On Sept. 6, Bitcoin (BTC) cost crumbled below $20,000 and also the asset looks prepared to undergo further loss of September as a result of strong U.S. dollar as well as an ominous technical analysis pattern.

Bitcoin eyes $15,000 next

Theoretically speaking, Bitcoin risks shedding to $15,000 or below within the coming days after breaking from its prevailing “bear flag” pattern.

For that unversed, bear flags form once the cost consolidates greater in the parallel, climbing range following a strong downtrend. They sometimes resolve following the cost breaks underneath the lower trendline and falls up to the prior downtrend’s length.

Bitcoin has joined the so-known as breakdown stage of their bear flag pattern, using its downside target lurking south of $15,000, as highlighted within the chart above.

Funds are king

The prospects of the less strong Bitcoin heading further into 2022 are increasing mainly due to a worsening economic backdrop.

Bitcoin’s 60% year-to-date cost decline is among the unfortunate effects from the Federal Reserve’s hawkish policy to create inflation lower to twoPercent from the current 8.5% level. At length, the U.S. central bank has elevated its benchmark rates towards the 2.25% – 2.5% range via four consecutive hikes in 2022.

The hikes have boosted hunger for money-based securities over riskier assets like Bitcoin.

For example, U.S. banks with savings accounts offer clients a yearly percentage yield of twoPercent or even more from around .5% at the beginning of this season, BankRate.com data shows.

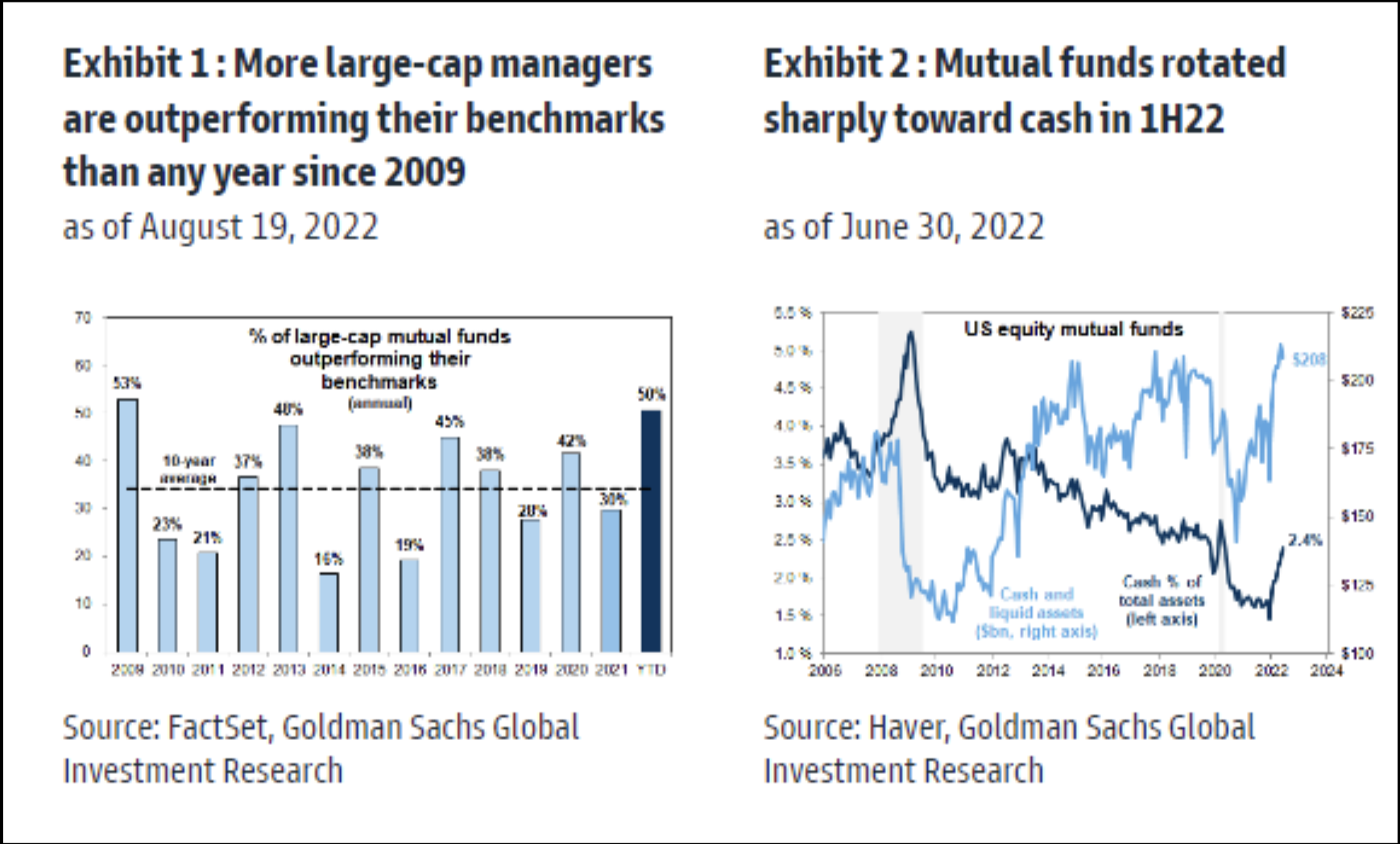

Meanwhile, a Goldman Sachs analysis shows that mutual funds with $2.7 trillion in equity under management have elevated their funds holdings by $208 billion within the first 1 / 2 of 2022, the quickest allocation rate up to now.

The broader interest in cash helps the U.S. dollar index, which measures the greenback’s strength against a swimming pool of top foreign currency, climb to 110.55 on Sept. 6, its greatest level since 2002.

Consequently, cash has drastically outperformed stocks, Bitcoin, Ethereum, copper, lumber along with other assets in 2022.

Related: A variety-break from Bitcoin might trigger buying in ADA, ATOM, FIL and EOS now

This trend may continue, since Fed plans to continue its rate-hiking spree, according to Jerome Powell’s statements in the recent Jackson Hole symposium.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.