Bitcoin (BTC) able to escape hodlers the discomfort of losing $20,000 on June 15 after BTC/USD came dangerously near to last cycle’s high.

Bitcoin “bottom” fools nobody

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD surging greater after reaching $20,079 on Bitstamp.

Inside a pause from the sell-off, the happy couple adopted U . s . States equities greater on your wall Street open, hitting $21,700. The S&P 500 acquired 1.4% following the opening bell, as the Nasdaq Composite Index managed 1.6%.

The restored market strength, commentators stated, was because of the majority already prices in outsized key rate hikes through the Fed, because of be confirmed at the time.

Nevertheless, it had been crypto using the worst hit within the inflationary atmosphere, Bloomberg chief commodity strategist Mike McGlone noted. Inside a tweet, he contrasted Bitcoin and altcoin performance with skyrocketing goods, particularly WTI oil, futures which now traded at almost double their 200-week moving average.

“Unparalleled Crude Spike versus. Bottoms in Bitcoin, Bonds, Gold — Oil futures’ in the past extreme stretch above its 200-week mean is ample fuel for inflation to spike, consumer sentiment to plunge, Fed rate hikes to accelerate as well as an long lasting hangover,” he contended.

Despite covered up cost action, many were unconvinced that Bitcoin could meanwhile sustain the low $20,000 zone considerably longer.

“We haven’t yet see capitulation within the Crypto markets,” popular trader Crypto Tony told Twitter supporters.

“It’s close, but does not want to yet. Every bounce is stuffed with optimism also it should not end up like that.”

Fellow trader and analyst Rekt Capital agreed, stating that the sell-off was not supported by appropriate volume.

“Strong market-wide selling is happening for BTC,” he authored at the time.

“Unquestionably, Seller Exhaustion is coming up next. Watch out for high sellside volume bars. These have a tendency to signal bottoming out after constant selling & precede a whole trend reversal with time.”

As Cointelegraph reported, Bitcoin’s own 200-week moving average lay at $22,400, Rekt Capital warning the level could now form a cost magnet for days or perhaps several weeks.

Losses still don’t equal “capitulation” — data

Data meanwhile demonstrated the level that panic selling have been happening for the short term.

Related: Bitcoin miners’ exchange flow reaches 7-month high as BTC cost tanks below $21K

Weekly recognized losses arrived at 2.6% of Bitcoin’s recognized cap, the greatest ever, based on figures from on-chain analytics firm Glassnode highlighted by CryptoVizArt.

The cumulative weekly recognized loss presently is = 2.6% from the #BTC recognized cap. The comparable historic occasions where this ratio >2.5% are highlighted by . pic.twitter.com/jbl3aD5WmJ

— CryptoVizArt.btc ∞/21M – LOST #BTC (@CryptoVizArt) June 15, 2022

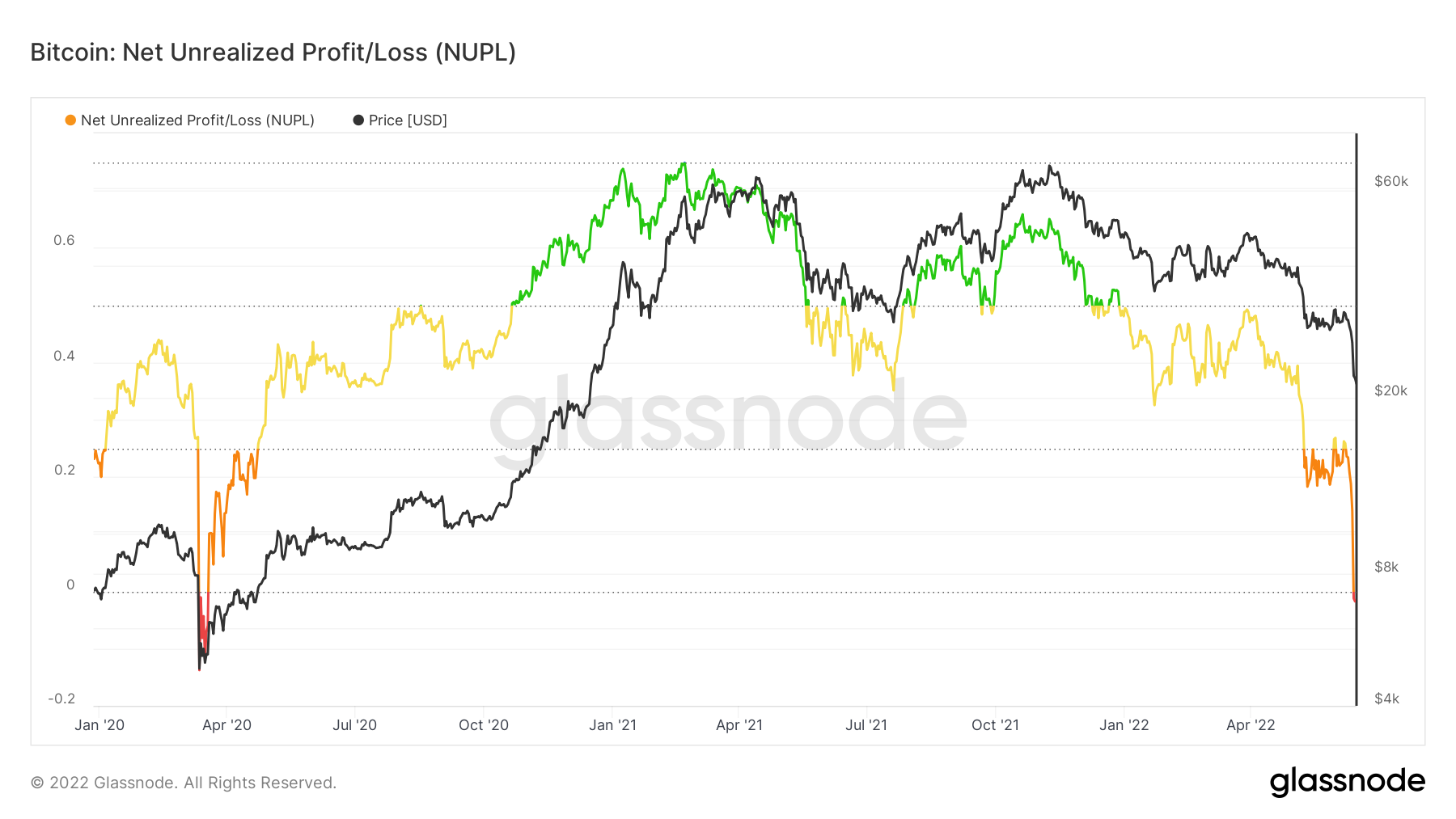

Bitcoin’s internet unrealized profit/loss (NUPL) metric, covering coins not physically offered, also shown a substantial proportion from the hodled supply being underwater — probably the most, actually, since March 2020.

Based on its associated scale, the metric has turning red after falling below zero, i.e., the historic “capitulation” zone.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.