Major cryptocurrencies were buying and selling slightly greater in early stages October 23, using the global crypto market cap at $923 billion, up greater than .5% from the day before. Within the last 24 hrs, the entire cryptocurrency market volume was $32 billion, a 39% increase.

The key cryptocurrency, Bitcoin, is consolidating near $19,216, getting acquired under 1% throughout the Asian session. BTC has created a symmetrical triangular pattern, along with a breakout of the triangular determines the cost action continuing to move forward. Ethereum, however, is rising, getting risen greater than 1% to trade at $1,313.

Top Altcoin Gainers and Losers

The very best performers within the Asian session were Bitcoin Gold (BTG), Aptos (APT), and Huobi Token (HT). Bitcoin Gold (BTG) has acquired over 11% to $18.35, as the cost of APT has risen by over 29% to $9.59. Furthermore, the Huobi Token cost rose over 11% to $8.70.

The Chain (XCN) cost has fallen by greater than 5% within the last 24 hrs to $.058. The cost of Maker (MKR) has dropped greater than 3% close to $990.

Fear & Avarice Index Signals Extreme Fear

Investors still avoid taking a chance and therefore are rather buying gold and also the US dollar. One possible reason behind the current market lull in cryptocurrencies would be that the market’s fear and avarice index is presently studying “Extreme Fear.”

Because many cryptocurrencies are oversold at this time, “Extreme Fear” is viewed as a great time to go in the marketplace and go lengthy with an oversold gold coin. Possibly that’s a primary reason behind the upward trend in Bitcoin and Ethereum.

BTC Has Become Less Volatile Than S&P 500 and Nasdaq

Reported by cryptocurrency analytics source Kaiko, Bitcoin’s volatility has decreased below those of the S&P 500 and Nasdaq. Cryptocurrency markets, the company contended, have become less responsive to dangerous macro occasions, including high inflation, an appreciating dollar, rising rates of interest, prolonged war, and also the energy crisis.

The information shows that cryptocurrency financial markets are less reactive to volatile macro occasions than earlier around, whereas equity markets have continued to be highly sensitive.

Within an interview, Clara Medalie, chief of research at Kaiko, stated:

Bitcoin volatility reaches multi-year lows while equity volatility is just at its cheapest level since This summer.The information shows that cryptocurrency financial markets are less reactive to volatile macro occasions compared to what they were previously around, whereas equity markets have continued to be highly sensitive.

Bitcoin’s volatility has decreased in accordance with the Nasdaq and also the S&P 500, based on cryptocurrency analytics source Kaiko, reported by CNBC. The very first time since 2020, Bitcoin’s 20-day moving volatility is under that of these two stock indexes, based on a study printed with a cryptocurrency data business on Friday.

At its meeting in November, the Fed will probably raise rates of interest by 75 basis points for that 4th time consecutively. But Mary Daly, president from the Fed Bank of Bay Area, stated last Friday that policymakers should consider slowing the speed of future rate of interest increases.

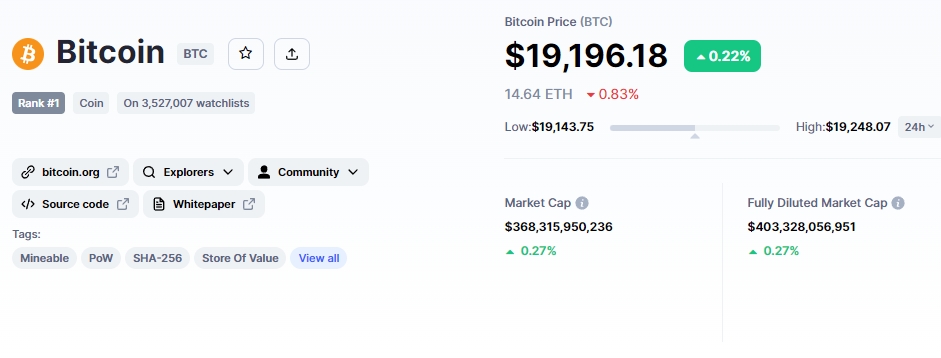

Bitcoin Cost Conjecture & Technical Outlook

The present Bitcoin cost is $19,206, and also the 24-hour buying and selling volume is $15 billion. Bitcoin has elevated by under 1% within the last 24 hrs. CoinMarketCap presently ranks first, having a live market cap of $368 billion.

