The Bitcoin price stepped dramatically and broke below a significant support degree of $21,000. Likewise, Ethereum also lost over 2% to accomplish a 61.8% Fibonacci correction at $1,566.

After Beijing stated it’d no intends to change its zero COVID-19 policy, US stock futures, cryptocurrencies and goods fell in Asia on Monday. However, resilient Asian markets helped mitigate the selling.

However, over the past weekend, medical officials reaffirmed their dedication to the “dynamic-clearing” method of COVID cases every time they occur, which caused risk assets to fall.

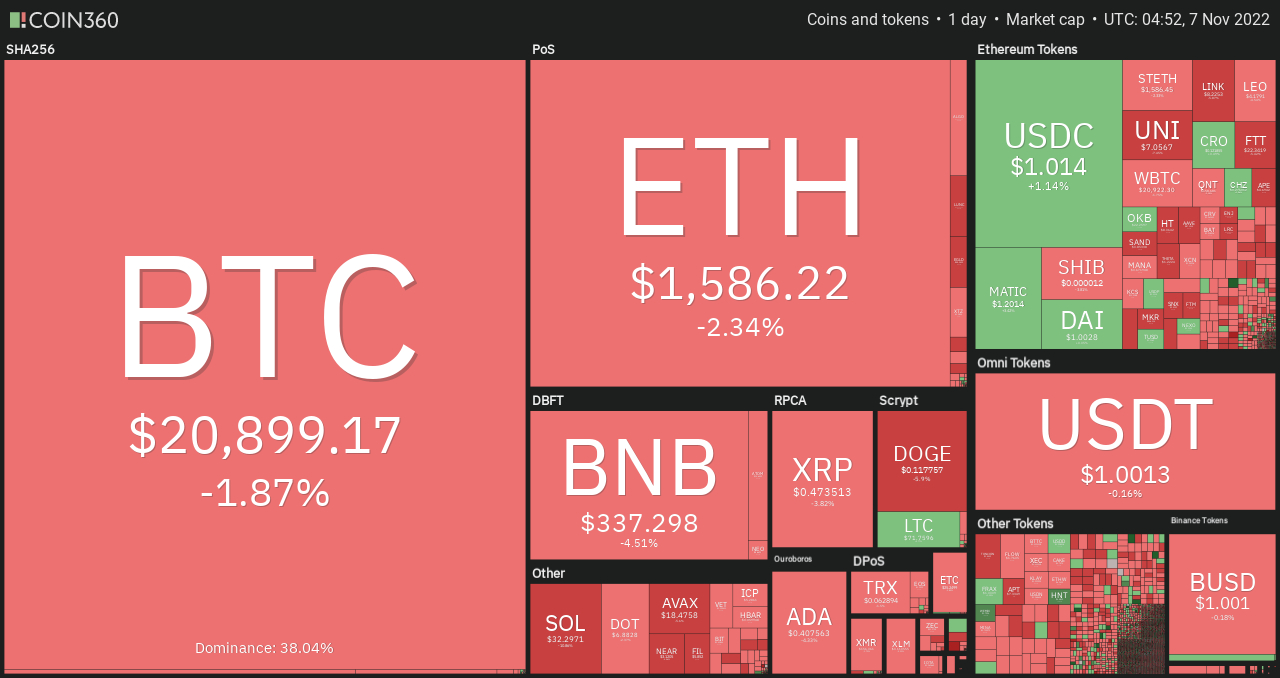

Major cryptocurrencies were buying and selling inside a mixed bag in early stages November 7, because the global crypto market cap fell over 1% to $1.04 trillion on the day before. During the last 24 hrs, overall crypto market volume fell under .50% to $69.99 billion.

The general volume in DeFi was $3.91 billion, comprising over 5% from the total 24-hour volume within the crypto market. The whole amount of stablecoins was $63.75 billion, comprising 91% from the overall 24-hour amount of the crypto market.

Top Altcoin Gainers and Losers

Within the last 24 hrs, the very best performers were Litecoin (LTC), Polygon (MATIC), and Chiliz (CHZ). Overall, the bullish bias is less strong as sellers have dominated the marketplace.

Litecoin and Polygon have risen by greater than 3% to $71.4 and $1.20, correspondingly. Simultaneously, CHZ has elevated by about .5% to $.27.

Within the last 24 hrs, Solana (SOL) has reversed and quit the majority of its gains, losing greater than 10% to trade at $32.25. ImmutableX (IMX) has dropped greater than 9% close to $.6025, while Loopring (LRC) is lower about 9% to $.3370.

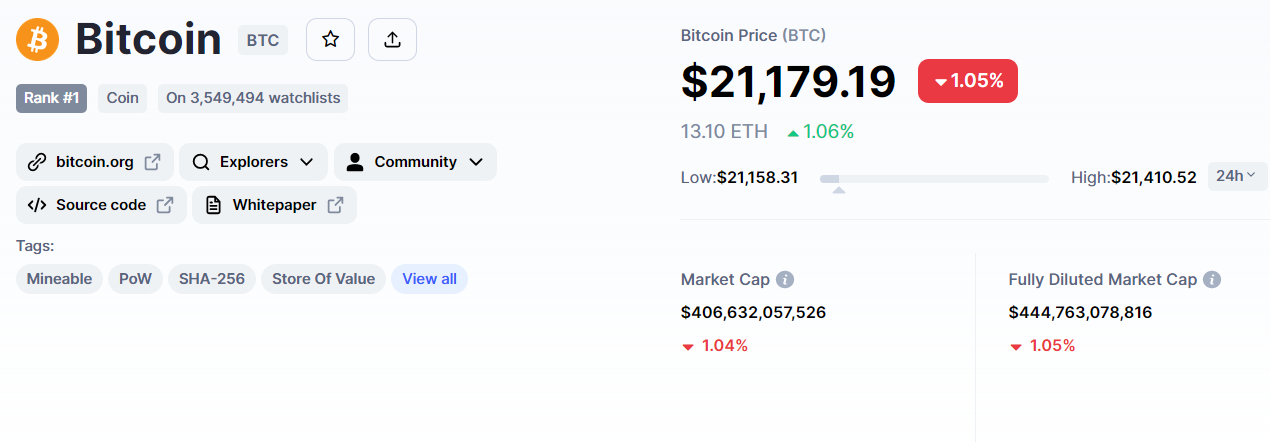

Bitcoin Price

The present Bitcoin cost is $20,892 and also the 24-hour buying and selling volume is $38 billion. Bitcoin lost over 1.5% throughout the Asian session. CoinMarketCap presently ranks it first, having a live market cap of $438 billion, up from $406 billion yesterday.

Bitcoin, the key cryptocurrency, has breached a powerful support degree of $20,900. Around the downside, BTC might find immediate support near $20,600, an amount based on a 50-day moving average.

A bearish crossover underneath the 50-day moving average will probably extend the downtrend before the $20,400 or $20,000 level.

The upward funnel around the 4-hour time-frame is supporting the likelihood of a bullish trend continuation while supplying support near $20,400. Around the upside, Bitcoin’s immediate resistance reaches $21,000, along with a break above this level can take BTC to $21,500 or $22,200.

Let us use today’s cost of $21,000 like a pivot point.

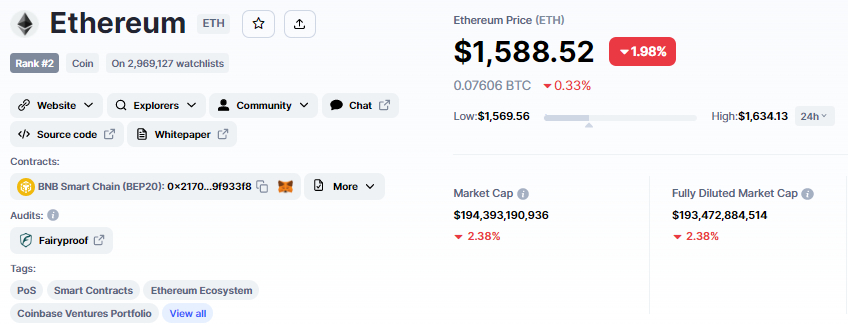

Ethereum Price

On Monday, the 2nd leading cryptocurrency, Ethereum, lost around 2% within the last 24 hrs to trade at $1,588. Now rated second on CoinMarketCap, having a live market capital of $193 billion, lower from $197 billion yesterday.

Around the 4-hour chart, Ethereum has fallen underneath the 50-day moving average, this was extending support at $1,590. Exactly the same level has become serving as an obstacle.

Around the downside, Ethereum is finding immediate support close to the $1,566 level, that is a 61.8% Fibonacci retracement level. A rest of the level could send ETH towards the 78.6% Fibo level at $1,540.

An outburst in ETH demand can slice via a 50-day SMA at $1,590 to retest a resistance section of $1,620. A mix above this level can send ETH toward the $1,660 level.

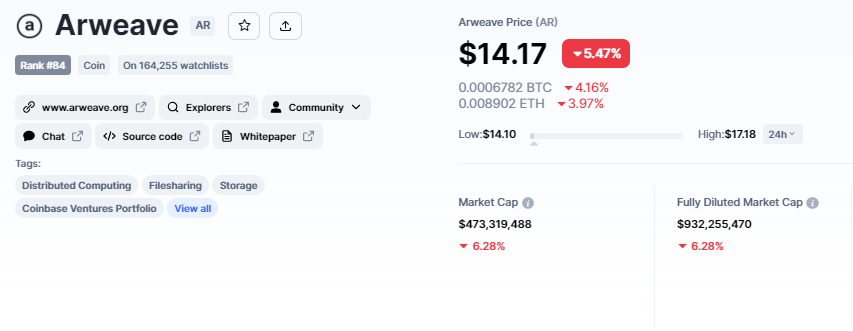

Arweave Gains Over 35% Per Week

The present cost of Arweave is $14.13, having a 24-hour buying and selling amount of $126 million. Arweave has fallen by over 6% in the last 24 hrs, however, it’s acquired over 35% within the last 7 days. Having a live market cap of $471 million, CoinMarketCap now ranks #84.

