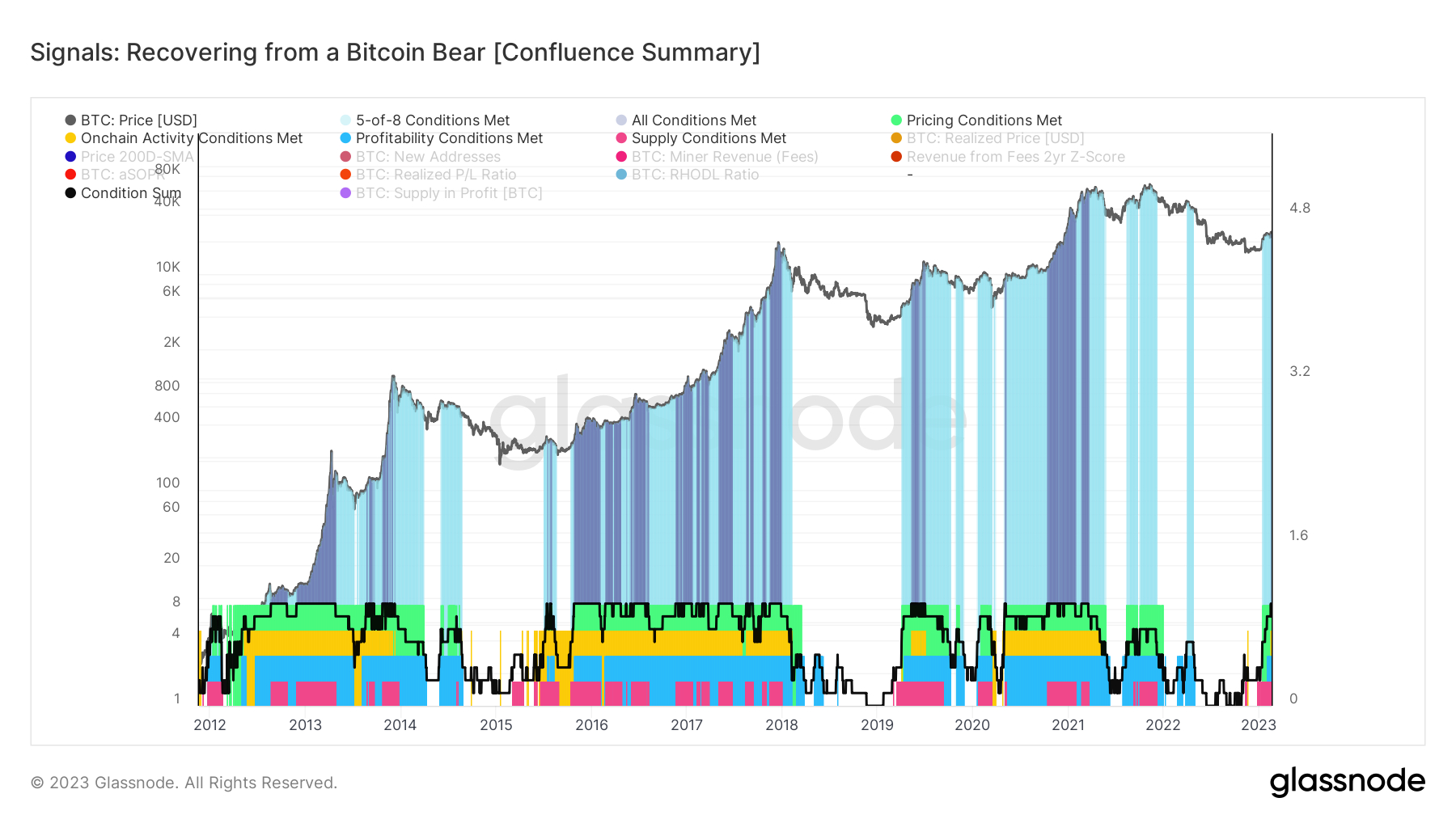

The 2009 week, eight from eight key on-chain and technical indicators tracked by crypto analytics firm Glassnode’s “Recovering from the Bitcoin Bear” just signaled the next Bitcoin bull market may be here. Which was the very first time that eight indicators have been flashing a BTC buy signal in symphony since March 2016.

