Bitcoin (BTC) speculators have disappeared in the market as well as their mood “destroyed,” states popular analyst Philip Quick.

Inside a tweet on 12 ,. 14, the co-founding father of buying and selling suite DecenTrader flagged potential maximum risk returns for BTC at current prices.

Quick: “Euphoria destroyed” from Bitcoin bear market

BTC/USD is about 70% below its last all-time highs, and also the drawdown has disguarded many short-term investors.

The FTX scandal precipitated a level more powerful capitulation, the one that is ongoing since it’s after-effects see nervous investors panic.

For Quick, signs that speculator “euphoria” has become gone from Bitcoin come by means of the most popular HODL Waves metric.

HODL Waves group transacted coins by age — how lengthy these were last dormant for until they left their wallet. The resulting data shows how much lengthy-term or short-term holders are transacting.

An additional iteration from the metric, Recognized Cap HODL (RHODL) Waves, furthermore weights these bands by recognized cost — the cost where each bitcoin last moved.

“So RHODL surf is telling us the price foundation of bitcoins which have been locked in wallets for various amounts of time. Every time period is proven through the waves around the chart,” Quick explains inside a description on his dedicated on-chain data resource, LookIntoBitcoin.

Presently, RHODL shows a definite minority of coins moving forward the network right after they were utilized in an earlier transaction. On the other hand, transactions presently involve coins that last moved 6-12 several weeks ago as the most typical age band.

With an associated chart, the more dark the colour from the wave, the greater lately the coins involved last moved.

“Euphoria from bitcoin vacationers has been completely destroyed,” Quick commented.

He added that under such conditions, the danger-reward (R:R) ratio for investing reaches its most engaging, according to historic trends from RHODL Waves.

“Realized Cap HODL Waves warmer colors spiking show periods when participants are euphoric,” he authored:

“We are actually at cycle lows…also known as max r:r chance.”

From capitulation to accumulation

Quick isn’t alone in eyeing potential bullish signals from Bitcoin as 2022 draws to some close.

Related: Bitcoin bear market can last ‘2-3 several weeks max’ — Interview with BTC analyst Philip Quick

Within the latest edition of their weekly e-newsletter, “The Week On-Chain,” analytics firm Glassnode highlighted the continuing trend from “capitulation” to “accumulation” by BTC investors.

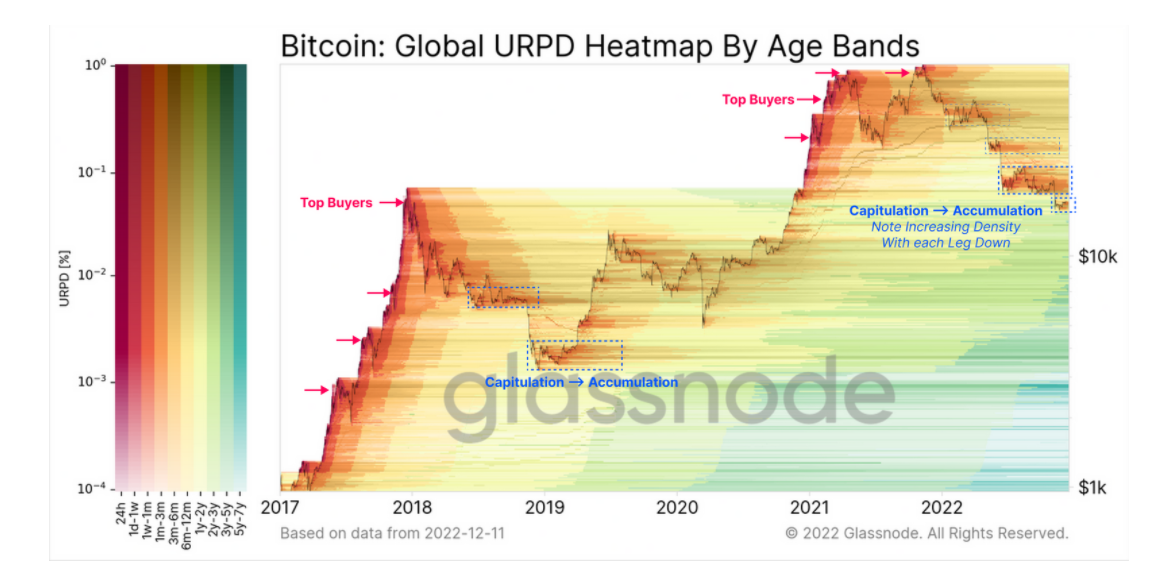

It accomplished it through the UTXO Recognized Cost Density metric, an identical tool to RHODL Waves, that provides a look into seller intensity according to gold coin age.

“After each market leg lower in 2022, we are able to begin to see the density of gold coin re-distribution (and therefore re-accumulation) has elevated,” it authored, noting the drop from $24,000 saw $18,000 saw especially strong reaccumulation.

An associated chart demonstrated individuals investors who bought the macro surface of each BTC cost run, particularly at the end of 2017 and thru April 2021.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.