The cryptocurrency market has exhibited a small recovery, with Bitcoin, the key cryptocurrency, jumping greater than 2.5% to $16,815 after you have rejected in the $17,250 level of resistance. Similarly, Ethereum, the 2nd-best cryptocurrency, is booming, reaching $1,286 after violating a symmetrical triangular pattern.

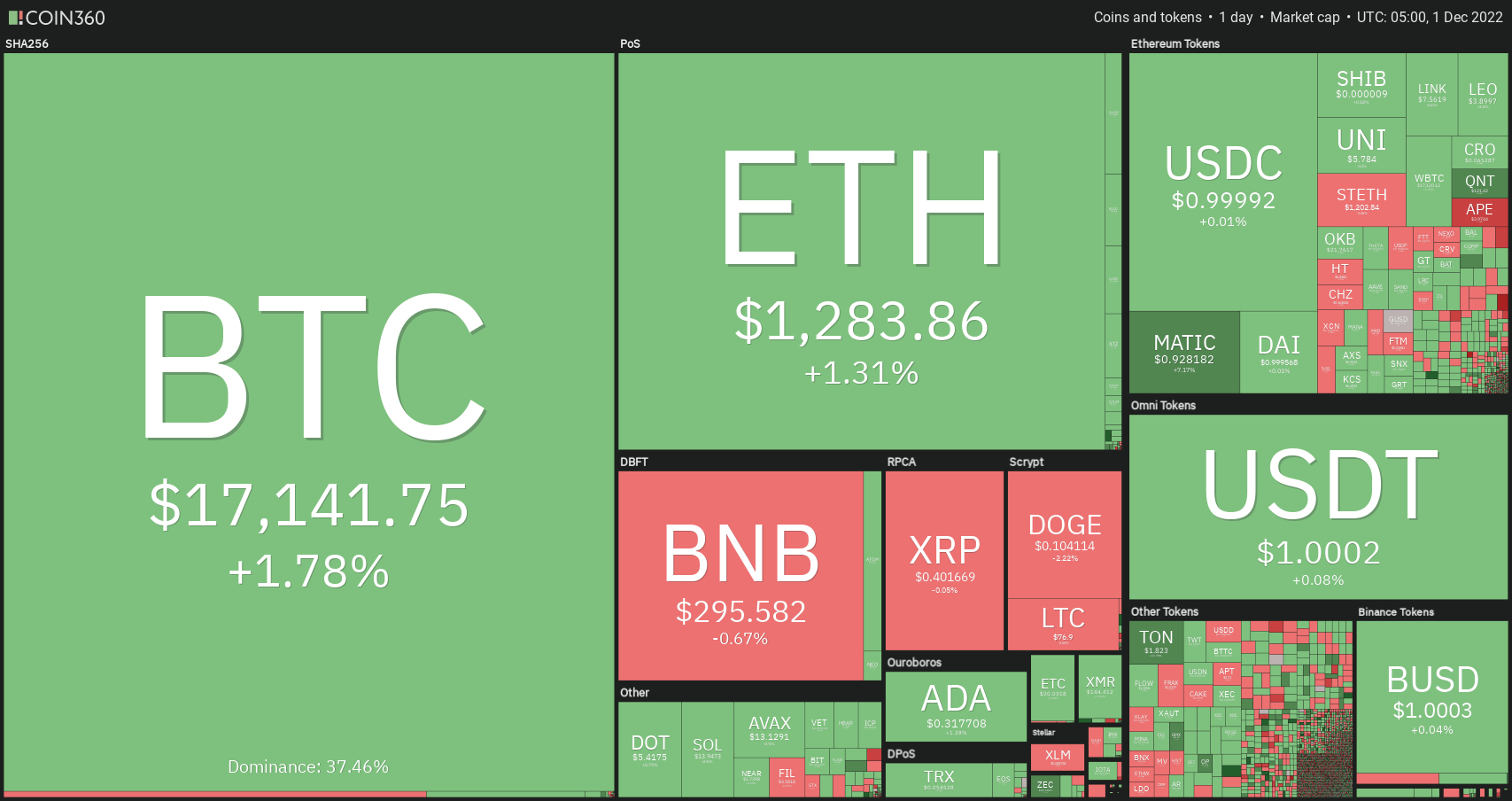

Major cryptocurrencies were buying and selling positively in early stages December 1, as the global crypto market capitalization elevated .56 percent in the last day-to $861.06 billion.

