Bitcoin (BTC) and decentralized blockchains are “as strong as ever” within the wake from the FTX meltdown, ARK Invest states.

Within the latest edition of their monthly e-newsletter, “The Bitcoin Monthly,” an investment giant arrived on the scene firmly bullish on BTC.

ARK: FTX scandal might be “most damaging event” ever

With BTC cost volatility ebbing into December, the continues to be reeling from ongoing FTX contagion.

As lawmakers only start to get a handle on the occasions, with regards to Bitcoin, ARK is doubling lower on its conviction — and setting it firmly aside from centralized alternatives.

“The fall of FTX may be the most damaging event in crypto history,” the newest report’s “key takeaways” states.

While acknowledging that even Digital Currency Group (DCG) — certainly one of whose products, the Grayscale Bitcoin Trust (GBTC), it lately bought — “faces considerable pressure” included in the fallout, ARK delivered a vital critique of the items it known as “centralized intermediaries.”

“ARK’s conviction in decentralized and transparent public blockchains is really as strong as always,” it confirmed.

“The FTX along with other cases like Celsius and Alameda claim that decentralization and transparency are vital as antidotes towards the gross mismanagement that may be connected with centralized intermediaries, especially fraudulent ones.”

As a result, despite being bearish on some on-chain metrics, there is need to keep your belief on Bitcoin.

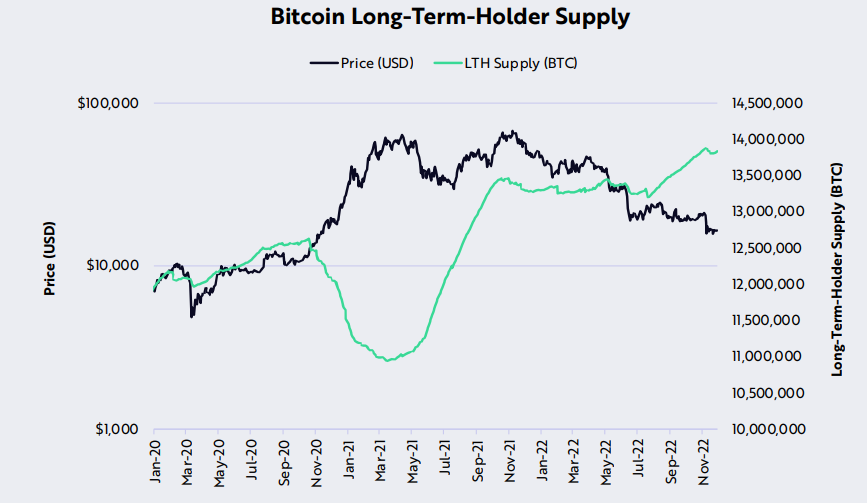

Examples to keep in mind incorporated the resilience of lengthy-term investors, an organization refusing to provide in to the temptation to market despite recent BTC cost declines.

“We believe this datapoint signifies holders’ lengthy-term focus and conviction, despite recent occasions. Today, lengthy-term-holder supply is 72% of bitcoin’s total circulating supply,” the report ongoing.

“A in the past significant capitulation is going ahead”

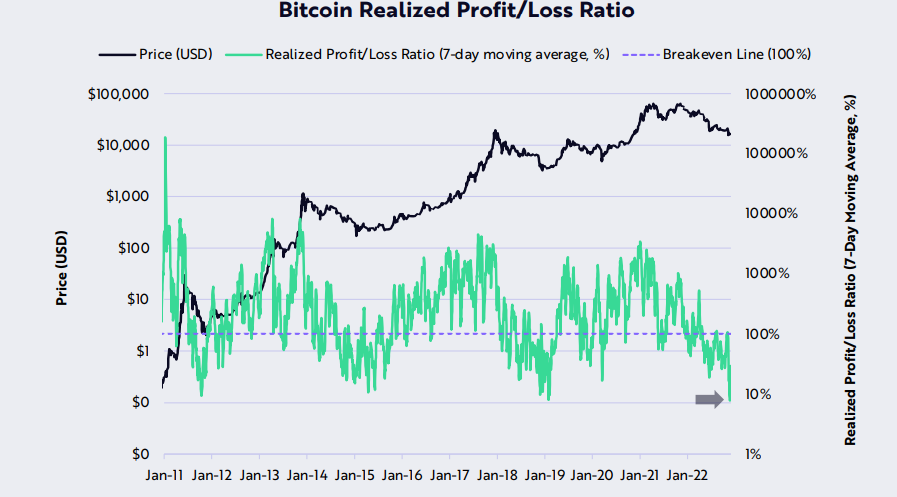

Bitcoin’s recognized profit/ loss ratio also arrived for attention, this now hitting all-time lows, as Cointelegraph reported.

Related: ‘Imminent’ crash for stocks? 5 items to know in Bitcoin now

Profit/ loss ratio describes BTC transacted on-chain in profit and loss, correspondingly.

“Bitcoin found significant bottoms in each and every previous instance—2011, 2015, and 2019—in which that metric arrived at

“November’s recognized profit/loss data inform our view that the in the past significant capitulation is going ahead.”

BTC/USD traded round the $17,000 mark in the 12 ,. 6 Wall Street open, data from Cointelegraph Markets Pro and TradingView demonstrated, still trying to switch the amount to firm support after times of indecisiveness.

ARK’s Chief executive officer, Cathie Wood, captured bending lower on the conjecture that Bitcoin would hit $a million by 2030.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.