Bitcoin, the key cryptocurrency, battled to interrupt over the $17,250 level on December 2, which is now heading lower to $16,900. Similarly, Ethereum, the 2nd-best cryptocurrency, has fallen after denial in the $1,300 level and it is presently consolidating near $1,275.

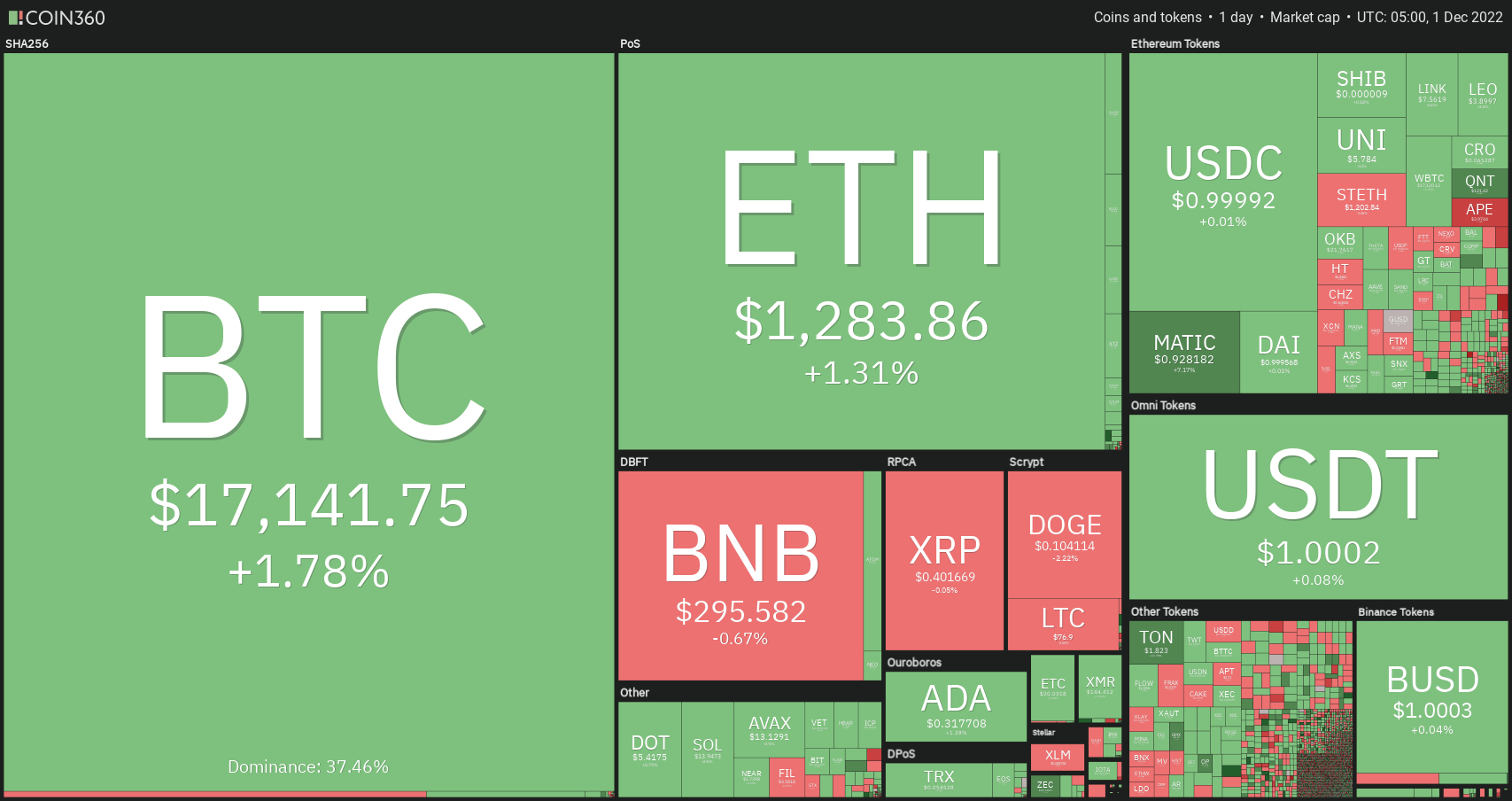

Major cryptocurrencies were buying and selling within the negative in early stages December 02, as the global cryptocurrency market value fell over 1.30% to $849.73 billion on the day before. During the last 24 hrs, overall crypto market volume fell 14 % to $42.61 billion.

The whole volume in DeFi was $2.99 billion, comprising 7% from the total 24-hour volume within the crypto market. The general amount of all stablecoins was $40.66 billion, comprising 95% from the total 24-hour amount of the crypto market.

Let us check out the very best 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

Three from the best players coins which have acquired value within the last 24 hrs are EthereumPoW (ETHW), GMX (GMX), and Terra Classic (LUNC). The cost of ETHW has elevated by greater than 20% to $4, the cost of GMX has elevated by greater than 14% to $55, and also the cost of LUNC has elevated by nearly 10%.

BinaryX (BNX), Curve DAO Token (CRV), and Dogecoin (DOGE) are three from the best players coins which have lost value within the last 24 hrs. Whereas BNX has lost about 6% to trade at $130, CRV is lower nearly 5% to trade at $.6350. Simultaneously, the DOGE cost is lower over 5% to trade at $.099.

Given Chair Jerome Powell’s Dovish Remarks

The reason behind its rise could be related to Given Chair Jerome Powell’s dovish remarks, that have been critical in supporting cryptocurrencies for example Bitcoin.

Jerome Powell, the chairman from the Fed, mentioned the bank will slow the speed where it raises rates of interest at its approaching meeting.

In addition, the united states dollar’s drop to some three-month low was considered a key point supporting greater Bitcoin prices, as BTC includes a strong inverse relationship using the US Dollar Index.

Revenue from Bitcoin Mining Drops

In comparison, Block Research data reveal that revenue from Bitcoin mining fell by 19.9% in November to roughly $472.64 million. It was seen among the important aspects to keep any extra gains in BTC gains in check.

Transaction charges taken into account merely a small part of bitcoin mining revenue ($12.32 million), using the block reward subsidy accounting for almost all revenue ($460.32 million).

Bitcoin transaction charges now take into account about 3% of total revenue, representing a marginal increase.

When it comes to earnings, Bitcoin miners outpaced Ethereum investors with a factor of approximately 5.3. Moving forward, traders appear cautious about placing any strong bids in front of US payroll data that will probably influence financial policy.

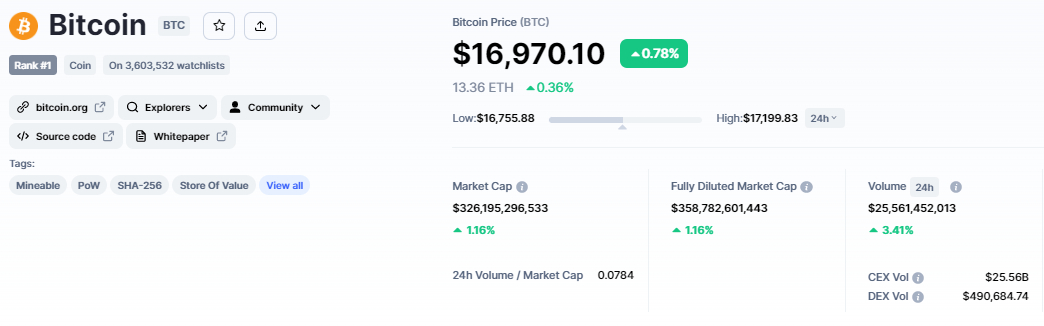

Bitcoin Price

The current Bitcoin cost is $16,970, and also the 24-hour buying and selling volume is $25 billion. Over the past 24 hrs, the BTC/USD pair has acquired above .50%, while CoinMarketCap currently ranks first having a live market cap of $358 billion, up from $323 billion yesterday.

It features a total way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,221,593 BTC coins.

The BTC/USD pair battled to interrupt with the $17,250 level, and also the closing of doji and spinning top candle lights indicate the potential of a bearish correction.

Around the downside, Bitcoin has completed a 23.6% Fibonacci retracement at $16,900, and shutting candle lights below $16,950 may trigger additional selling before the $16,750 level.

Further lower, Bitcoin can concentrate on the $16,600 level, that is extended by 50% Fib level, along with a break below this could expose BTC towards the $16,450 level, that is extended by 61.8% Fib level.

Around the upside, a bullish breakout from the $17,250 level could expose BTC to 17,650 and $18,100 levels.

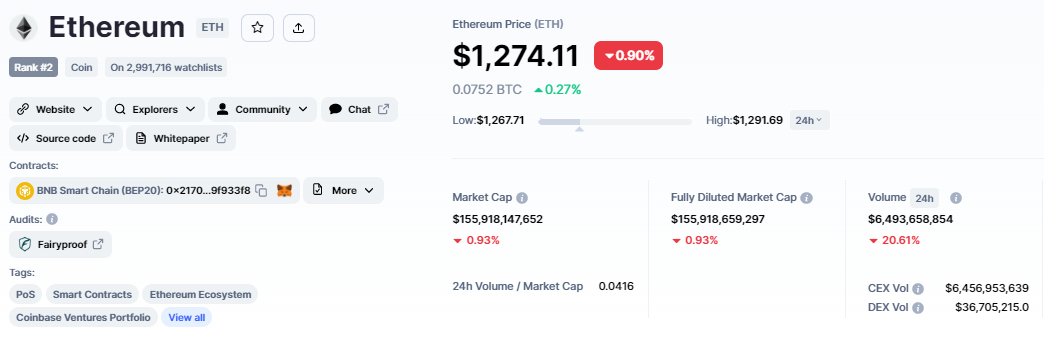

Ethereum Price

The present cost of Ethereum is $1,274, having a 24-hour buying and selling amount of $6 billion. Within the last 24 hrs, Ethereum has lost nearly 1%. CoinMarketCap presently ranks #2, having a live market cap of $155 billion. It features a circulating way to obtain 122,373,866 ETH coins.

