Bitcoin bulls are licking their lips because they take a look at various broadly adopted metrics of on-chain activity. The world’s first cryptocurrency and largest by market capital has already been up over 40% this season, however that rally could extend within the several weeks ahead if positive on-chain trends continue, presuming macro headwinds because the US Fed is constantly on the tighten financial policy don’t get too severe.

On-chain Metrics Trending inside a Bullish Direction – A Glance Underneath the Hood

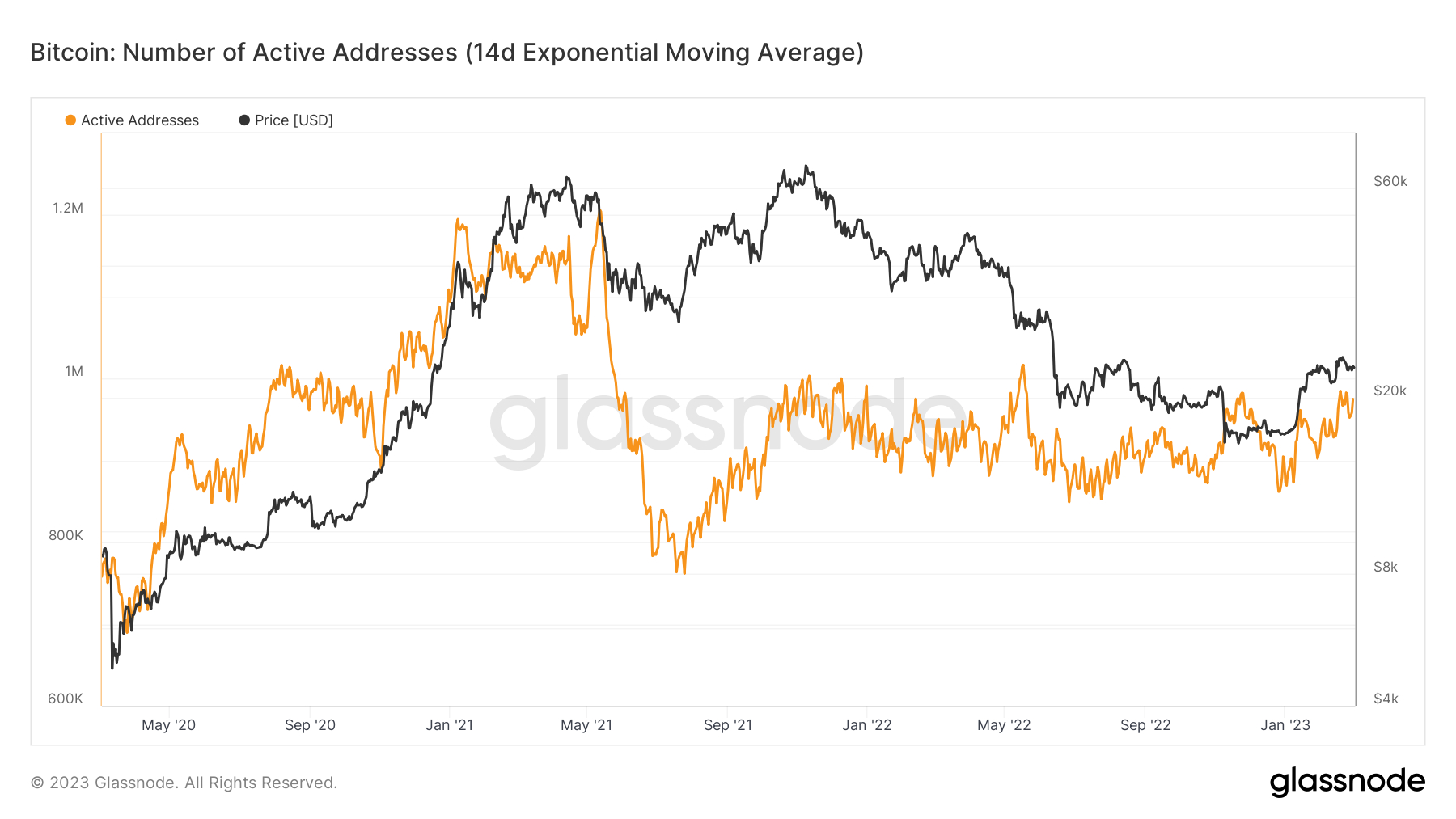

Based on data presented by crypto analytics firm Glassnode, the 14-day Exponential Moving Average (EMA) of the amount of active addresses getting together with the Bitcoin network what food was in around 975,000 on Wednesday, getting trended greater consistently since ending this past year well under 900,000. If the metric could rise and push above 982,000, active addresses could be in their greatest since last May. The amount of active addresses around the network is visible like a rough proxy for BTC demand.

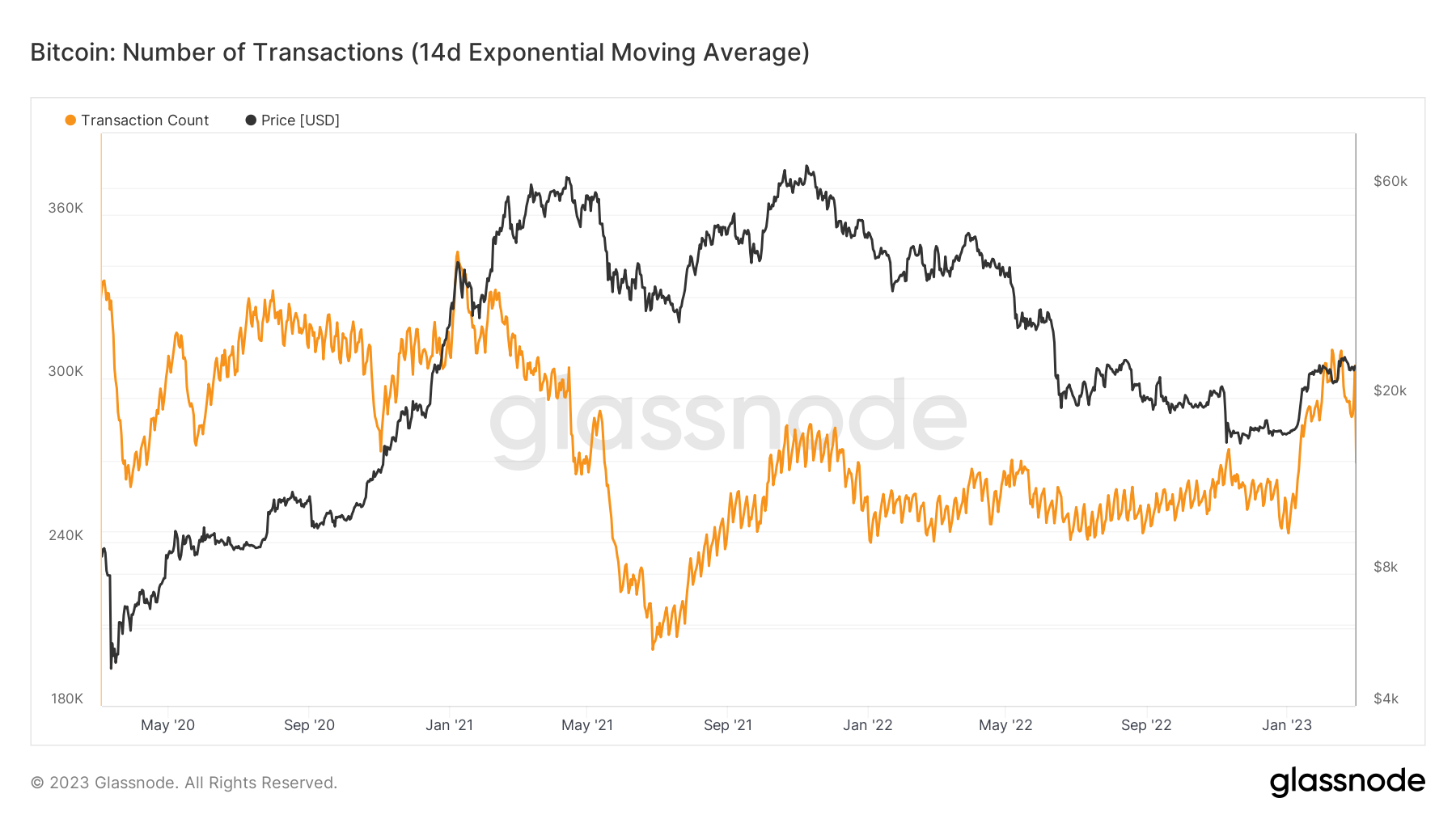

Elsewhere, the 14-day EMA of the amount of transactions happening around the network lately came near to its greatest levels since early 2021 if this nearly hit 305,000 on Wednesday. That’s approximately 50,000 rise because the finish of 2022. Rising transaction figures may also be used a tough proxy for a boost in BTC demand.

