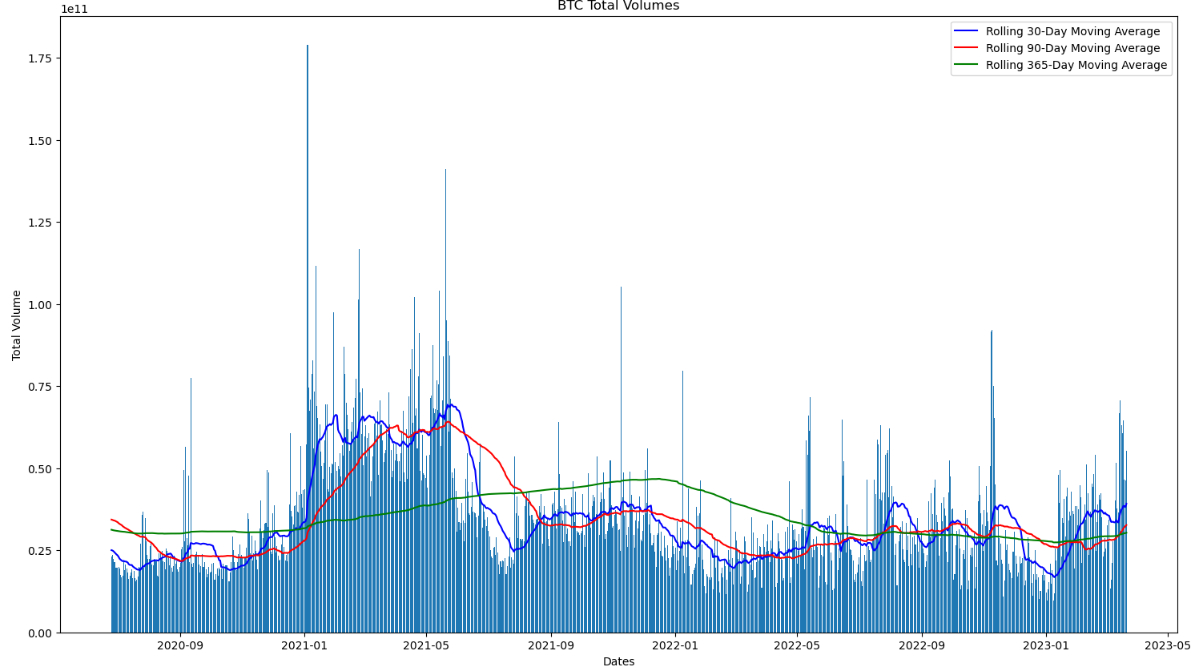

Bitcoin’s bull run since the beginning of 2023 that has seen its cost jump by near to 70% continues to be supported by a boost in Bitcoin buying and selling volumes.

Daily buying and selling volumes lately hit their greatest level because the aftermath from the FTX collapse at greater than $70 billion.

Bitcoin was last altering hands just above $28,000, up over 40% versus earlier monthly lows under $20,000.

Indeed, Bitcoin buying and selling volumes seem to be inside a definitive upward trend, using the 21 and 50-day Moving Average of volumes lately rising over the 200DMA of volumes, and also the former closing in on its greatest level since mid-2021.

Rising buying and selling volumes come during periods of time of aggressive market movement, i.e. during acute bull and bear market phases.

The Bitcoin bulls is going to be wishing the market remains inside the former of those phases.

