The key cryptocurrency, Bitcoin, unsuccessful to interrupt over the $16,800 level on November 27 and started to fall toward the 38.2% Fibonacci retracement level.

Similarly, the 2nd best cryptocurrency, Ethereum, has adopted Bitcoin’s lead and it is buying and selling bearishly above $1,200.

Crypto Market Cap Update

Major cryptocurrencies were buying and selling lower in early stages November 27 because the global crypto market cap fell by .16% to $840.32 billion on the day before.

During the last 24 hrs, overall crypto market volume fell 10% to $33 billion. DeFi’s total 24-hour volume is presently $2.74B, comprising 8% from the crypto market.

The general amount of all stablecoins has become $31.69 billion, comprising 93.28% from the total 24-hour amount of the crypto market.

Let us check out the very best 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

Apecoin (APE), UNUS SED LEO (LEO), and Huobi Token (HT) are three from the best players coins which have acquired value within the last 24 hrs. The APE cost has soared by greater than 15% to $2.75, the LEO cost is continuing to grow by greater than 8% to $4, and also the HT cost has elevated by nearly 6.5%.

Trust Wallet Token (TWT), BinaryX (BNX), and Synthetix (SNX) are three from the best players coins which have lost value within the last 24 hrs, where TWT has lost over 8% to trade at $1.95, BNX is lower 4% to trade at $148. Simultaneously, SNX’s cost is lower over 4% to trade at $1.68.

Ava Labs President States One Crypto Firm Threatens Markets Greater Than FTX

Ava Labs’ president John Wu has lately mentioned the collapse of the major digital asset loan provider might have more serious effects for that crypto markets compared to recent FTX debacle.

Based on a current interview conducted by Bloomberg, Ava Labs president John Wu cites the possibility collapse of Genesis Global Capital like a greater threat towards the digital asset markets compared to failure from the FTX exchange.

“In my seat, I really think Genesis is really a bigger issue with regards to the capital markets of crypto than even FTX.

Genesis was the biggest loan provider available. They’ve done unsecure in addition to collateralized lending. There’s really nobody else doing that lending. Without one within the markets, everyone within the value chain, all of the the likes of market makers who require to gain access to to do market making, you’re likely to see liquidity get sapped from the markets, spreads widen, no investors wish to are available in and you’ve got a vicious circle.

So, Genesis is an extremely important area of the crypto capital markets.”

Earlier in November, news surfaced that Genesis had temporarily blocked withdrawals because of liquidity issues following a collapse of FTX and crypto hedge fund Three Arrows Capital (3AC).

Another report from a week ago established that before Genesis froze withdrawals, it’d requested investors for any $1 billion loan to pay for an unpredicted expense.

Binance releases its Proof-of-Reserve

Following the FTX went lower, Binance Chief executive officer Changpeng Zhao (CZ) issued a rallying cry, demanding that other exchanges show their financial strength. Binance released its Proof-of-Reserve (PoR) mechanism on November 25 after most CEXs adopted his recommendations.

The publication of the Merkle Tree Proof-of-Funds came two days following the exchange initially guaranteed to do this. There’s been pushback to Binance’s newest move.

Jesse Powell, Chief executive officer, and co-founding father of Kraken, mentioned that Binance lacked a complete PoR. The whole Evidence of Repossession (PoR) requires, because he tweeted, the sum of the clients’ liabilities, cryptographic proof that every account was incorporated within the sum, and signatures validating the custodian’s control of the wallets.

Other participants, Powell stated, happen to be remiss in noting accounts with negative balances. Kraken’s Proof-of-Reserve is helpful for evaluating the business’s holdings to the financial obligations.

CZ responded by emphasizing the official statement’s mention of the another-party audit will suffice to allay Powell’s worries concerning the PoR. Binance’s latest move, if transported out properly, can restore belief in centralized exchanges and cryptocurrency.

Despite these efforts, Bitcoin along with other leading currencies are declining. Let us take a look at Bitcoin cost conjecture.

