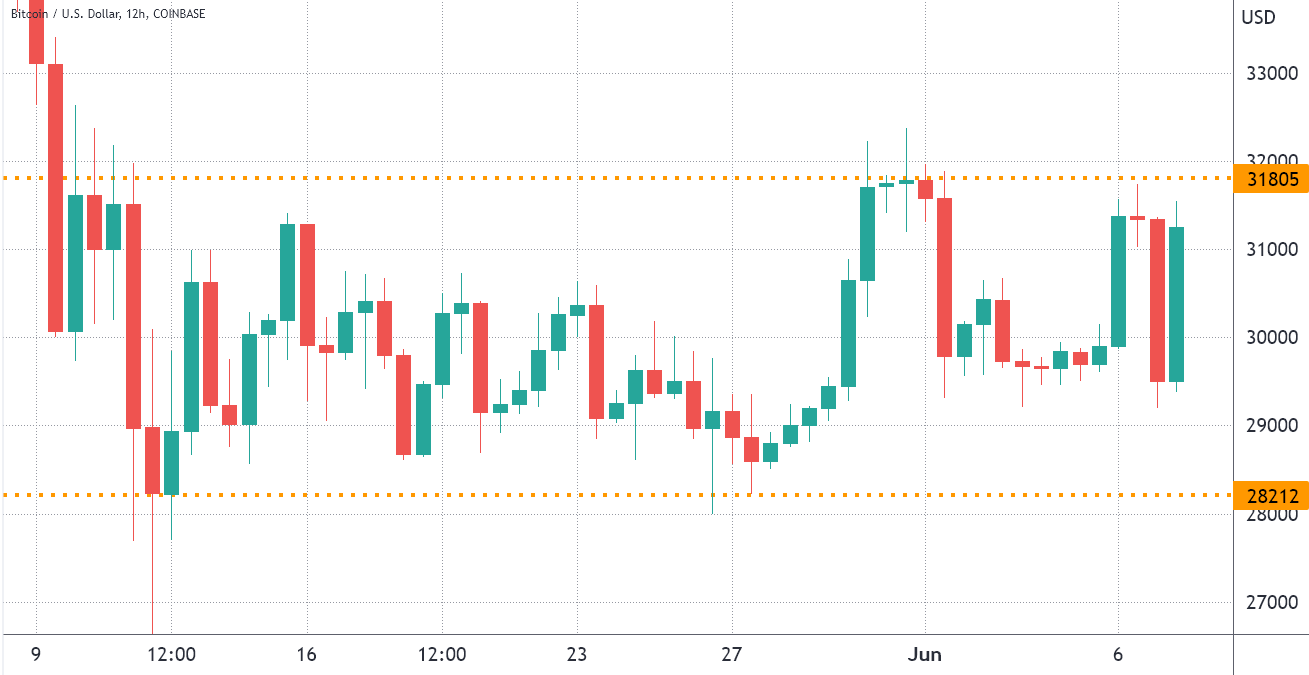

Since May 10, the Bitcoin (BTC) chart shows a comparatively tight selection of cost movement and also the cryptocurrency has unsuccessful to interrupt the $32,000 resistance on multiple occasions.

The choppy buying and selling partly reflects the uncertainty of the stock exchange because the S&P 500 Index ranged from three,900 to 4,180 within the same period. Somewhere, there’s been economic development in the Eurozone in which the gdp increased 5.1% annually. Alternatively, inflation continues to grow, reaching 9% within the Uk.

Further contributing to Bitcoin’s volatility was the digital assets regulatory framework proposal brought to the U.S. Senate on June 7. The 69-page bipartisan bill is based on Senator Cynthia Lummis of Wyoming and Senator Kirsten Gillibrand of recent You are able to also it addresses the CFTC’s authority over relevant digital asset place markets.

On June 3, South Korea’s Financial Supervisory Service (FSS) started an inquiry with 157 payment gateway services that actually work with digital assets. Formerly, on May 24, South Korean officials opened up an analysis against Do Kwon, the main estimate the Terra incident.

The U.S. Registration (SEC) also started an analysis against Binance Holdings on June 6. Binance may be the world’s largest crypto exchange in volume terms and also the SEC is evaluating if the BNB token initial gold coin offering violated securities rules.

On June 6, IRA Financial Trust, a platform supplying self-directed digital asset retirement and pension accounts, filed a suit against Gemini cryptocurrency exchange and claimed that the February. 8 breach brought to some $36 million reduction in crypto assets from customer accounts under Gemini’s child custody.

Let us take a look at Bitcoin’s futures data to know how professional traders are situated, including whales and market makers.

