Bitcoin (BTC) might find elevated interest in the Uk “very quickly” as fiat currency volatility makes BTC seem like a stablecoin.

Which was the final outcome from Gabor Gurbacs, strategy advisor at investment giant VanEck, one of several flagging Bitcoin’s appeal within the pound now.

United kingdom becomes fertile ground for Bitcoin “orange pill”

Because the U.S. dollar runs rampant, its strength originates at the fee for buying and selling partner currencies, particularly the euro, pound and Japanese yen.

The pound’s disintegration collected pace now, however, as GBP/USD hit its cheapest on record at nearly $1.03.

Using the U . s . Kingdom’s central bank, the financial institution of England, staying away from interventions to date, nerves are showing as purchasing power requires a double hit from currency weakness and inflation at forty-year highs.

“The Uk can get orange-pilled very rapidly given GBP volatility,” Gurbacs predicted.

“Given the United kingdom has become outdoors from the EU bureaucratic apparatus, it’ll get another chance to become Bitcoin hub. I believe United kingdom leaders uses this chance reasonably well.”

The pound was lower nearly 25% year-to-date at some point in USD terms. While Bitcoin beats it at 56%, data from Cointelegraph Markets Pro and TradingView shows, the longer time horizon, the greater attractive a BTC hedge becomes.

“Over yesteryear 4 years the dollar has collapsed -67% gains USD,” Michael Saylor, former Chief executive officer of MicroStrategy, noted in the own assessment of fiat currency losses on Sept. 26.

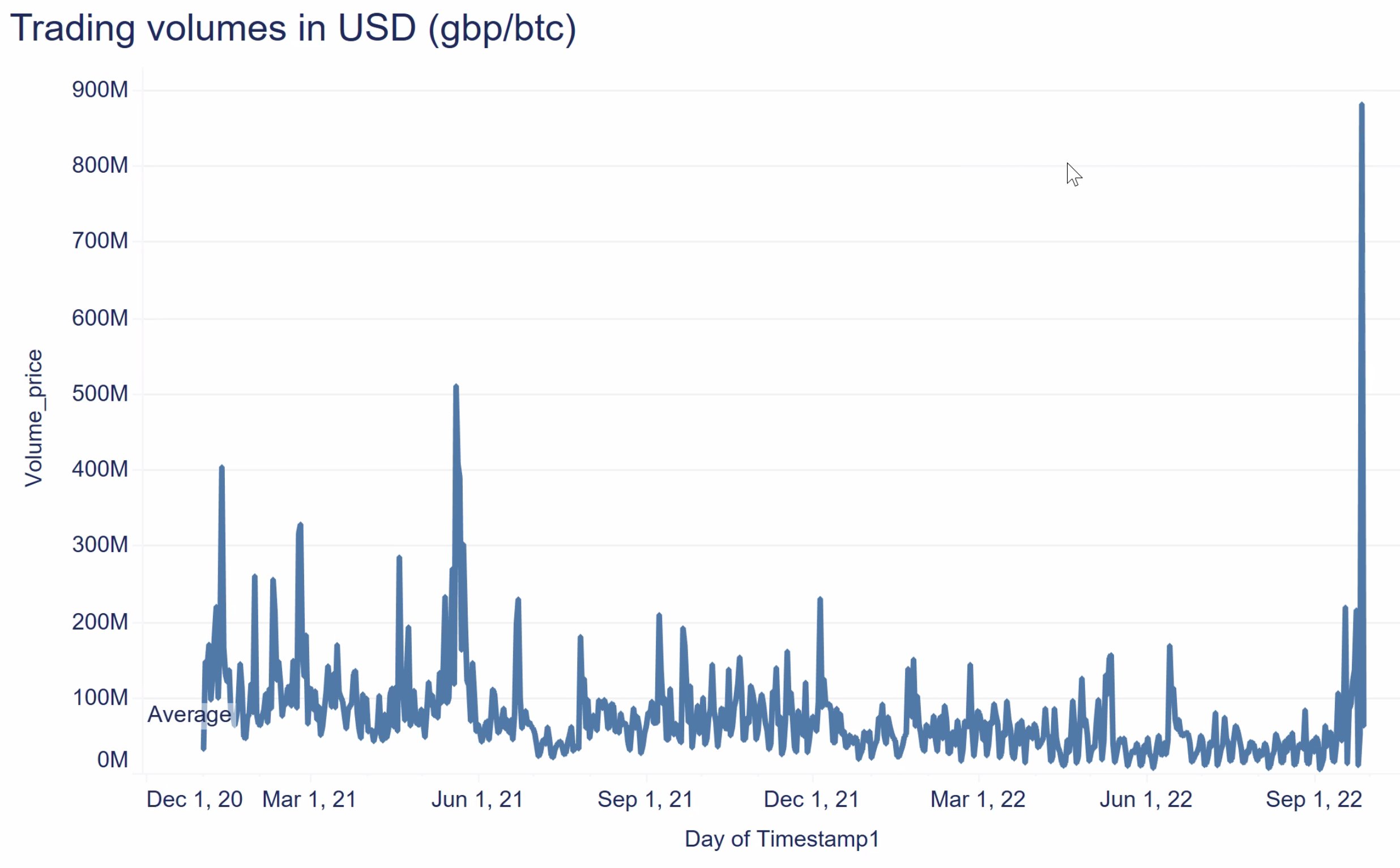

According to data from CoinShares mind of research James Butterfill, trade volume for that GBP/BTC pair on major exchanges Bitstamp and Bitfinex, normally worth a combined $70 million each day, hit a huge $881 million on Sept. 26 — a rise well over 1,150%.

Butterfill contended this demonstrated that “whenever a FIAT currency is threatened, investors begin to favour Bitcoin.”

Reacting, Saifedean Ammous, author from the popular book, “The Bitcoin Standard,” known as the phenomenon “fascinating.”

G20 is “beginning to know” the requirement for a BTC hedge

Gurbacs, meanwhile, acknowledged that although he “might be too positive concerning the United kingdom,” G20 countries could yet enact a significant policy shift vis-a-vis BTC acceptance.

Related: Bitcoin gains 5% to reclaim $20K, eyes first ‘green’ September since 2016

“Like gold, Bitcoin might be a hedge against their very own policies. That is worth a little % allocation and support,” he ongoing.

“Some are beginning to know this.”

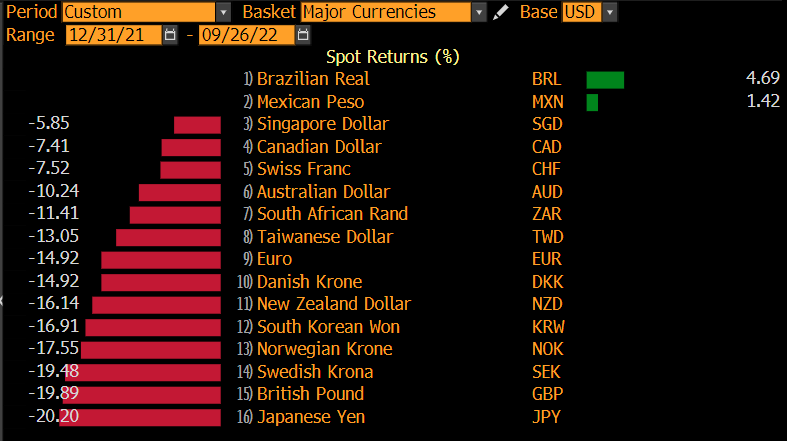

Past the pound, data shows that it’s the major fiat currencies that suffer more as a result of a surging greenback than individuals of emerging markets (EMs).

“The tables have switched,” Robin Brooks, chief economist in the Institute of Worldwide Finance, declared now.

“Emerging markets like South america and Mexico are year-to-date outperforming G10 currencies from the Dollar. This can be a big pivot in global markets that’s unparalleled. EM financial policy is nowadays more orthodox compared to advanced economies. Congratulations EM…”

An associated chart from Bloomberg demonstrated the Brazilian real and Mexican peso gaining even around the dollar in 2022.

The pound introduced in the rear combined with the yen, as the Russian ruble was particularly absent, getting hit its greatest in USD since 2015.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.