Bitcoin is mainly unchanged on November 17, however it remains pressurized as Genesis Buying and selling, a crypto financial services firm, has suspended withdrawals from the loan section, citing the “remarkable market instability” brought on by Mike Bankman’s FTX collapse. Ethereum, the 2nd-best cryptocurrency, can also be buying and selling sideways, having a cost selection of $1,175 to $1,280.

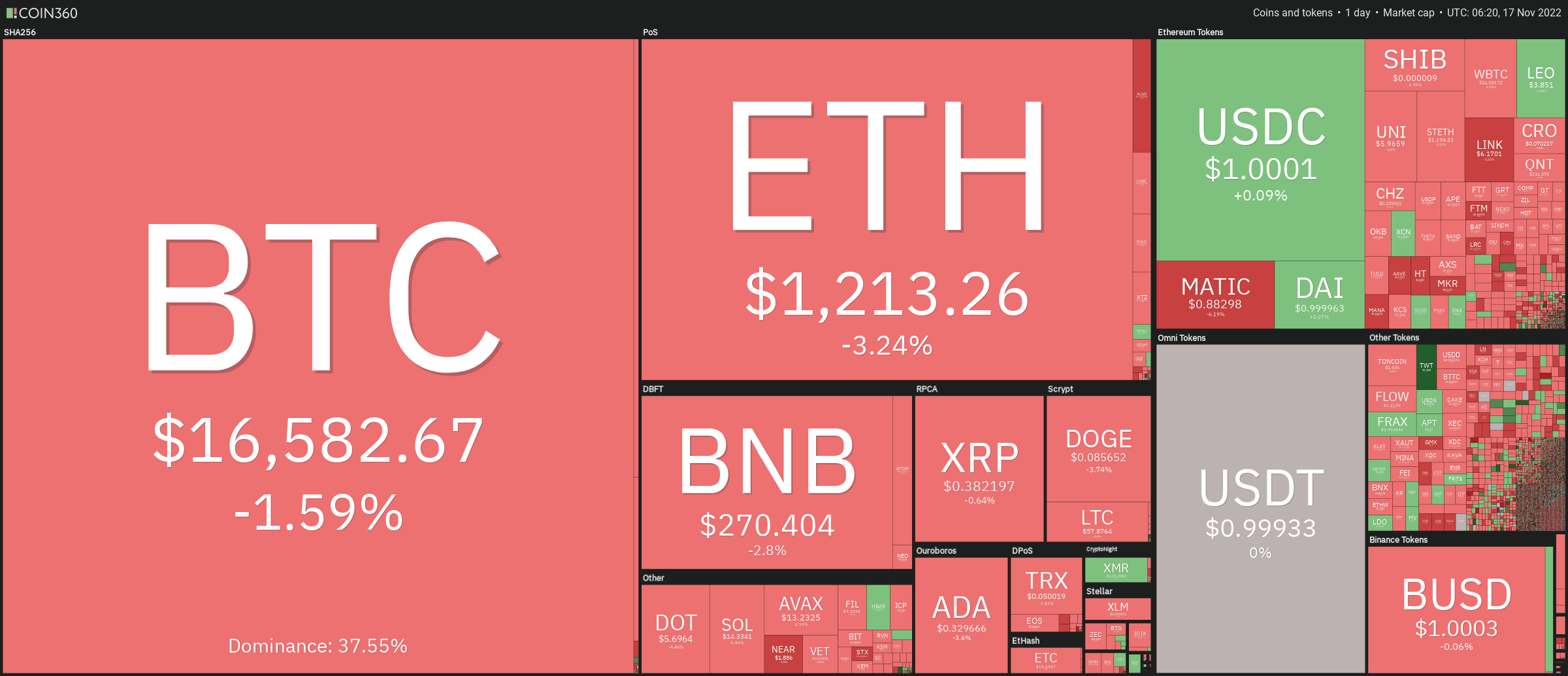

The worldwide crypto market cap fell over 1% to $835 billion the day before, delivering major cryptocurrencies in to the red in early stages November 17. During the last 24 hrs, the entire crypto market volume fell over 3% to $60.72 billion.

The entire volume in DeFi was $3.30 billion, comprising 5% from the total 24-hour volume within the crypto market. The entire amount of all stablecoins was $57.26 billion, comprising over 94% from the total 24-hour amount of the crypto market.

Let us check out the very best altcoin gainers and losers during the last 24 hrs.

