Now the stock markets started to flash just a little eco-friendly, and Bitcoin (BTC) is decoupling from traditional markets — although not in a great way. The cryptocurrency is lower 3%, as the Nasdaq Composite tech-heavy stock exchange index expires 3.1%.

May 27 data in the U . s . States Commerce Department shows the personal savings rate fell to 4.4% in April to achieve the cheapest level since 2008, Meanwhile, crypto traders are involved that worsening global macroeconomic conditions could increase investors’ aversion to dangerous assets.

For instance, Invesco QQQ Trust, a $160 billion tech company-based U.S. exchange-traded fund (ETF), is lower 23% year-to-date. Meanwhile, the iShares MSCI China ETF, a $6.1 billion tracker from the Chinese shares, has declined 20% in 2022.

To obtain a clearer picture of methods crypto traders are situated, traders should evaluate Bitcoin derivatives metrics.

Margin traders have become more bullish

Margin buying and selling enables investors to gain access to cryptocurrency and leverage their buying and selling position to potentially increase returns. For instance, it’s possible to buy cryptocurrencies by borrowing Tether (USDT) to enlarge exposure.

Bitcoin borrowers are only able to short the cryptocurrency when they bet on its cost decline, and in contrast to futures contracts, the total amount between margin longs and shorts isn‘t always matched.

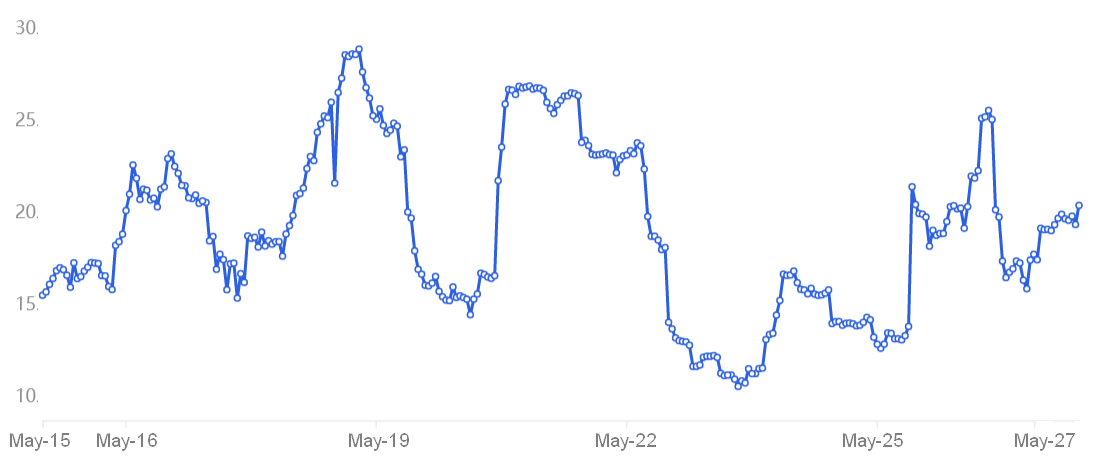

The above mentioned chart implies that traders happen to be borrowing more USD and Tether lately, since the ratio elevated from 13 on May 25 to the present 20. The greater the indicator, the greater confident professional traders are with Bitcoin’s cost.

It’s important to note the 29 margin lending ratio arrived at on May 18 was the greatest level in additional than six several weeks also it reflected bullish sentiment. However, a USDT/BTC margin lending ratio below 5 is frequently a bearish sign.

Options markets joined “extreme fear”

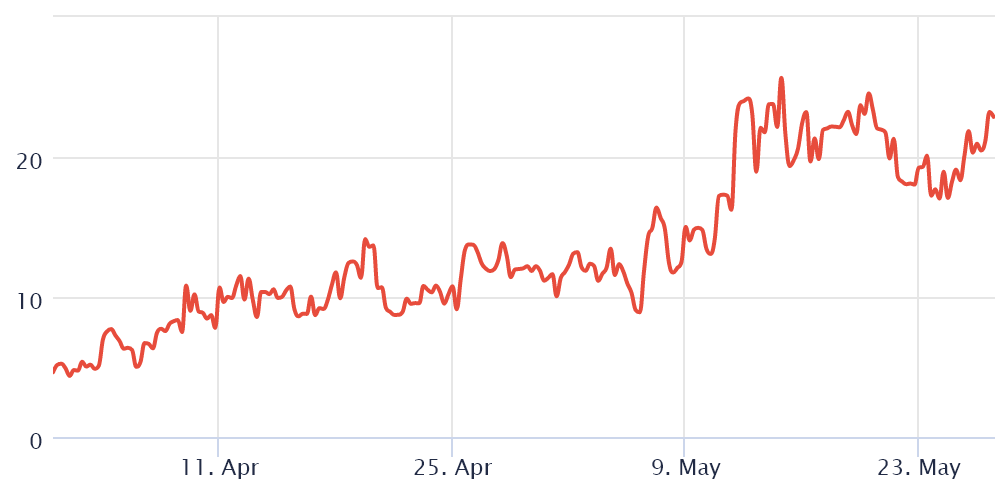

To exclude externalities specific towards the margin markets, traders also needs to evaluate the Bitcoin options prices. The 25% delta skew compares similar call (buy) and set (sell) options. The metric will turn positive when fear is prevalent since the protective put options fees are greater than similar risk call options.

The alternative holds when avarice is prevalent, resulting in the 25% delta skew indicator to shift towards the negative area. In a nutshell, if traders fear a Bitcoin cost crash, the skew indicator will move above 8%. However, generalized excitement reflects an adverse 8% skew.

The 25% skew indicator continues to be above 16% since May 11, indicating an very unbalanced situation because market markets and professional traders are reluctant to consider downside prices risks.

More to the point, the current 25.6% peak on May 14 was the greatest ever 25% skew in Bitcoin’s history. Presently, there’s a strong feeling of bearishness in BTC options markets.

Related: Falling Bitcoin cost does not affect El Salvador’s strategy

Explaining the duality between margin and options

A possible reason behind the divergent mindset between BTC margin traders and option prices might have been the Terra USD (UST) collapse on May 10. Market makers and arbitrage desks may have taken heavy losses because the stablecoin lost its peg, consequently reducing their risk appetite for BTC options.

Furthermore, the price of borrowing USD Tether has dropped to threePercent each year on Aave and Compound, according to Loanscan.io. Which means that traders will utilize this low-cost leverage strategy, therefore growing the USDT/BTC margin lending ratio.

There’s not a way to calculate what can cause Bitcoin to finish the present bearish trend, so use of cheap financing will not guarantee an optimistic cost action.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.