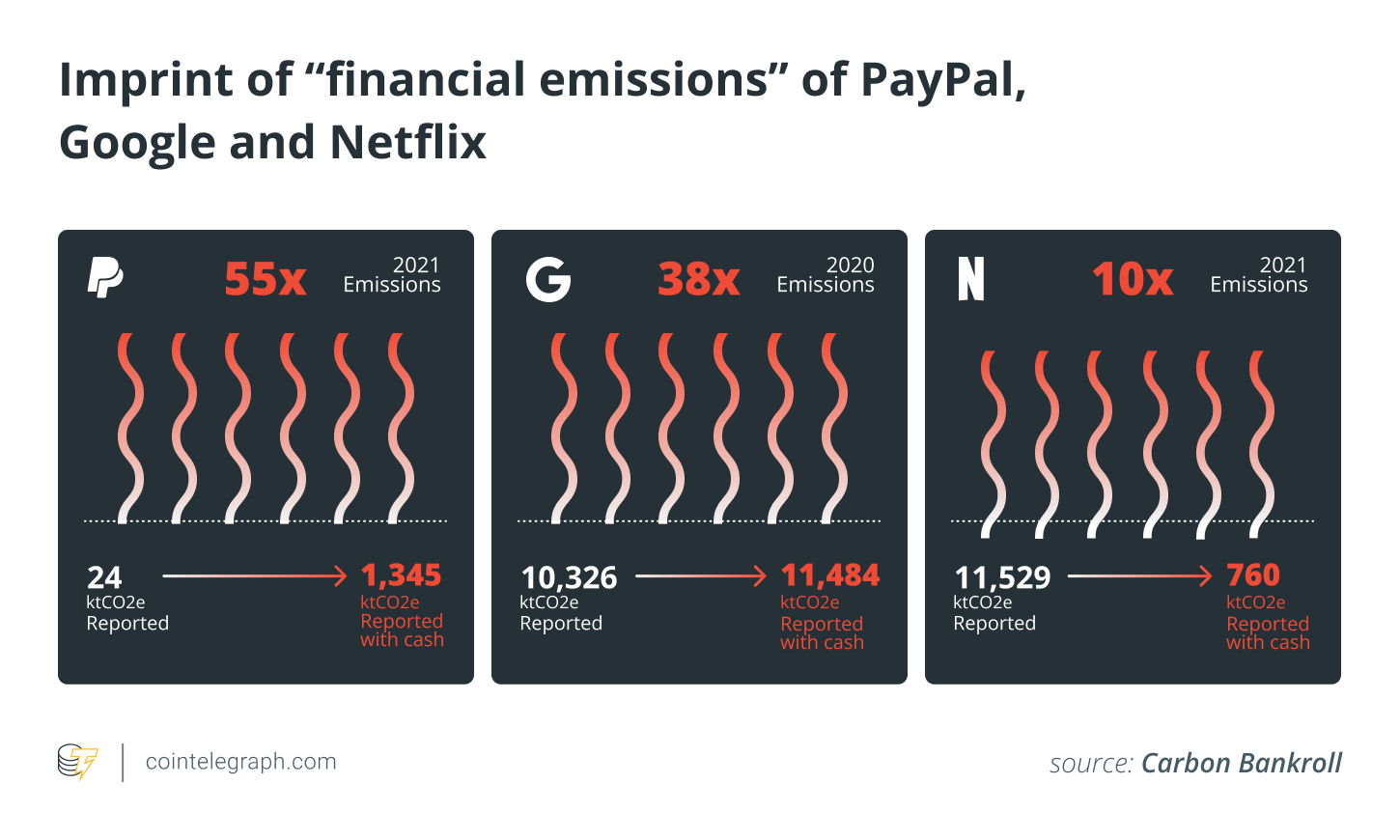

The development in the amount of participants and related activity around the Bitcoin network is apparent within the monthly electricity use of the network. From The month of january 2017 to May 2022, the monthly electricity consumption has multiplied over 17 occasions from .62 TWh to presently standing around 10.67 TWh. Compared, companies for example PayPal, Alphabet and Netflix have observed their carbon emissions multiplied by 55, 38 and 10 occasions, correspondingly.

Collins spoke further concerning the thought of the Bitcoin network that may be altered later on. He added when more and more people contacted Bitcoin (BTC) mining like a financial service instead of mining, sentiment surrounding Bang systems might start to change, and also the public may be thankful more being an essential service instead of a reckless gold hurry. Also, he highlighted the function of thought leaders locally in conveying the real nature of Bitcoin mining to policymakers and also the public in particular.

Cooperating to resolve the power problem

Lately, there has been several types of the Bitcoin mining community collaborating using the energy industry — and vice-versa — to operate on methodologies advantageous for parties. The American Energy company, Crusoe Energy, is repurposing wasted fuel energy to power Bitcoin mining, beginning in Oman. The nation exports 23% of their total gas production and aims to lessen gas flaring to a great zero by 2030.

The U . s . States energy giant ExxonMobil couldn’t help but enter the loop. In March this season, it had been says Crusoe Energy had inked an offer with ExxonMobil to make use of excess gas from oil wells in North Dakota to operate Bitcoin miners. Typically, energy companies turn to a procedure referred to as gas flaring to eliminate the surplus gas from oil wells.

Related: Stranded forget about? Bitcoin miners may help solve Big Oil’s gas problem

A study released through the Bitcoin Mining Council in The month of january says the Bitcoin mining industry elevated the sustainable energy mixture of its consumption by nearly 59% between 2020 and 2021. The Bitcoin Mining Council is several 44 Bitcoin mining firms that represent 50 plusPercent from the entire network’s mining power.

Cointelegraph spoke to Bryan Routledge, affiliate professor of finance at Carnegie Mellon University’s Tepper School of economic, concerning the comparison between your carbon emissions from Bitcoin and traditional banking.

He mentioned, “Bitcoin (blockchain) is really a record-keeping technology. Can there be another protocol that might be comparably secure although not as energy pricey as Bang? You will find certainly many individuals focusing on that. Similarly, we are able to compare Bitcoin to record-keeping financial transactions in regular banks.”

The block reward for mining a block of Bitcoin presently is 6.25 BTC, over $190,000 according to current prices, and also the current average quantity of transactions per block stands around 1,620 according to data from Blockchain.com. This entails the average reward of 1 transaction might be believed to become over $117, an acceptable reward for any single transaction.

Routledge further added, “Traditional banks really are a far bigger size and thus, in aggregate, possess a large effect on the atmosphere. However for many transactions, there’s a significantly lower per-transaction cost — e.g., an ATM fee. BTC is loaded with lots of advantages, perhaps. But surely increasingly efficient appears an essential step.”

Since gauging the real impact of Bitcoin isn’t a quantifiable effort because of the significant change the technology and also the currency represent, you should keep in mind that the power use of Bitcoin can’t be vilified within an isolated manner. The worldwide financial community frequently easily forgets our prime impact of the present banking system that isn’t offset by corporate social responsibility along with other incentives alone.