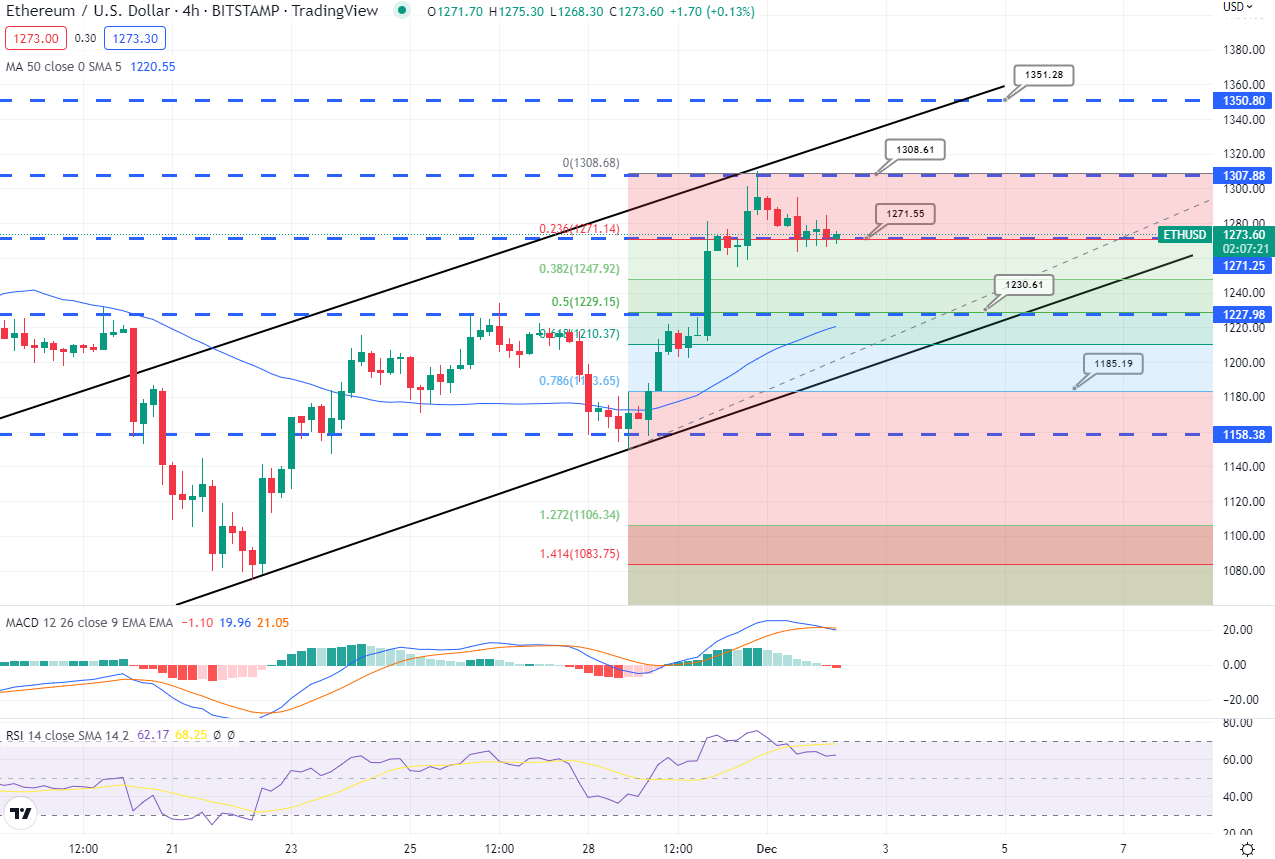

Around the 4-hour chart, Ethereum traded bullishly but unsuccessful to interrupt over the $1,310 level of resistance, triggering a bearish correction.

The tweezers’ top pattern is weakening the bullish trend and may lead to a bearish market correction.

Around the downside, Ethereum’s immediate support will probably be around $1,225, having a drop to $1,150 possible.

The MACD and RSI indicators are diverging since the MACD is within a selling zone as the RSI continues to be inside a buying zone. Additionally, the 50-day simple moving average (SMA) continues to be indicating a buying trend.

