Noisy . Asian session, major cryptocurrencies were buying and selling within the negative, because the global crypto market cap fell .05% on the day before to $918.19 billion. During the last 24 hrs, overall crypto market volume fell 9.88% to $44.13 billion.

The general volume in DeFi was $2.40 billion, comprising 5.44% from the total 24-hour volume within the crypto market. The general amount of all stablecoins was $41.54 billion, comprising 94.13% from the total 24-hour amount of the crypto market.

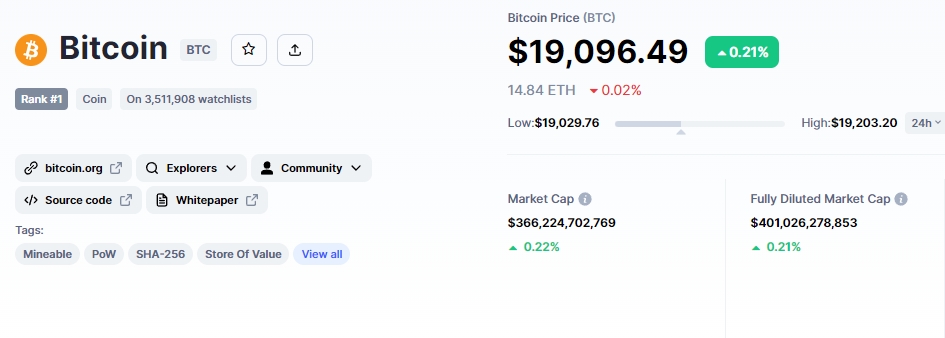

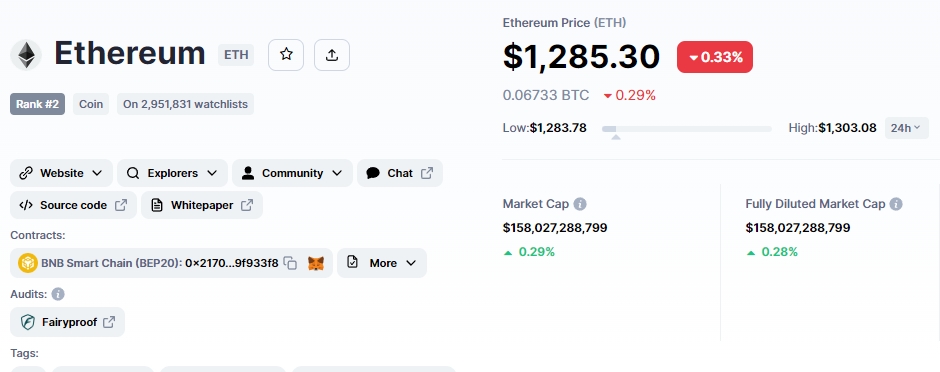

Bitcoin, the key cryptocurrency, has acquired .21% after losing greater than 6% in the last 7 days. Ethereum, however, continues to be buying and selling below $1,300 (the mental level), getting lost nearly 6.19% now.

Top Altcoin Gainers and Losers

Huobi Token (HT), Terra (LUNA), and OKB (OKB) ongoing is the top performers within the Asian session. Huobi’s cost has risen by greater than 12% to $7.31, while Terra’s cost has risen by 5.06% to $2.68. In comparison, OKB rose 1.65% to $16.68.

The TerraClassicUSD cost has continued to be bearish, falling 22.36% to $.0455 within the last 24 hrs. The buying and selling sentiment within the cryptocurrency marketplace is slightly negative, and digital assets are battling to increase.

Consequently, there exists a good chance to go in positions, especially given how oversold the financial markets are.

Cryptocurrency News Highlights

Here are the occasions that was in the crypto news section:

US Dollar increasing

The US Dollar Index (DXY) has gone to live in 113.20 after breaking a 5-day rise with slight losses yesterday. The United States dollar index from the other six major currencies was flat on Thursday, prior to the discharge of the important US Consumer Cost Index (CPI) data for September, neglecting to justify recent hawkish Given bets and cheery Given governor comments.

The greenback’s value retreated after minutes from the newest Fed meeting revealed some dovish undertones. Within the meeting minutes, it had been noted that many people spoken about the necessity to slow lower the interest rate of further tightening to reduce the threat towards the US economy.

However, the Given maintained its intend to increase rates of interest in order to slow inflation.

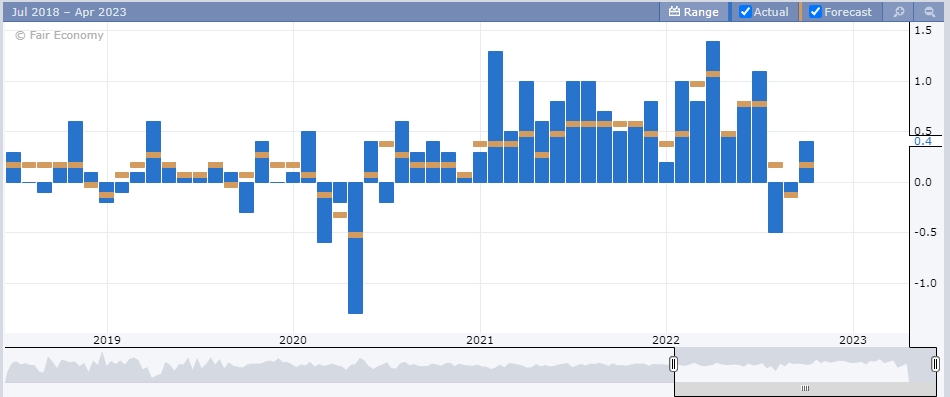

US PPI Figures

The dollar acquired ground versus most cryptocurrencies after news that US producer prices rose greater than expected in September.

The PPI for final demand rose .4%, greater than the .2% increase economists had predicted. The PPI rose 8.5% year-over-year in September after rising 8.7% in August.

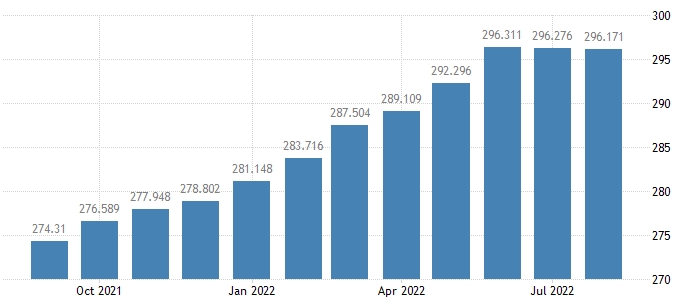

US CPI Figures Ahead

Inflation within the U . s . States slowed for any second consecutive month in August 2022, falling to eight.3% from 8.5% in This summer but nonetheless arriving above market expectations of 8.1%. The United States consumer cost index arrived at 296.17 in August, just below the prior month’s studying of 296.28 and over the 295.53 that were anticipated through the market.

The most recent Consumer Cost Index (CPI) report for September is going to be published through the US Bls (BLS) on Thursday, October 13, at 8:30 ET. When it comes to core (ex-food and) CPI data, the consensus forecast is perfect for it to print at .4% m/m, 6.5% y/y, as the headline CPI is anticipated in the future in at .2% m/m, 8.1% y/y.

What effect will more powerful US economic figures dress in the cryptocurrency market?

The cryptocurrency market might take a bearish turn with greater US CPI figures. It’s mainly since the US Fed carefully monitors economic statistics for example inflation, labor, GDP, along with other occasions to find out its approaching policy.

The raised economic data will persuade Jerome Powel and all of those other FOMC to boost rates of interest. Consequently, investors may shift their investments from dangerous investments like cryptocurrency, foreign exchange, and stocks and toward safe-haven investments like gold and government bonds.

Bitcoin Cost Conjecture & Technical Outlook

The present Bitcoin cost is $19,094.36, and also the 24-hour buying and selling volume is $25 million. Bitcoin has elevated by .23% in the last 24 hrs.

CoinMarketCap now ranks first, having a live market cap of $366 billion. It features a total volume of 21,000,000 BTC coins along with a circulating way to obtain 19,177,593 BTC coins.