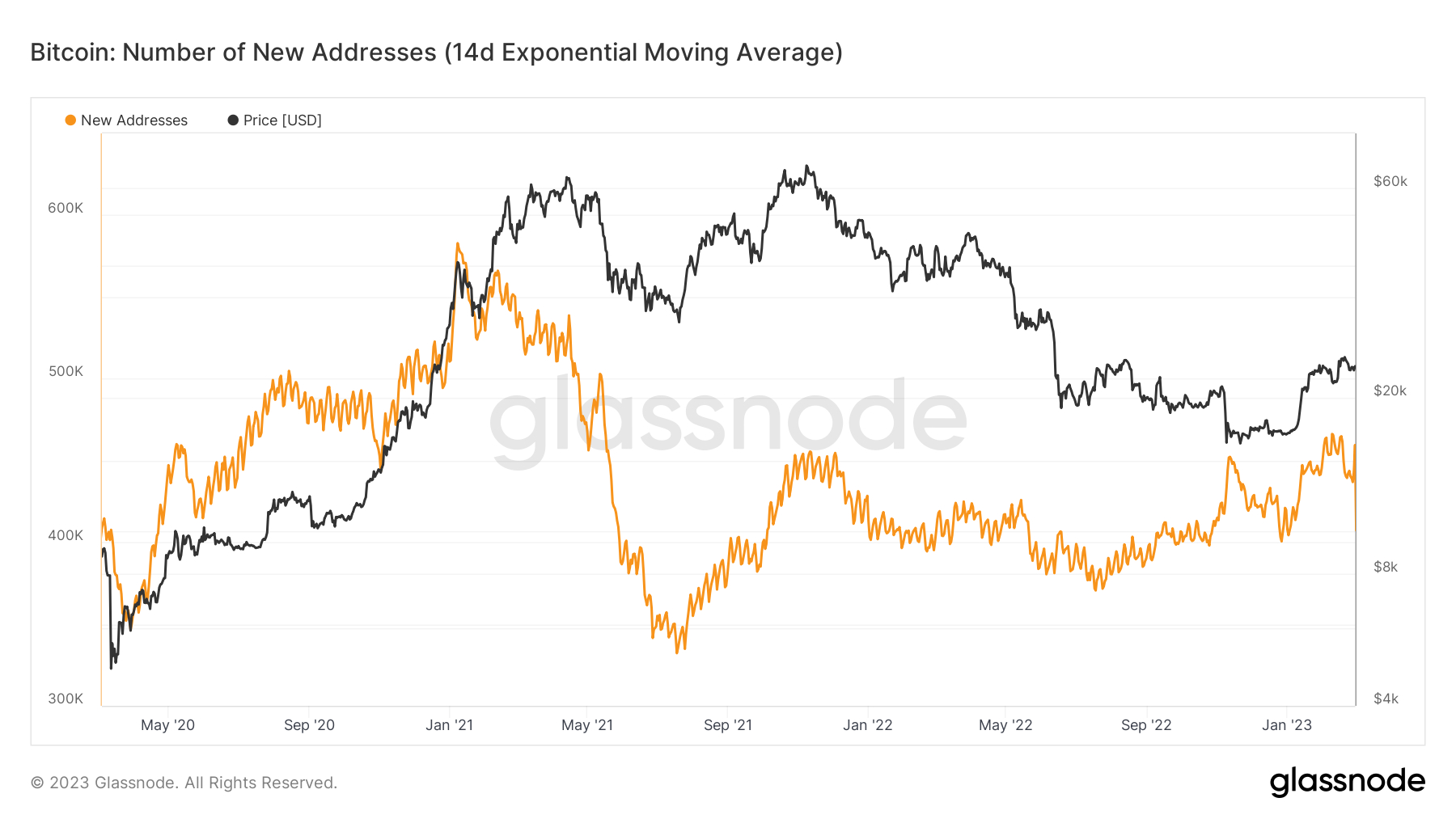

Likewise, the 14-day EMA of recent Bitcoin addresses being produced lately rose near to its greatest since mid-2021, clocking in at 459,000. That’s up around 40,000 because the finish of December. An acceleration in the amount of new addresses getting together with the Bitcoin network suggests an acceleration in Bitcoin’s “adoption”, another proxy for demand.

