Bitcoin (BTC) could see more discomfort soon, but the majority of the bear marketplace is already “likely” behind it.

That is among many conclusions from Philip Quick, the most popular on-chain analyst whose data resource, LookIntoBitcoin, tracks most of the best-known Bitcoin market indicators.

Quick, who along with analyst Filbfilb is another co-founding father of buying and selling suite Decentrader, believes that despite current cost pressure, there’s not lengthy to visit until Bitcoin exits its latest macro downtrend.

Inside a fresh interview with Cointelegraph, Quick revealed insights into exactly what the information is telling analysts — and just what traders should focus on consequently.

How lengthy will the typical hodler need to hang about until the tide turns and Bitcoin comes storming away from two-year lows?

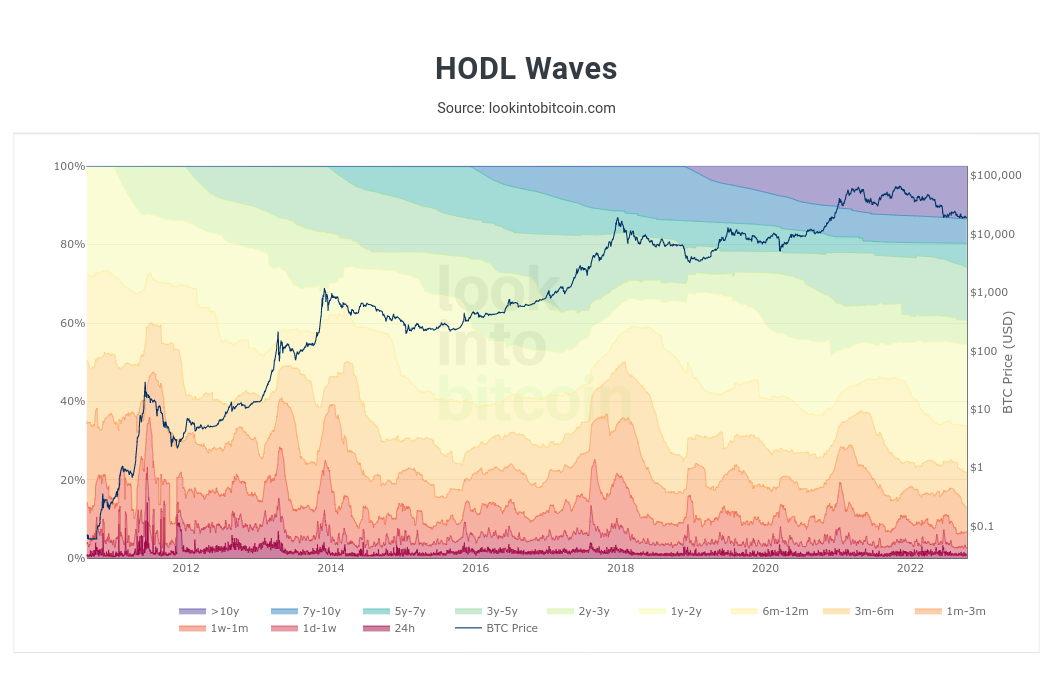

Cointelegraph (CT): You’ve stated that some on-chain metrics for example HODL Waves and RHODL Ratio are meaning in a BTC bottom. Would you expand about this? Are you currently certain that history will continue doing this cycle?

Philip Quick (PS): In my opinion we’re now at the purpose of maximum chance for Bitcoin. There are many key metrics on LookIntoBitcoin that indicate we’re at major cycle lows.

There has been the proportion of lengthy-term holders peak (1yr HODL Wave), which generally occur in the depths of bear market because these lengthy-term holders don’t wish to take profit until cost moves greater.

It has the result of restricting available supply on the market, which could cause cost to improve when demand does eventually relax in.

We’re also seeing metrics like RHODL Ratio use their accumulation zones, which shows the level that excitement has been drained in the market. This elimination of positive sentiment is essential for any bottom range to create for BTC.

RHODL Ratio is highlighting the cost foundation of recent Bitcoin purchases is considerably less than prices compensated 1–2 years back once the market was clearly euphoric and expecting +$100k for Bitcoin. So with the ability to inform us once the market has reset when preparing for the following cycle to begin.

CT: How’s this bear market not the same as previous BTC cycles? Can there be any silver lining?

PS: I had been around for that 2018/19 bear market also it really feels pretty similar. All of the vacationers have remaining and you simply possess the committed passionate crypto people residing in the area. These folks may benefit probably the most within the next bull run — as lengthy because they don’t add too much buying and selling with leverage.

