Bitcoin is buying and selling at $17,765 throughout the Asian session on December 14, as investors seem to cost in less strong-than-expected US CPI figures. Similarly, Ethereum has risen over the $1,300 mark, because the weakening of america dollar has elevated interest in cryptocurrencies.

Major cryptocurrencies were buying and selling within the eco-friendly in early stages December 14, because the global crypto market value elevated by 2.52% to $870.79 billion on the day before. During the last 24 hrs, the general crypto market volume has elevated by 52.60 % to $53.51 billion.

DeFi’s total volume is presently $2.94 billion, comprising 5.49 percent from the entire 24-hour volume within the crypto market. The general amount of all stablecoins has become $53.26 billion, comprising 99.53 % from the total 24-hour amount of the crypto market.

Let us check out the very best 24-hour altcoin gainers and losers.

Today’s US FOMC and Given Expectations

In the finish of their two-day policy meeting on Wednesday, the Fed is anticipated to boost rates of interest with a half a place, signaling a less aggressive approach in the central bank as evidence emerges that inflation might be slowing. That’s still almost nothing, especially in comparison to the quarter-point increases announced in the last four Given conferences.

Still, it is a hefty rise which will hurt the economies of countless American companies and households by looking into making it more costly to get loans for such things as homes, vehicles, along with other requirements compared to what they otherwise could be.

The expected move through the Given would push the speed where banks charge one another for overnight borrowing to between 4.25 and 4.five percent, the greatest level seen since 2007.

Once the Fed releases its economic outlook within the Review of Economic Projections on Wednesday, investors is going to be having to pay close attention. And they’ll be jamming to Powell’s news briefings to obtain a feeling of what’s in the future, even when they could be set for a large letdown.

Effect on Cryptocurrency Market

Using the .50% rate hike, we might visit a dip within the cryptocurrency market, but chances are it will be temporary, and costs will go back to where these were before. Because the majority of the .50% rate hike was already priced in, the marketplace is not likely to exhibit significant cost movements unless of course the Given surprises having a .75% or .25% rate hike.

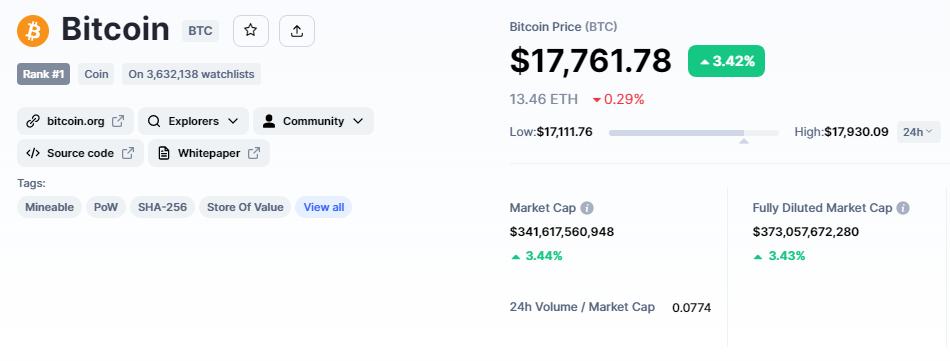

Bitcoin Price

Bitcoin’s current cost is $17,755, and also the 24-hour buying and selling volume is $26 billion. The BTC/USD pair has acquired nearly 3.5% within the last 24 hrs, while CoinMarketCap presently ranks first having a live market cap of $341 billion.

Bitcoin is presently increasing, getting damaged via a key level of resistance at $17,350. This means the purchasing trend may continue.

Leading technical indicators, like the relative strength index (RSI) and also the moving average convergence divergence (MACD), are presently in positive territory, implying the cost of Bitcoin will continue to rise.

Bitcoin’s next major level of resistance reaches $18,125, along with a break above this level can lead to further gains along with a cost of $18,600.

Around the downside, the amount of $17,350 is support for that cost of BTC. This level has formerly offered like a barrier, and chances are it will maintain BTC’s bullish trend.

A bearish crossover below this level, however, can lead to a stop by the cost of BTC towards the $16,850 level.

