Bitcoin (BTC) may be beginning its new macro upward trend if historic “hodl” habits repeat.

Which was the final outcome from research in to the latest data covering the quantity of the BTC supply dormant for just one year or even more by This summer 2022.

Hodled BTC hints the bear marketplace is over

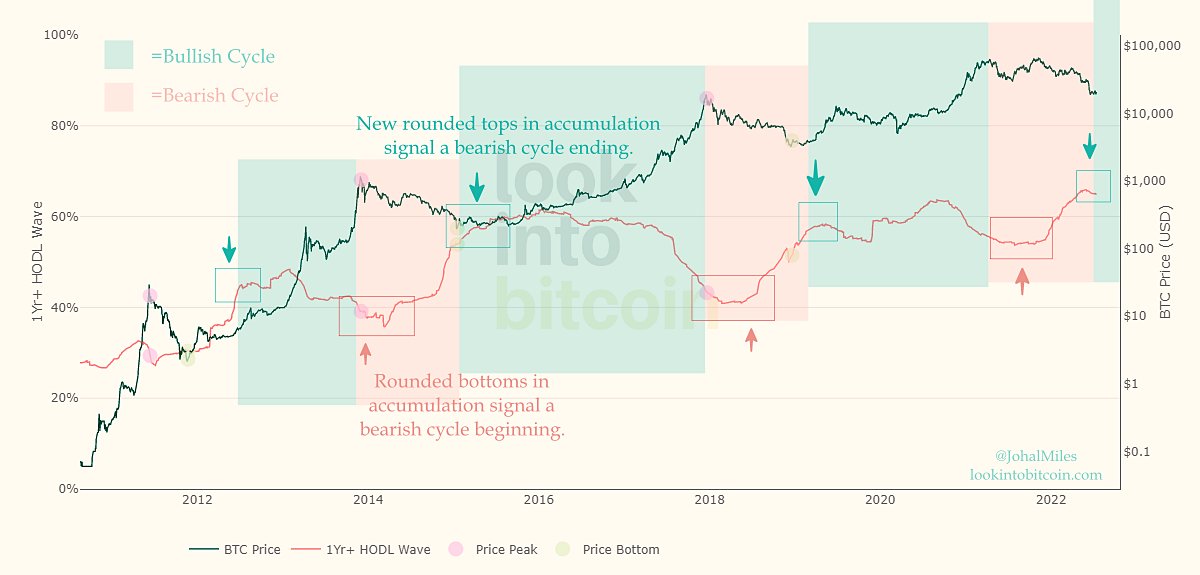

Based on independent analyst Miles Johal, who submitted the findings to social networking on This summer 29, a “rounded top” formation in “hodled” BTC is while finishing.

Once it will, the cost should react — much like on multiple occasions before.

The clue is based on Bitcoin’s HODL Waves metric, which breaks lower the availability based on when each Bitcoin last moved. Twelve months ago or even more — the main one-year HODL Wave — presently reflects a lot of the supply.

Johal’s associated chart implies that the higher the proportion from the overall supply stationary for more than a year, the closer BTC/USD would be to a macro bottom.

More to the point, however, a slowing from the one-year HODL Wave — indicating accumulation is calming lower — adopted by the beginning of a reversal has always come at the beginning of a brand new lengthy-term BTC cost upward trend.

This “rounded top” chart phenomenon is thus being acutely eyed like a potential supply of hope with Bitcoin already creating lost ground.

In comments, Johal contended that couple of have been having to pay focus on HODL Waves.