When it comes to silver linings, I’ve got a couple! First, we’re really a good way with the market cycle, and sure through nearly all this bear market already. The chart below shows Bitcoin performance each cycle because the halvening, and we’re already round the capitulation points from the previous two cycles.

Second, the macro context is extremely different now. While it’s been painful for bulls to determine Bitcoin and crypto so heavily correlated to battling traditional markets, In my opinion we’re soon likely to visit a invest in Bitcoin as confidence in (major) governments crosses downwards beyond an item of no return.

In my opinion this insufficient confidence in governments as well as their currencies can create a hurry towards private “hard” assets, with Bitcoin as being a major beneficiary of this trend in 2023.

CT: The other key on-chain metrics can you also recommend to keep close track of to place the underside?

PS: Be skeptical of Twitter personalities showing Bitcoin on-chain charts cut by exotic/ weird variables. Such data hardly ever adds any genuine value towards the story proven through the major key metrics which personalities simply do it in an effort to grab attention instead of genuinely trying to help individuals.

Two metrics which are particularly helpful in the present market conditions:

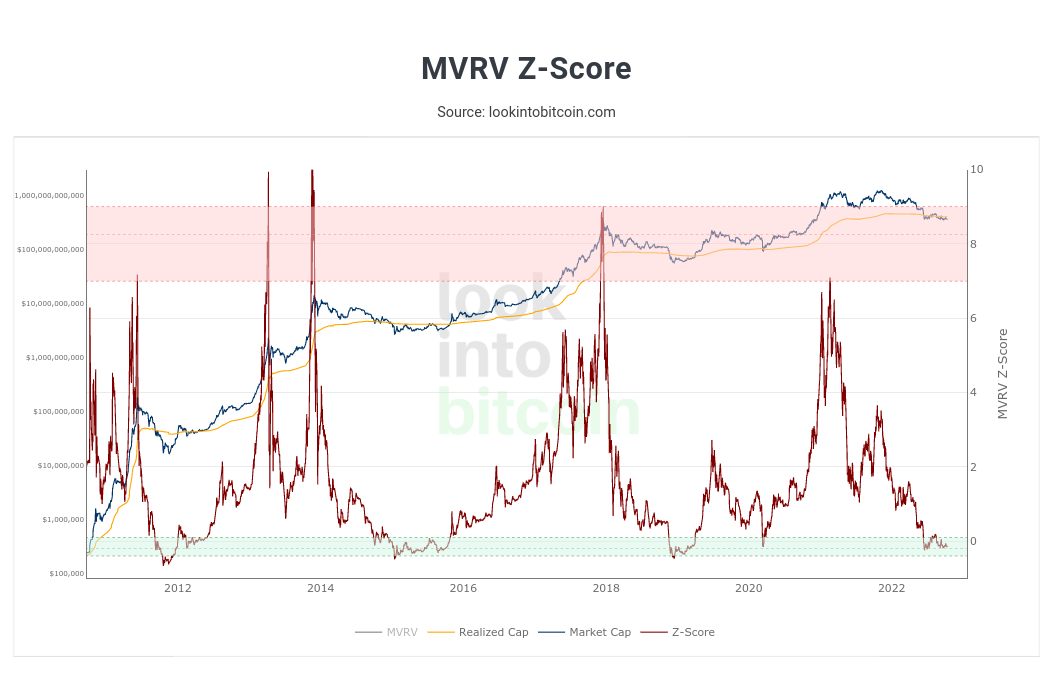

The MVRV Z-Score is an essential and broadly used metric for Bitcoin. It shows the extremes of Bitcoin cost moving below or above its recognized cost. Recognized cost may be the average cost foundation of all Bitcoin purchased. So it may be regarded as approximately break-even level for that market. Cost only dips below that much cla in extreme bear market conditions.

If this does, the indicator about this chart dips in to the eco-friendly “accumulation” zone. We’re presently for the reason that zone, which implies these could be very good levels for that proper lengthy-term investor to amass more Bitcoin.

