On December 5, Bitcoin, the key cryptocurrency, finally broke over the major level of resistance of $17,000, which is now heading north to $17,600. Similarly, Ethereum, the 2nd-best cryptocurrency, has damaged with the $1,300 barrier and obtained care of to $1,350.

Major cryptocurrencies traded mixed in early stages December 5, because the global crypto market capital elevated 1.58 % in the last day-to $865.67 billion. During the last 24 hrs, overall crypto market volume increased 5.91% to $32.24 billion.

The general volume in DeFi was $2.42 billion, comprising 7.49% of the entire 24-hour volume within the crypto market. The general amount of all stablecoins was $29.19 billion, comprising 90.52% of the entire 24-hour amount of the crypto market.

Let us check out the very best 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

Three from the best players coins which have acquired value within the last 24 hrs are Cronos (CRO), Celo (CELO), and Litecoin (LTC). The cost of CRO has elevated nearly 12% to $.071 the cost of CELO has elevated by greater than 11% to $.6955, and also the cost of LTC expires by nearly 7.5%.

Monero (XMR), Neutrino USD (USDN), and TRON (TRX) are three from the best players coins which have lost value within the last 24 hrs. Whereas XMR has lost about 1.30% to trade at $144.50, USDN is lower nearly 1% to trade at $.8890. Simultaneously, the TRX cost is lower over .50% to trade at $.0535.

Bybit to chop 30% of Workforce as Crypto Bear Market Deepens

Bybit, a centralized cryptocurrency exchange, is just about the latest to put off employees because the crypto winter continues. The organization had already let go workers in June of the year. Bybit, a business with headquarters in Singapore, has announced layoffs.

Additionally, it’s all regulated an element of the company’s ongoing effort to restructure. It is the latest cryptocurrency firm to shift priorities because the bear market worsens. Bybit co-founder and Chief executive officer Ben Zhou made the statement on December 4, adding the layoffs would affect all departments.

Kraken to get rid of Over 1,000 Employees as Crypto Winter Casualties Rise

Kraken co-founder and Chief executive officer Jesse Powell announced the organization could be lounging off nearly 1,100 workers, or 30% of their workforce, to “adjust to market conditions.”

Particularly, Powell pointed to “macroeconomic and geopolitical concerns” because the real cause from the disappointingly weak growth. He noticed that the current market downturn has decreased trade volumes, new signups, and client demand.

Kraken claimed it had been obliged to put off many employees despite getting already decreased personnel and marketing expenses. Kraken’s layoffs mirror reductions in personnel at other cryptocurrency companies this month because of the bear market.

Unchained Capital (which let go 600 people) and Coinbase (which let go 60) are some of the firms that have lately reduced their workforce. Within the wake of FTX’s collapse, probably the most publicized illustration of market volatility this season, BlockFi declared personal bankruptcy the 2009 week.

The exchange rate of the largest cryptocurrency towards the US dollar, BTC/USD, has hit a 2-year low because of the crash.

This ultimately places a bearish effect on the cryptocurrency market, however, the technical outlook is driving a bullish trend within the leading crypto coins.