A bullish breakout from the $1,310 level, however, could expose the ETH cost towards the $1,354 level.

Fantom Rockets Over 35%

Fantom extended its upward momentum on December 02 despite rumors the Fantom Foundation makes regular earnings and it has 3 decades from the runway without requiring to market any FTM tokens.

FTM cost rose about 35% hitting $.24, its greatest level in three days. An upswing comes as part of a larger rebound trend that began if this bottomed out at roughly $.17 on November. 22. This means a 50% cost rebound within the last eight days.

Interestingly, the rally required up momentum following the Fantom Foundation’s “Architect,” Andre Cronje, disclosed the firm’s financial documents on November. 28, disclosing it had $340 million price of digital assets coupled with been making over $ten million yearly.

When it comes to technical analysis, the FTM/USD has completed a 61.8% Fibonacci retracement at $.2580. Around the plus side, a rest above $.2580 could expose FTM to $.2830 or $.3100.

Around the downside, FTM’s immediate support reaches $.2410, and also the cost can fall as little as $.2235 and $.2015.

Presale Cryptocurrency With Massive Potential Profit

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives traders of abilities with real-time analytics and social data, letting them make smarter-informed decisions. The woking platform goes reside in the very first quarter of 2023, supplying information to investors to enable them to for making positive buying and selling decisions.

Dash 2 Trade has additionally been successful, with two exchanges (LBank and BitMart) promising to list out the D2T token following the presale concludes. 1 D2T is presently worth .0513 USDT, however this increases to $.0533 in the finish from the purchase. D2T has to date elevated greater than $7.seven million by selling greater than 88% of their tokens.

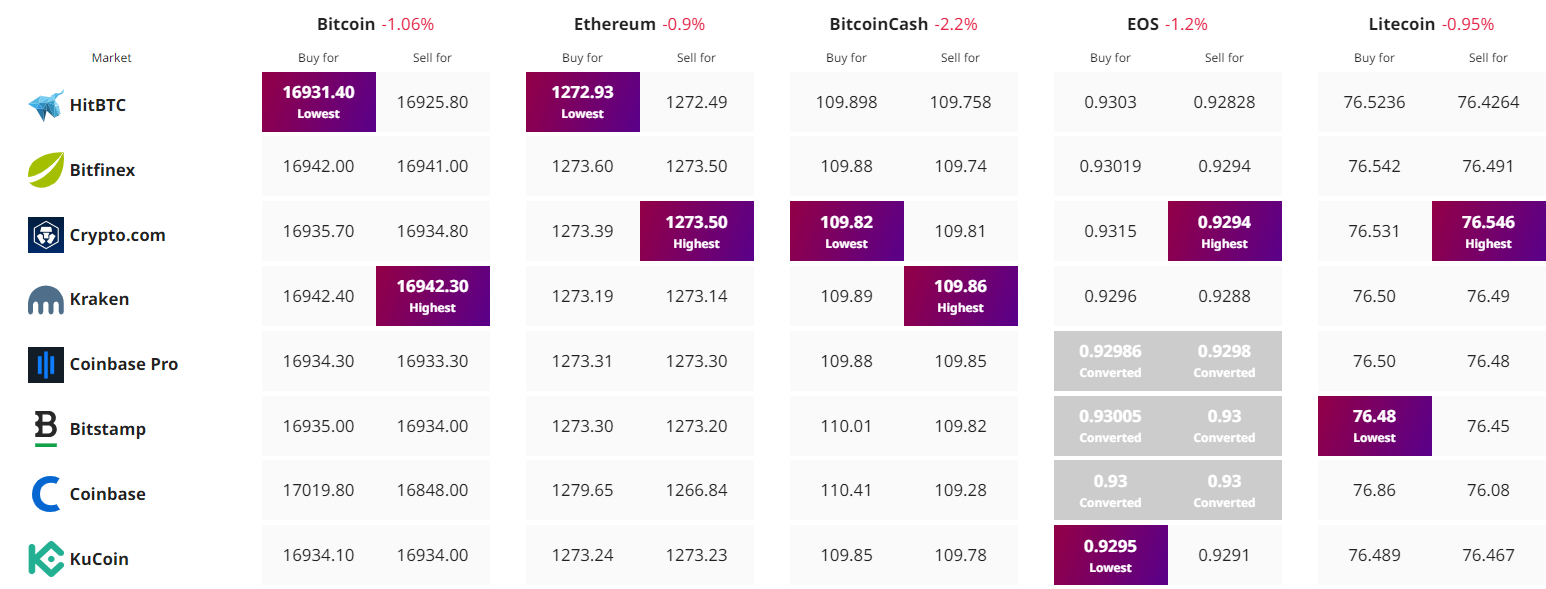

Get The Best Cost to purchaseOrMarket Cryptocurrency