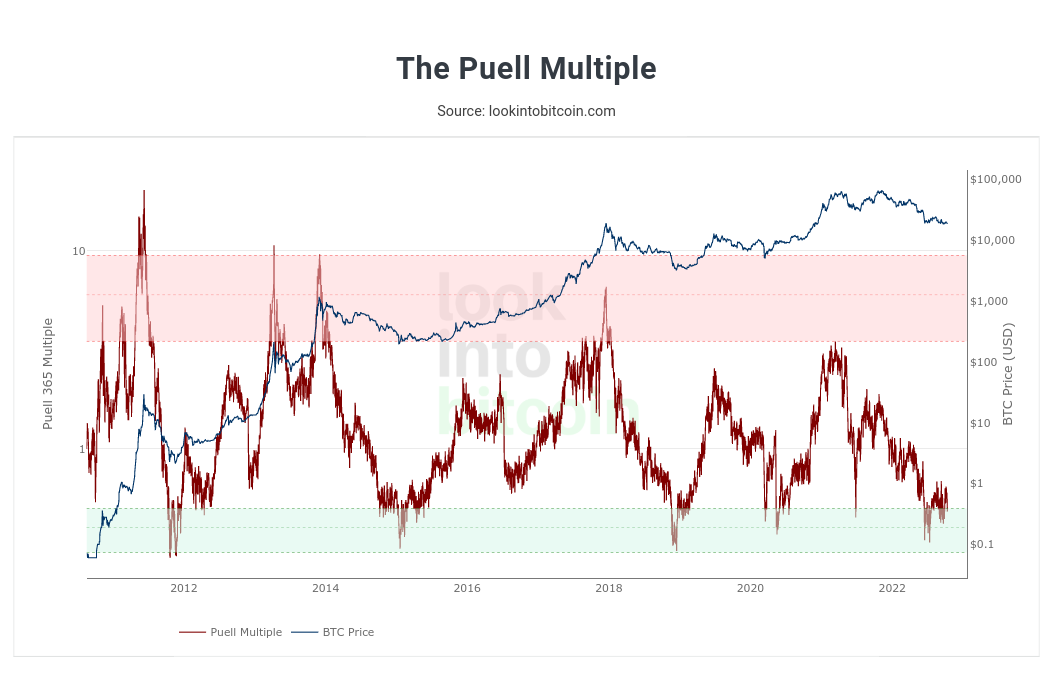

The Puell Multiple Looks at miner revenues versus their historic norms. Once the indicator dips in to the eco-friendly accumulation band, like it’s now, it shows many miners they are under significant stress. This frequently occurs at major cycle lows for Bitcoin. This indicator suggests we’re near to a significant cycle low for Bitcoin if we’ve not already bottomed.

CT: Other analyst Filbfilb expects BTC to reverse course in Q1 2023. Would you agree?

PS: Yes, I actually do. I believe traditional markets most likely have a little more downturn entering early 2023. At worst, I see crypto getting trouble for now, so most likely another 2–3 several weeks max. However I think nearly all fear will quickly switch toward governments as well as their currencies — appropriately so. Well, I do expect private assets like Bitcoin to outshine in 2023 and surprise most of the doomers who’re saying Bitcoin has unsuccessful and will zero.

Related: Bitcoin analyst who known as 2018 bottom warns ‘bad winter’ could see $10K BTC

CT: October is really a in the past bad month for stocks — less for Bitcoin. How lengthy would you expect BTC to stay in lockstep with risk-on assets and just what would be the catalyst?

PS: Bitcoin is a helpful forward-searching risk indicator for that markets throughout a lot of 2022. What’s going to alternation in 2023 is the fact that market participants will appreciate [that] the majority of the risk actually lies with governments, avoid typically defined “risk” assets. Consequently, I expect a story shift which will benefit Bitcoin the coming year.

Those things from the U . s . Kingdom’s government around their small-budget two days ago were a vital level for your potential narrative shift. Markets demonstrated these were ready to show their disapproval of poor policy and incompetence. I expect that trend to accelerate not just for that U.K. but far away also.

CT: Are you currently amazed at Ethereum’s poor performance publish-Merge? Are you currently bullish on ETH long term using its supply-burning mechanisms?

PS: [Ether] (ETH) were built with a strong short-term narrative using the Merge, however it was inside the context of the global bear market. So it’s not surprising that it is cost performance continues to be lackluster. Ultimately, the general market conditions dominated, that was to become expected.

Lengthy term, though, Ethereum is to establish to complete extremely well. It’s a critical element of Web3, that is growing tremendously. And So I am very bullish on Ethereum within the next few years.

CT: What’s the best jurisdiction for any Bitcoin/ crypto trader today?

PS: Somewhere that’s low-tax and crypto-friendly. Personally, i think Singapore is excellent and there’s an increasing crypto scene here, that is fun too. I’ve buddies who’re in Indonesia, that also sounds great and it is less expensive.

CT: Anything you want to add?

PS: Resist any temptation to stop crypto near the foot of the bear market. You need to be patient and employ good quality tools to assist manage your feelings.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.