It features a total way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,186,937 BTC coins. Bitcoin is forecasted to satisfy immediate technical resistance close to the $19,300 level, in which a symmetrical triangular pattern can also be developing. Furthermore, the 50-day MA keeps a bearish bias for BTC prices below $19,250.

A sustained make room $19,300 could open the doorway for bulls to challenge the following resistance zone between $19,650 and $19,950 in BTC.

However, a rest below $18,920 support may push BTC towards $18,600 or $18,400 levels.

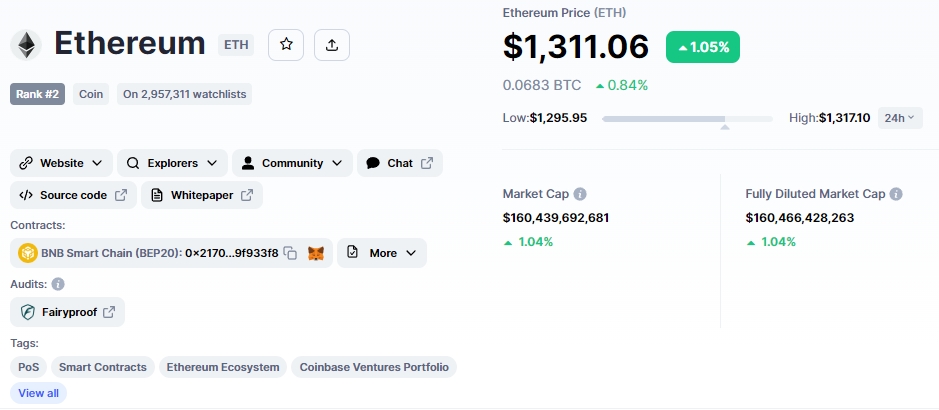

Ethereum Conjecture & Technical Outlook

The present cost of Ethereum is $1,311, having a 24-hour buying and selling amount of $7.1 billion. In the last 24 hrs, Ethereum has acquired over 1%. CoinMarketCap now ranks #2, having a live market cap of $160 billion.

The ETH/USD pair has produced an climbing triangular pattern, which signifies near-term tech support team around $1,292. However, instant resistance has been met at the amount of $1,320. The 50-day moving average also lends credence towards the bullish situation for ETH.

Ethereum’s primary resistance levels at $1,320 have organized well, however the mix above this could push ETH toward $1,340 or $1,385.

Leading technical indicators like the RSI and MACD are holding above 50 and , correspondingly, indicating likelihood of an upward trend continuation. However, a bearish introduction to the $1,292 level could bring ETH lower to $1,270 or $1,240.

New Altcoin News

Together with Bitcoin and Ethereum, Dash 2 Trade is making the news because of its massive success in the presale phase. Cryptocurrency traders will get access to real-time market data, insights, and analysis via Dash 2 Trade, an Ethereum-based platform.

Following its launch on October 20th, the Dash 2 Trade presale has surpassed $a million. To now, it’s elevated roughly $1.3 million and it is likely to pass a lot more key benchmarks within the coming hrs.

Although predicting the long run is hard, D2T appears to possess a vibrant future according to its firm foundation.

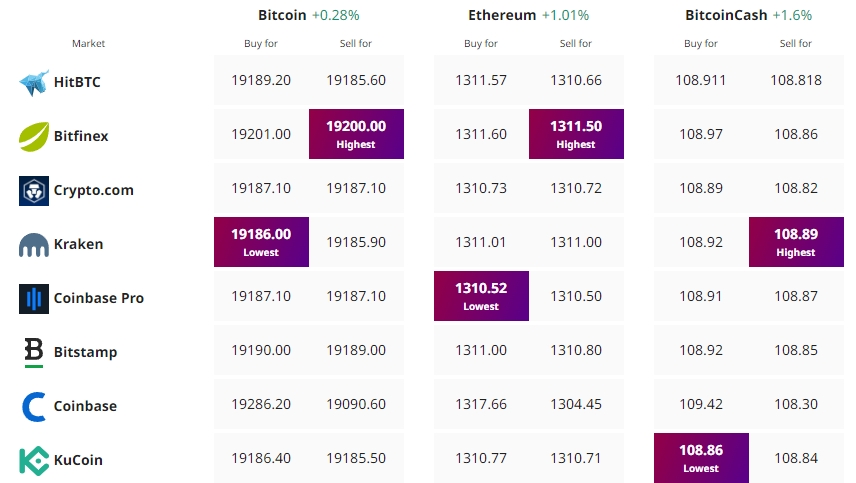

Get The Best Cost to purchaseOrMarket Cryptocurrency: