Bitcoin (BTC) found a brand new home at $36,000 into May 7 as volatility finally cooled in to the weekend.

Terra lower a minimum of $250 million in crunch

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling the $36,000 mark overnight after losing 12% in only 72 hrs.

Still near its cheapest levels since late Feb, the happy couple had nevertheless prevented a rematch of 2022 lows during the time of writing despite low-volume weekend market conditions.

In the latest Twitter on May 6, popular trader Anbessa highlighted the planned support level to purchase Bitcoin with what he referred to as a “fakeout” — a zone beginning just under $33,000.

#Bitcoin Update

Twitter friendly, easy words

BTC support, BTC fakeout you want to buy. Chop very lucrative it had been. Now awaiting final HTF entry we all do.

Superior we’re. pic.twitter.com/Lt5XT5rRKw

— AN₿ESSA (@Anbessa100) May 6, 2022

Although some eyed profit possibilities, however, there wasn’t any hiding others’ losses, particularly individuals from the Luna Foundation Guard (LFG), the nonprofit organization mounted on Blockchain protocol Terra which now purchased $1.5 billion of BTC in over-the-counter deals.

Based on data from on-chain monitoring resource BitInfoCharts, LFG was lower over $240 million on its BTC stash during the time of writing, this excluding the week’s latest purchase.

As Cointelegraph reported, Terra and it is co-founder Do Kwon remain dedicated to buying limitless levels of BTC to back their U.S. dollar stablecoin, TerraUSD (UST).

Bitcoin-skeptic gold bug Peter Schiff meanwhile recommended that whales were accountable for keeping BTC/USD at $36,000.

Feb buyers might have exited BTC positions

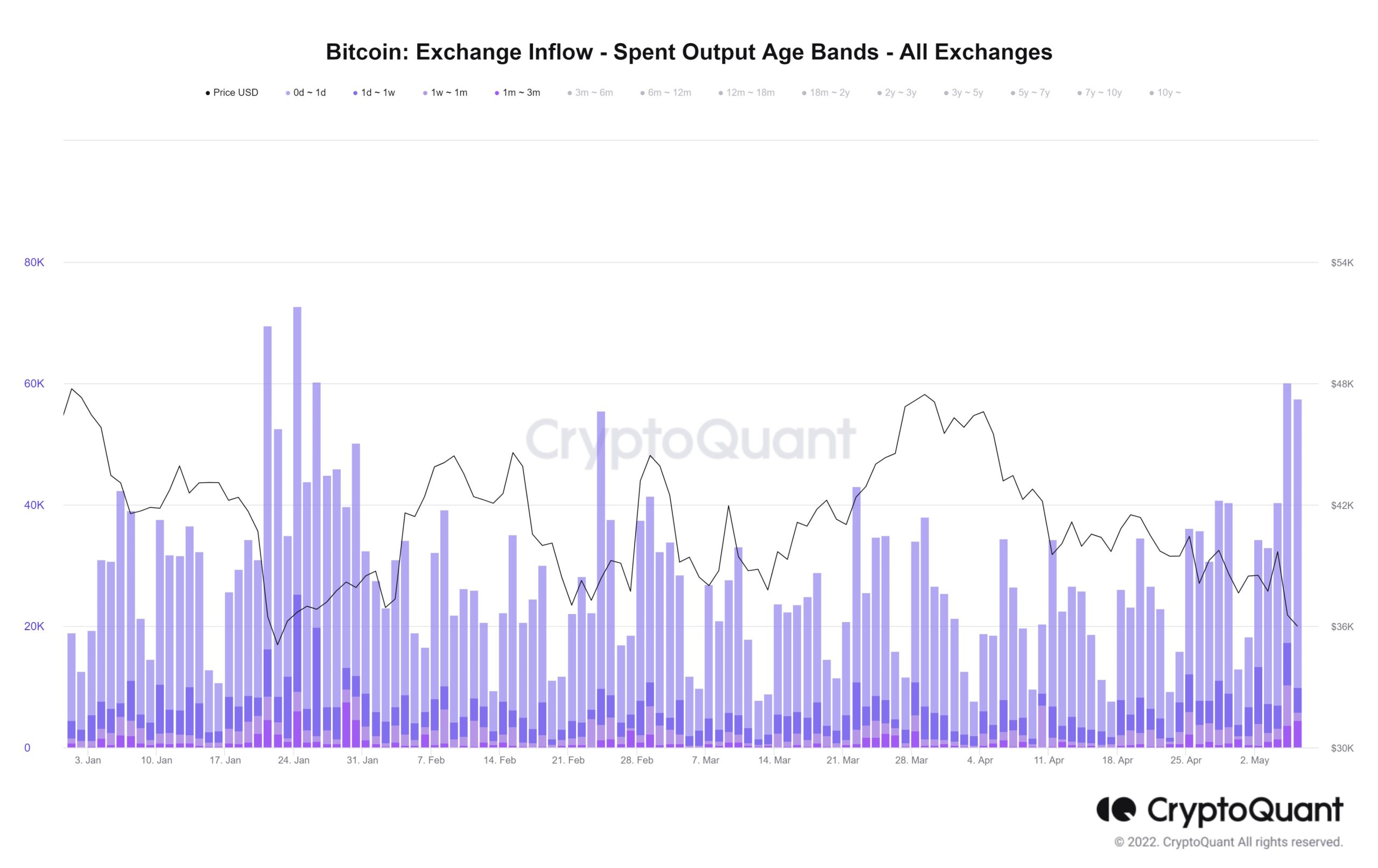

Analyzing possible causes of the level of Bitcoin’s losses beyond stock markets, on-chain analytics platform CryptoQuant noted that speculators might have had an overriding affect on the week’s proceedings.

Related: ‘Someone is blowing up’ — Bitcoin sees 2022 volume record among hopes capitulation has ended

Exchange inflows, it revealed at the time, had involved coins dormant for optimum three several weeks, and therefore apt to be of more speculative investors.

Three several weeks ago, around the beginning of Feb, was when BTC/USD had begun rising quickly after investing in its $32,000 lows. As a result, individuals investors might have hit breakeven point now.

“Based on CryptoQuant data, the decline previously 2 days might be covered with short-term holders. Around the fifth and sixth, as many as 11.76k “youthful” BTC held for under 3 several weeks ran in to the exchange,” journalist Colin Wu commented around the figures.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.