Glassnode analysts make use of the “Recovering from the Bitcoin Bear” dashboard to gauge whether Bitcoin may be while transitioning from the bear market right into a longer-term bull market. The dashboard analyses whether Bitcoin is buying and selling above key prices models, whether network utilization momentum is growing, whether market profitability is coming back and if the balance of USD-denominated Bitcoin wealth is in support of the lengthy-term HODLers.

On Thursday, among the indicators (the two-year Z-score from the Revenue From Charges Multiple) reserved slightly and it was no more flashing a buy signal. However, this reversal will probably be short-resided and all sorts of eight indicators will probably soon start flashing eco-friendly in symphony once more.

This might have important implications for that Bitcoin cost. Because the graphic above demonstrates, throughout a Bitcoin bull market, it’s quite common to determine Glassnode’s “Recovering from the Bitcoin Bear” dashboard switching between all eight and under eight indicators flashing eco-friendly. This doesn’t itself mean anything for that Bitcoin cost.

Furthermore significant here’s considering as soon as when all eight from the indicators from the dashboard start flashing eco-friendly the very first time following a prolonged Bitcoin bear market. The final time this happened was during October 2020, when Bitcoin was buying and selling around $11,500. By April 2021, Bitcoin had surged in to the $63,000s. Just before October 2020, all eight indicators hadn’t been flashing eco-friendly since This summer 2019, apart from a short period in April 2020.

Other types of when all eight indicators began flashing eco-friendly the very first time inside a lengthy time carrying out a prolonged Bitcoin bear market use in May 2019 as well as in October 2015. Many of these past aforementioned instances represent excellent moments to possess bought Bitcoin. If all eight of Glassnode’s Dealing with a Bitcoin Bear indicators start flashing eco-friendly, just might be likely, analysts might thus interpret this like a signal that Bitcoin’s risk-reward at current cost levels is excellent indeed.

Breaking Lower the Dealing with a Bitcoin Bear Dashboard

Here is a introduction to each one of the eight indicators utilized by Glassnode within their “Dealing with a Bitcoin Bear” dashboard.

