On November 15, Bitcoin bounced off an assistance degree of $15,800 together with resistance near $17,150, gaining greater than 5%. However, Ethereum, the 2nd-best cryptocurrency, has retrieved over 6% within the last 24 hrs to trade at $1,257.

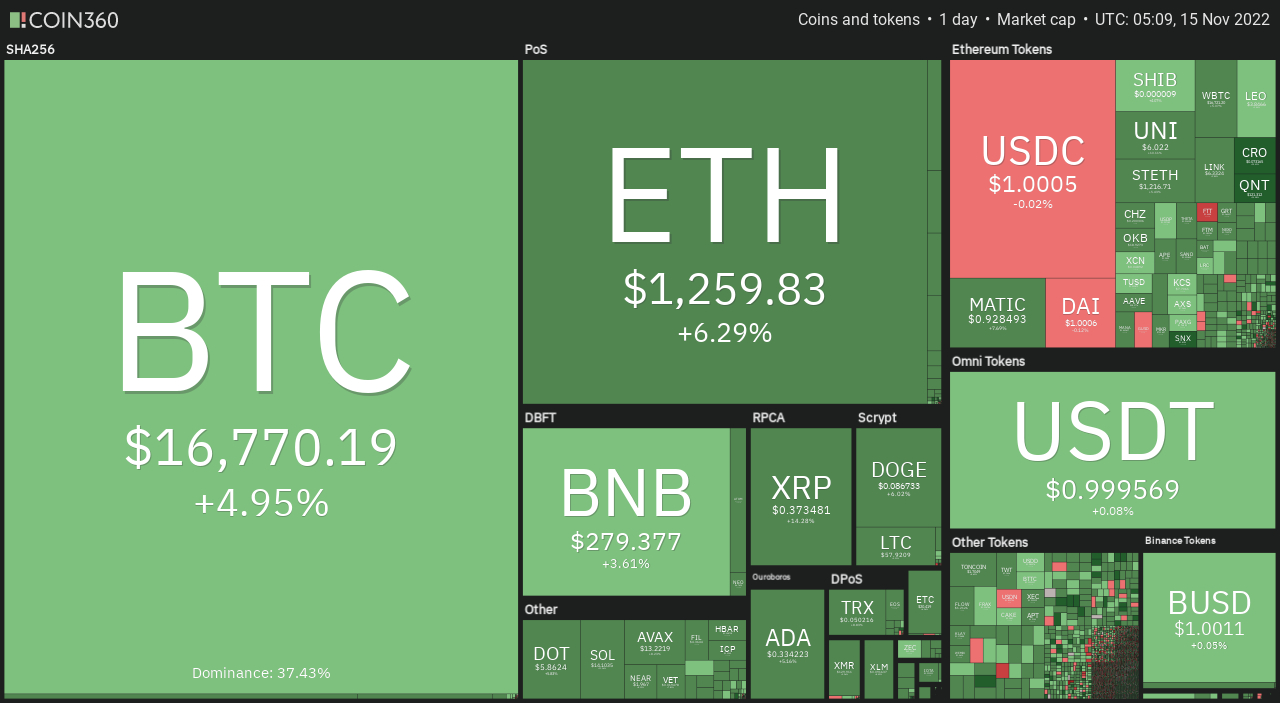

Major cryptocurrencies were buying and selling within the eco-friendly in early stages November 15, because the global crypto market cap elevated over 4% in the last day-to $842.95 billion. During the last 24 hrs, the entire crypto market volume has elevated by 37% to $82.88 billion.

DeFi’s total volume is presently $4.13 billion, comprising 5% from the total crypto market 24-hour volume. The entire amount of all stablecoins has become $77.78 billion, comprising 93% from the total crypto market 24-hour volume.

Let us check out the very best altcoin gainers and losers during the last 24 hrs.