Top Altcoin Gainers and Losers

Chiliz (CHZ), Stacks (STX), and Arweave (AR) are three from the best players coins which have acquired value within the last 24 hrs. The CHZ cost has soared by greater than 13% to $.2285, the STX cost is continuing to grow by greater than 5% to $.2385, and also the AR cost has elevated by nearly 5%.

Trust Wallet Token (TWT) has dropped greater than 15% within the last 24 hrs to trade at $1.96. GMX (GMX) has came by greater than 12% within the last 24 hrs to trade at $39.5.

Risk-off Triggers as Genesis Buying and selling Halts Withdrawals

The cryptocurrency marketplace is buying and selling having a bearish sentiment following a news of Genesis buying and selling, halting crypto withdrawals. Interim Chief executive officer Derar Islim informed customers that Genesis Global Trading’s lending arm could be temporarily suspending redemptions and new loan originations within the wake of FTX’s collapse.

Genesis Global Capital, the company unit under consideration, suits institutional clients coupled with $2.8 billion in active loans by the finish from the third quarter of 2022, per the business’s website. Islim emphasized that Genesis Buying and selling, the broker/dealer arm of Genesis Global Capital, features its own capital and it is run individually in the lending arm.

Buying and selling and child custody services supplied by Genesis are, he added, still running easily. Around the call, Islim informed listeners that Genesis is searching into choices for the lending unit, for example obtaining a new supply of liquidity. In a few days, Genesis will give you more details to the customers, he stated.

Digital Currency Group (DCG), which controls Genesis, also owns CoinDesk. An announcement released by DCG’s v . p . of communications and marketing, Amanda Cowie, read the following:

“Today Genesis Global Capital, Genesis’ lending business, made the tough decision to temporarily suspend redemptions and new loan originations.” This decision is made as a result of the “extreme market dislocation and lack of industry confidence” brought on by the FTX implosion.

Because of the ongoing uncertainty within the cryptocurrency market, overall buying and selling sentiment remains negative.

Bitcoin Price

The present Bitcoin cost is $16,526, and also the 24-hour buying and selling volume is $34 billion. Bitcoin has elevated by under 2% within the last 24 hrs. CoinMarketCap presently ranks first, having a live market cap of $349 billion, up from $324 billion.

It features a maximum way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,208,887 BTC coins.

Bitcoin’s technical aspects haven’t altered considerably, because it is constantly on the trade perfectly in compliance with this previous Bitcoin cost projection. Bitcoin is stabilizing inside a broad buying and selling selection of $18,000 to $16,000, having a breakout dictating future cost action.

Within the 4-hour time-frame, Bitcoin has completed a 38.2% Fibonacci retracement in the $18,100 level and it is now stable. An optimistic crossover occurs when the cost increases above $18,100.

At this time, the Bitcoin cost might be uncovered towards the 61.8% Fibonacci degree of $19,350. Bitcoin might fall below $15,965 whether it does not break with the 38.2% Fibonacci retracement barrier of $18,250.

The MACD has moved in to the purchase zone, as the 50-day moving average and also the relative strength index (RSI) remain bearish. If Bitcoin’s closing prices maintain below $18,000, the currency’s slide will probably continue close amounts of support are $16,000 and $15,850.

Ethereum Price

The present cost of Ethereum is $1,213, having a 24-hour buying and selling amount of $12 billion. Within the last 24 hrs, Ethereum has stepped over 2.5%. Having a live market cap of $148 billion, CoinMarketCap presently ranks second. It features a circulating way to obtain 122,373,866 ETH coins.

Around the daily chart, a bullish retracement has happened, and Ethereum has reclaimed the $1,262 mark. The 50-day moving average functions being an immediate resistance barrier for Ethereum. When the bullish crossover above $1,370 is maintained, the recovery might accelerate to $1,506 or $1,670.

Support remains to be $1,170 or $1,095. If ETH falls below this level, it might approach $1,000, or $881, however this is improbable for the moment.

Crypto Presale With Huge Upside Potential

Dash 2 Trade (D2T)

Dash 2 Trade, produced through the Learn 2 Trade service, provides investors with market-driven insights, buying and selling signals, and conjecture services. The cryptocurrency project promises to provide users with sufficient information to create lucrative decisions.

D2T is definitely an Ethereum-based buying and selling intelligence platform that gives traders of abilities with real-time analytics and social data, letting them make more informed decisions.

It started its token purchase three days ago and it has already elevated greater than $6.4 million. Additionally, it announced its first CEX listing on LBank exchange. 1 D2T is presently worth .0513 USDT, however this is anticipated to increase to $.0533 within the next stage of sales and $.0662 within the final stage.

Get The Best Cost to purchaseOrMarket Cryptocurrency