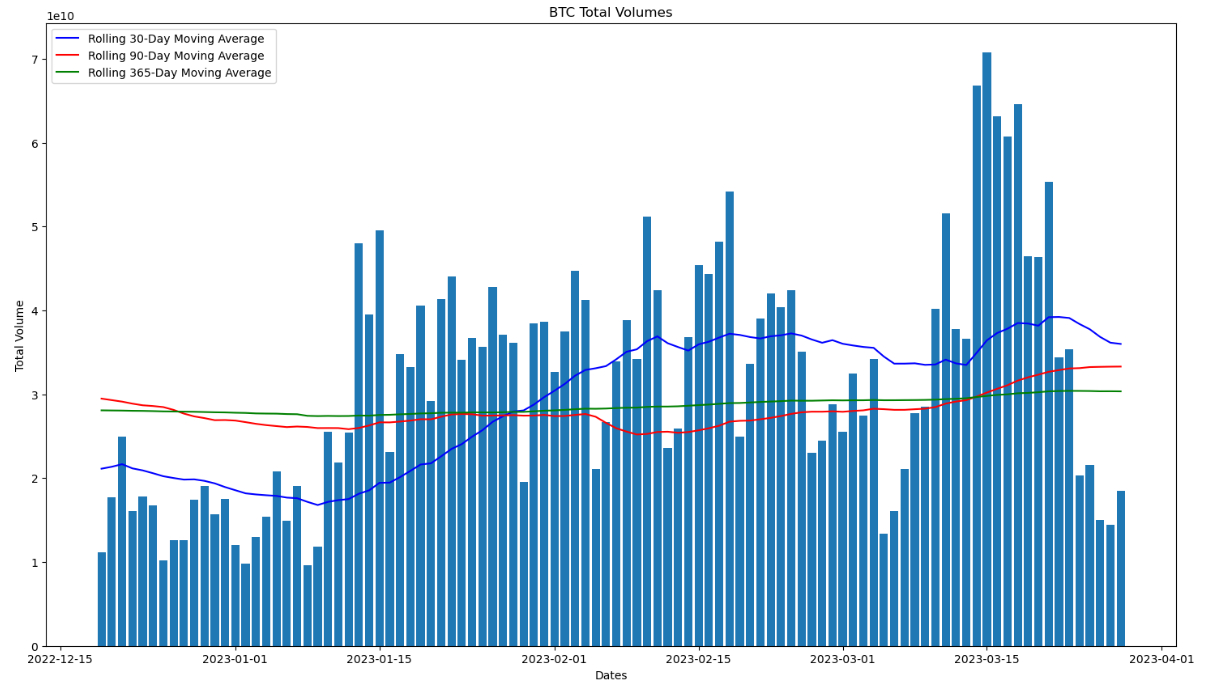

Bitcoin buying and selling volumes have collapsed previously couple of days. Based on data sourced from CoinGecko, daily Bitcoin buying and selling volumes across major exchanges fell to as little as $14.5 billion on Monday, its cheapest level because the 5th of March.

That’s an enormous drop after Bitcoin daily buying and selling volumes surged up to $70 billion earlier within the month, the greatest level because the aftermath from the FTX collapse last November.

The stop by buying and selling volumes is concerning.

It might suggest waning investor appetite for getting Bitcoin at current levels within the $27,000s, as US regulatory concerns mount, so that as fears in regards to a US bank crisis ebb.

Maybe it’s a consequence of reduced fiat-to-crypto on-ramps in wake from the collapse of crypto-friendly banks in america earlier this year (most particularly, the collapse of Silvergate).

Worryingly, the dip in Bitcoin volumes seen earlier this year began a clear, crisp though ultimately short-resided dip in the mid-$22,000s to sub-$20,000 levels.

Bitcoin bulls is going to be wishing that BTC doesn’t notice a similar drop from current levels to key support within the $25,000 area.

Contributing to bearish fears is recent weakness noticed in various metrics calculating activity around the Bitcoin network.

CFTC’s Binance Suit Weighs on Volumes

The stop by buying and selling volumes started before the announcement through the US Commodity Futures and Buying and selling Commission’s of the suit against Binance. However the suit certainly will not be helping things.

Major market makers and institutional players involved with crypto could be more careful about getting together with Binance if it’s about to be labeled an unregistered/unlicensed exchange in america.

And Binance handles the lion’s share of crypto buying and selling volumes. Based on data presented through the Block, Binance taken into account 62% of worldwide crypto buying and selling volumes in Feb, an astounding amount of market domination.

However that dominance continues to be waning given that they removed their zero-fee buying and selling for Bitcoin pairs.

Much has been created inside the crypto space from the loss of Bitcoin’s so-known as 2% market depth as recently.

This is actually the quantity of purchase and sell orders waiting to absorb liquidity on exchanges which are within 2.% of the present cost.

When 2% market depth declines, this will make it simpler for big orders to maneuver the BTC cost, creating a far more volatile market.

Option Investors Remain Sanguine on Volatility Risks

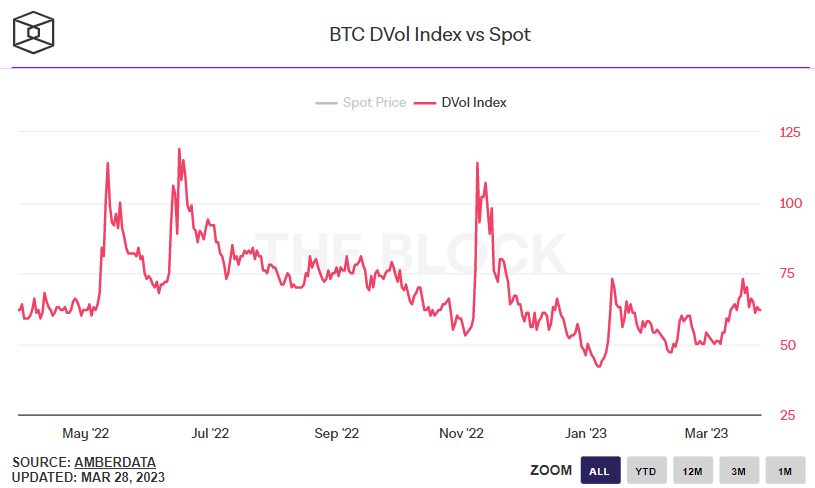

Regardless of the ongoing loss of Bitcoin’s market depth and sharp recent stop by buying and selling volumes, investors apparently remain fairly sanguine on cost volatility risks. That’s the content from options market prices, anyway.

Deribit’s Bitcoin Volatility Index (DVOL) continues to be pulling away from earlier monthly highs of 73 in recent days and it was last around 62.

That’s well above earlier March levels within the 50 area, but nonetheless fairly low by historic comparison. Deribit may be the dominant Bitcoin derivatives exchange.

While Bitcoin may be set for a bumpy near-term ride, many analysts believe that Bitcoin’s longer-term outlook remains strong.

Find Out More: Bitcoin Bears Eye Possible Pullback for this Key Support Area, But Longer-term BTC Cost Outlook Remains Strong