The cryptocurrency market is constantly on the shed bloodstream, with nearly all cryptocurrencies buying and selling at a negative balance on November 9 because of panic selling yesterday, fueled by rumors of FTX’s insolvency. While Bitcoin fell to almost $18,000, Ethereum was near a substantial loss below $1,300.

The global crypto market cap is $913.58 billion, over 11% from the day before. DeFi’s total volume is presently $9.99 billion, accounting in excess of 4.5% from the overall crypto market 24-hour volume. The general amount of all stablecoins has become $199 billion, comprising 93% from the total 24-hour amount of the crypto market.

Binance Triggers Liquidity Crisis, then Buys FTX

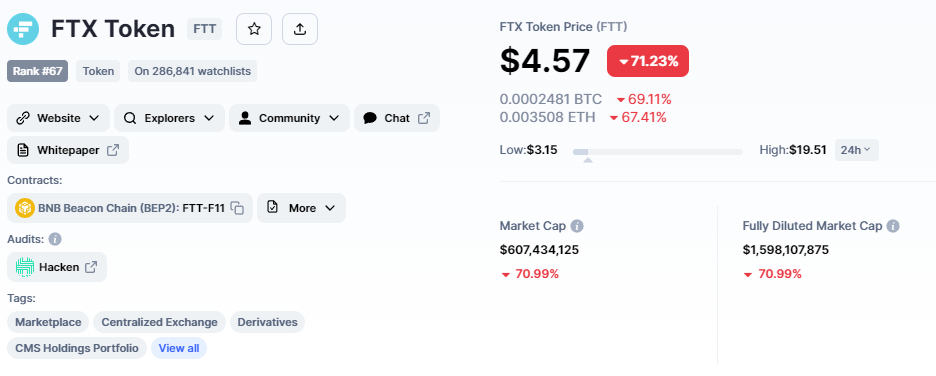

Mike Bankman-Fried, who established the cryptocurrency exchange FTX right into a global powerhouse, has tweeted that Binance has decided to buy the organization. Following news of the alleged impending Binance buyout, the native token of Mike Bankman-cryptocurrency Fried’s exchange FTT rose initially, but investors continued to be uncertain, and FUD triggered an impressive sell-off, causing FTT to fall from $22 to $4, a small amount of greater than 80%.

Changpeng Zhao, the founding father of Binance, also required to Twitter to go over the transaction, writing, “This mid-day, FTX requested for the support.” We’re experiencing a serious lack of cash. To guarantee the safety in our users, we’ve signed a non-binding LOI using the aim of obtaining FTX.com in the whole and relieving the financial strain.

Over the following couple of days, i will be conducting a thorough DD. Since falling dramatically on Saturday night, when Binance Chief executive officer Changpeng Zhao stated the exchange would dump vast sums of dollars price of FTX’s native token FTT because of allegations of Alameda Research’s insolvency, Bitcoin and Ether happen to be continuously regaining their losses.

The Chief executive officer of FTX, Mike Bankman-Fried, discusses how everything has “full circle” with Binance to be the exchange’s first and last investor. The the agreement are now being stored private.

Since Binance has got the choice to terminate the agreement anytime, FTT investors stay in FUD (fear, uncertainty, and doubt), maintaining the general buying and selling bias bearish.

Read this link if you wish to on the FTX backstory.

Top Altcoin Gainers and Losers

There has been very couple of gold coin gains within the last 24 hrs, with BinaryX and PAX Gold being two best players. BinaryX cost acquired over 2% to trade at $145, and PAX Gold has risen by greater than 2% to $1,700.

FTX Token (FTT) has lost greater than 71% of their value within the last 24 hrs because of FTX insolvency rumors. Aptos (APT) is lower 21% to $4.8, while Chiliz (CHZ) is lower 16% to $.20.

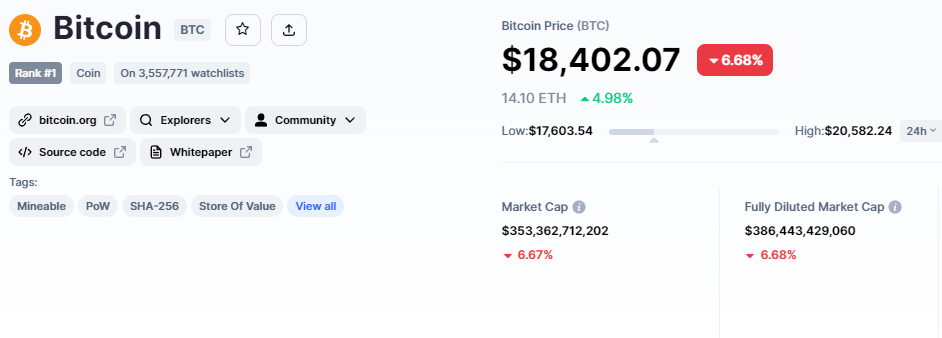

Bitcoin Price

The present Bitcoin cost is $18,395 and also the 24-hour buying and selling volume is $115 billion. Bitcoin lost over 6% throughout the Asian session and also over 10% within the last 7 days. CoinMarketCap presently ranks it first, having a live market cap of $351 billion, lower from $378 billion yesterday.

Around the technical front, BTC/USD has breached all previous support levels pointed out within the Bitcoin cost conjecture for that European session. Bitcoin is presently gaining immediate support at $18,170, using the next support level remaining at 17,150.