Top Altcoin Gainers and Losers

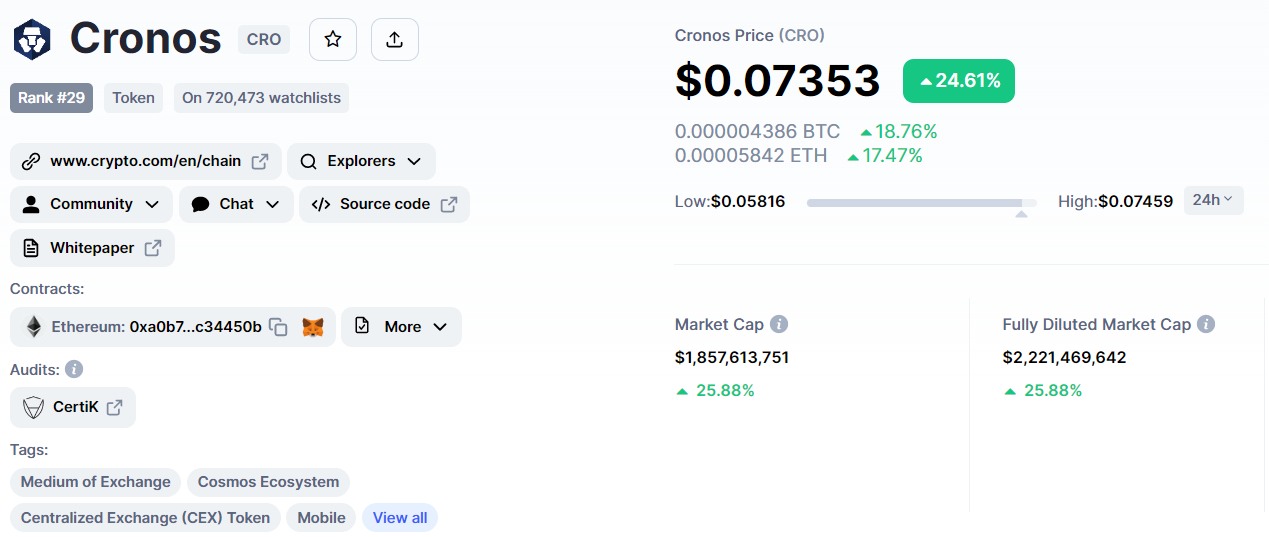

Cronos (CRO), Quant (QNT), and Lido DAO (LDO) are three from the best players coins which have acquired value within the last 24 hrs. The CRO cost has soared by greater than 21% to $.072, the QNT increased by greater than 20% to $119, and also the LDO elevated by nearly 13%.

We do not have many losers today since the overall market sentiment is positive. Axie Infinity (AXS) has dropped under 1% within the last 24 hrs to trade at $7.25.UNUS SED LEO (LEO) has came by greater than .50% within the last 24 hrs.

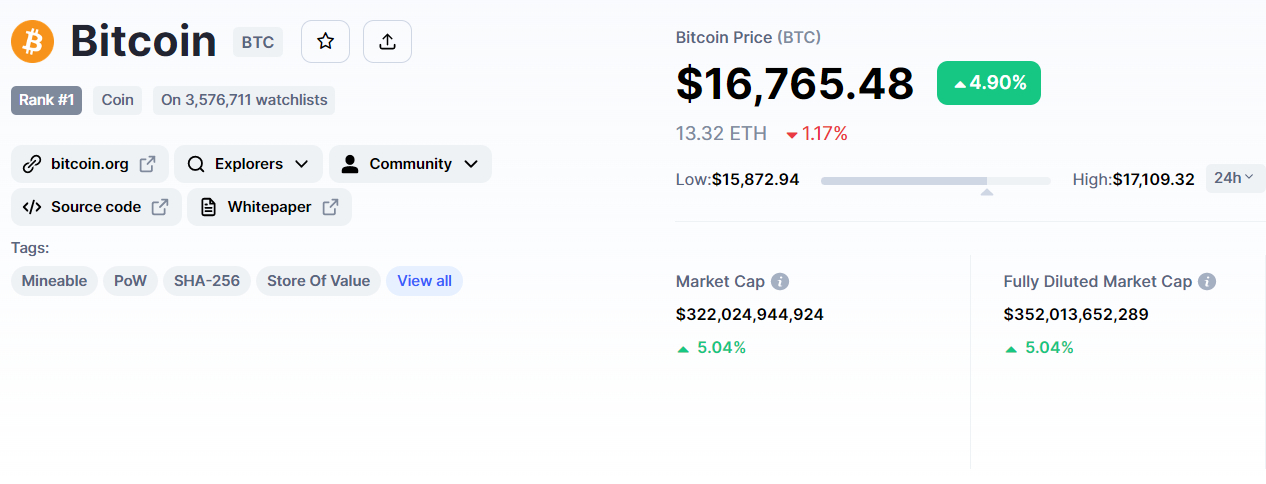

Bitcoin Price

The present Bitcoin cost is $16,766, and also the 24-hour buying and selling volume is $47 billion. Bitcoin has elevated by 4% within the last 24 hrs. CoinMarketCap presently ranks first, having a live market cap of $352 billion, up from $322 billion.