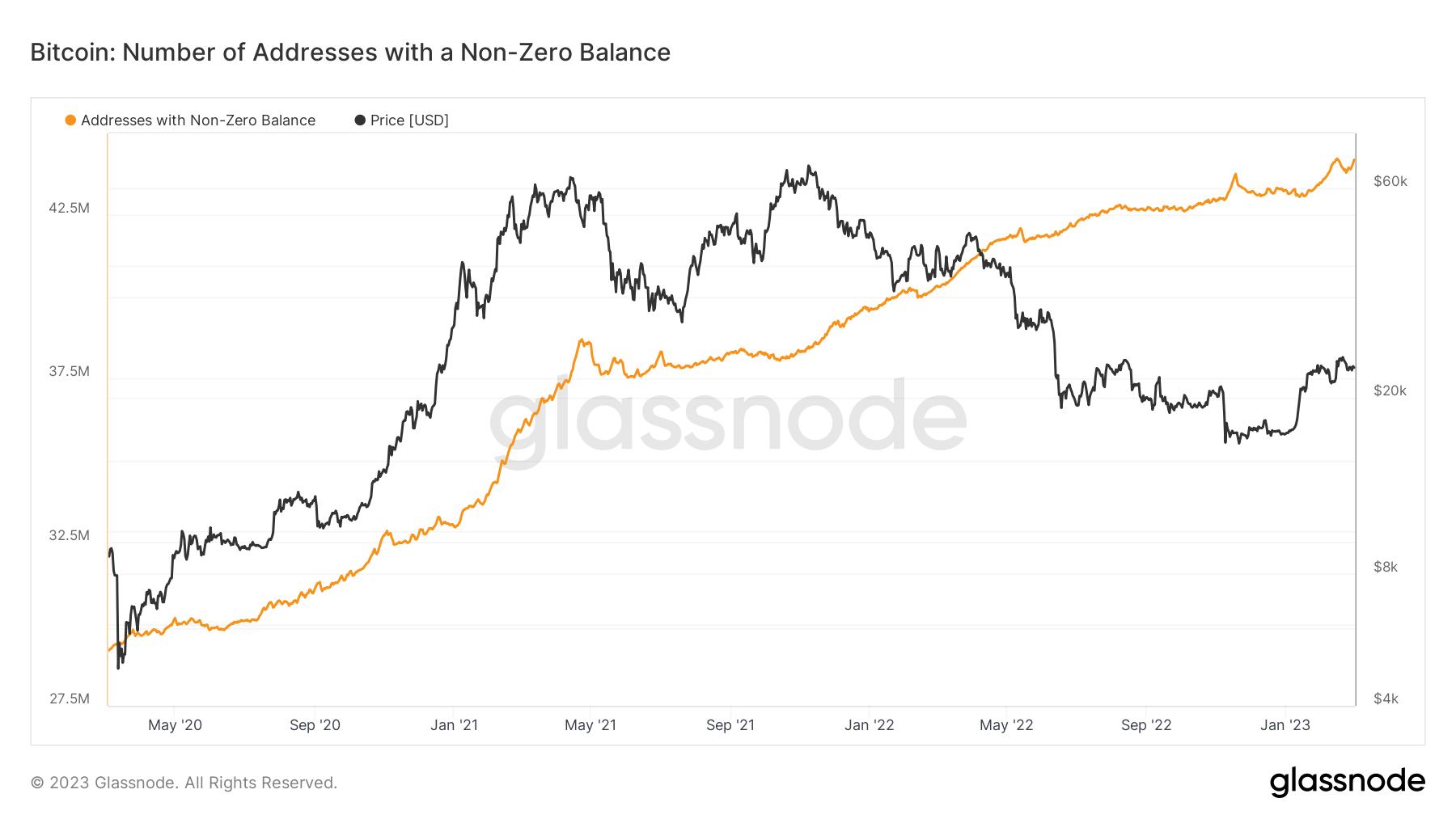

The increase in the speed where new addresses are now being produced may also be observed in the current uptick in the amount of Bitcoin addresses holding a non-zero balance, that was last at 44.193 million on Thursday, near to the all-time high it set recently above 44.two million. While addresses holding a non-zero balance have in the past risen both in bull and bear markets, meaning its short-term correlation to cost is really non-existent, most still interpret rising non-zero balance address figures like a positive register the lengthy-term, trained with implies ongoing Bitcoin “adoption”.