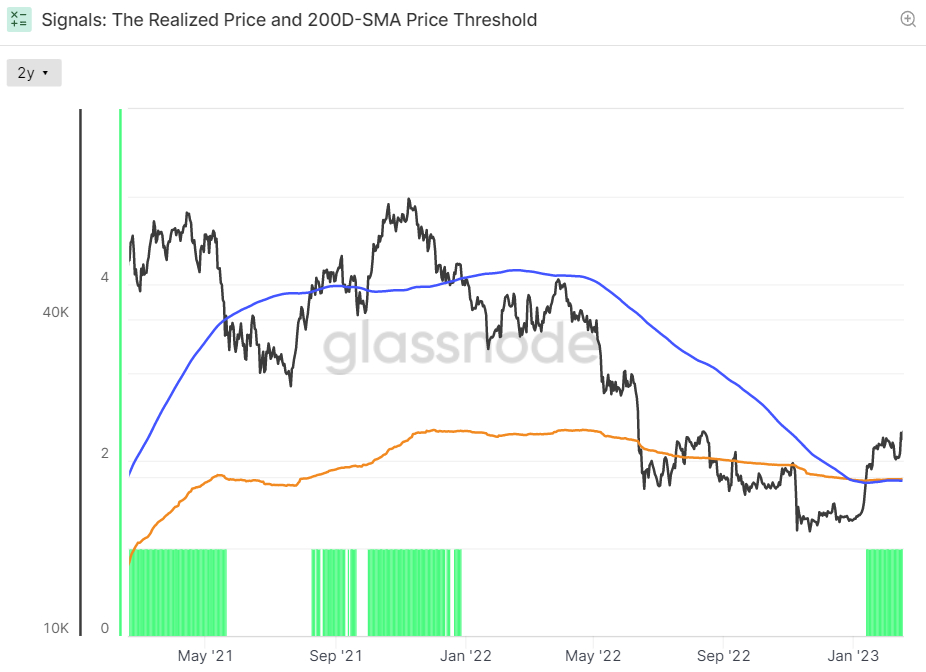

Signals 1 and a pair of – Bitcoin Above its 200DMA and Recognized Cost

Bitcoin’s 2023 rally has witnessed it break to northern its 200-Day Simple Moving Average (SMA) and Recognized Cost, the typical cost at that time when each Bitcoin last moved. Both are thought to be technical levels with key lengthy-term significance. A rest above them is observed by many people being an indicator that near-term cost momentum is shifting inside a positive direction.

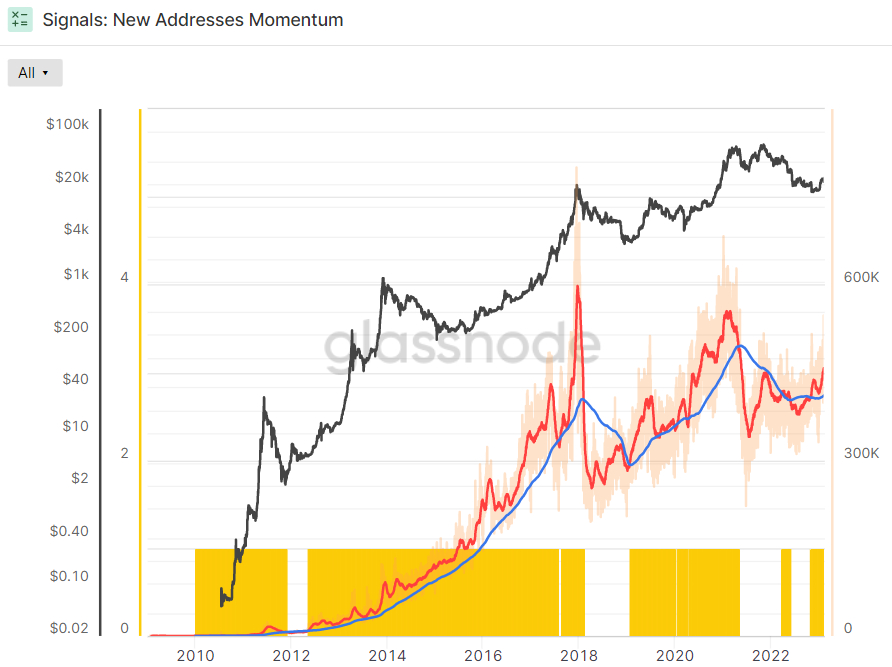

Signal 3 and 4 – New Address and Fee Revenue Momentum Are Positive

The 30-Day SMA of recent Bitcoin address creation moved above its 365-Day SMA a couple of several weeks ago, an indication the rate where new Bitcoin wallets are now being produced is speeding up. It has in the past happened at the beginning of bull markets.

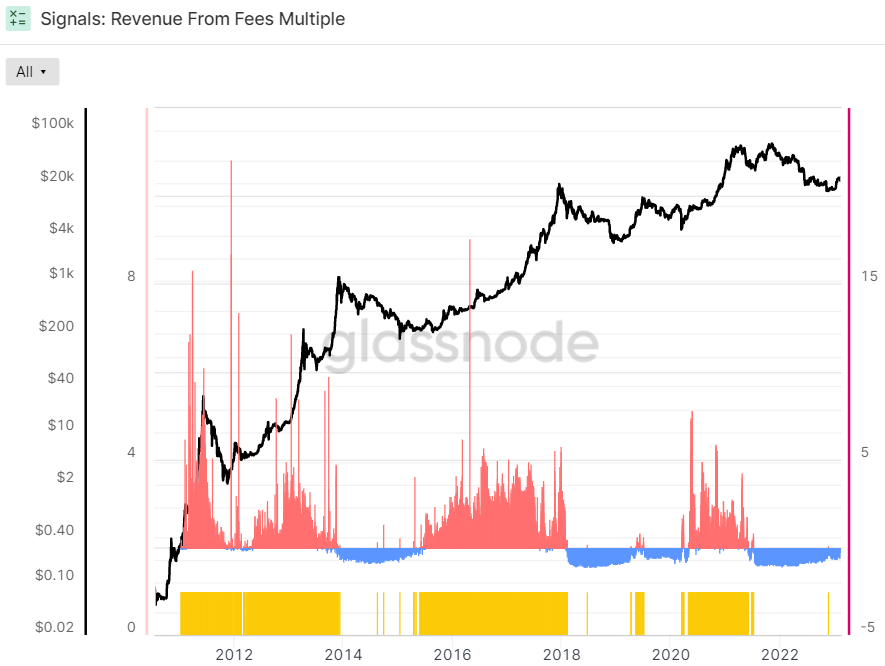

The Revenue From Charges Multiple was the indicator that switched positive on Wednesday, simply to then turn negative again on Thursday. The Z-score is the amount of standard deviations below or above the mean of the data sample. In cases like this, Glassnode’s Z-score is the amount of standard deviations below or above the mean Bitcoin Fee Revenue from the last 2-years.

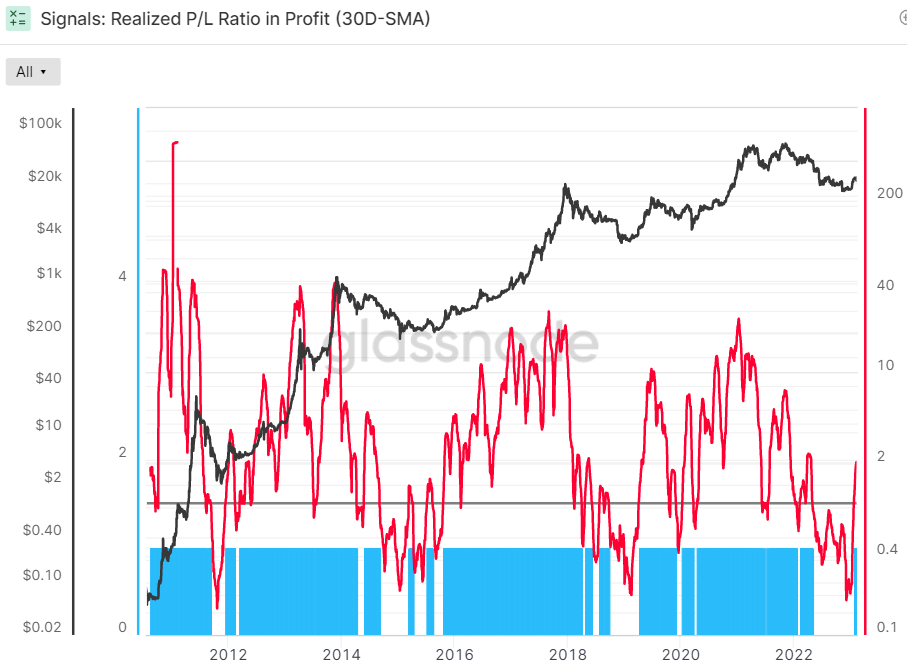

Signals 5 and 6: Market Profitability is Coming back

The 30-Day Simple Moving Average (SMA) from the Bitcoin Recognized Profit-Loss Ratio (RPLR) indicator moved above one a couple of days ago the very first time last April. This means that the Bitcoin marketplace is realizing a larger proportion of profits (denominated in USD) than losses.

Based on Glassnode, “this generally ensures that sellers with unrealized losses happen to be exhausted, along with a healthier inflow of demand exists to soak up profit taking”. Hence, this indicator is delivering a bullish sign.