On-chain Metrics And in an optimistic Trend

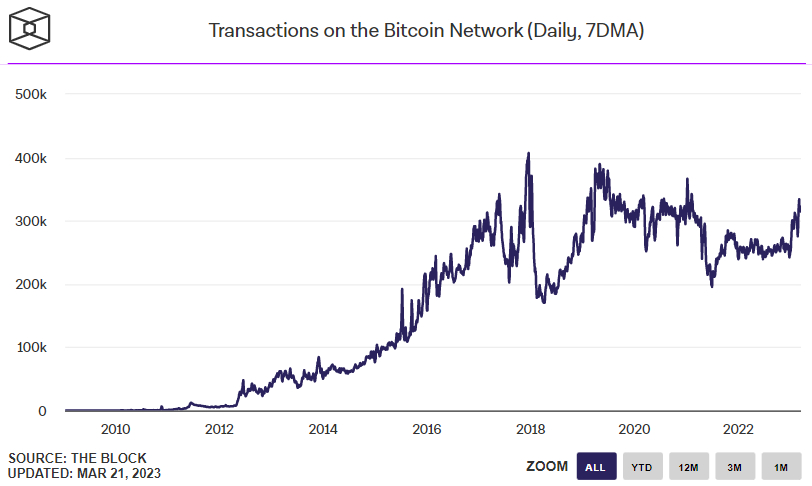

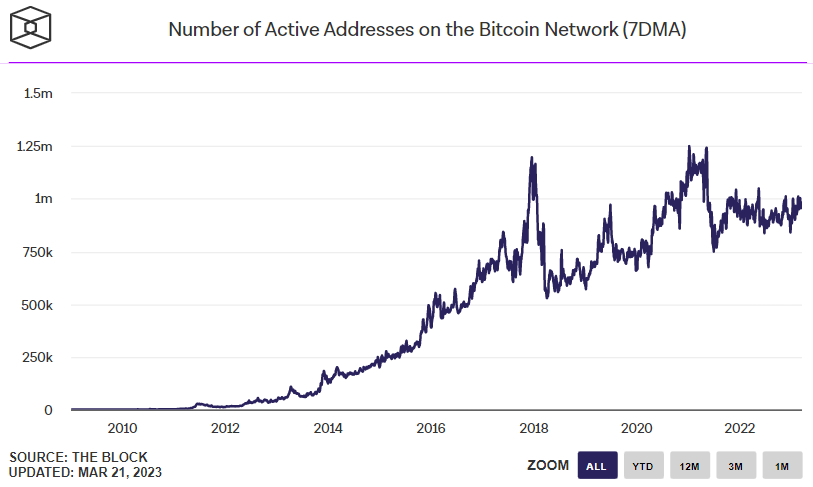

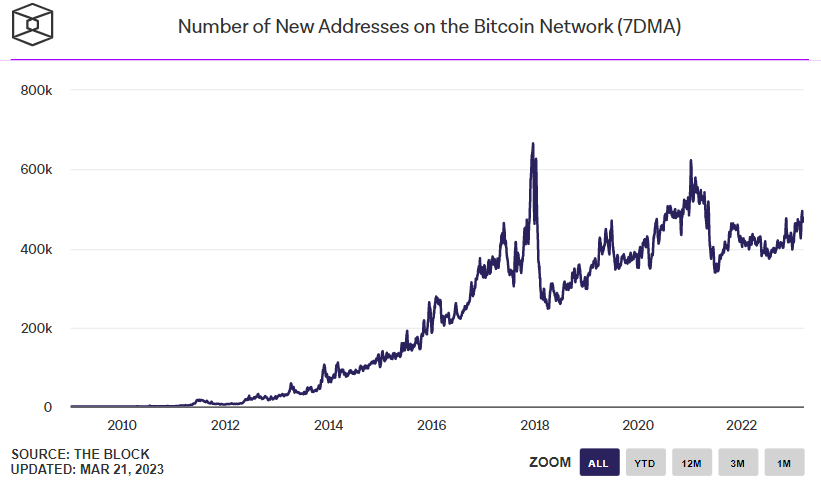

Enhancements associated with Bitcoin buying and selling activity on exchanges comes at any given time when on-chain data implies that activity around the Bitcoin blockchain is also obtaining.

As are visible in the below graphs presented through the Block, the amount of transactions happening every day around the Bitcoin blockchain lately hit its greatest level since early 2021.

Meanwhile, the increase in the amount of active addresses around the Bitcoin network in recent days hasn’t been as impressive, however the metric continues to be near to multi-month highs.

Elsewhere, the speed where new addresses are getting together with the Bitcoin network the very first time has additionally been trending greater.

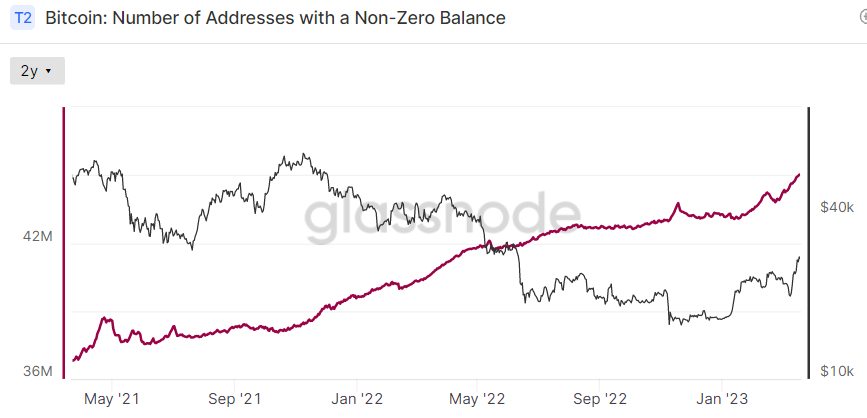

Addresses having a non-zero balance also continue storming greater. Based on data presented by Glassnode, this metric lately surpassed 45 million the very first time.

Economic Crisis Worries Could Send Bitcoin Yet Greater

Despite growing technical signs the Bitcoin marketplace is heating up for the short term, analysts believe that rumblings of the economic crisis could yet send the world’s largest cryptocurrency by market capital greater.

Bitcoin continues to be serving as a secure haven in recent days, rallying together with gold as investors use currency alternatives that aren’t susceptible to a collapse from the traditional economic climate.

If US Fed Chairman Jerome Powell fumbles his communications around the outlook for policy tightening as a direct consequence of Wednesday’s policy announcement, then that may exacerbate crisis concerns.

Based on Bloomberg’s Senior Macro Strategist Mike McGlone, Bitcoin’s recent strong cost outperformance versus gold may be indicative that the new “supercycle” is establishing.

McGlone also posited that recent relative strength versus most assets can be a sign that Bitcoin is transitioning to trade a lot more like gold and US treasuries (i.e. a secure haven), as opposed to a risk asset.