The Laundry Listing of Bullish Technical as well as on-chain Signals keeps growing

Positive trends within the above-noted technical metrics be a number of alternative on-chain and technical metrics all scream that 2022’s bear marketplace is most likely now over. As discussed inside a recent article, nearly all on-chain and technical indicators tracked by Glassnode within their “Recovering from the Bitcoin Bear” dashboard are flashing eco-friendly.

The dashboard tracks eight indicators to determine whether Bitcoin is buying and selling above key prices models, whether network utilization momentum is growing, whether market profitability is coming back and if the balance of USD-denominated Bitcoin wealth favors the lengthy-term HODLers.

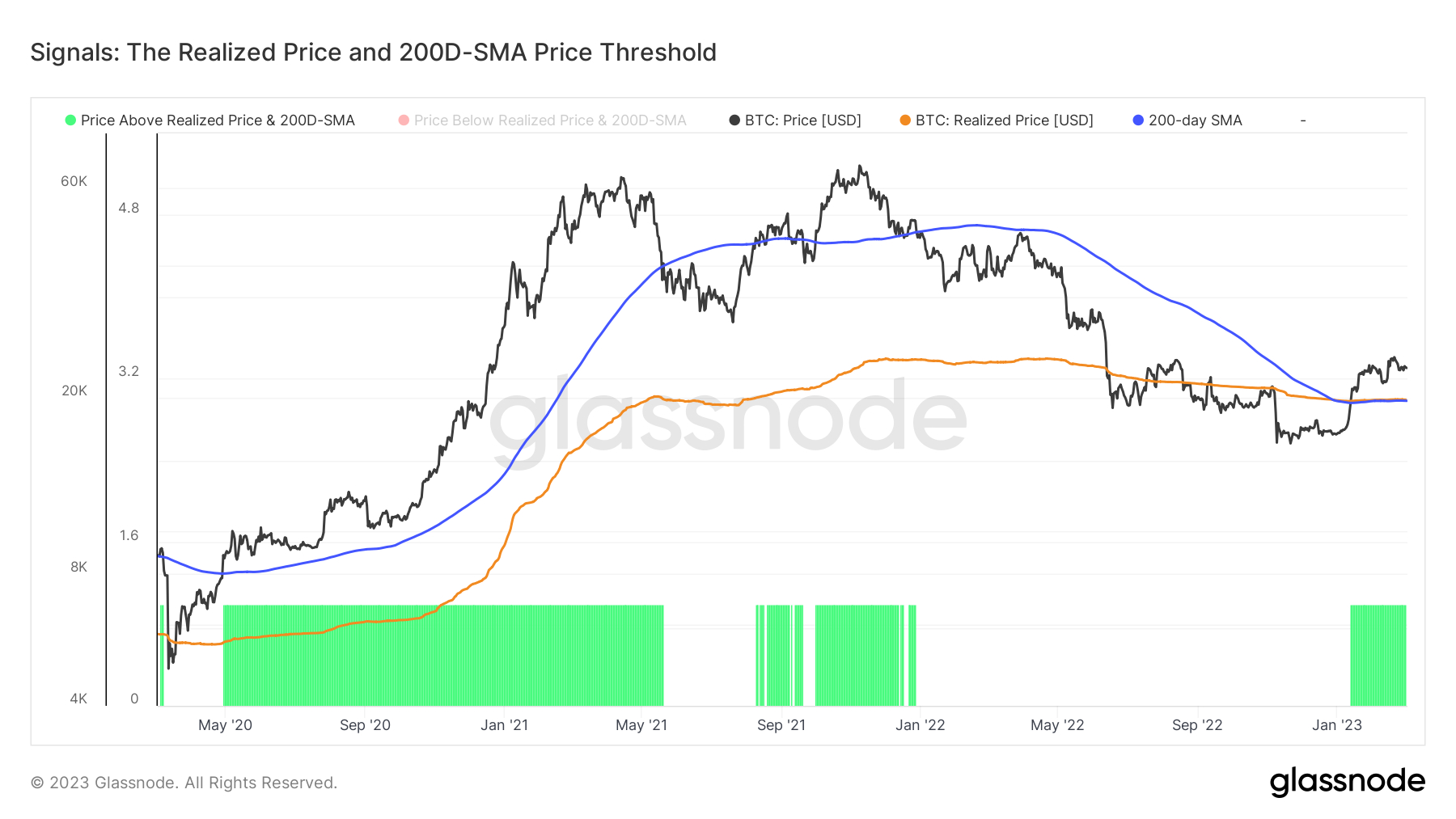

Regarding where Bitcoin is buying and selling versus key prices models, BTC this season surged above its 200-Day Moving Average and Recognized Cost, each of which sit just below $20,000, a dual bullish sign up the technical front. Another recent technical buy signal that got the bulls excited was Bitcoin experiencing only its seventh “gold cross” in the final ten years.