During the last 24 hrs, overall crypto market volume increased 5.03 percent to $49.73 billion. The general volume in DeFi was $3.43 billion, comprising 6.90 % from the total 24-hour volume within the crypto market.

The general amount of all stablecoins was $47.01 billion, comprising 94.53 % from the total 24-hour amount of the crypto market.

Let us check out the very best 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

GMX (GMX), Polygon (MATIC), and Zcash (ZEC) are three from the best players coins which have acquired value within the last 24 hrs. The GMX cost has soared by greater than 12% to $48.80, the MATIC cost is continuing to grow by greater than 6% to $.9275, and also the ZEC cost has elevated by nearly 5.5%.

ApeCoin (APE), Fantom (FTM), and Helium (HNT) are three from the best players coins which have lost value within the last 24 hrs. Whereas APE has lost over 7% to trade at $3.97, FTM is lower nearly 2.25% to trade at $.2345. Simultaneously, the HNT cost is lower over 3% to trade at $2.45.

Kraken to put off 30% of their Global Workforce

Based on a corporate blog publish published on Wednesday, US-based cryptocurrency exchange Kraken will laid off 30% of their global employees, or higher 1,100 individuals, to “adapt to market conditions.”

Forever of the year, markets happen to be pressurized for macroeconomic and geopolitical reasons.

Kraken authored.

“As due to, we had a precipitous stop by buying and selling volumes and new client sign-ups. Regrettably, bad everything has stored happening available on the market, and we have consumed all of the best ways to change prices to satisfy demand.”

Because of these layoffs, Kraken’s overall workforce has returned where it had been last year, the company claimed.

Following the recent failure from the cryptocurrency exchange FTX.com within the Bahamas, that has pulled lower cryptocurrency markets and threatened companies with contact with FTX (including crypto loan provider BlockFi Corporation., which declared personal bankruptcy now), Kraken has had this course of action.

Auros Global Misses DeFi Payment because of FTX Contagion

After failing to create a principal repayment on the 2,400 Wrapped Ether (wETH) decentralized finance (DeFi) loan, cryptocurrency buying and selling firm Auros Global looks to become have contracted the FTX virus.

On November 30, M11 Credit, an institutional credit underwriter that oversees liquidity pools on Walnut Finance, tweeted to the supporters the Auros had unsuccessful to create a principal payment on the 2,400 wETH loan worth around $3 million.

Based on M11 Credit, Auros is facing a “short-term liquidity crisis because of the FTX insolvency,” The organization has been around constant connection with its borrowers, especially considering recent occasions.

Walnut Finance has retweeted the thread, but algorithmic buying and selling and market-making business Auros has yet to reply to M11 Credit’s claims.

M11 Credit has additionally mentioned the loan isn’t defaulted due to the delayed payment. Rather, a “5-day elegance period as reported by the smart contracts” continues to be activated due to the overtime.

Which means that the deadline for Auros to help make the overtime and steer clear of default is December 5.

With all this news, the marketplace continues to be figuring out whether or not to keep up with the bullish trend or wait for correction.

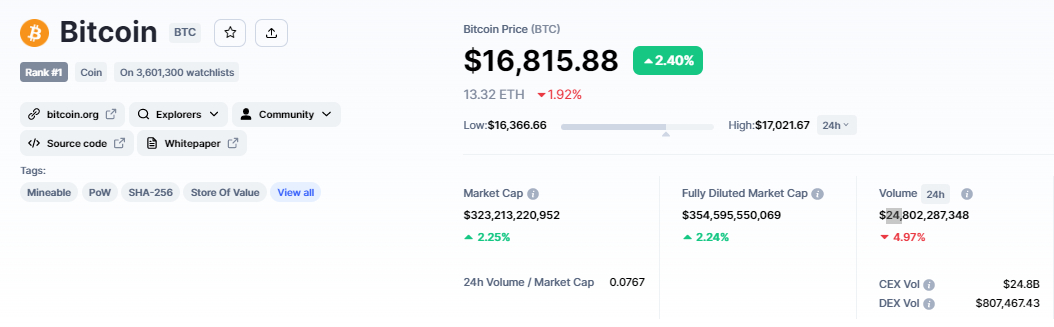

Bitcoin Price

The current Bitcoin cost is $16,815, and also the 24-hour buying and selling volume is $24 billion. Over the past 24 hrs, the BTC/USD pair has acquired nearly 2.5%, while CoinMarketCap currently ranks first having a live market cap of $323 billion, lower from $323 billion yesterday.

It features a total way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,220,518 BTC coins.

The BTC/USD is buying and selling having a bullish bias on Thursday, however it has arrived at an overbought zone, and also the double top pattern is extending resistance close to the $17,255 level. A bullish breakout from the $17,255 level may lead Bitcoin to another resistance amounts of $17,600 and $18,000.

Since the RSI and MACD have been in the overbought zone, a bearish correction under $17,250 can be done. Around the downside, Bitcoin’s immediate support reaches $16,700, which could fall as little as $16,250.

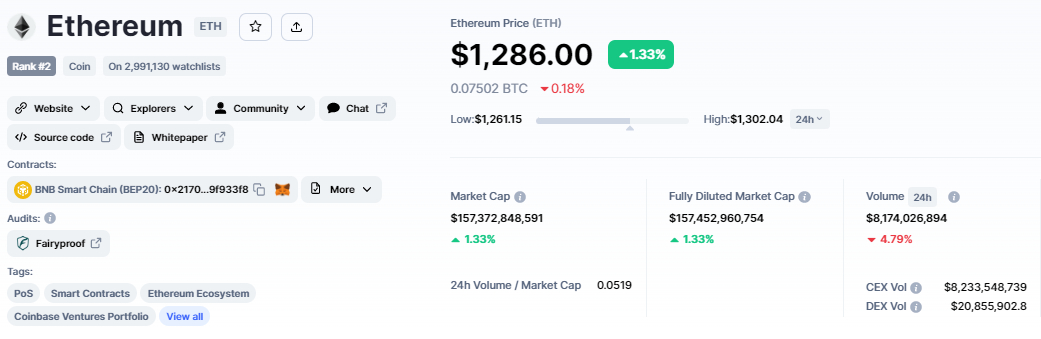

Ethereum Price

The present cost of Ethereum is $1,286, having a 24-hour buying and selling amount of $8 billion. Within the last 24 hrs, Ethereum has acquired nearly 1%. CoinMarketCap presently ranks #2, having a live market cap of $157 billion. It features a circulating way to obtain 122,373,866 ETH coins.

Around the 4-hour time-frame, Ethereum continues to be buying and selling strongly bullish, but it’s now encountering strong resistance in the $1,310 level. The development from the tweezers’ top pattern is weakening the bullish trend and can lead to a bearish market correction.

Around the downside, Ethereum’s immediate support is probably around $1,225, which could go as little as $1,150.

However, a bullish breakout from the $1,310 level could expose the ETH cost towards the $1,354 level.

Huobi Token Pumps Over 25%

Huobi Token has become buying and selling at $6.85 having a 24-hour buying and selling amount of $16 billion. Within the last 24 hrs, Huobi Token continues to be lower 1.5% however it has acquired over 25% within the last 7 days. CoinMarketCap now ranks #39, having a live market cap of $1,050,454,242 USD. You will find 153,357,694 HT coins in circulation, having a maximum way to obtain 500,000,000 HT coins.