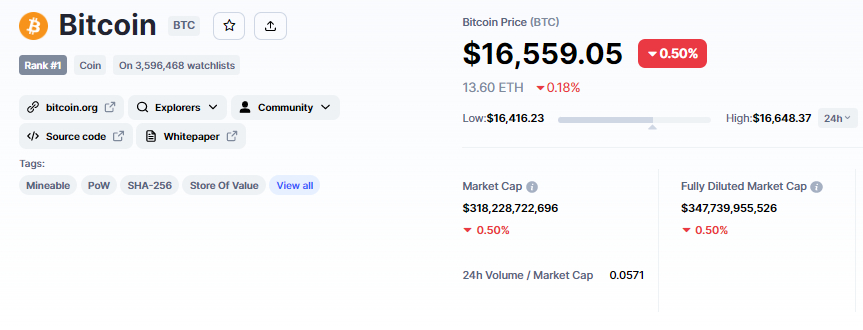

Bitcoin Price

The present Bitcoin cost is $16,558 and also the 24-hour buying and selling volume is $18 billion. Over the past 24 hrs, the BTC/USD pair has dropped nearly .50%, while CoinMarketCap presently ranks first having a live market cap of $318 billion, lower from $348 billion yesterday. It features a total way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,217,818 BTC coins.

On Sunday, the BTC/USD is buying and selling choppy, having a narrow buying and selling selection of $16,300 to $16,800. To be able to forecast future trends, Bitcoin must first break with the formerly pointed out buying and selling range.

Within the 4-hour time-frame, the BTC/USD pair is presently holding over the 23.6% Fibonacci retracement degree of $16,400, along with a breakout of the level can determine the following buying and selling range.

If Bitcoin breaks underneath the 23.6% Fib level, it will likely be uncovered towards the 38.2% Fib degree of $16,275 and also the 61.8% Fib degree of $15,900.

Leading technical indicators, like the RSI and MACD, are oscillating between exchanging ranges, indicating investor indecision. The 50-day moving average, however, is maintaining your BTC supported near $16,450, indicating a higher probability of an upward trend continuation.

If buyers go into the market, a bullish breakout from the $16,785 level could send BTC to $17,000 within days.

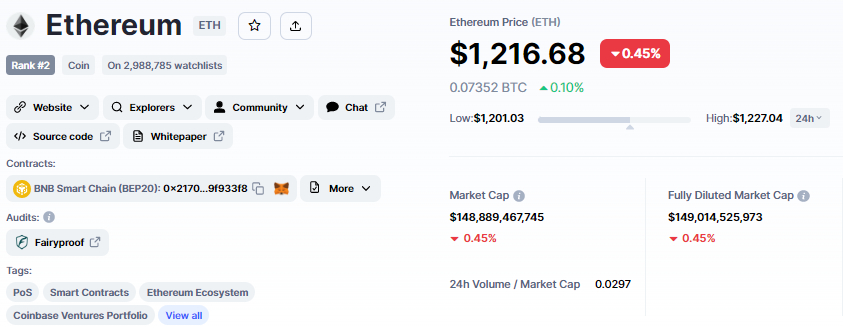

Ethereum Price

The present cost of Ethereum is $1,216, having a 24-hour buying and selling amount of $4 billion. Within the last 24 hrs, Ethereum has lost nearly .50%. CoinMarketCap presently ranks #2, having a live market cap of $148 billion. It features a circulating way to obtain 122,373,866 ETH coins.

Ethereum is buying and selling slightly bullishly, getting created an upward funnel that’s supporting it around $1,200 (mental level). Around the 4-hour chart, Ethereum is developing “greater highs and greater lows, ” signaling an elevated bullish bias.

The 50-day moving average line at $1,175 is suggesting a bullish trend, as the RSI and MACD indicators will also be holding inside a buying zone.

Around the upside, the main level of resistance for ETH remains $1,235, along with a break above this might go towards the $1,250 level. Around the downside, a bearish breakout of the upward funnel at $1,200 could spark selling before the $1,185 and $1,145 levels are arrived at.