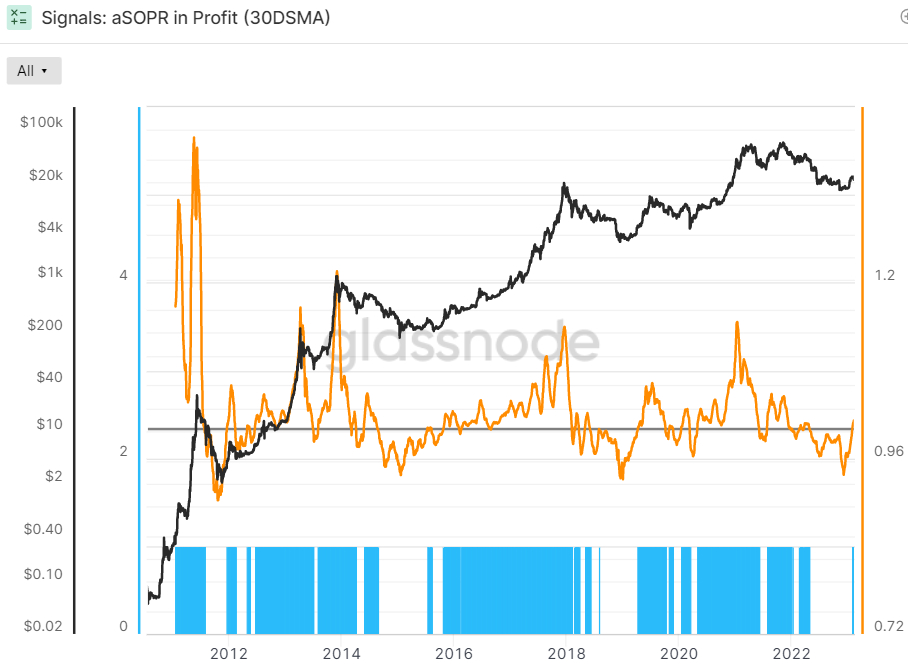

Meanwhile, the Adjusted Spent Output Profit Ration (aSOPR), an indication that reflects the quality of recognized profit and loss for those coins managed to move on-chain, also lately surpassed 1, indicating the marketplace is within profit. Searching back during the last eight many years of Bitcoin history, the aSOPR rising above 1 following a prolonged spell below it’s been an incredible buy signal.