The closing of bearish engulfing signifies the selling trend will probably continue, therefore we should keep close track of $18,170. Closing below this level may lead to additional selling.

Leading and lagging indicators like RSI, MACD, and 50-day moving averages are indicating a bearish trend. Bitcoin may encounter immediate resistance at $19,000 or $19,895.

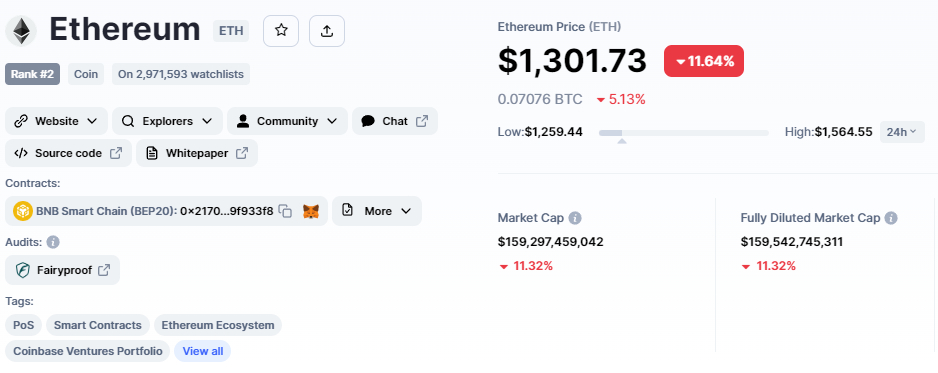

Ethereum Price

On Wednesday, the 2nd best cryptocurrency, Ethereum fell roughly 12% in the last 24 hrs and also over 17% within the last 7 days to trade at $1,303. On CoinMarketCap, it’s now rated second, having a live market capital of $159 billion, lower from $178 billion yesterday.

Around the daily chart, Ethereum has created a symmetrical triangular pattern, that is supporting ETH close to the $1,227 level. The ETH/USD pair has damaged underneath the 50-day moving average, that was formerly extended as support at 1,385 and it is now serving as resistance.

The RSI and MACD will also be within the selling zone, and also the formation of the bearish engulfing candle signifies the potential of further selling.

Around the downside, a rest from the $1,227 level may expose the ETH cost towards the $1,125 or $1,000 mark.

FTX Token is Lower 84%

The present cost of FTX Token is $4.54, having a 24-hour buying and selling amount of $3 billion. FTT has fallen by over 71% in the last 24 hrs and also over 84% within the last 7 days. Having a live market cap of $607 million, CoinMarketCap now ranks #30.

Around the technical front, the FTT/USD has damaged via a climbing down triangular pattern, indicating a potential continuation from the bearish trend. Around the downside, FTT might find support near $3 or $1, because the breakout from the climbing down triangular pattern could have a negative effect on FTT investors’ sentiment.

FTT’s immediate resistance remains at $6 or $10 around the upside.

New Crypto Presale With Huge Potential

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives traders of abilities with real-time analytics and social data, letting them make more informed decisions.

It started its token purchase three days ago and also has elevated greater than $5.seven million, whilst confirming its first CEX listing around the LBank Exchange.

1 D2T presently equals .0513 USDT, however this will quickly increase to $.0533 within the next stage from the purchase and $.0662 within the final stage.

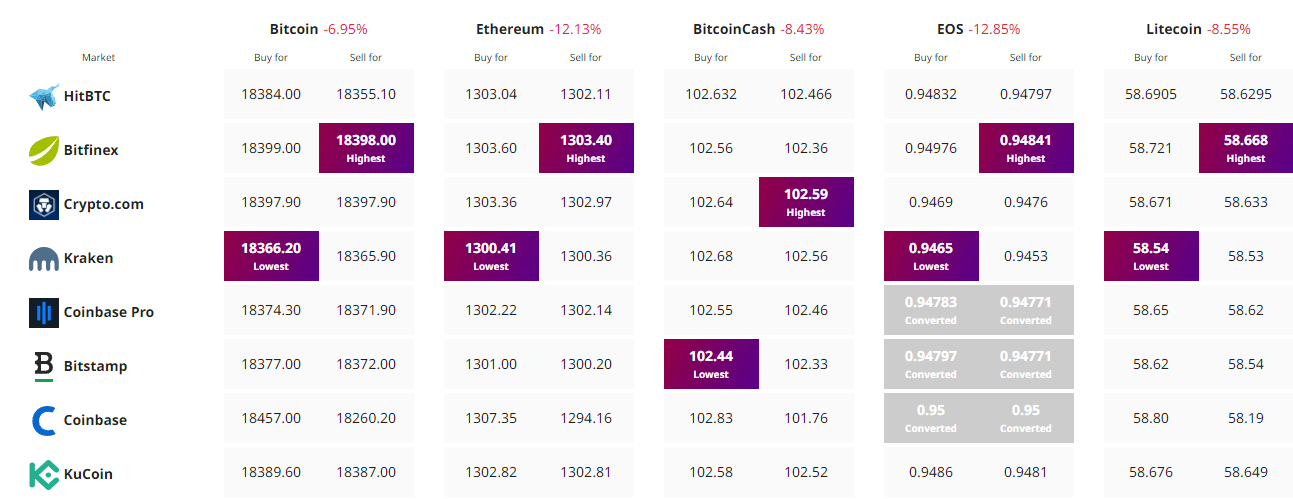

Get The Best Cost to purchaseOrMarket Cryptocurrency