It features a total volume of 66,000,000 AR coins along with a circulating circulation of 33,394,701 AR coins.

Around the technical front, the AR/USDT pair has fallen to $14 as early buyers seem to be profiting. AR has completed a 50% Fibonacci retracement at $14, along with a break below this level can lead to a 61.8% Fib degree of $13.

Overall, the buying and selling bias is bullish, using the 50-day moving average supplying support at $13. AR’s immediate resistance remains at $15 and $16.50 around the upside. A rest above this level might take AR towards the $17.95 level.

New Crypto Presales

The D2T presale’s second stage has offered out, earning $5.16 million in only over two days. Dash 2 Trade is really a concept produced by Learn 2 Trade, a tremendously popular buying and selling signal provider, that’ll be implemented within the other half of 2022.

The platform’s purpose would be to give investors with market-driven insights to enable them to make informed decisions. D2T offers buying and selling signals, social analytics, as well as market sentiment monitoring to boost the buying and selling experience.

Based on the team of developers, Dash 2 Trade intends is the Bloomberg buying and selling terminal for cryptocurrencies. The program also features automation and backtesting abilities for automating buying and selling processes and optimizing all buying and selling strategies.

Dash 2 Trade provides a notification service that notifies investors of new gold coin listings on centralized exchanges, providing them with use of information which was formerly only accessible to elite investors.

With the much promise, it’s really no question that D2T presale figures happen to be outstanding. In the third stage of pre-purchase, digital currency has elevated greater than $5.4 million ($5,443,909).

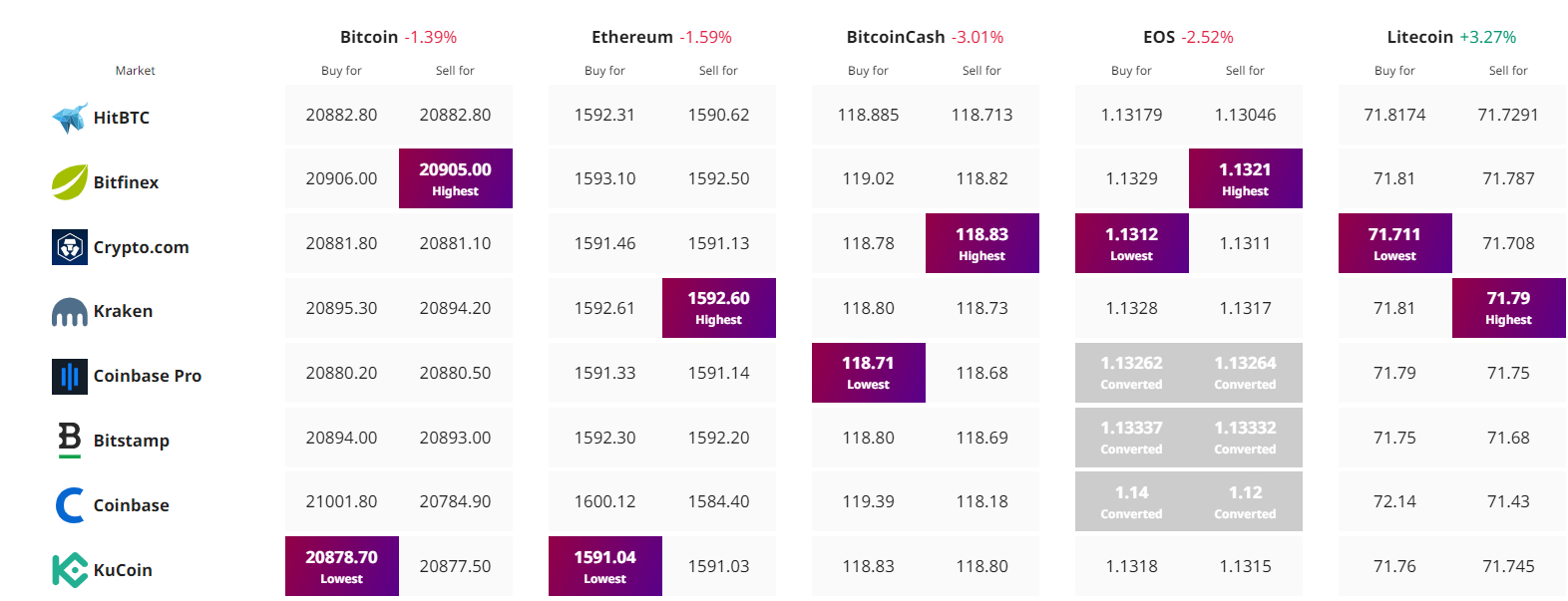

Get The Best Cost to purchaseOrMarket Cryptocurrency