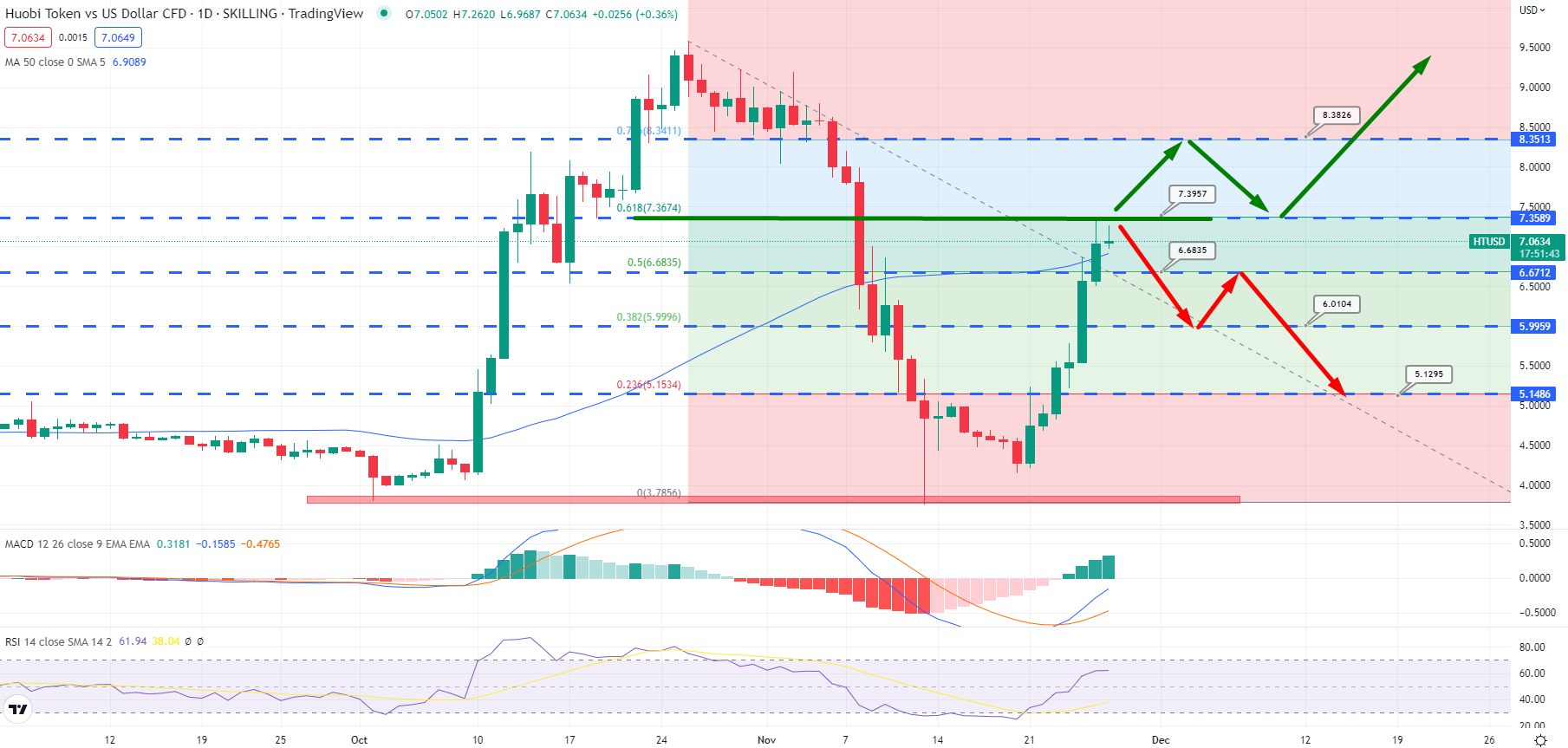

Huobi Token Storms 58%

Huobi Token is rising, getting surged over 58% within the last 7 days and also over 4% within the last 24 hrs. CoinMarketCap presently ranks #39, having a live market cap of One Dollar billion. You will find 153,357,694 HT coins in circulation, having a maximum way to obtain 500,000,000 HT coins.

Around the technical front, the HT/USD pair has risen above $7 and arrived at the 61.8% Fibonacci retracement level. Simultaneously, HT has entered over the 50-day simple moving average line at $6.75, indicating a powerful bullish trend.

The RSI and MACD, however, have joined the overbought zone, which isn’t a great sign for that bulls. Consequently, failure to interrupt over the $7.40 level of resistance may lead to a bearish correction towards the $6 or $5.15 levels.

