Bitcoin (BTC) held near $38,000 in to the November. 26 weekly close as traders boosted their BTC cost optimism.

Bitcoin buyers give bears no room for maneuver

Data from Cointelegraph Markets Pro and TradingView demonstrated a typically flat weekend for Bitcoin, with classic volatility yet hitting because the weekly close contacted.

#Bitcoin Straightforward and slow weekend.

Usually volume/volatility accumulates a little later today. https://t.co/joyKaqG68f pic.twitter.com/T9sXbJ2c6d

— Daan Crypto Trades (@DaanCrypto) November 26, 2023

After setting new 18-month highs in recent days, some contended the largest cryptocurrency demonstrated encouraging signs for upside continuation.

Included in this was popular trader and analyst Credible Crypto, who eyed buyers absorbing any sell volumes close to the local highs.

Together with open interest (OI) on derivatives markets remaining low and place demand remaining steady, happens might be set for the following move greater.

“Overall I believe that dips here might be much more shallow than initially anticipated because of the insufficient OI to induce liq flushes and also the obvious place demand there has been at these levels,” a part of a publish on X (formerly Twitter) read.

“We possess some potential liquidations above 38k and a few below 37.5k, but the quantity of open positions here’s relatively low — so not expecting huge volatility either in direction until our breakout unless of course place flows shift dramatically.”

Credible Crypto figured that even his previous forecast of the go back to $36,900 — itself only a 2.1% drop in the current place cost — might not happen.

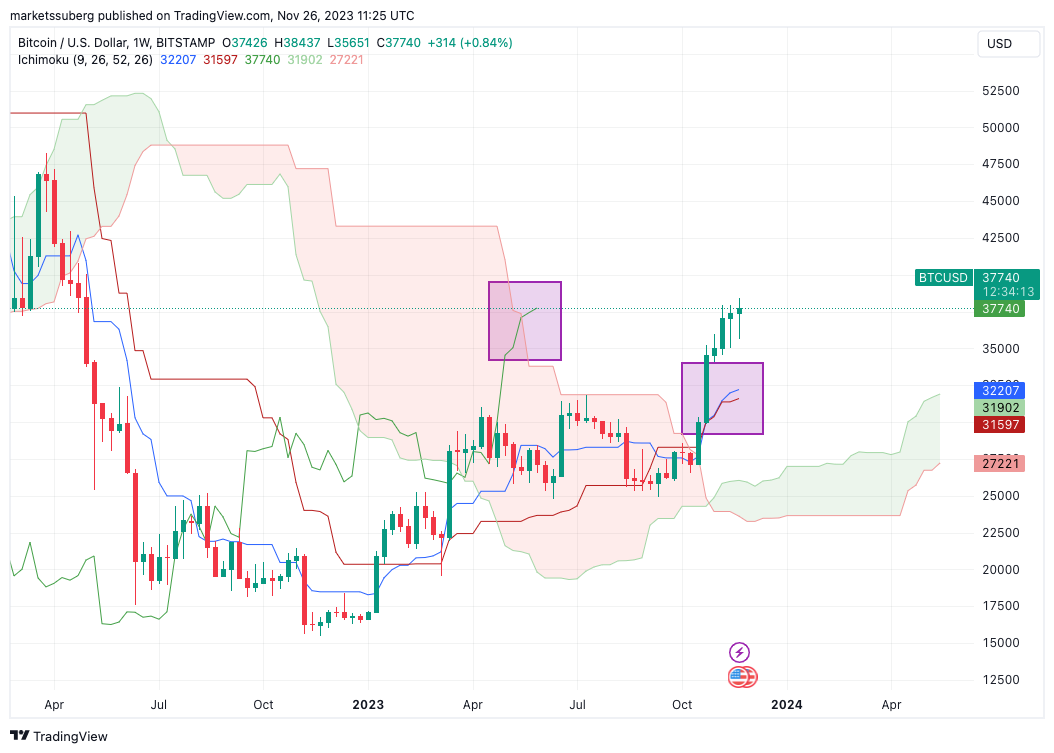

BTC cost prints key Ichimoku setup

Equally buoyant around the immediate future was fellow market commentator Titan of Crypto.

Related: ‘Enjoy sub-$40K Bitcoin’ — PlanB stresses $100K average BTC cost from 2024

Within an analysis that leveraged the Ichimoku Cloud indicator, Titan of Crypto spied a clear breakout of their critical factors inside a rare event for that Bitcoin weekly chart.

Ichimoku’s lagging span, Chikou — as measured 26 days prior — was now both above cost and towards the top of the Kumo Cloud. Along with Tenkan-sen and Kijun-sen displaying a restored upward trend, the image looked highly promising for upside continuation, Titan of Crypto concluded.

“Price action wise take notice of the last 2 weekly candle lights. Wicks indicate bulls are pushing back,” he summarized partly of associated X commentary on November. 25.

“The momentum expires, $39.3k is next.”

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.