It features a maximum way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,207,618.00 BTC coins.

The technical side of Bitcoin has not altered much, as it is still buying and selling exactly consistent with our previous Bitcoin cost conjecture.

Bitcoin is consolidating inside a broad buying and selling selection of $18,000 to $16,000, having a breakout figuring out future cost action. Within the 4-hour time-frame, Bitcoin has completed a 38.2% Fibonacci retracement in the $18,100 level, which is now stable. An optimistic crossover takes place when the cost increases above $18,100.

This level may expose the Bitcoin cost towards the 61.8% Fibonacci degree of $19,350. Bitcoin could fall below $15,965 whether it does not break with the 38.2% Fibonacci retracement degree of $18.250.

One forward-searching technical indicator, the MACD, has entered in to the buy zone, as the 50-day moving average and also the relative strength index (RSI) still indicate a bearish market.

If Bitcoin’s closing prices stay below $18,000, it is possible the currency’s decline may continue $16,000 and 15,850 are nearby amounts of support.

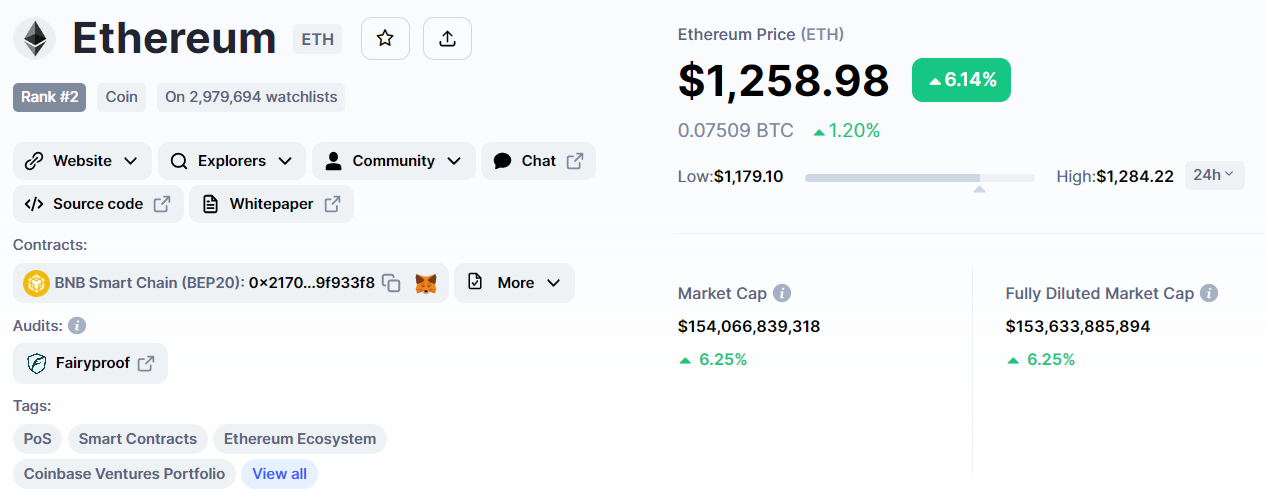

Ethereum Price

The present cost of Ethereum is $1,258, having a 24-hour buying and selling amount of $14 billion. Within the last 24 hrs, Ethereum has acquired over 6%. Having a live market cap of $153 billion, CoinMarketCap presently ranks second. It features a circulating way to obtain 122,373,866 ETH coins with no maximum supply.

There’s been a bullish retracement around the daily chart, and Ethereum has reclaimed the $1,262 level.

The 50-day moving average provides support for that $1,370 level being an immediate level of resistance for Ethereum.

The rebound could accelerate to $1,506 or $1,670 when the bullish crossover above $1,370 holds.

Support remains to be $1,170 or $1,095. If ETH falls below this level, it might achieve $1,000, or $881, however this seems unlikely for the moment.

Cronos Cost Conjecture as CRO Pumps 25%

Cronos’s current cost is $.073, having a 24-hour buying and selling amount of $240 million. CRO has elevated by over 25% within the last 24 hrs. CoinMarketCap presently ranks #29, having a live market cap of $1.8 billion. You will find 25,263,013,692 CRO coins in circulation, having a maximum way to obtain 30,263,013,692 CRO coins.