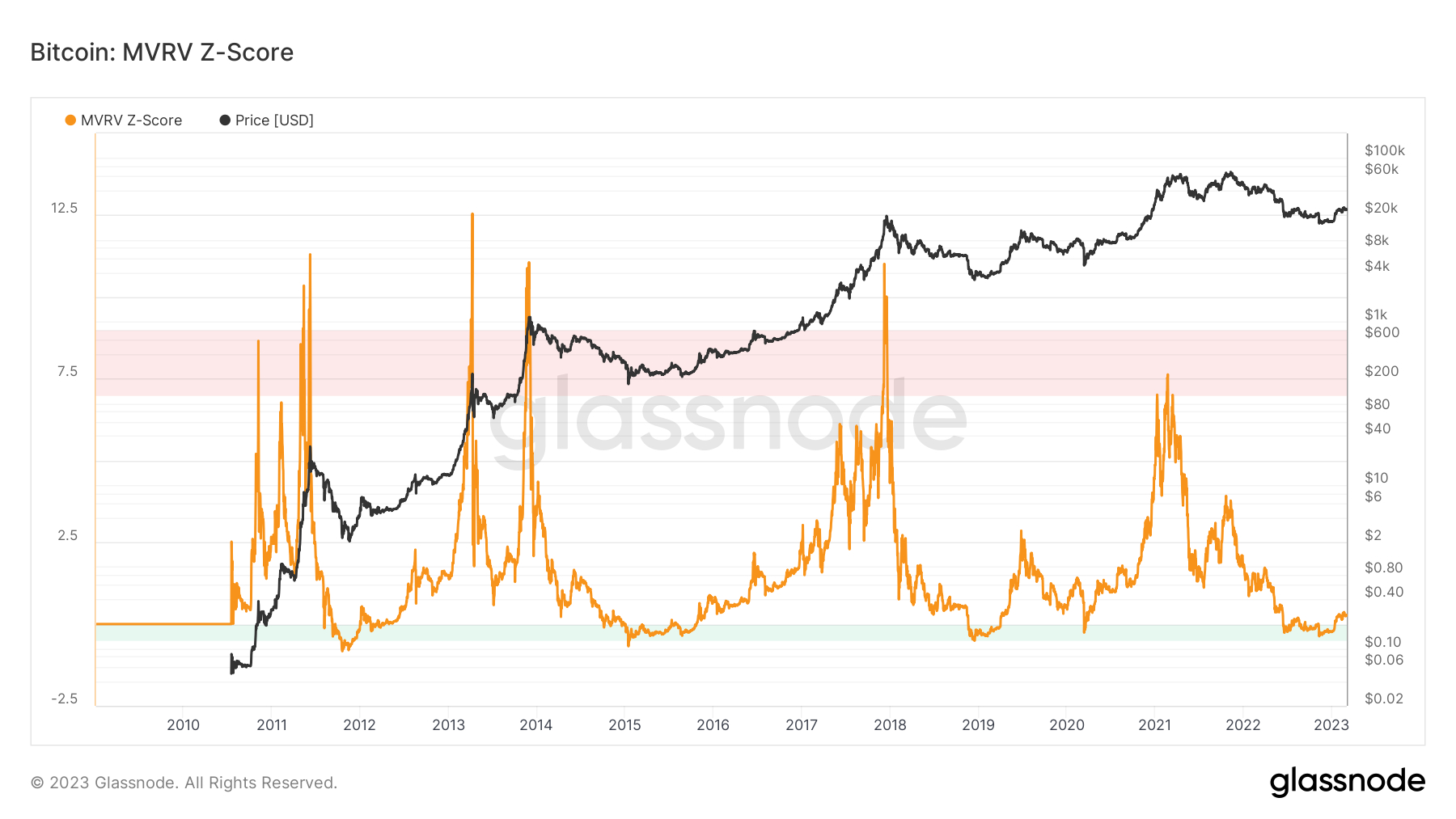

Other on-chain indicators tracked by Glassnode like Bitcoin’s Reserve Risk, as discussed in this recent article, and also the MVRV-Z score, which “compares market price and recognized value to evaluate when a good thing is overvalued or undervalued”, will also be screaming bull signals. The second lately mustered a sustained recovery back above zero following a prolonged period below, that has in the past happened at the beginning of bull markets.