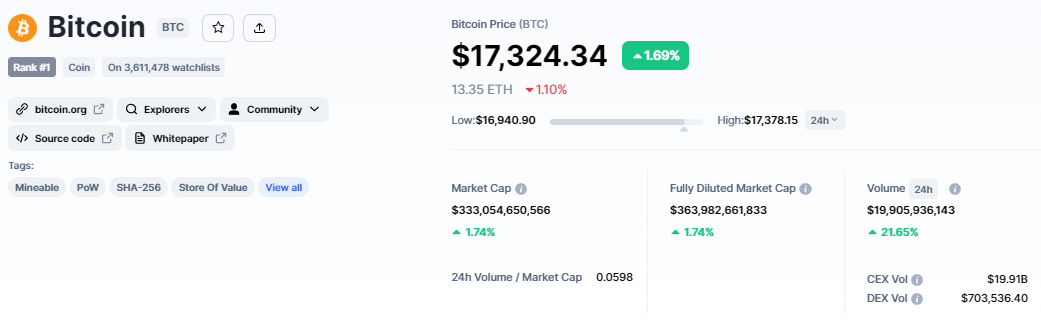

Bitcoin Price

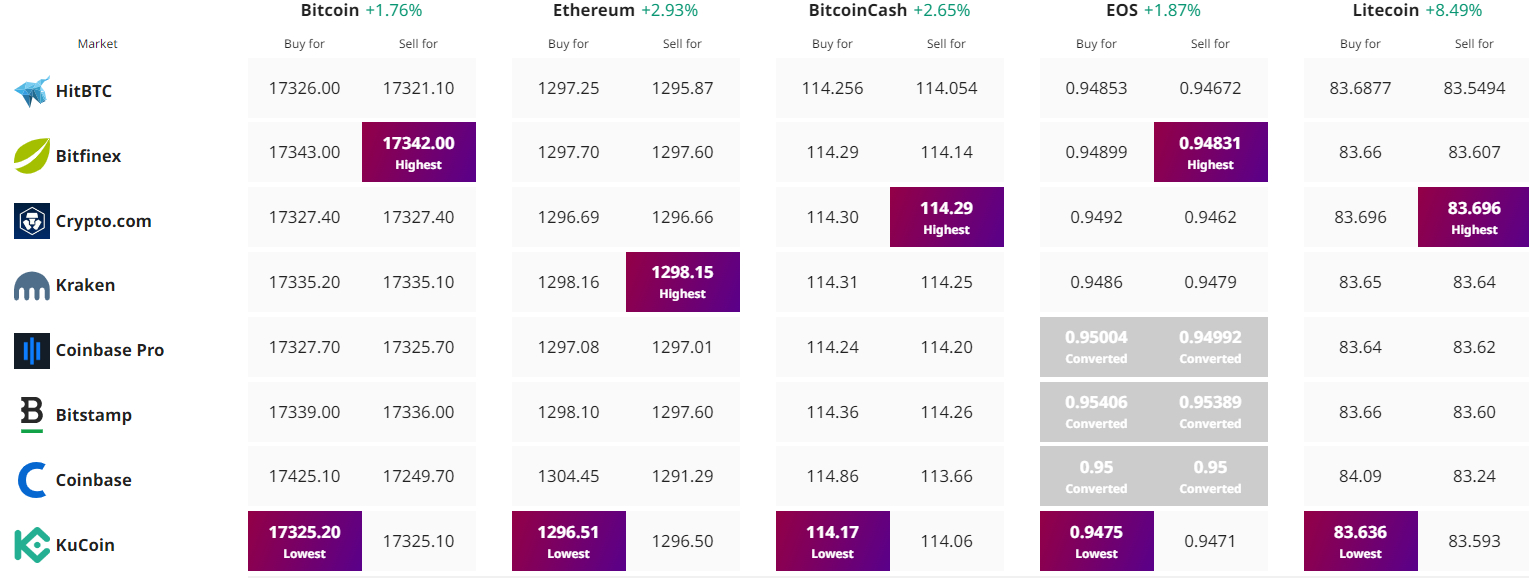

The current Bitcoin cost is $17,332, and also the 24-hour buying and selling volume is $19 billion. Over the past 24 hrs, the BTC/USD pair has acquired above 1.5%, while CoinMarketCap currently ranks first having a live market cap of $363 billion, above from $357 billion yesterday.

It features a total way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,224,668 BTC coins.

The BTC/USD pair has damaged with the $17,250 barrier, penetrating a narrow buying and selling selection of $16,800 to $17,250. The RSI and MACD indicators have been in an optimistic territory, and also the 50-day moving average is supporting BTC at $16,800.

Around the plus side, Bitcoin is approaching the following level of resistance of $17,650, along with a break above this might expose BTC to $18,000. BTC has created a bullish engulfing candle around the 4-hour time-frame, just above an upward trendline degree of $17,000.

Around the downside, Bitcoin support remains at $17,200, along with a break below this level may lead BTC to $17,000 or perhaps lower towards the $16,750 level.

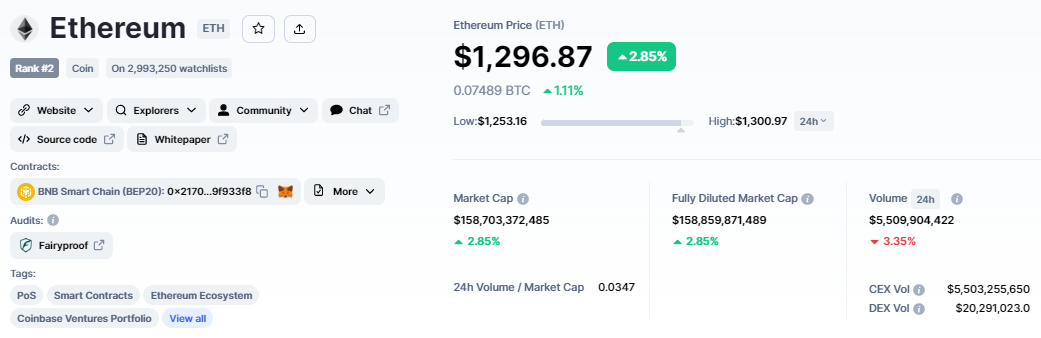

Ethereum Price

The present cost of Ethereum is $1,296, having a 24-hour buying and selling amount of $5.5 billion. Within the last 24 hrs, Ethereum has surged nearly 2%. CoinMarketCap presently ranks #2, having a live market cap of $158 billion. It features a circulating way to obtain 122,373,866 ETH coins.

Around the 4-hour chart, Ethereum is buying and selling bullish over the $1,250 mental level, which is now buying and selling bearish above and underneath the $1,300 mental level.

The bullish bias remains strong, because the 50-day moving average is near to $1,250. The RSI and MACD have lately joined the buying zone, indicating a great chance to visit lengthy.

Elevated interest in ETH can push its cost to the $1,350 level of resistance. If ETH does not close candle lights over the $1,300 level, the cost may fall toward the $1,250 or $1,220 support zones.

Keep close track of the $1,300 level, which will probably behave as a pivot point today.

IMPT Presale Ends Soon: 7 days to Buy

IMPT is yet another Ethereum-based network which will reward users for using the services of eco responsible firms. These advantages is going to be provided with the company’s IMPT token, that you can use to get NFT-based carbon offsets which may be offered or upon the market.

IMPT has elevated greater than $14 million since its dpo in October, with 1 IMPT presently buying and selling at $.023.

IMPT.io, a groundbreaking platform for carbon offsetting and carbon credits buying and selling, will finish its token presale on December eleventh because of remarkable success.

Get The Best Cost to purchaseOrMarket Cryptocurrency