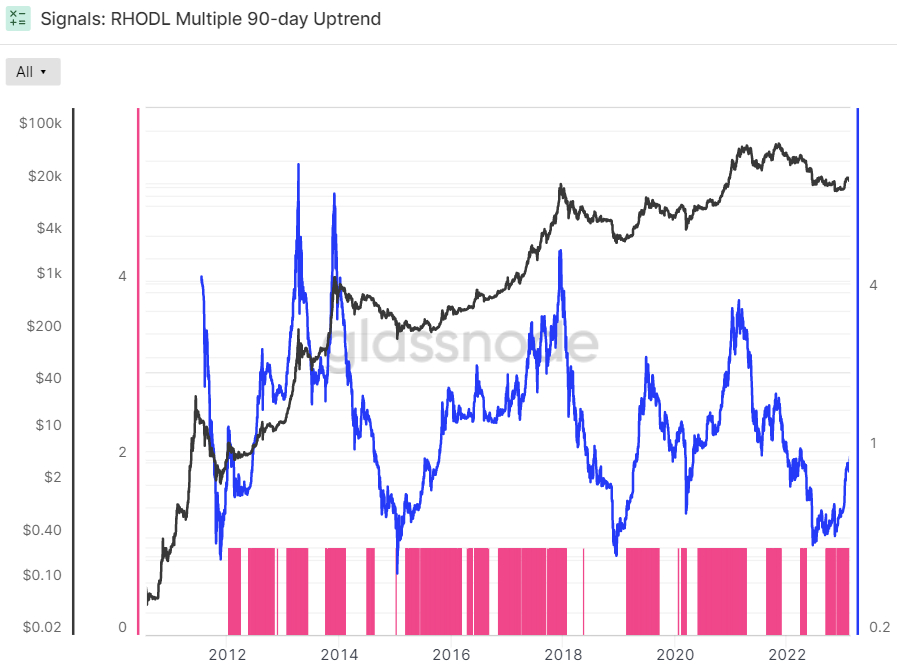

Signals 7 and eight: BTC Balance Has Moved In support of The HODLers

The Bitcoin Recognized HODL Multiple has been around an upward trend during the last 3 months, a bullish sign based on Glassnode. The crypto analytics firm claims that “when the RHODL Multiple transitions into an upward trend more than a 90-day window, it signifies that USD-denominated wealth is beginning to shift back towards new demand inflows”. It “indicates earnings are being taken, the marketplace is capable of doing absorbing them… (and) that longer-term holders are beginning to invest coins” Glassnode states.

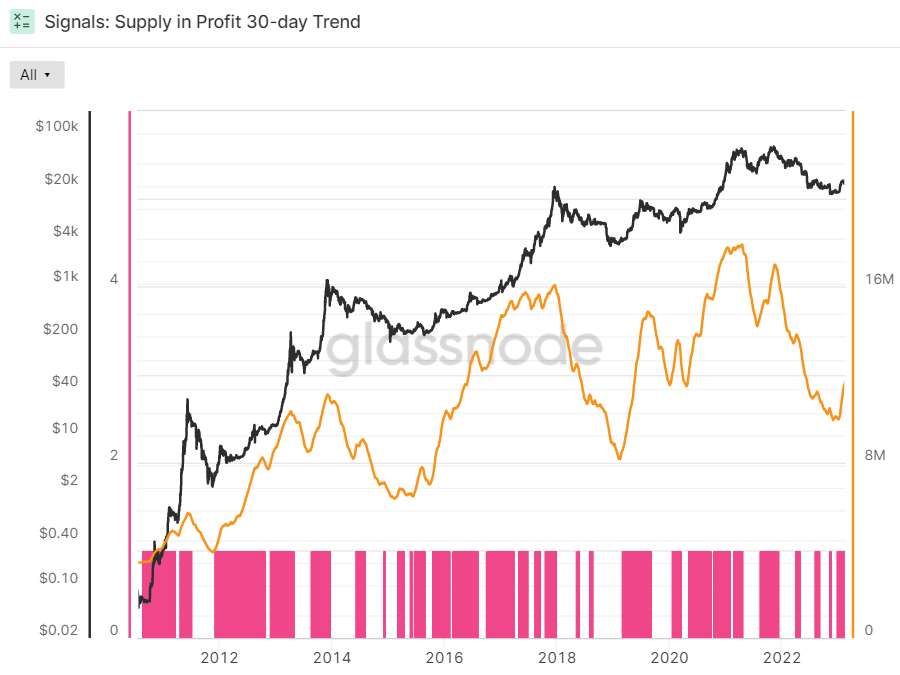

Glassnode’s final indicator in the Dealing with a Bitcoin Bear dashboard is if the 90-day Exponential Moving Average (EMA) of Bitcoin Supply in Profit has been around an upward trend during the last thirty days or otherwise. Supply in Profit is the amount of Bitcoins that last moved when USD-denominated prices were less than they’re at this time, implying these were bought for any lower cost and also the wallet is possessing a paper profit. This indicator can also be flashing eco-friendly.

Glassnode’s broadly adopted dashboard comes at any given time whenever a laundry listing of other popular on-chain and technical indicators will also be flashing bullish signals.

Find out more: Bitcoin Bears Beware – Another Key Metric is Flashing a BTC Buy Signal

Given the suggestions above, possibly it shojuld not be a surprise that Bitcoin is constantly on the defy macro headwinds, like the recent move greater in america dollar and US bond yields driven with a build-from Given tightening expectations in wake of latest hawkish communications from policymakers after this month’s string of super strong tier one US data releases.