Throughout the Asian session, the Bitcoin price is buying and selling bearish, near $20,916 after bouncing from the $20,000 support level. Similarly, Ethereum has risen greater than 2% to $1,637 and it is on the way to the 78.6% Fibonacci retracement level.

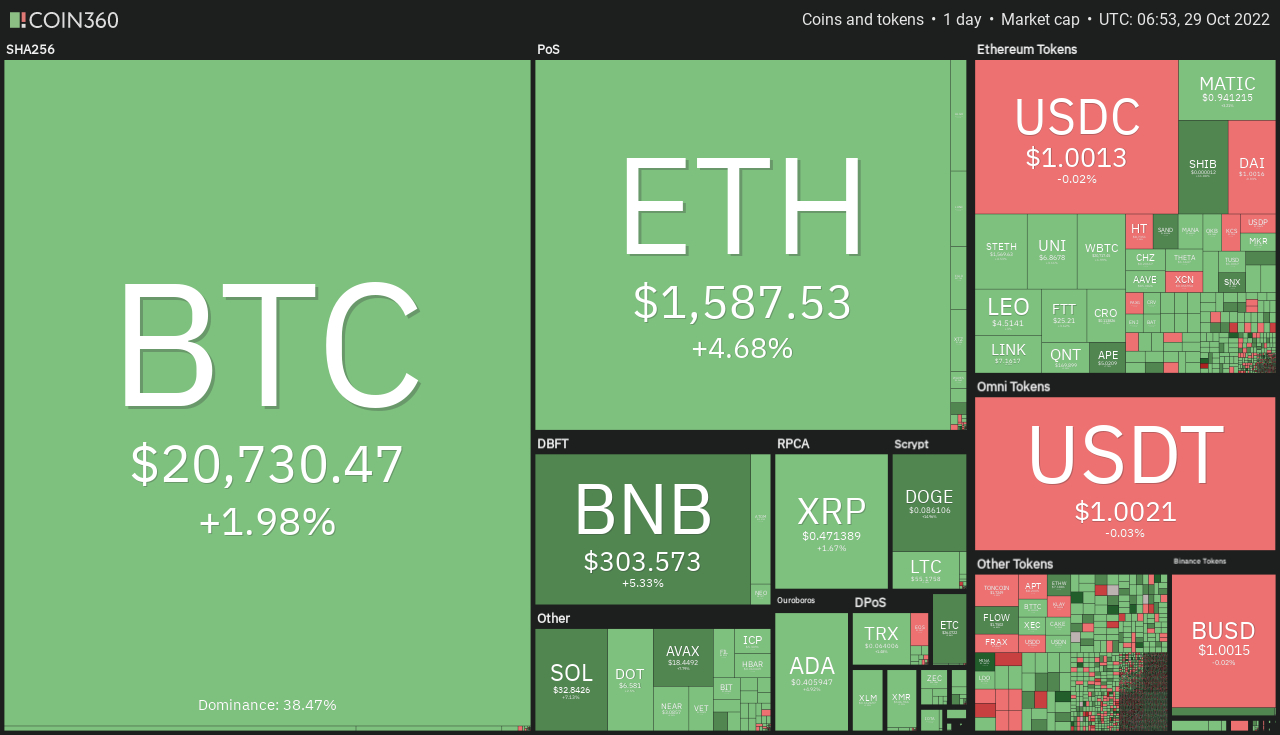

In early stages October 30, major cryptocurrencies were buying and selling within the eco-friendly, as the global crypto market cap surpassed $1 trillion having a buying and selling amount of $91 billion.

Overall, the marketplace is risk-on in front of the US Federal Reserve’s financial policy and rate decision in a few days.

Top Altcoin Gainers and Losers

Dogecoin (DOGE), Klaytn (KLAY), and Waves (WAVES) were the very best performers within the last 24 hrs. DOGE‘s cost has elevated by greater than 50% to $.1344, while KLAY’s cost has elevated by nearly 19% to $.29. Simultaneously, WAVES has acquired greater than 13% to trade at $3.80.

Mina (MINA) has dropped greater than 5% now to $.70. TerraClassicUSD (USTC) has fallen by greater than 6% close to $.038.

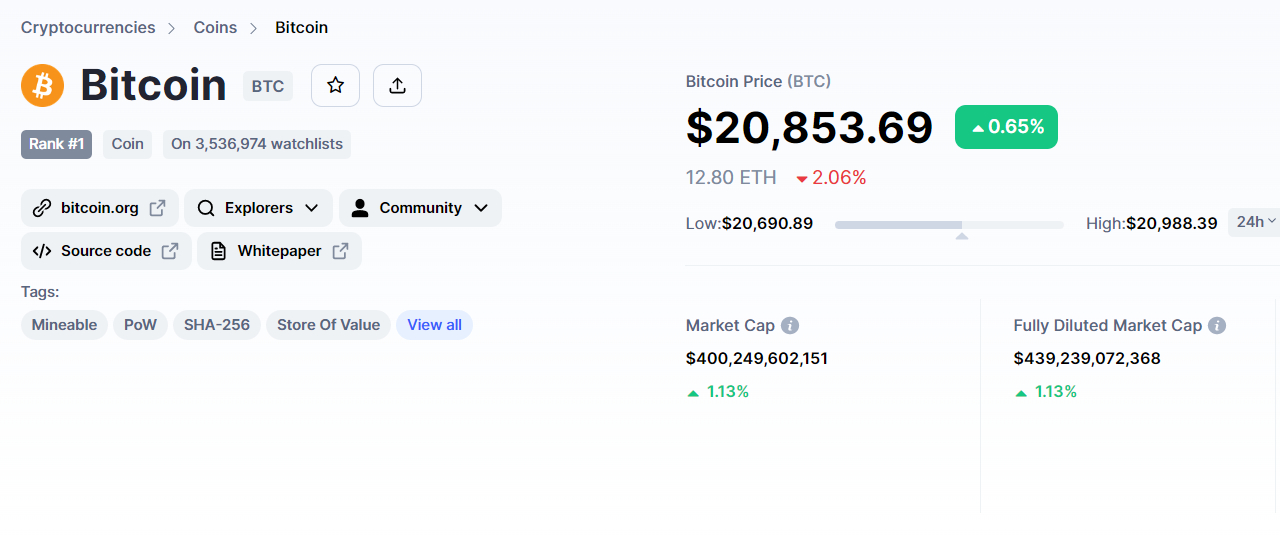

Bitcoin Price

The present Bitcoin cost is $20,869, and also the 24-hour buying and selling volume is $39 billion. Bitcoin has surged over 8% within the last 7 days. CoinMarketCap presently ranks first, having a live market cap of $400 billion, up from $397 billion yesterday.

The BTC/USD pair has become consolidating inside a large buying and selling selection of $20,000 to $21,000, that is extended by Fibonacci retracement levels varying from 38.2% to 61.8%. However, the general buying and selling basis remains bullish.

The RSI and MACD continue to be inside a bullish zone, indicating the positive trend will probably continue. Additionally, the 50-day moving average advises buying above $19,750.

Consequently, a breach from the 61.8% Fibo level might extend the buying trend to $21,900. Bitcoin might hit $22,500 when the present upward trend continues.

Around the downside, Bitcoin’s immediate support level continues to be near $20,250. Today, investors may seek a buy position upon a bullish breakout of $21,000 and the other way around.

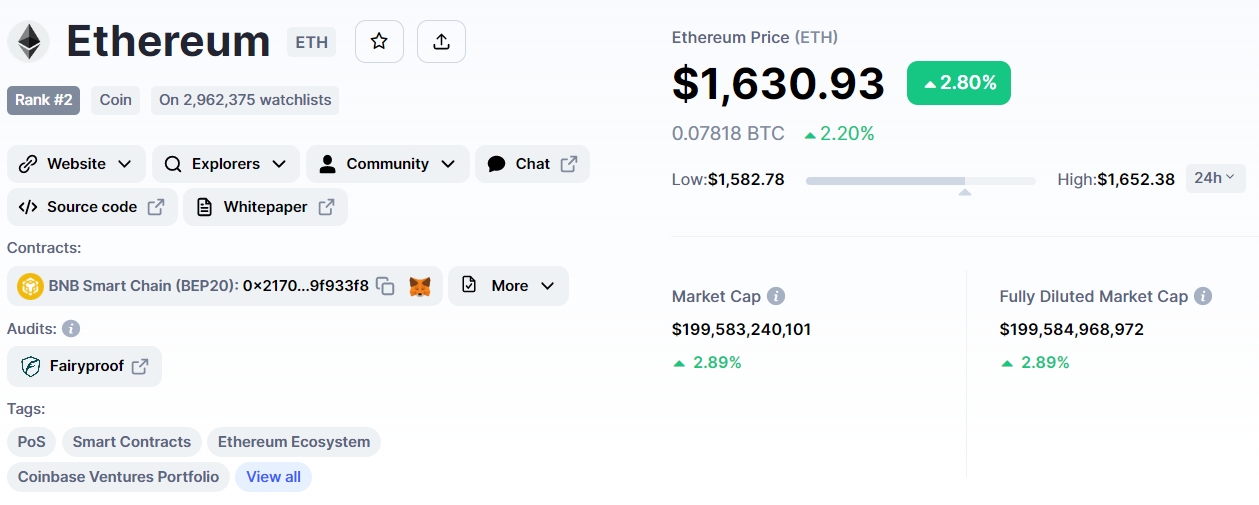

Ethereum Price

Ethereum’s current cost is $1,630, having a 24-hour buying and selling amount of $19 billion. Within the last 7 days, Ethereum has elevated by greater than 24%. CoinMarketCap has become rated second, having a live market capital of $199 billion, up from $194 billion yesterday.