CRO is on the bullish streak, getting risen over the $.064 level of resistance to accomplish a 38.2% Fibonacci retracement at $.071. Around the plus side, a bullish breakout from the $.071 level can expose CRO towards the $.0765 or $.0820 levels, which represent the 50% and 61.8% Fibonacci retracement levels, correspondingly.

The 50-day moving average, however, will probably extend resistance close to the $.089 level. The MACD and RSI are diverging, because the MACD is within a buying zone and also the RSI is within a selling zone.

CRO might find immediate support at $.064, along with a breach of the level may expose its cost to $.053.

New Crypto Presale With Massive Potential

Dash 2 Trade (D2T)

Dash 2 Trade, produced through the Learn 2 Trade service, provides investors with market-driven insights, buying and selling signals, and conjecture services. The cryptocurrency project aims to supply users with sufficient information to create lucrative decisions.

D2T is definitely an Ethereum-based buying and selling intelligence platform that gives traders of abilities with real-time analytics and social data, letting them make more informed decisions.

It started its token purchase three days ago and it has since elevated over $6.two million. It’s also confirmed its first CEX listing on LBank exchange. The present worth of 1 D2T is .0513 USDT, however this is anticipated to increase to $.0533 within the next stage of sales and $.0662 within the final stage.

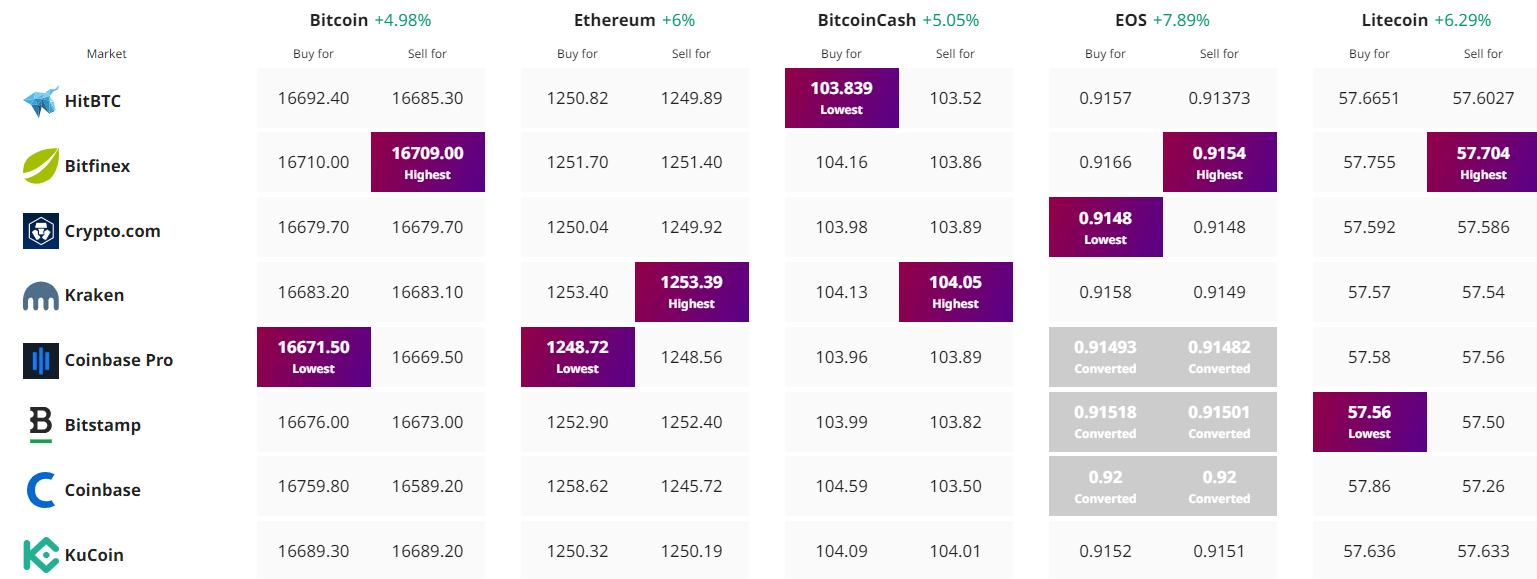

Get The Best Cost to purchaseOrMarket Cryptocurrency