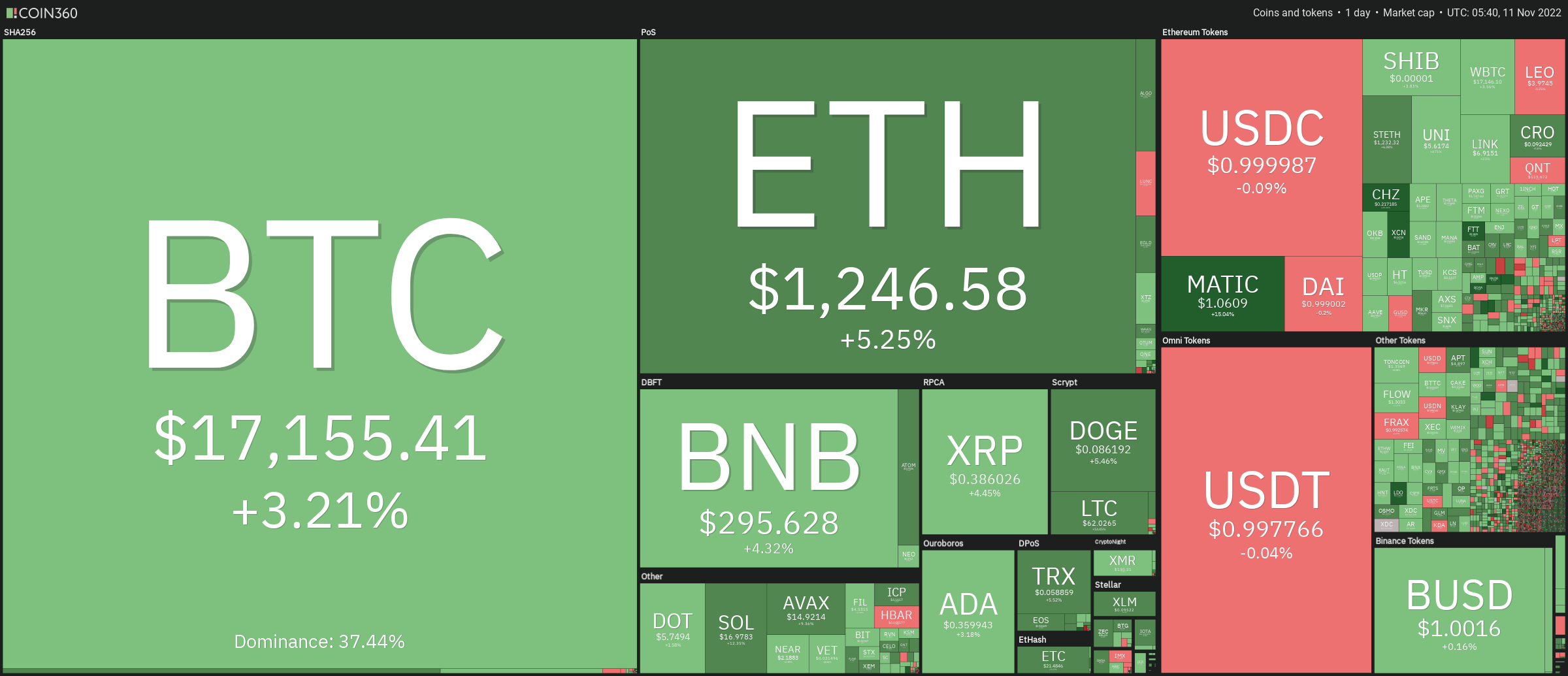

On November 11, major cryptocurrencies were buying and selling within the eco-friendly early because the global crypto market cap acquired over 7.5% in the last day-to $869 billion. During the last 24 hrs, however, overall crypto market volume fell over 23% to $144.29 billion.

The general volume in DeFi was $6.88 billion, comprising 4% from the entire 24-hour volume within the crypto market. The general amount of all stablecoins was $140.42 billion, comprising 97% from the total 24-hour amount of the crypto market.

Bitcoin expires nearly 3.5% to $17,138, because of less strong-than-expected CPI figures, which indicate the US Given may slow lower on approaching rate hikes. Similarly, Ethereum, the 2nd best cryptocurrency, has elevated by greater than 5% to trade at $1,248.

Let us check out the very best altcoin gainers and losers during the last 24 hrs.

Top Altcoin Gainers and Losers

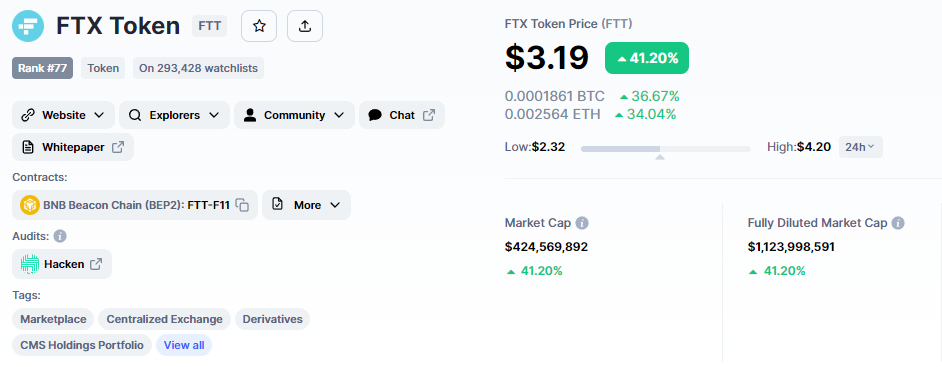

Three from the best players coins which have acquired value within the last 24 hrs are FTX Token (FTT), Chiliz (CHZ), and Chain (XCN).

The FTT retrieved greater than 40% to $3.22, as the Chiliz acquired greater than 24% to $.2166 and also the Chain acquired nearly 20%.

Quant (QNT) has lost greater than 3.5% of their value within the last 24 hrs to trade at $119. ImmutableX (IMX) is lower over 3% to $.4686, while Terra Classic can also be lower 3% to $.00019.

FTX Pumps 40%

The present FTX Token cost is $3.24, and also the 24-hour buying and selling volume is $949 million. Within the last 24 hrs, FTX Token has elevated by 40%. CoinMarketCap now ranks #77, having a live market cap of $431 million. You will find 133,025,776 FTT coins in circulation, having a maximum way to obtain 352,170,015 FTT coins.

Based on a study by Coindesk on Friday, which reported unnamed sources, the united states Department of Justice (DoJ) has required evidence in the Binance cryptocurrency exchange about its unsuccessful bailout negotiations using the cash-strapped FTX exchange.

Another potential savior has abandoned cryptocurrency exchange FTX because it struggles to plug a suspected multi-big hole in the balance sheet. On November , Tether’s Chief Technology Officer Paolo Ardoino mentioned emphatically the stablecoin issuer has “no intends to invest or lend money to FTX/Alameda.”

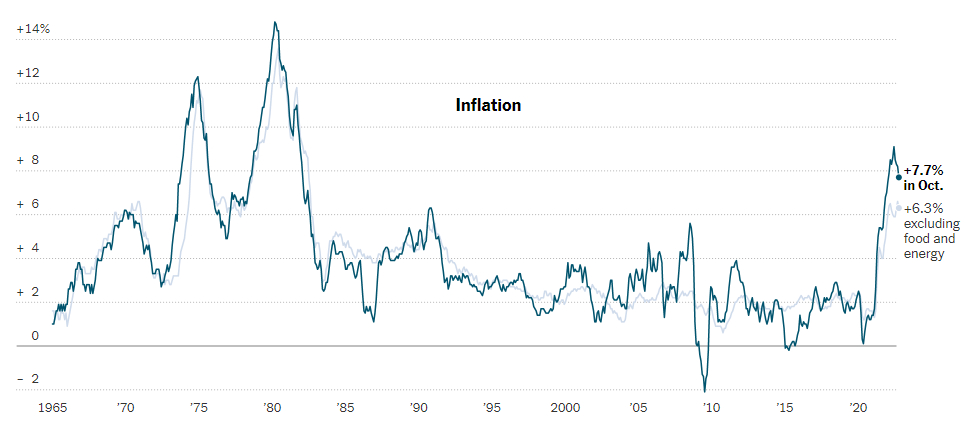

US inflation Sparks an Upward trend within the Cryptocurrency Market

A lot of the cryptocurrency market’s recovery was triggered by less strong US CPI figures. Less strong-than-expected inflation data recommended the government Reserve’s onslaught of great interest rate hikes is starting to achieve the intended impact on US markets, the currency, and Treasury yields on Thursday.

Following a broad and powerful rebound, the 3 primary US market indexes had their largest one-day percentage gains within 2 1/24 months. The safe-haven greenback also fell because the yield on 10-year Treasuries hit its cheapest level in five days because of the risk-on enthusiasm.

Inflation continues to be speeding up, and it is certainly hurting many people’s wallets, however it seems to become leveling off. By October, the customer Cost Index had elevated by 7.7% yearly, that was less than the 7.9% increase forecast by economists and also the 8.2% increase observed in the last twelve several weeks through September.

Prices elevated by 6.3% yearly, lower from 6.6% in the last studying, after modifying for that volatile expenses of food and fuel. Which underlying gauge of inflation slowed to the tiniest monthly development in several months recently.

Investors anticipate the Fed will slow the interest rate of rate hikes and issue a dovish policy, that will weaken the united states dollar later on, causing an upward trend within the crypto market.

