Bitcoin (BTC) hodlers have capitulated greater than at just about any reason for Bitcoin’s history this month.

Data from on-chain analytics firm Glassnode confirms the November 2022 BTC sell-off was the 4th-largest ever.

Bitcoin investors see multi-big loss

Within the latest edition of their weekly e-newsletter, “The Week On-Chain,” Glassnode reached grips using the impact from the FTX debacle on BTC investors.

The outcomes happen to be mixed, it reveals, having a major lack of confidence on a single hands triggering loss-making divestment of funds, while “strong accumulation” has additionally happened.

For individuals entering BTC in current conditions, however, existence continues to be not easy.

“One consistent event which motivates the transition from the bear back perfectly into a bull marketplace is the dramatic realization of losses, as investors quit and capitulate at scale,” Glassnode described.

“November has witnessed the 4th largest capitulation event on record, recording a 7-day recognized lack of -$10.16B. This really is 4.0x bigger compared to peak in 12 , 2018, and a pair of.2x bigger than March 2020.”

As the dollar-value capitulation could be described because of BTC/USD buying and selling five occasions greater compared to late 2018 and 4.5 occasions greater compared to March 2020, it’s not secret that cold ft have characterised crypto markets since FTX imploded.

As Cointelegraph reported, directly following a event, hodlers were located on 50% from the BTC supply in an unrealized loss.

Glassnode referenced Bitcoin’s Adjusted MVRV Ratio, which implies that coins moving forward-chain are coming back loss-making levels rarely seen before with what it calls “peak under-performance.”

Adjusted MVRV Ratio may be the relationship between the marketplace worth of BTC and it is recognized value, without the profit impact of coins dormant for seven years or longer.

“This metric is presently coming back something of .63 (average unrealized lack of 37%), that is very significant since only one.57% of buying and selling days in bitcoin history have recorded a lesser Adjusted MVRV value,” the e-newsletter mentioned.

“In short, when we discount profit held over the presumably lost supply, the present market is easily the most underwater it’s been because the near pico-bottom occur 12 , 2018 and Jan 2015.”

Purchasing the diplike it’s December 2018

“A Few Days On-Chain” nevertheless contains what’s promising for market participants.

Related: Bitcoin shrugs off BlockFi, China protests as BTC cost holds $16K

Regardless of the previous losses, hodlers happen to be accumulating BTC strongly since — and also the trend is encompassing everybody, in the tiniest “shrimps” towards the largest whales.

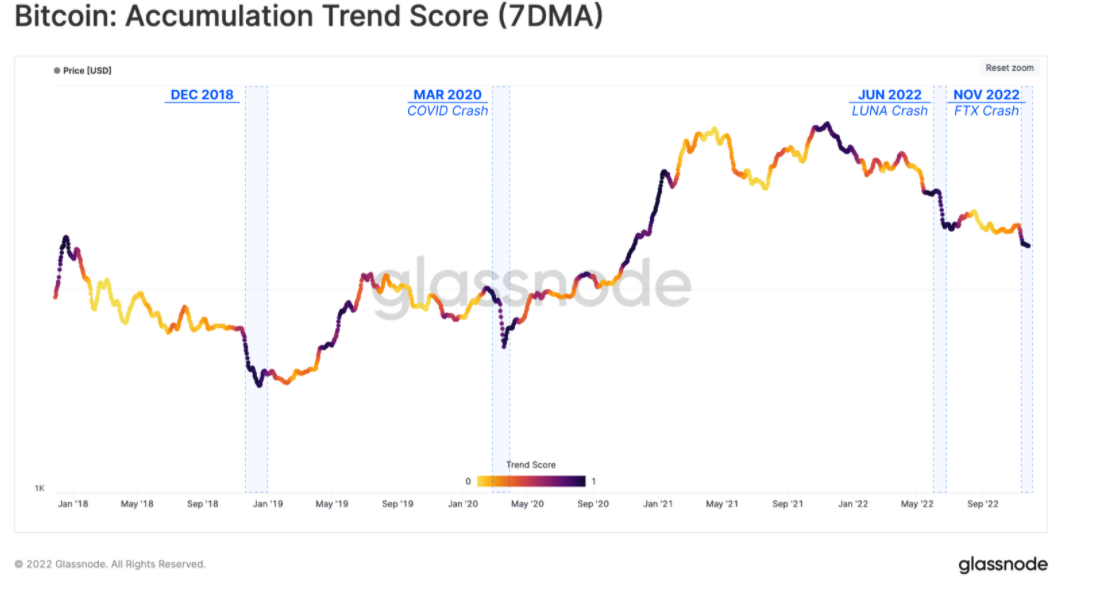

“From the comparative perspective, the current strong accumulation score following a recent sell-off resembles that recently 2018,” Glassnode mentioned.

It added that similar black swan occasions in Bitcoin’s past, including recent ones like the Terra LUNA collapse, sparked similar investor reactions.

An associated chart, the 7-day moving average (MA) from the Accumulation Trend Score, demonstrated current conditions as crimson — sign of mass accumulation. Yellow, on the other hand, suggests mass distribution of BTC available on the market.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.