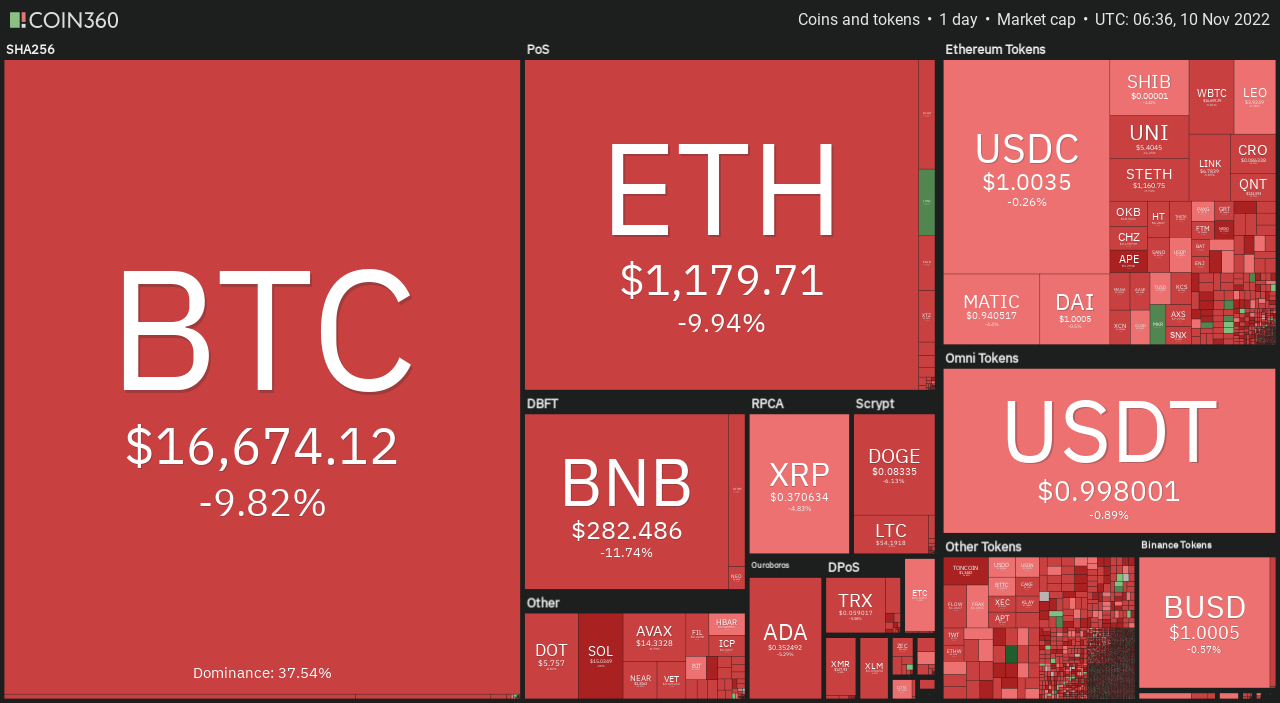

The cryptocurrency market continues to get a massive downtrend. The global crypto market cap fell over 11% to $809 billion the day before, delivering major cryptocurrencies in to the red on early November 10.

During the last 24 hrs, the whole crypto market volume plummeted 11% to $189 billion.

Bitcoin dropped to almost $16,010, while Ethereum was near a substantial drop, buying and selling just above $1,100.

The general volume in DeFi was $8.57 billion, accounting in excess of 4% from the total 24-hour volume within the crypto market. The overall amount of all stablecoins was $180 billion, comprising 95% from the total 24-hour amount of the crypto market.

Let us check out the very best altcoin gainers and losers during the last 24 hrs.

Top Altcoin Gainers and Losers

Chain (XCN), Gemini Dollar (GUSD), and Fei USD (FEI) are three from the best players coins which have acquired value within the last 24 hrs. The chain cost elevated by greater than 7% to $.043, as the Gemini Dollar elevated by greater than .18% to $.9964.