Elevated interest in HT, however, could cut through $7.40 resistance and expose cost to $8.35 or $9.50 resistance levels. Let us keep close track of $7.40 since it is a probable pivot point for HT.

Presale Cryptocurrency With Enormous Potential Gains

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives real-time analytics and social data to traders of abilities, letting them make smarter-informed decisions. The woking platform goes reside in the very first quarter of 2023, supplying investors with information to assist them to make positive buying and selling decisions.

Dash 2 Trade, a platform for crypto buying and selling intelligence and signals, has piqued investors’ interest after raising $seven million in only more than a month. Consequently, the D2T team has made the decision to it quits at stage 4 minimizing hard cap target to $13.4 million.

Dash 2 Trade has additionally been successful, with two exchanges (LBank and BitMart) promising to list out the D2T token when the presale concludes. 1 D2T is presently worth .0513 USDT, however this will rise to $.0533 within the final stage from the purchase. D2T has to date elevated over $seven million by selling greater than 82% of their tokens.

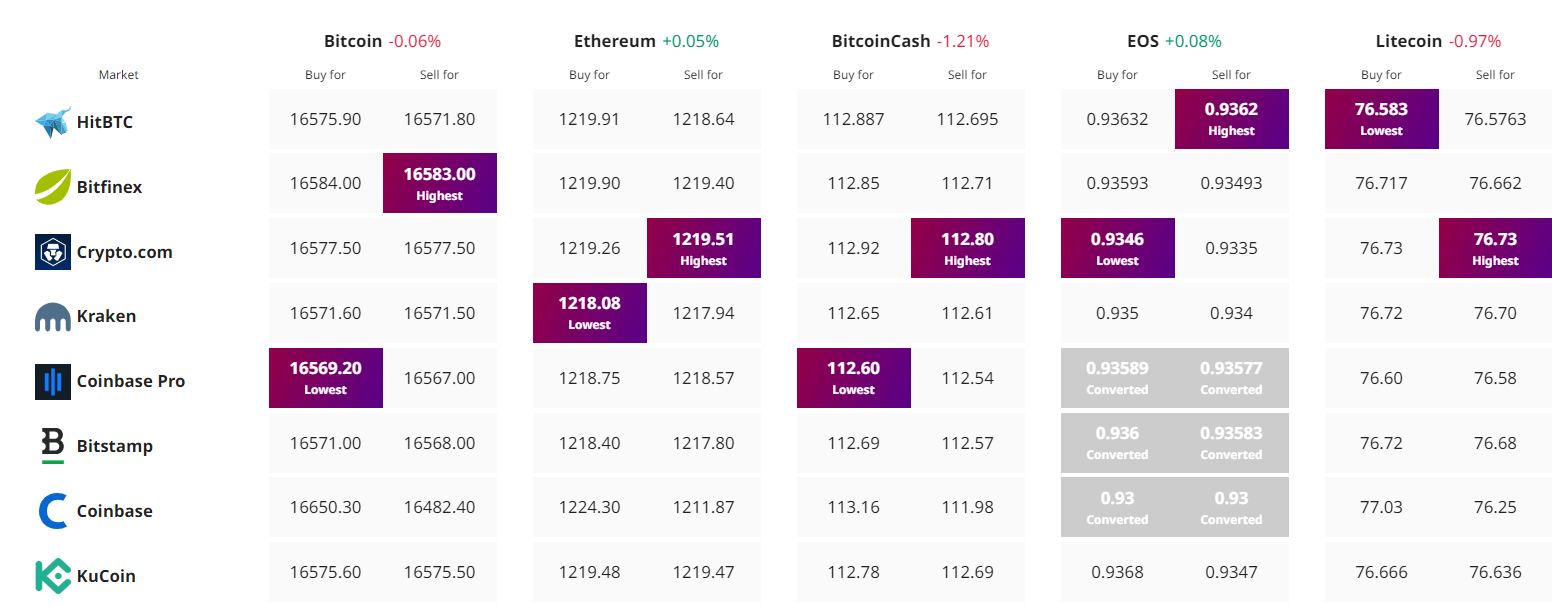

Get The Best Cost to purchaseOrMarket Cryptocurrency