On Sunday, the ETH/USD technical outlook has not altered a great deal and is constantly on the exhibit a bullish bias. The ETH/USD pair has completed a 61.8% Fibonacci retracement at $1,550 and it is now crossing above this level, indicating the potential of a bullish trend correction.

On the daily chart, ETH has breached the formerly placed a lot of $1,595 level, indicating strong bullish power. When the cost of ETH increases above $1,595, it might achieve $1,650 or $1,700.

Leading indicators like the RSI and MACD stay in the buying zone. Consequently, the likelihood of a bullish correction remain strong above $1,550. Simultaneously, support is constantly on the remain at $1,404 today.

New Crypto Presales

Apart from Bitcoin and Ethereum, new coins on presale do well and making the news. For example, Dash 2 Trade, this is an Ethereum-based platform that aims to supply its users with real-time analytics and social buying and selling signals the quantity elevated so far represents a substantial election of confidence within the platform.

The organization promises to launch its platform within the first quarter of 2023, following a presale, using its D2T token likely to be for auction on multiple exchanges.

The Dash 2 Trade presale has elevated over $3.3 million in under per week, using it track to get among the year’s largest token sales. The Dash 2 Trade presale continues to be ongoing D2T tokens could be purchased for $.05 USDT.

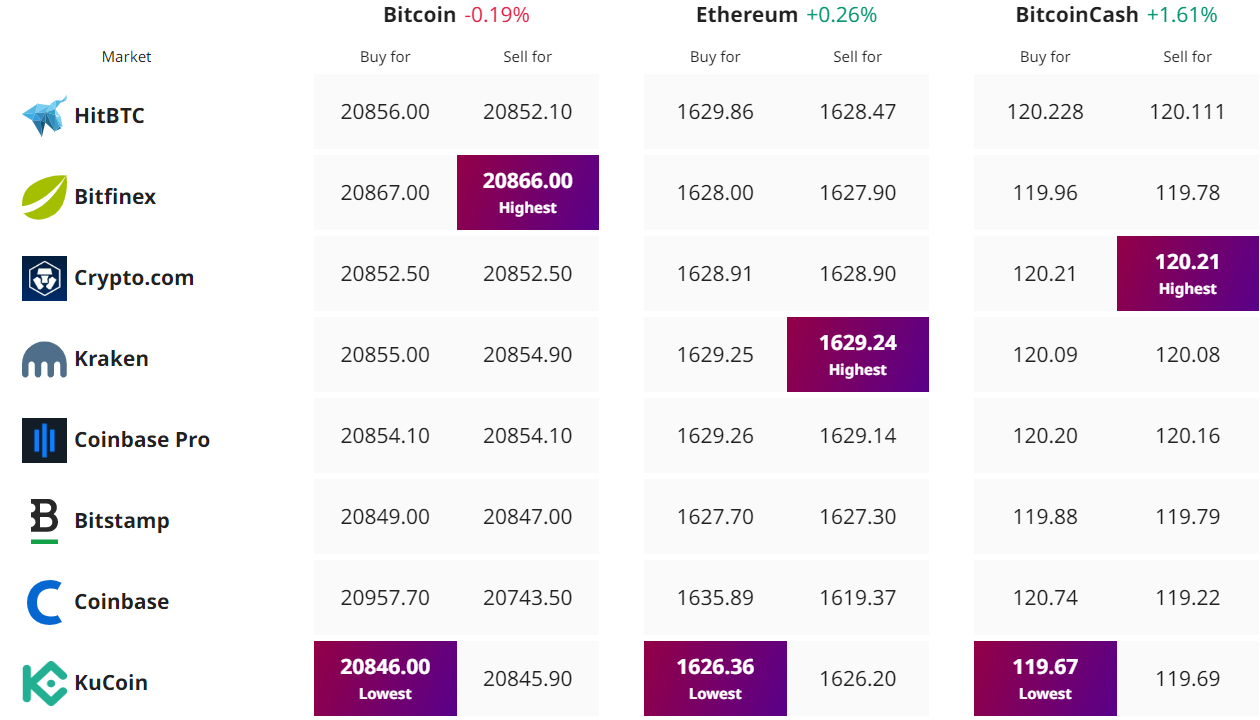

Get The Best Cost to purchaseOrMarket Cryptocurrency