Solana (SOL) has lost greater than 45% of their value within the last 24 hrs as Binance pulls from the FTX save. FTX Token is lower 38% to $3.13, while Lido DAO is lower 25% to $.9870.

Binance Backs from FTX Save

On Wednesday, Binance announced that it might not be obtaining FTX, departing Mike Bankman-Crypto Fried’s empire in risk.

Binance stated inside a tweet on Wednesday,

“In the start, our hope was so that you can support FTX’s people to provide liquidity, however the issues are beyond our control or capability to help.”

The turnaround uses Binance Chief executive officer Changpeng Zhao mentioned the day before the largest cryptocurrency exchange had arrived at a non-binding agreement to buy FTX’s non-US companies to have an unknown value, saving the organization from the liquidity problem.

Eco-friendly put FTX’s value at $32 billion captured.

The crypto market endured significant losses because of this thought. Between Monday and Tuesday, FTT lost 80% of their value, plummeting to $5 and eliminating over $2 billion.

On Wednesday, it came by over half close to $2.30, reducing the need for all tokens in circulation to around $308 million.

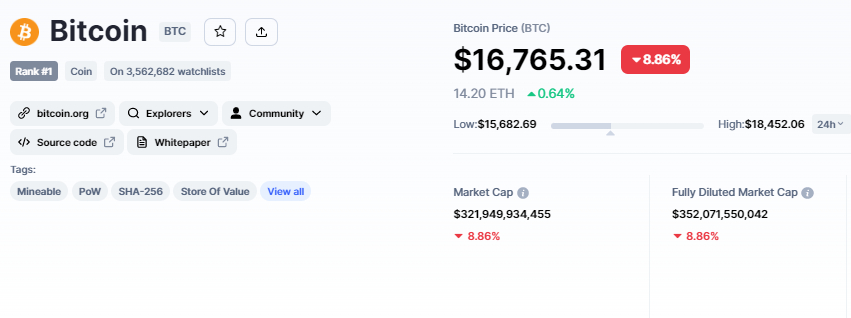

Bitcoin Price

The present Bitcoin cost is $16,015 and also the 24-hour buying and selling volume is $100 billion. Bitcoin lost over 12% throughout the Asian session and also over 20% within the last 7 days. CoinMarketCap presently ranks it first, having a live market cap of $314 billion, lower from $351 billion yesterday.

Around the technical front, Bitcoin has damaged via a triple bottom support degree of $18,244 closing candle lights below this level can lead to a drop to $16,000.

Around the daily time-frame, Bitcoin has additionally created a “three black crows” pattern, indicating the probability of a downtrend continuation. Because of elevated selling pressure, Bitcoin’s cost could fall to $14,500.

As leading technical indicators such as the RSI and MACD have joined the oversold zone, closing candle lights above $16,000 may signal the beginning of a bullish correction. Around the plus side, the immediate level of resistance for Bitcoin remains at $18,244.

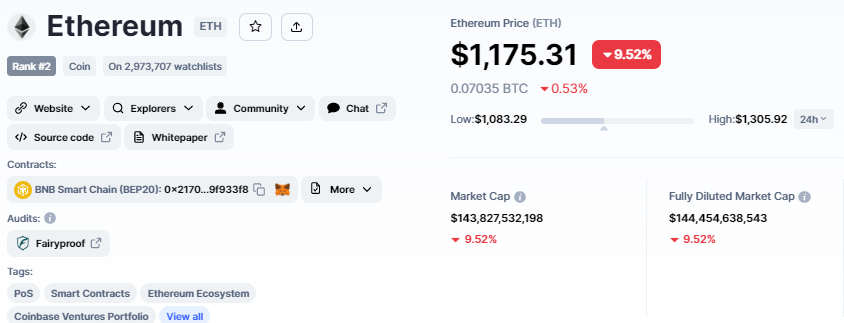

Ethereum Price

On Thursday, the 2nd best cryptocurrency, Ethereum, fell roughly 14% in the last 24 hrs and also over 25% within the last 7 days to trade at $1,118. On CoinMarketCap, it’s now rated second, having a live market capital of $142 billion, lower from $159 billion yesterday.

Around the daily chart, Ethereum has damaged via a symmetrical triangular pattern that were supporting ETH near $1,227. A bearish engulfing candle closing outdoors of the symmetrical triangular pattern confirms a bearish breakout and could lead ETH towards the $1,000 or $810 support zone.

The 50-day moving average at $1,400 also signifies the potential of a continuation from the selling trend. The ETH/USD pair may encounter significant resistance coming to $1,400 in the $1,227 level.

The RSI and MACD will also be oversold, and ETH may recover to retest the $1,300 level before shedding further on the market.

New Crypto Presale With Huge Potential

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives traders of abilities with real-time analytics and social data, letting them make more informed decisions.

It started its token purchase three days ago and also has elevated greater than $5.8 million, whilst confirming its first CEX listing around the LBank Exchange.

1 D2T presently equals .0513 USDT, however this will quickly increase to $.0533 within the next stage from the purchase and $.0662 within the final stage.

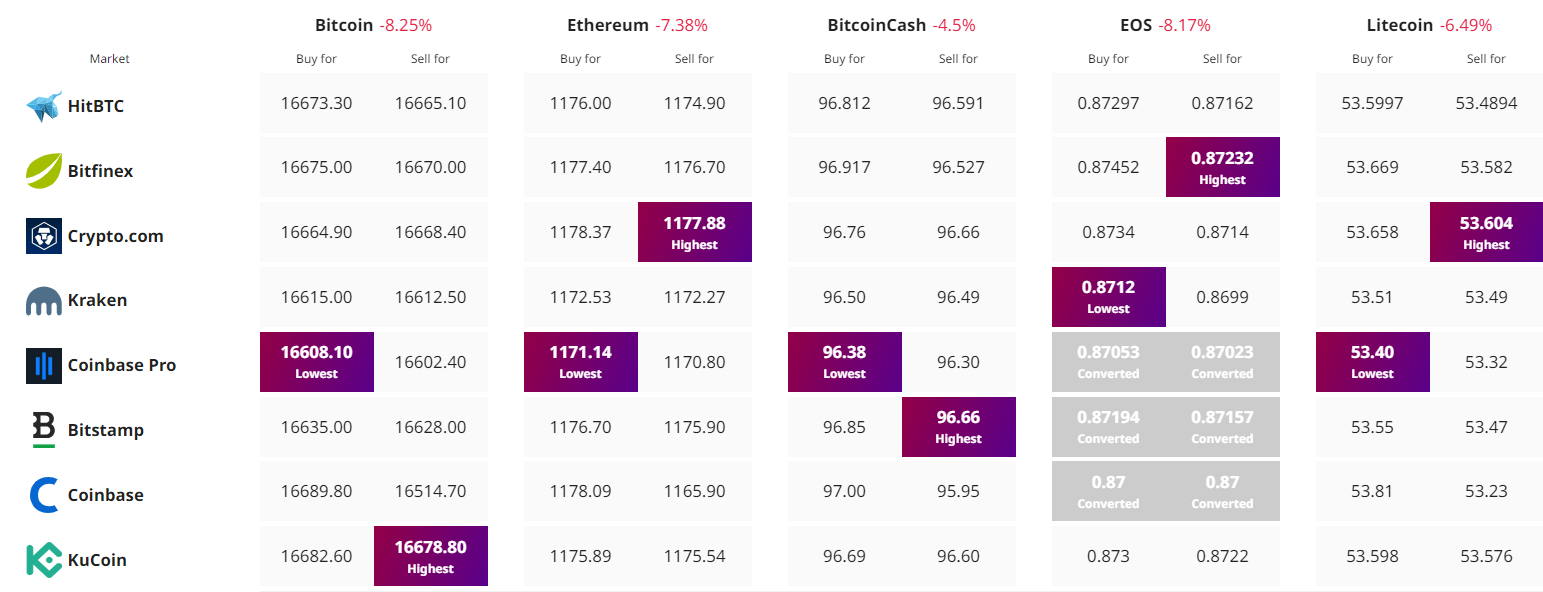

Get The Best Cost to purchaseOrMarket Cryptocurrency