Derivatives metrics reflect investors’ bearish expectations

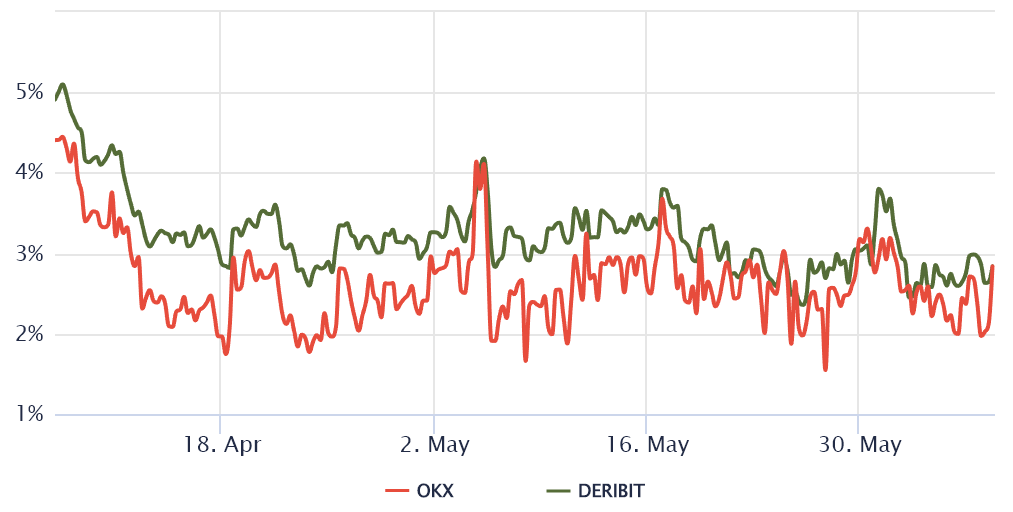

Traders should evaluate Bitcoin futures market data to know how professional traders are situated. The quarterly contracts are experienced traders’ preferred instrument to prevent the perpetual futures’ fluctuating funding rate.

The foundation indicator measures the main difference between longer-term futures contracts and also the current place market levels. The Bitcoin futures annualized premium should run between 5% to 10% to pay traders for “locking in” the cash for 2 to 3 several weeks before the contract expiry.

Bitcoin’s futures premium continues to be below 4% since April 12, a studying usual for bearish markets. Much more concerning would be that the before these professional traders were bullish was over six several weeks ago once the metric surpassed the tenPercent threshold.

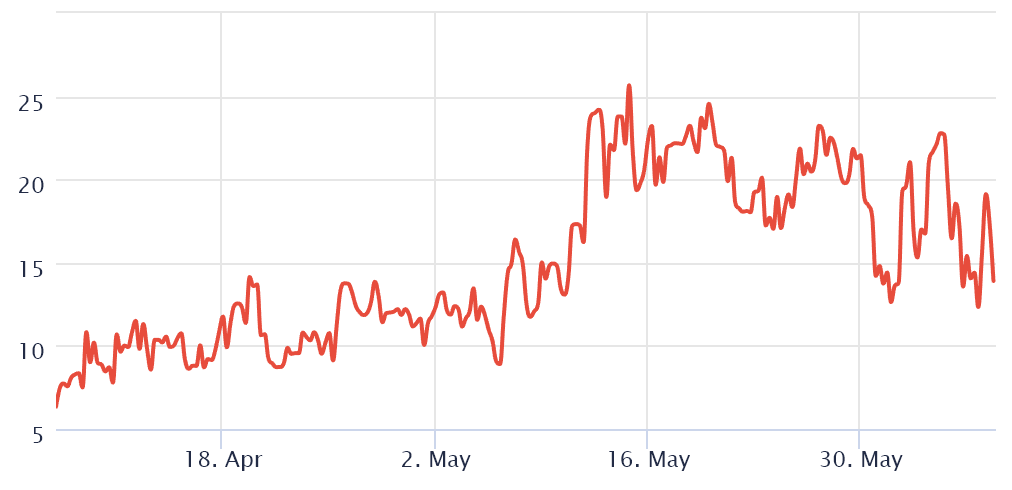

To exclude externalities specific towards the futures instrument, traders should also evaluate the Bitcoin options markets. The 25% delta skew is really a telling sign when ever Bitcoin market makers and arbitrage desks are overcharging for upside or downside protection.

During bullish markets, options investors give greater odds for any cost pump, resulting in the skew indicator to maneuver below negative 12%. However, a bear market’s generalized panic induces an optimistic 12% or greater skew.

The 30-day delta skew has ranged from 12.5% to 23% between June 1 and seven, which signals options traders are prices greater likelihood of a bearish movement. Still, it shows an average sentiment improvement in the previous few days.

Cryptocurrency regulation and weak economic figures are clearly weighing on investor sentiment and derivatives data shows professional Bitcoin traders staying away from leveraged lengthy positions, and they’re unwilling to take downside-risk.

Right now, it’s obvious that bears are comfy with setting $32,000 like a level of resistance and repeat drops towards the $28,200 level will probably continue.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.