Bitcoin (BTC) is the greatest focal point in “moderate the economical impact” of major rate of interest bulletins, according to a different report from Babel Finance, a crypto-financial services provider.

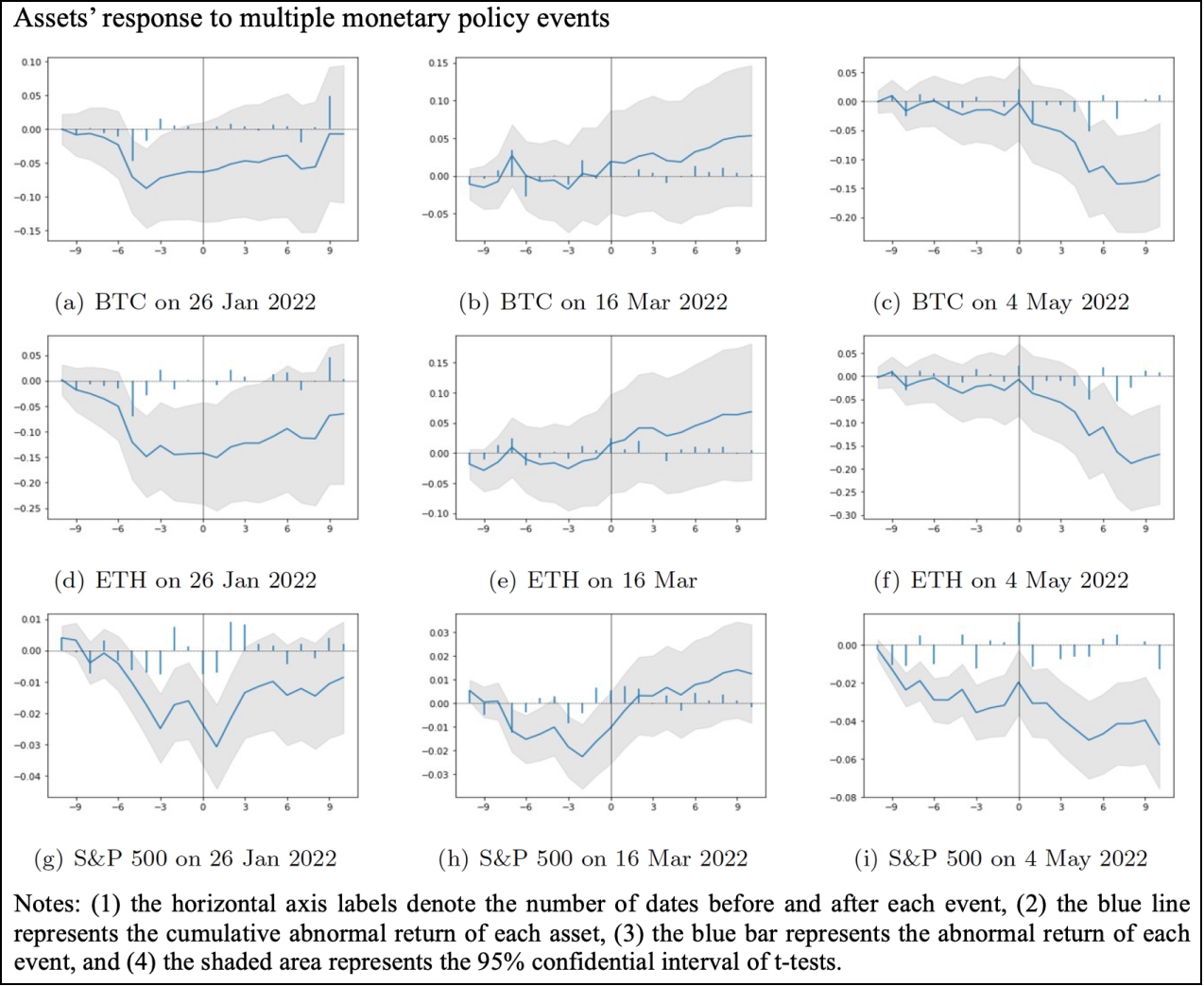

The report, compiled by Babel Finance analysts Robbie Liu and Yuanming Qiu, showed up at its conclusions by searching in the market reaction when it comes to various assets during three rate of interest bulletins in america this season: on May 4, March 16, and The month of january 26.

The moderating effect bitcoin had was better compared to other digital assets for example Ethereum’s native ETH token, and also the effect was obvious despite BTC being carefully correlated with traditional assets like the US S&P 500 stock index, the report stated.

Overall, Bitcoin’s performance around the above-mentioned dates demonstrates the asset’s capability to “better moderate the economical impact of financial occasions in comparison to the U.S. stock exchange and ETH,” they authored.

Just as one reason behind this, the report pointed that “a significant proportion” of bitcoin holders usually have had confidence within the asset’s “store-of-value qualities and inflation-hedging narrative.”

Consequently, a bigger proportion of Bitcoin holders are selecting to keep the asset, even while other risk assets crash, the report stated.

Rate of interest bulletins as well as their effect on BTC:

Particularly, the moderate reaction within the Bitcoin market came even though digital asset has mirrored the united states stock exchange “to an unparalleled degree” since May 2020.

Based on the report, 30-day correlations arrived at almost .8 on May 6 of 2022 – the greatest correlation since This summer 2017.

When it comes to what to anticipate moving forward, it’s still uncertain whether bitcoin has arrived at the foot of the present bear cycle, the report stated.

“Some analysts are searching for indications of a Bitcoin bottom,” however this report is “not answering whether ‘buy the dip’ has become a great bet,” the authors authored.

Rather when trying to calculate a bottom for bitcoin, the report managed to get obvious the digital asset’s store-of-value property “does not entirely diminish” despite the fact that its cost falls and it is correlation along with other risk assets remains high.

“As always, Bitcoin’s lengthy-term narratives wouldn’t be easily undermined by another cost collapse. ‘True believers’ continue to be building there,” the authors concluded.

____

Find out more:

– Bitcoin, Ethereum Struggle each day After Fed’s Record Rate Hike as Analysts Expect a Bounce

– Given Raises Rates by 75 Basis Points, Bitcoin and Ethereum Progress

– Bitcoin, Ethereum & Crypto Dive as Celsius Adds Fuel towards the Given Fire Now

– Given Has ‘Limited Firepower’ for Rate Hikes, Current Expectations Already Priced set for Bitcoin – CoinShares

– For This Reason Given Might Attack Inflation More Strongly

– Davos Watch: Real Rates Of Interest to stay at ‘Nothing or Alongside Nothing’ & Greater Inflation Target

– Given: ‘I Wouldn’t Be Amazed When They Really Moved’ To some 100 Basis Point Hike, Strategist States

– Bitcoin Will Turn When The Given Flinches – Mike Novogratz