On October 13, the Bitcoin cost conjecture remains bearish although it’s gaining immediate support near $18,857. Closed Doji and spinning top candlesticks above this level will probably fuel Bitcoin’s upward trend. As proven within the 4-hour chart above, the relative strength index (RSI) has joined the oversold zone, indicating that sellers happen to be exhausted and buyers are coming.

They’re simply awaiting a glimmer of hope, like a less strong US CPI, before benefiting from the chance.

Around the upside, Bitcoin’s immediate resistance remains at $19,295 and $19,550 that has been extended through the 50-day moving average. A bullish crossover over the 50-day moving average could push the cost of bitcoin as much as $20,470.

Ethereum Cost Conjecture & Technical Outlook

The present cost of Ethereum is $1,287.17, having a 24-hour buying and selling amount of $8.5 billion. Within the last 24 hrs, Ethereum has acquired .28%. Having a live market cap of $158 billion, CoinMarketCap presently ranks second. It features a circulating way to obtain 122,771,325 ETH coins with no maximum supply.

Ethereum cost conjecture remains bearish as ETH has damaged via a symmetrical triangular formation at $1,303, and candle lights closing below this level will probably push the cost lower. Ethereum may regress to retest the important degree of $1,300 failure to interrupt above this level confirms the continuation from the downturn.

Around the downside, ETH’s immediate support remains at $1,260, along with a break below this level may lead to selling ETH around $1,220. An outburst in selling pressure might push ETH below $800, however this is not likely since the $1005 level will give you significant support on the way.

IMPT – The Eco-friendly Alternative Crypto

Tamadoge, a meme gold coin, is gaining traction, getting elevated by greater than 33% within the last 24 hrs to trade at $.04143. OpenSea now sells the Ultra-rare Tamadoge NFTs, having a start cost of just one WETH. Tamadoge is just about the 3rd greatest meme gold coin within the crypto space.

For only 9 times of the presale, the project’s native currency, the IMPT token, has elevated an incredible $3.9 million, getting offered 217 million tokens.

Although the blockchain-based carbon credit marketplace started its auction throughout a bear marketplace for cryptocurrencies, interest in industry token continued to be high.

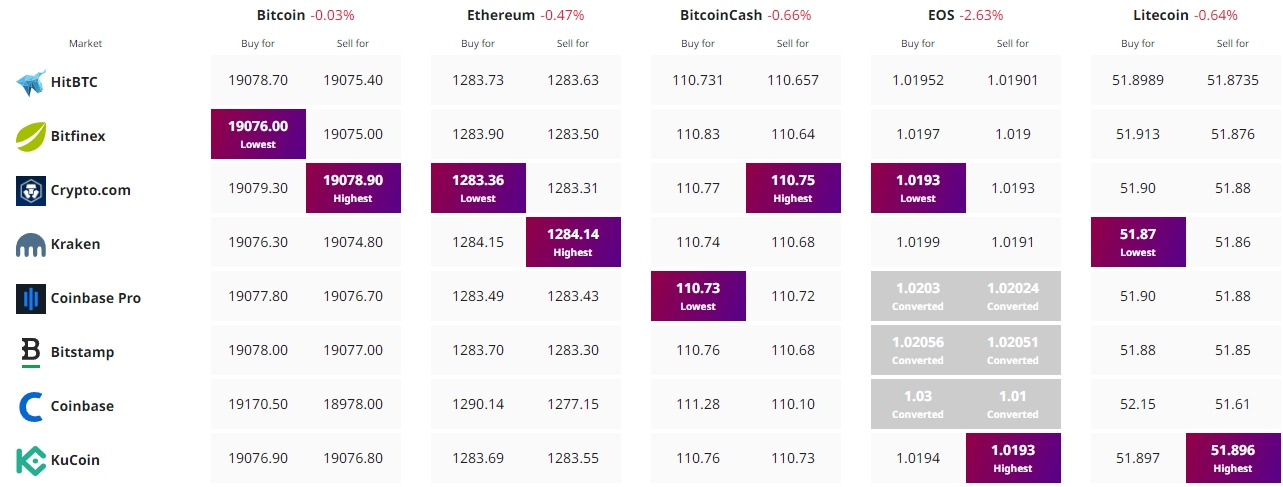

Get The Best Cost to purchaseOrMarket Cryptocurrency: