Bitcoin (BTC) has fallen by over 67% in 2022 and it is now wobbling from a tight buying and selling range based on $28,000 as interim support and $30,500 as interim resistance.

The selloff seems within the wake from the Federal Reserve’s hawkish policy and also the uncertainties within the crypto market brought by Terra, an algorithmic stablecoin project whose native token LUNA fell by 99% earlier within the month.

Nevertheless, Bitcoin’s decline has somewhat cooled lower as May draws to some close, departing speculators with the expectation the token is while bottoming out.

Something similar to this may engage in for #Bitcoin. Spot the lower left corner we’d a dual bottom prior to getting a eco-friendly wave. We’re presently sitting at the end from the wedge. We are able to go just a little lower and form another double bottom before reversing. pic.twitter.com/feuzp5tiDZ

— BitcoinAlArab (@BitcoinAlArabx) May 23, 2022

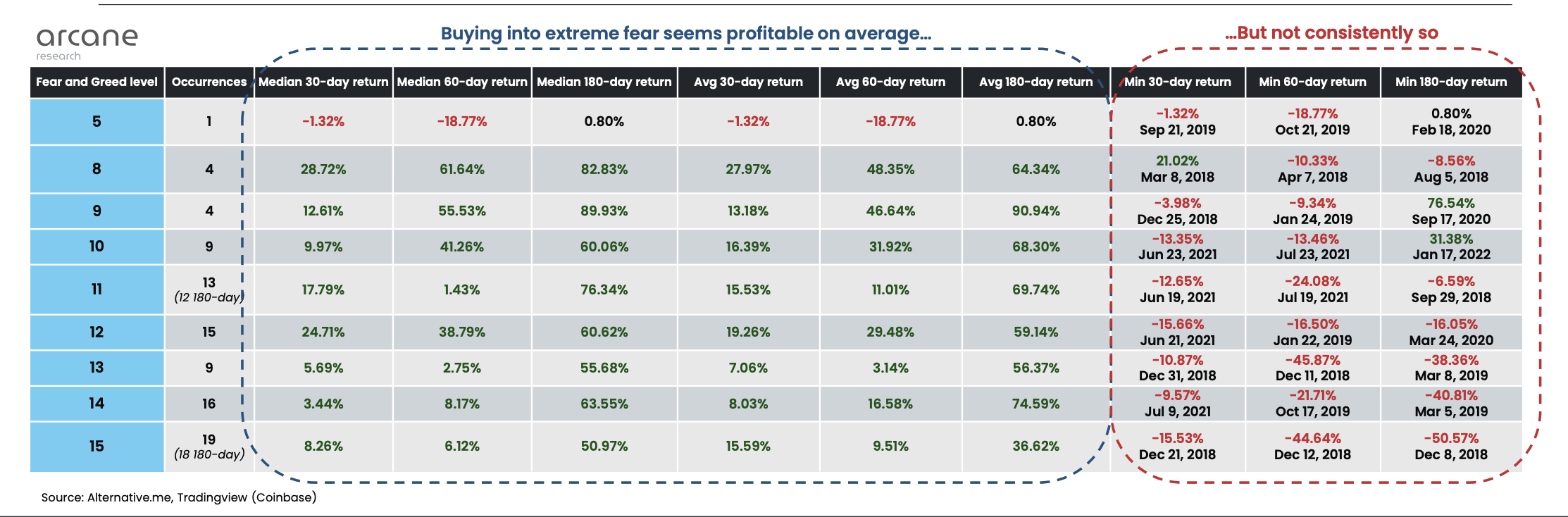

Interestingly, Bitcoin’s Fear and Avarice Index (F&G) also shows exactly the same scenario, notes Arcane Research in the latest weekly report.

Bitcoin F&G readings hit March 2020 lows

At length, Bitcoin’s F&G arrived at the score 8 on May 17, indicating “extreme fear,” an initial since March 2020.

“We have seen that purchasing fear has formerly been a lucrative strategy when calculating median and average returns of previous extreme fear periods,” Arcane authored while citing the 4 instances in which Bitcoin’s F&G had dropped to eight.

Meanwhile, Ben Lilly, market investigator at Jarvis Labs, added that Bitcoin’s F&G index falling below ten signals the ultimate chance of the marketplace bottoming out. Also, he noted that purchasing Bitcoin when its F&G score is below 10 is a great short-term strategy, saying:

“Ends up the process in which you hold it at a lower price time created greater results. Meaning the process in which you offered after F&G rose above 35 (yellow line within the chart [below]) created better results than the usual studying of fifty (orange) and 80 (red).”

Around the switch side, Arcane highlighted that does not all lower F&G scores have guaranteed bullish retracement moves previously some preceded ongoing selloffs. For example, Bitcoin dropped nearly 11% on April 7, 2018, just 60 days after its F&G arrived at extreme fear levels.

More indicators signal bottom

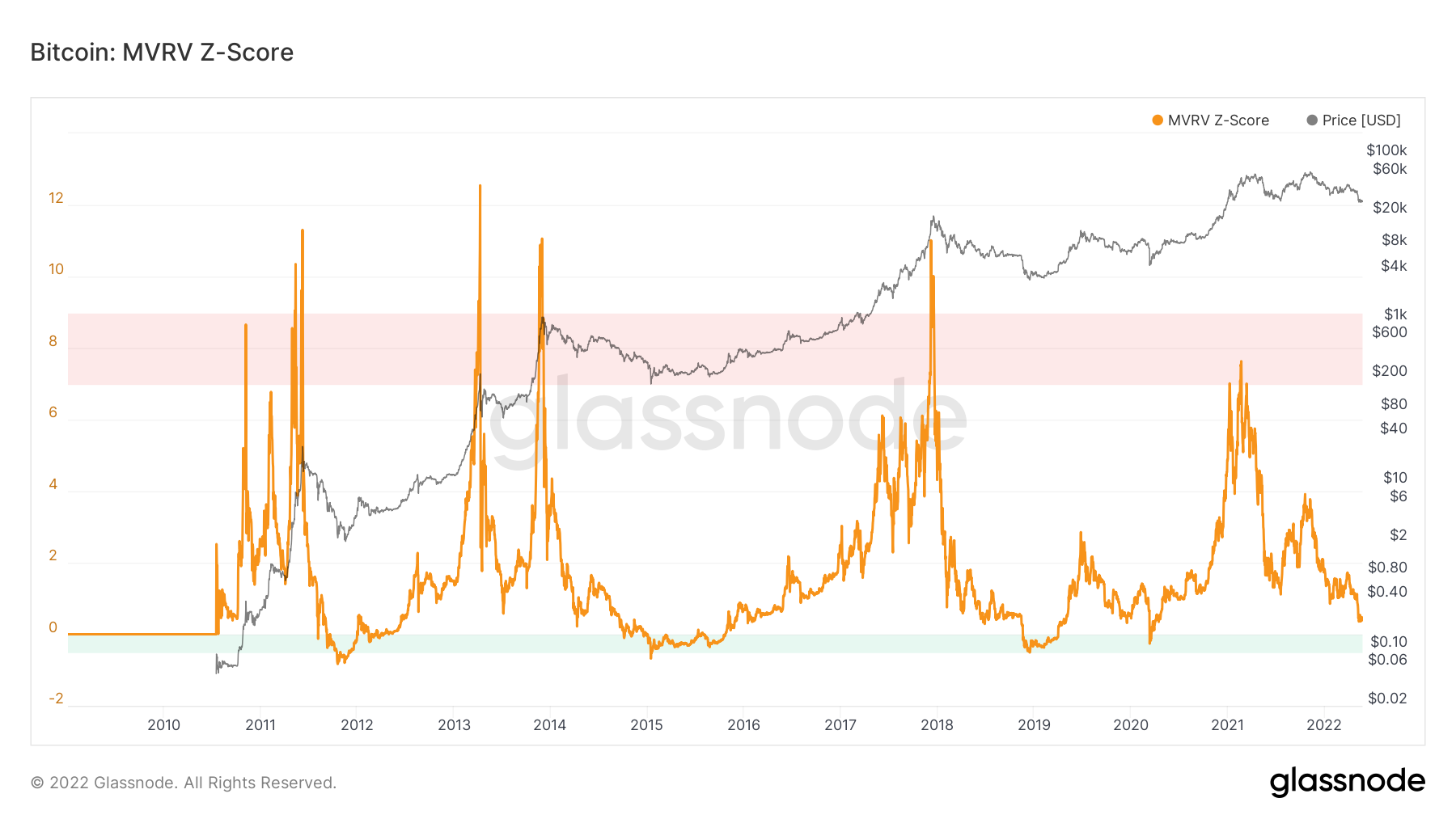

More indications of a potential within the Bitcoin market originate from several on-chain indicators.

For example, Glassnode’s MVRZ Z-Score, which assesses when Bitcoin is undervalued/overvalued according to its “fair value,” is nearing the eco-friendly zone which had preceded the crypto’s massive rebound rallies, as proven within the chart below.

Concurrently, the Lengthy Term Output Profit Ratio (LTH-SOPR) indicator, which “evaluates the net income ratio from the whole market participants by evaluating the need for outputs in the stayed to produced time,” also suggests that Bitcoin is bottoming out.

Particularly, once the LTH-SOPR value falls below 1, it highlights that some lengthy-term Bitcoin holders could sell BTC baffled. On the other hand, something above 1 implies that they might sell in profit.

By May 25, the LTH-SOPR is .72, that could mean a possible developing bottom within the Bitcoin market because individuals is going to be unwilling to sell BTC baffled.

Selloff warnings remain for BTC

Nonetheless, the uplifting bottom indicators appear as opposed to a couple of other bearish signs elsewhere on the market and requires as little as $15,500 as well as below $10,000.