Exchange balances cheapest since 2018

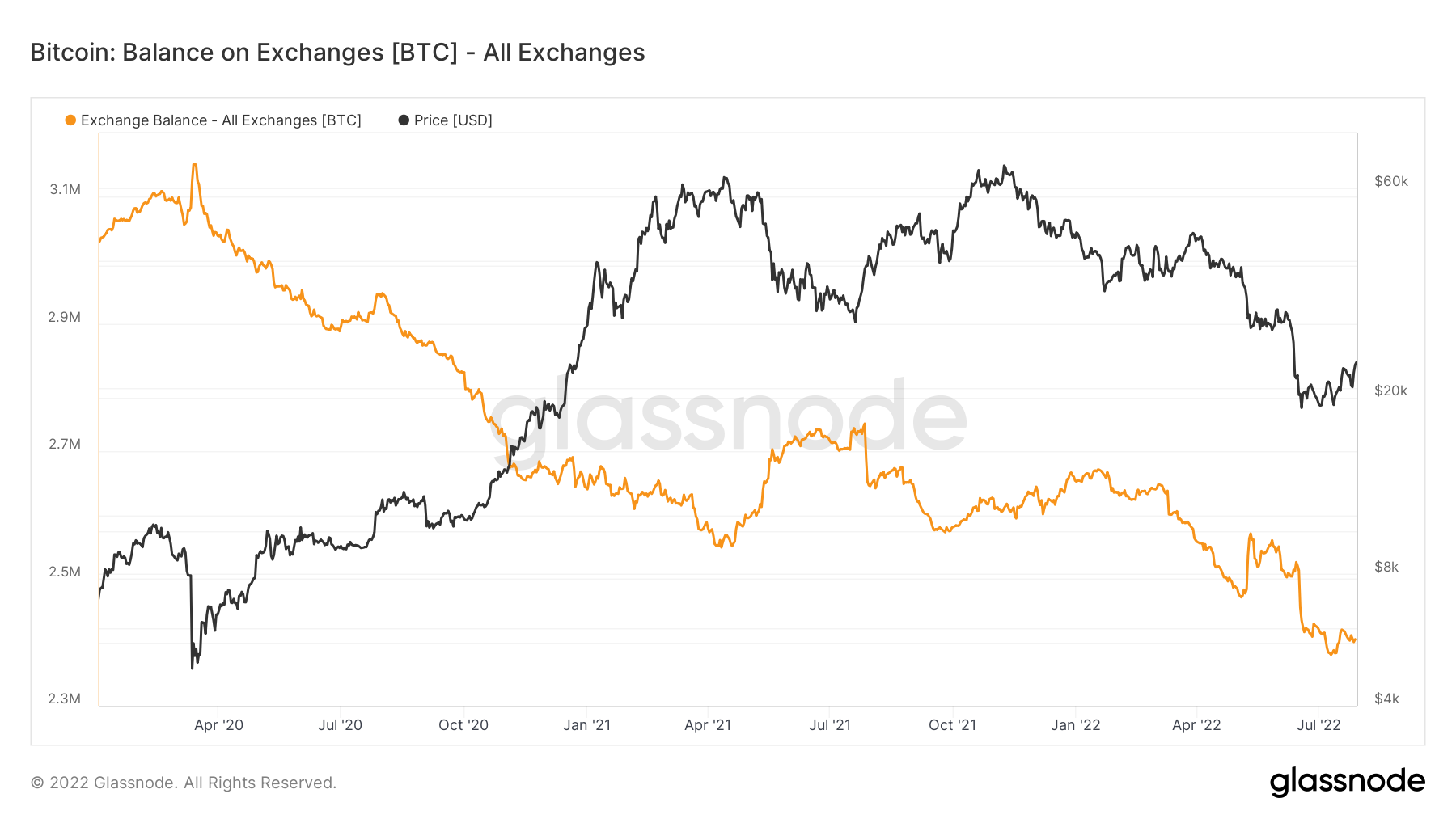

Separate data from on-chain analytics firm Glassnode meanwhile highlighted the continuing trend of Bitcoin departing exchanges.

Related: Bitcoin bull run ‘getting interesting’ as BTC cost hits 6-week high

BTC as a swap wallets now makes up about just 12.6% from the overall supply, lower 4.6% from the overall supply because the March 2020 crash, staff noted.

#Bitcoin balance on exchanges continues its macro decline, reaching 12.6% from the Circulating Supply (2.4M $BTC).

Exchange balances have finally seen a macro output well over 4.6% from the circulating supply because the March 2020 ATH.

Live Chart: https://t.co/zJnfaG05zt pic.twitter.com/vhKCudqGUr

— glassnode (@glassnode) This summer 29, 2022

In BTC terms, the figure is 2.4 million BTC now when compared with 3.15 million BTC in March 2020. The amount may be the cheapest since This summer 2018.

Earlier this year, Cointelegraph reported around the speeding up trend of removing coins from exchanges.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.