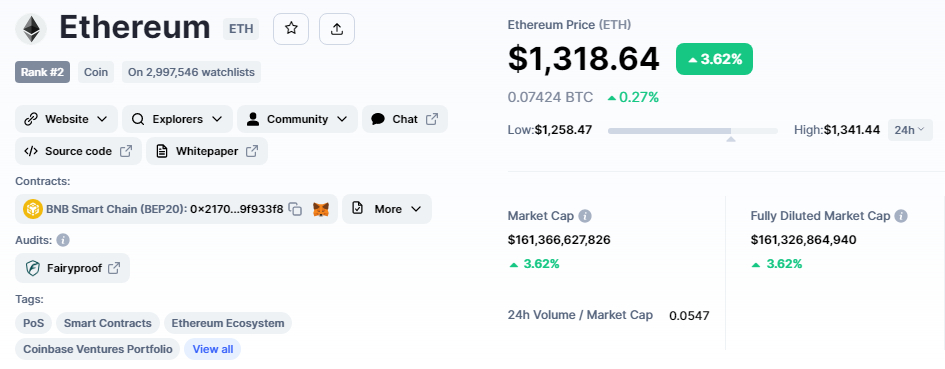

Ethereum Price

Ethereum’s current cost is $1,318, by having an $8 billion 24-hour buying and selling volume. Within the last 24 hrs, Ethereum has acquired over 3Percent, and CoinMarketCap presently ranks second, having a live market cap of $161 billion.

Around the 4-hour chart, Ethereum has violated an climbing triangular pattern which was extending resistance in the $1,305 level. This level has become serving as an assistance. The bullish bias is shown by the 50-day moving average, RSI, and MACD indicators.

Around the upside, Ethereum’s immediate resistance remains at $1,345, along with a bullish crossover above this mental buying and selling level could expose ETH to $1,385 territory.

Alternatively, a rest below $1,310 may expose ETH towards the $1,260 level.

Dash 2 Trade (D2T) – Final Stage of Presale

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that can help investors make smarter buying and selling decisions by supplying real-time analytics and social buying and selling data. It’ll go reside in early 2023, and it is D2T token will be employed to pay monthly platform subscription costs.

The Dash 2 Trade presale has elevated greater than $9.seven million in the 4th and final stage. It’s also announced listings on Uniswap, BitMart, and LBANK Exchange for early the coming year, implying that early investors will quickly have the ability to secure some profits.

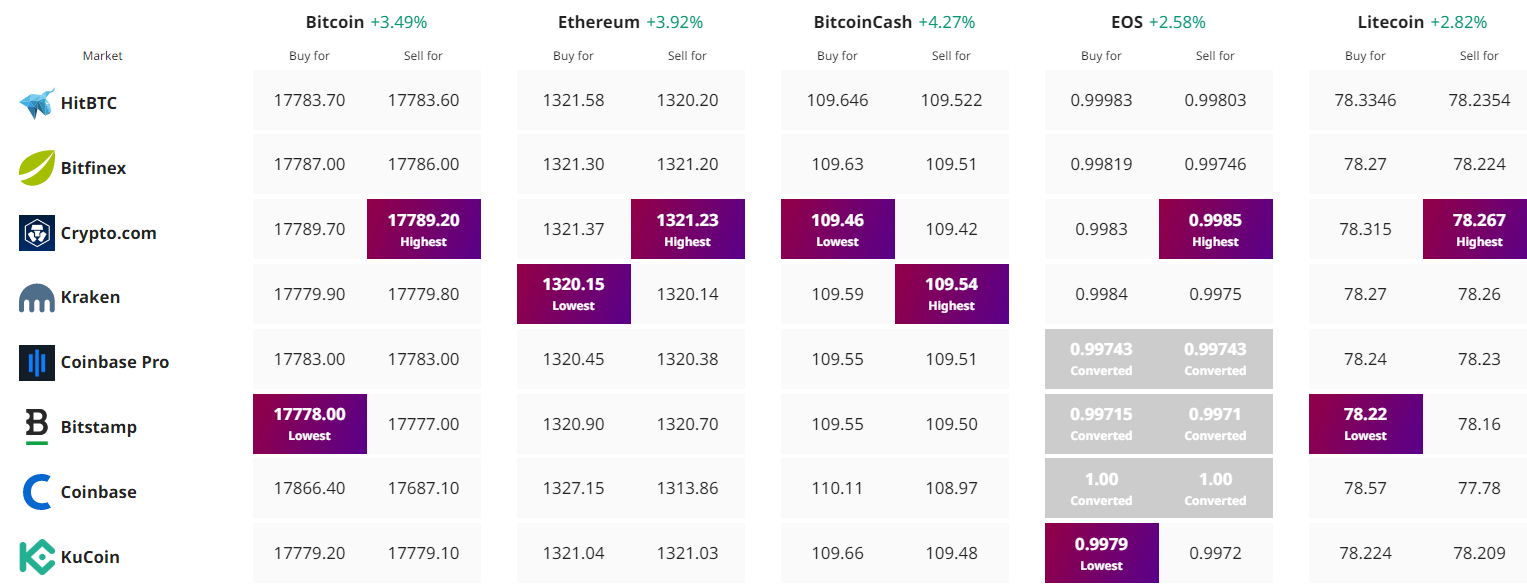

Get The Best Cost to purchaseOrMarket Cryptocurrency