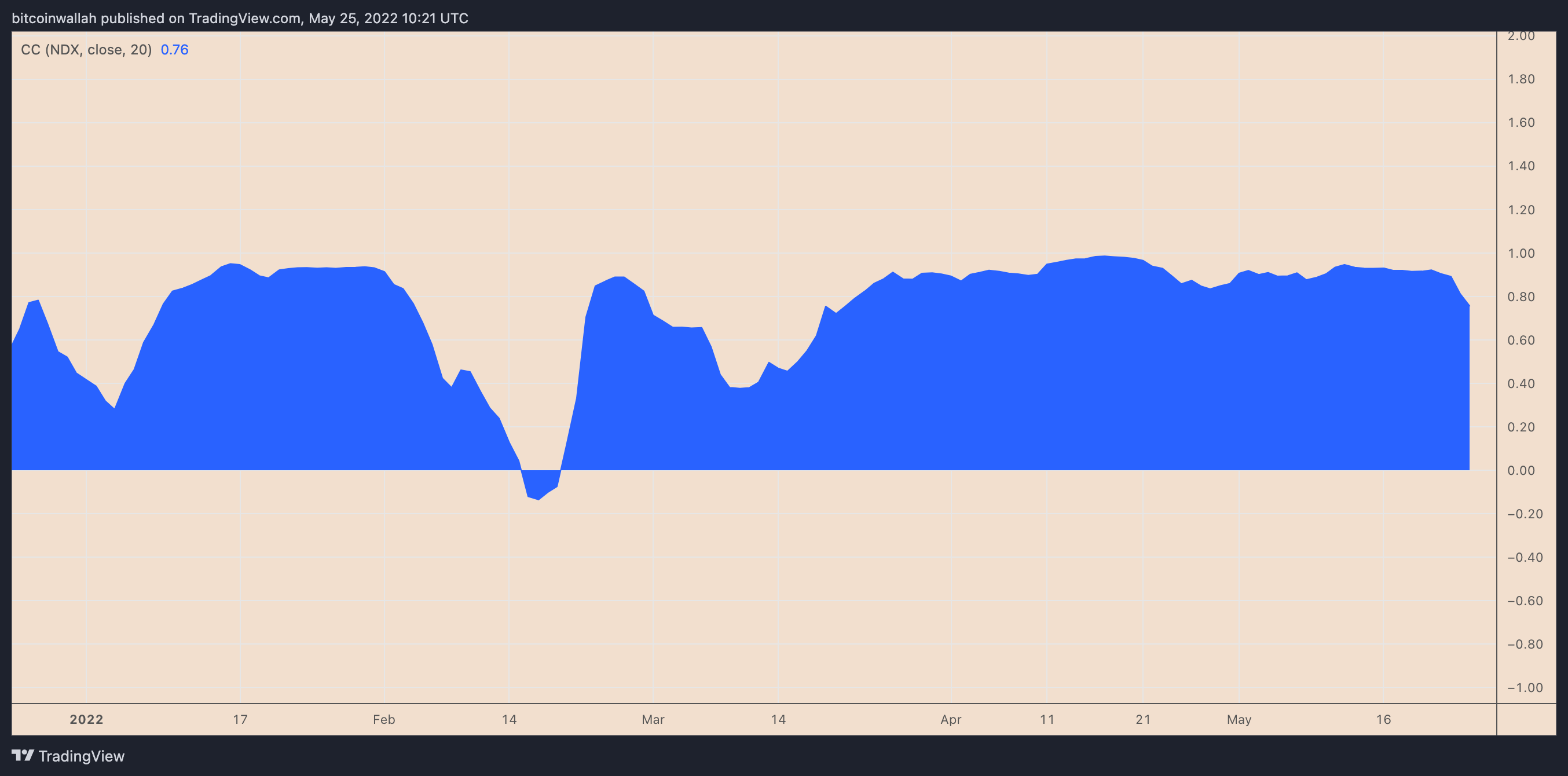

For example, Scott Minerd, chief investment officer at Guggenheim, argues that Bitcoin obtained care of to $8,000, a 70% drop from today’s cost. Minerd cites a hawkish Fed for that bearish outlook on Bitcoin, whose daily correlation with Nasdaq continues to be positive since Feb 2022.

In the technical perspective, Bitcoin could indeed fall further toward the $22,000-$26,000 range before bottoming out.

Related: Bitcoin ‘death cross’ data hints 43% drop due in BTC cost bear market

These levels coincide with two historic support levels—the 200-day exponential moving average (200-week EMA nowhere wave) and also the 200-day simple moving average (200-week SMA the orange wave)—that marked the finish of BTC’s previous bearish cycles.

“For the downside, the $25,000 bottom from May twelfth may be the nearest support level below $29,000,” further noted Arcane’s researchers Vetle Lunde and Jalan Mellerud, adding that Bitcoin’s “next critical support level” might be around $20,000, the 2017 peak. Excerpts:

“For the upside, $30,500 is a strong resistance area during the last week. If BTC breaks from resistance, $35,000 may be the next key resistance area.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.