Around the technical front, the HT/USD pair is facing immediate resistance at $7.40, having a break above this level potentially exposing HT towards the $8.35 level.

Around the upside, a rest above $8.35 can result in $9. A bearish breakout from the $6.6 level, however, could extend supplying $6.10 or $5.10.

Presale Cryptocurrency With Massive Potential Profit

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives real-time analytics and social data to traders of abilities, letting them make smarter-informed decisions. The woking platform goes reside in the very first quarter of 2023, supplying investors with information to assist them to make positive buying and selling decisions.

Dash 2 Trade is a success too, with two exchanges (LBank and BitMart) promising to list out the D2T token when the presale is finished. 1 D2T is presently worth .0513 USDT, but in the finish from the purchase, this can increase to $.0533.

D2T has elevated over $7.six million to date by selling over 87% of their tokens.

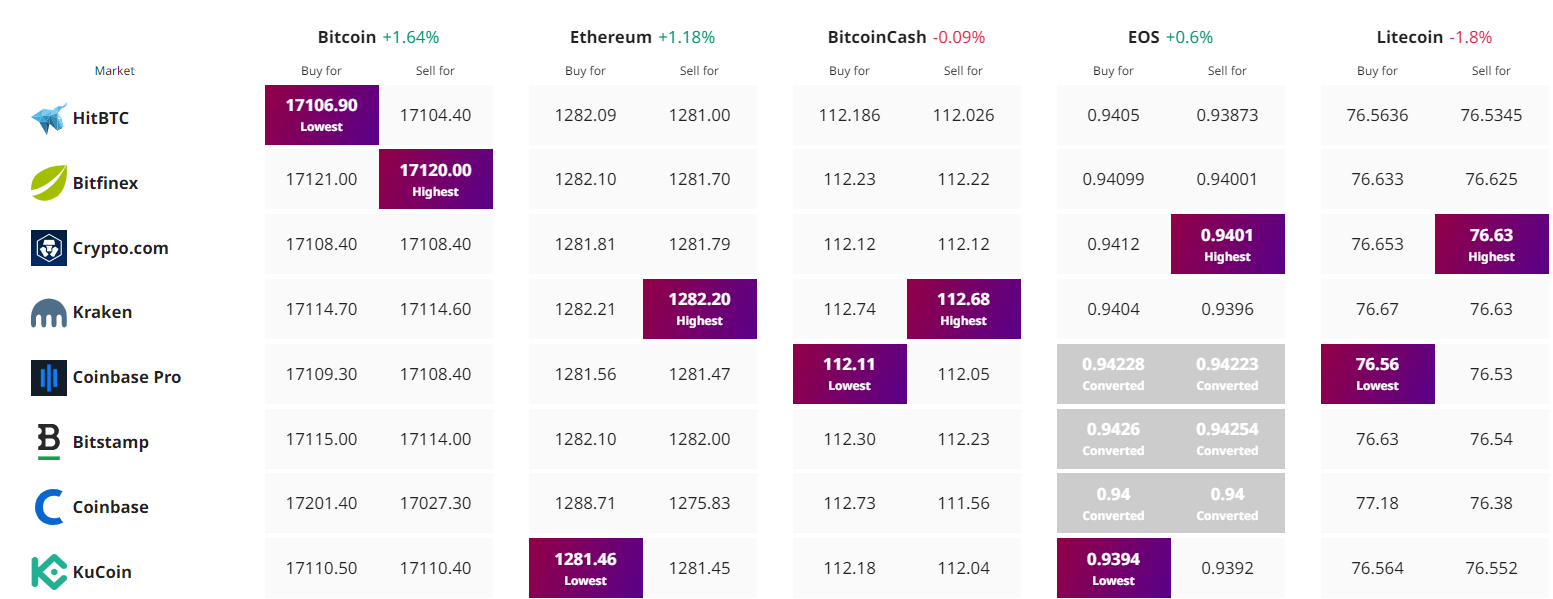

Get The Best Cost to purchaseOrMarket Cryptocurrency