Although the cost of bitcoin (BTC) expires 23% per week, institutional investors are “just watching” for the time being, found the blockchain analytics firm CryptoQuant.

After two several weeks of their cost hovering around $16,000-$17,000, bitcoin is seeing eco-friendly fields again. It increased 2% in the last 24 hrs and most 23% in the last seven days, presently buying and selling at $21,188 (at 9:20 UTC). Overall, it’s appreciated by 26% in the last month.

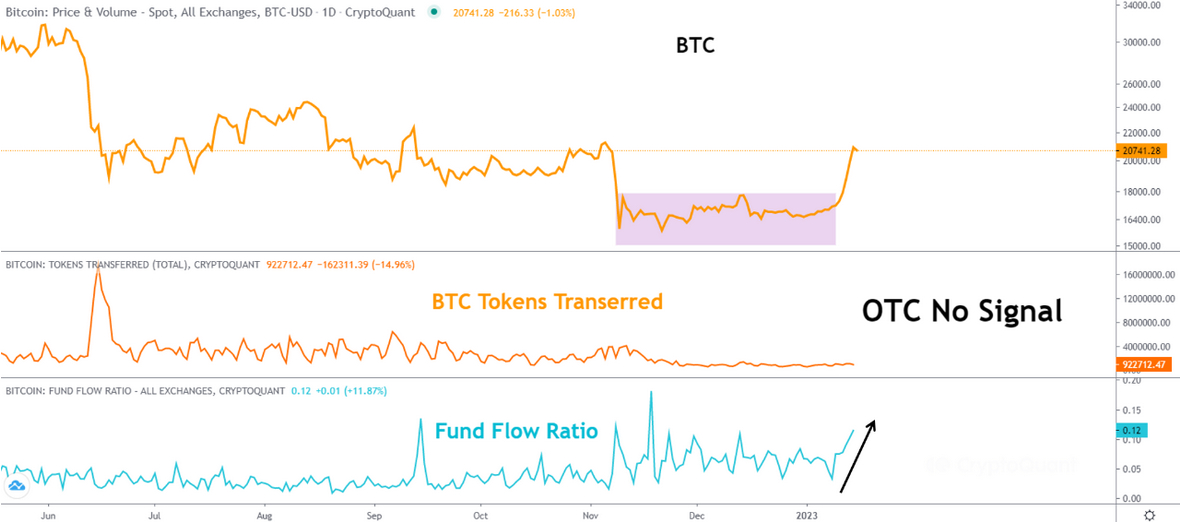

The rise can clearly be viewed around the 14-day cost chart below, showing an upward trend beginning on The month of january 11.

Meanwhile, it’s lower 51% each year, and 69% since its all-time high observed in November 2021.

However, regardless of the cost increase, institutional investors appear to be around the sidelines.

According to some CryptoQuant publish printed on The month of january 15,

“The present institutional investors have continued to be calm and merely watching. OTC [over-the-counter] buying and selling is going to be brisk once they expect a complete-fledged upward trend turn.”

CryptoQuant analyst MAC_D noted within the publish there are three indicators to check out while crypto was rising to $21,000 – that do not show a buying trend by institutional investors.

- the Fund Volume index: the amount of transaction volume is minor, and there’s nothing unusual to notice

- the Fund Holdings index: institutions’ BTC holdings are decreasing, only prices have risen

- Over-The-Counter transactions: no unusual transactions happened here it had been positively traded around the exchange only, without any unusual transactions onchain usually at the end, we’d see institutional investors buying silently through OTC buying and selling.

Because of the three indicators, stated the analyst, it’s unlikely the current rise means a genuine upward trend transition.

Rather, added the writer,

“I believe this is actually the consequence of buying sentiment, that was covered up once the U.S. CPI index was lately released. Therefore, it appears easier to find calm than excitement concerning the rise.”

The US Bls released the customer Cost Index (CPI) on The month of january 12. Amongst other things, it stated the CPI for those Urban Consumers declined .1% in December 2022, after growing .one percent the month before. The all products index elevated 6.5% for that 12 several weeks ending December – the tiniest 12-month increase because the period ending October 2021.

____

Find out more:

– What Bitcoin Cost Models Flashing Eco-friendly Reveal – Is Crypto Winter Embracing Spring

– Skybridge Capital is Predicting Bitcoin Will get to $35k This Season But is the fact that Hope Over Realism?

– Experts Predict Crypto Prices to blow up to any or all Time Highs should this happen

– Why Bitcoin Hash Rate and Mining Difficulty Headed Greater is excellent News for Bulls