Elsewhere, another market profitability indicator tracked by CryptoQuant, another crypto analytics firm, is giving out a definitive buy signal the very first time since 2019.

Market Cycle Analysis Also Signal Incoming Bull Market

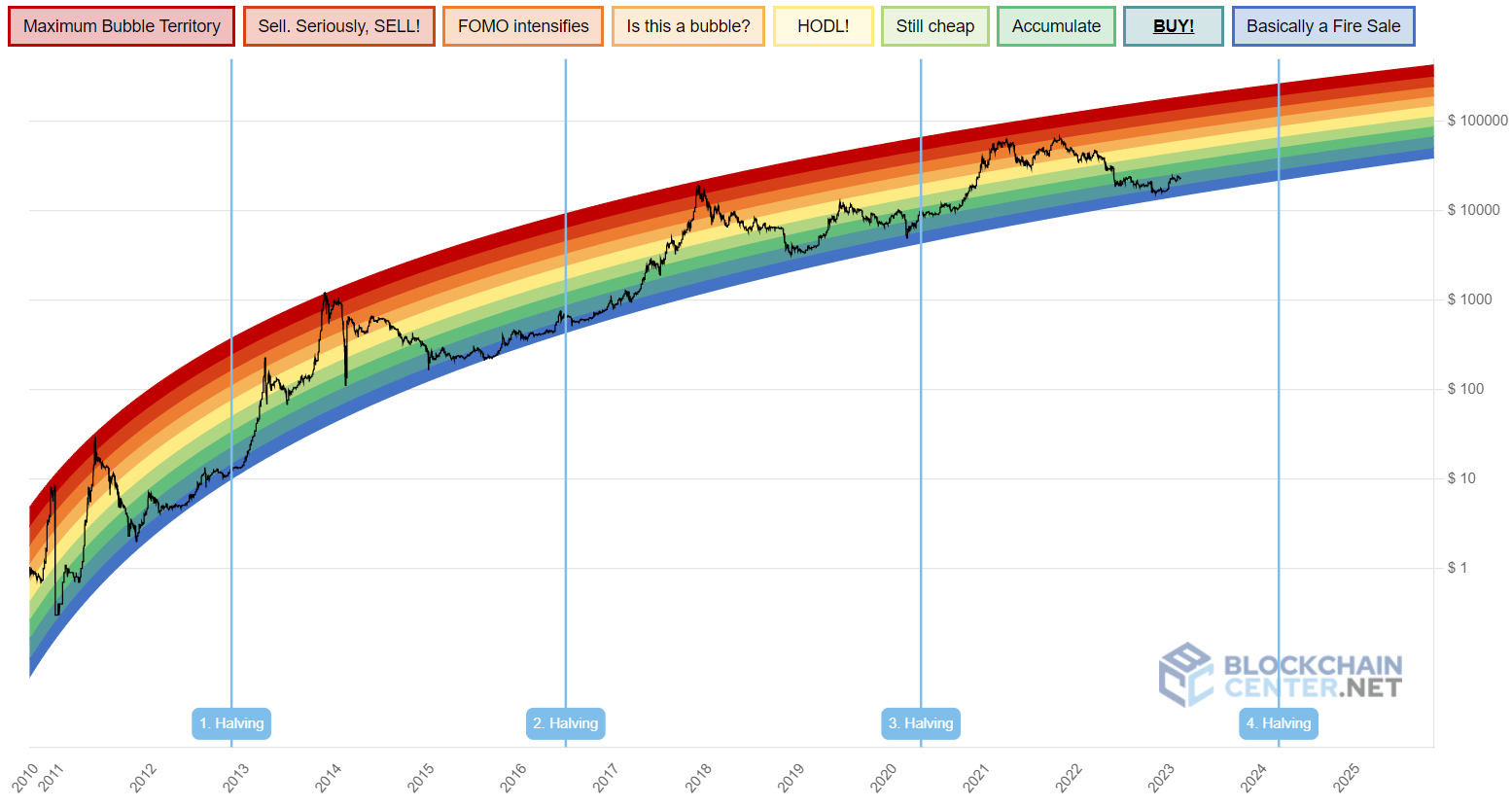

Bulls will also be taking solace from research into the market cycles the world’s largest cryptocurrency by market capital has in the past adopted. At the begining of The month of january, crypto-focused Twitter account @CryptoHornHairs identified that Bitcoin is following nearly exactly within the road to a roughly four-year market cycle that’s been respected perfectly let’s focus on over eight years.

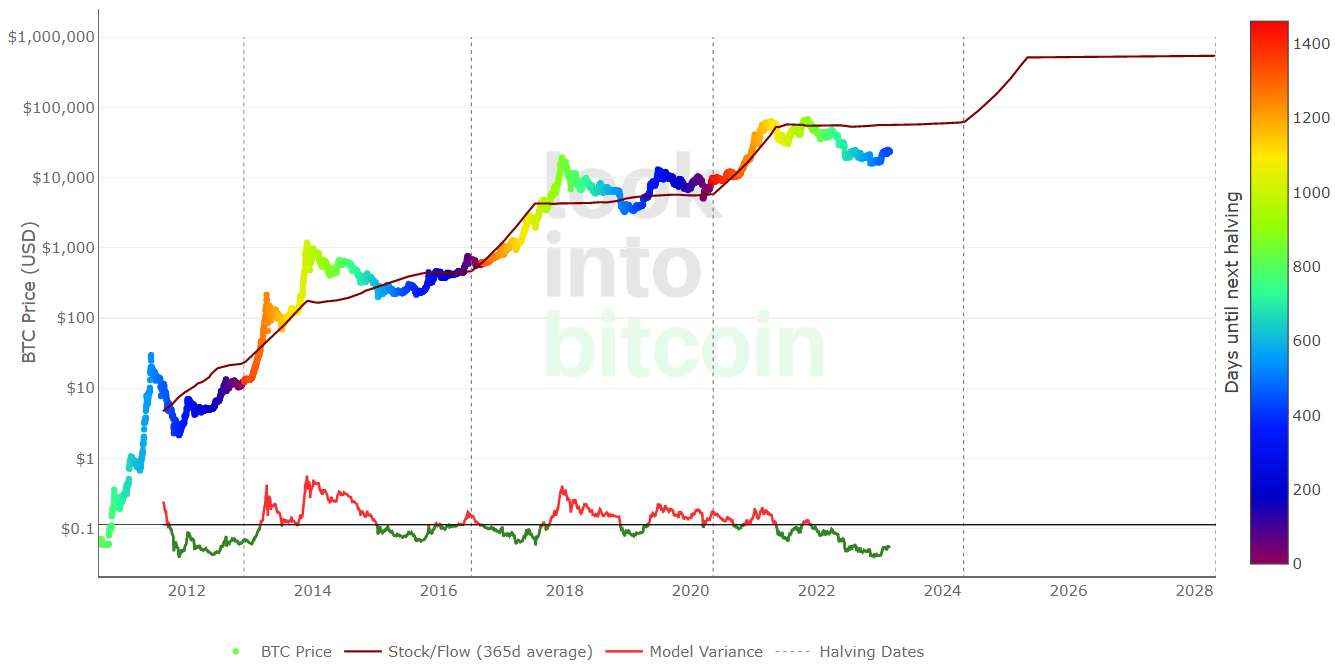

Elsewhere, a broadly adopted Bitcoin prices model is delivering an identical story. Based on the Bitcoin Stock-to-Flow prices model, the Bitcoin market cycle is roughly 4 years, which shows an believed cost level in line with the quantity of BTC available for sale in accordance with the quantity being found every year, Bitcoin’s fair cost at this time is about $55K and may go above $500K within the next publish-halving market cycle. That’s around 20x gains from current levels.

Finally, Blockchaincenter.net’s popular Bitcoin Rainbow Chart implies that, at current levels, Bitcoin is incorporated in the “BUY!” zone, getting lately retrieved in the “Basically a fireplace Sale” focus late 2022. Quite simply, the model shows that Bitcoin is progressively dealing with being highly oversold. During its last bull run, Bitcoin could achieve the “Sell. Seriously, SELL!” zone. Whether it can continue doing this task within the next publish-halving market cycle within someone to 1 1 / 2 years following the next halving, the model suggests a potential Bitcoin cost within the $200-$300K region. That’s around 8-13x gains from current levels.