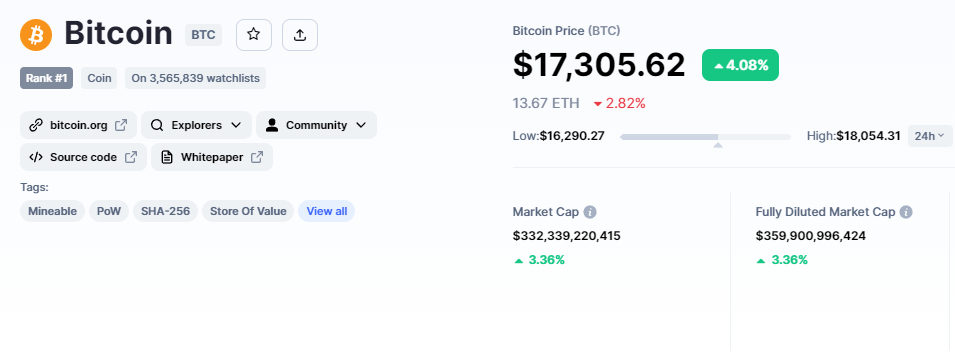

Bitcoin Price

The present Bitcoin cost is $17,305 and also the 24-hour buying and selling volume is $75 billion. Bitcoin acquired over 4% throughout the Asian session among less strong US CPI figures. CoinMarketCap presently ranks it first, having a live market cap of $359 billion, up from $314 billion yesterday.

Bitcoin has surged within the $16,000 support level, and also the closing of candle lights above this level shows that Bitcoin is within a bullish trend. Bitcoin has earlier damaged with the $18,244 triple bottom support level, with closing candle lights below this level producing a decline to $16,000. However, exactly the same $18,240 level will probably operate like a barrier for the moment.

Around the 4-hour time-frame, Bitcoin has completed 38.2% Fibonacci retracement at $18,240 along with a break above this might open further room for purchasing before the $19,370 level which marks 61.8% Fibonacci retracement level.

Bitcoin might fall back below $15,965 whether it does not break within the 38.2% Fibonacci retracement mark of $18.250.

A number one technical indicator, MACD has joined the buying zone, however the 50-day moving average (blue line) and RSI continues to be indicating a selling trend. BTC may remain bearish if closing candle lights fall below $18,000, with support near $16,000 and 15,850.

Ethereum Price

On Friday, the 2nd-best cryptocurrency, Ethereum, retrieved the majority of its losses to surge over 7% in the last 24 hrs to $1,270. On CoinMarketCap, it’s now rated second, having a live market capital of $154 billion, up from $142 billion yesterday.

Ethereum has reclaimed the $1,270 level around the daily chart, because of a bullish retracement. Ethereum’s immediate resistance remains at $1,370, that is based on a 50-day moving average. A bullish crossover above $1,370 could extend the recovery to $1,506 or $1,670.

While support remains around $1,170 or $1,095. A rest below this level could expose ETH towards the $1,000 or $881 level, however this appears unlikely at this time.

New Crypto Presale With Huge Potential

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives real-time analytics and social data to traders of abilities, letting them make more informed decisions.

It launched its token purchase three days ago and also has elevated over $5.8 million, whilst confirming its first CEX listing on LBank exchange.

1 D2T is presently worth .0513 USDT, however this will quickly rise to $.0533 within the next stage of sales and $.0662 within the final stage.

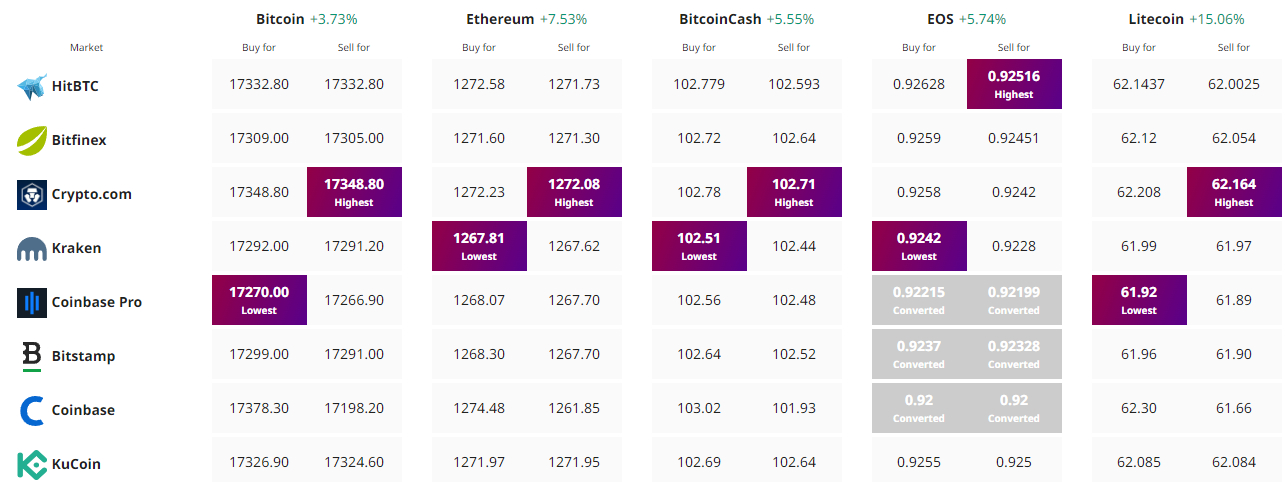

Get The Best Cost to purchaseOrMarket Cryptocurrency