147 days have passed since Bitcoin (BTC) closed above $25,000, and as a result investors are less certain the $20,000 support holds. Backing these concerns are persistent global financial and macroeconomic tensions, which escalated on November. 7 after Eu officials expressed concerns within the $369 billion U.S. Inflation Reduction Act.

The extended tax, health insurance and climate bill was approved in August and in addition it includes subsidies for planet and battery supply chains that come in The United States.

Based on CNBC, this isn’t the very first time that Europe has expressed its concerns, citing worldwide trade rules and “discriminatory” policies.

There’s additional uncertainty from the November. 8, U.S. midterm elections that will pick which party controls Congress. Presently, Democrats possess a majority within the Lower House, but a general change in this status could ease President Biden’s future spending plans.

In other news, Apple announced a brief reduction in iPhone 14 production because of Covid-19 limitations in China. To place things in perspective, Apple’s $2.2 trillion market capital has surpassed the sum of the Alphabet (Google) and Amazon . com.

Let us take a look at Bitcoin derivatives data to know when the worsening global macroeconomic conditions have impacted crypto investors.

Pro traders weren’t excited through the rally above $21,000

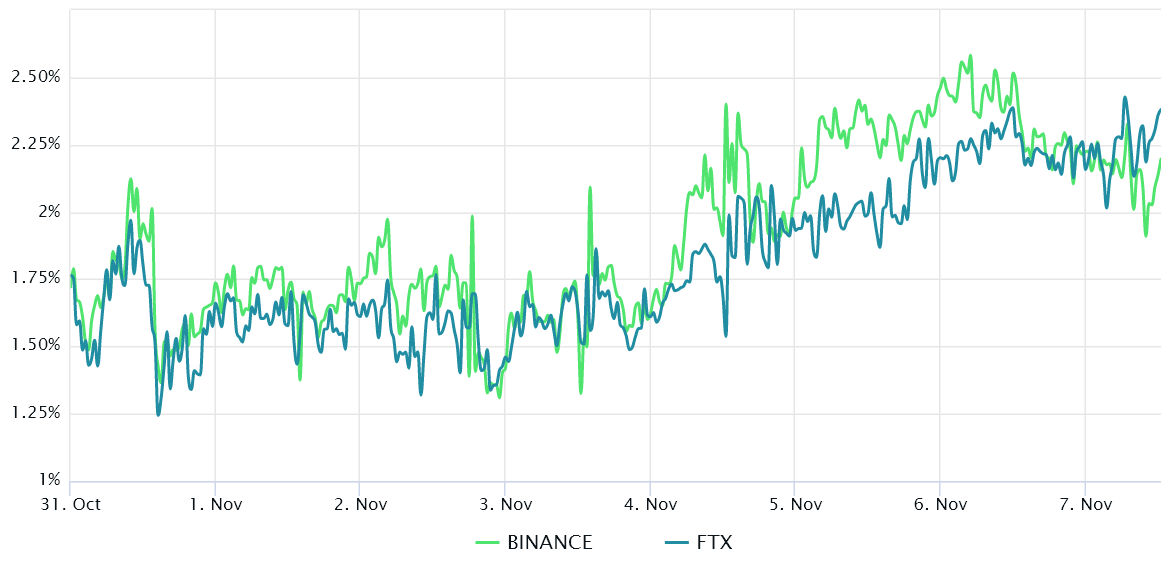

Retail traders usually avoid quarterly futures because of their cost difference from place markets. Still, they’re professional traders’ preferred instruments simply because they avoid the fluctuation of funding rates that frequently happens in a perpetual futures contract.

The 3-month futures annualized premium should trade at +4% to +8% in healthy markets to pay for costs and connected risks. The chart above implies that derivatives traders happen to be neutral to bearish within the last week because the Bitcoin futures premium continued to be below 2.5% the whole time.

More to the point, the metric didn’t improve after BTC rallied 7% between November. 3 and November. 5 to check the $21,500 resistance. That cost level was the greatest since Sept. 13, therefore the data reflects professional traders’ unwillingness to include leveraged lengthy (bull) positions.

Related: Crypto forget about in top ten most-reported potential risks: US central bank report

Margin markets show bulls’ resilience

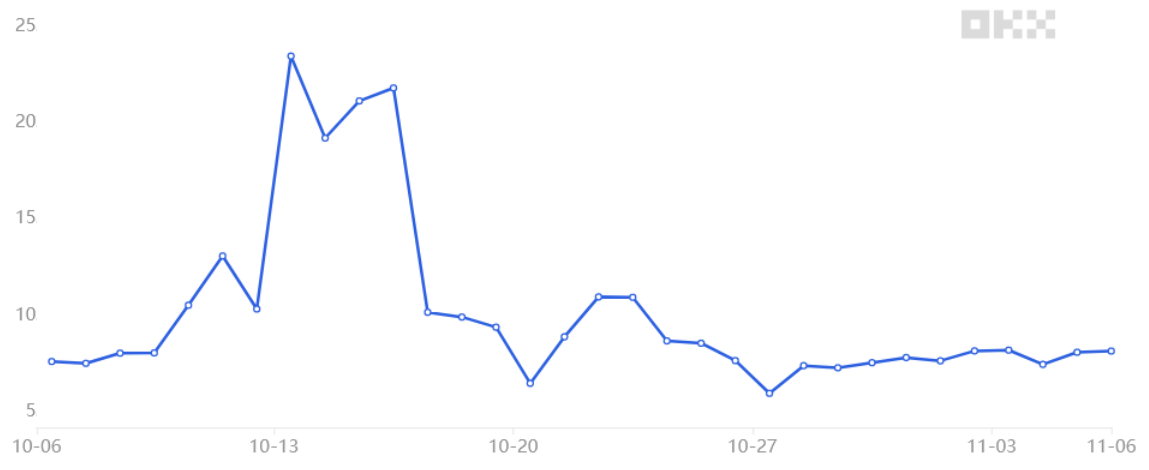

Traders also needs to evaluate the margin buying and selling markets to know how professional traders are situated. Margin buying and selling enables investors to gain access to cryptocurrency to leverage their buying and selling position. For instance, it’s possible to increase exposure by borrowing stablecoins to purchase yet another Bitcoin position.

However, Bitcoin borrowers are only able to short the cryptocurrency simply because they bet on its cost declining. However, unlike futures contracts, the total amount between margin longs and shorts is not always matched.

Data implies that OKX traders’ margin lending ratio has continued to be relatively stable at 8 within the last week. In one side, the indicator is sort of concerning, giving the rally from $20,050 to $21,475 on November. 5, that ought to have positively impacted the margin lending ratio. The current 8.1 level leaves enough room for sustainable leverage buying pressure when it’s time.

The metric remains bullish by favoring stablecoin borrowing with a wide margin. The bottom line is, pro traders happen to be holding bullish positions using stablecoin margin lending.

The futures and margin metrics claim that Bitcoin’s failure to carry the $21,000 support was inadequate in instilling panic in pro traders.The information also shows a modest amount of indifference since the recent 7% rally toward $21,500 wasn’t supported by greater interest in leverage longs.

Bears still exert potency and efficacy even while the elusive $25,000 daily close becomes much more distant. Until macroeconomic conditions and political uncertainty dominate the headlines, bulls are less inclined to have high about a far more sustainable rally.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.