This week’s Bitcoin (BTC) chart leaves little question the symmetrical triangular pattern is breaking towards the upside after constricting the cost for pretty much 20 days. However, derivatives metrics tell a totally different story because professional traders are reluctant to include leveraged positions and therefore are overcharging for downside protection.

Will BTC reverse course even while macroeconomic conditions crumble?

Whether BTC turns the $30,000 to $31,000 level into support depends to some extent about how global markets perform.

The final time U.S. stock markets faced a seven-week consecutive downtrend was over about ten years ago. New house sales within the U.S. declined for that 4th straight month, also is a long streak since October 2010.

China saw an astonishing 20% year-on-year decline because of its on-demand services, the worst change on record. Based on government data released on May 30, consumer spending for internet services from The month of january to April was at $17.7 billion.

The need for stock choices in Europe also hit the worst level in 19 years after rising rates of interest, inflation and macroeconomic uncertainties caused investors to find shelter in cash positions. Based on Bloomberg, initial public choices and follow-on transactions elevated only $30 billion throughout 2022.

The suggestions above allow it to be simpler to know the discrepancy between your recent Bitcoin cost recovery to $32,300 and weak derivatives data because investors are prices greater likelihood of a downturn, mainly driven by worsening global macroeconomic conditions.

Derivatives metrics are neutral-to-bearish

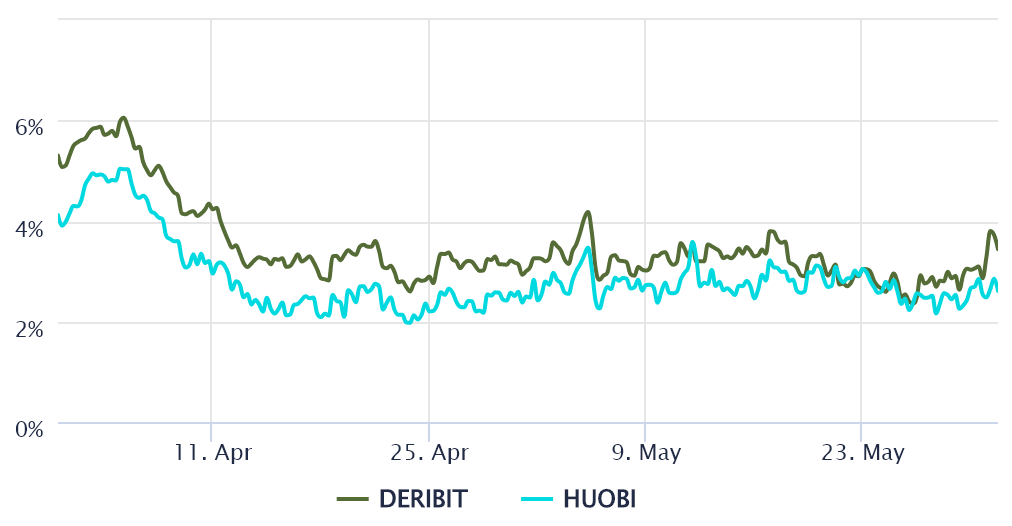

Retail traders usually avoid quarterly futures because of their cost difference from place markets, but they’re professional traders’ preferred instrument simply because they steer clear of the perpetual contracts fluctuating funding rate.

These fixed-month contracts usually trade in a slight premium to place markets because investors require more money to withhold the settlement. This case isn’t only at crypto markets. Consequently, futures should trade in a 5% to 12% annualized premium in healthy markets.

Based on data from Laevitas, Bitcoin’s futures premium continues to be below 4% since April 12. This studying is normal of bearish markets and it is worrisome the metric unsuccessful to interrupt over the 5% neutral threshold even while the cost moved toward $32,000.

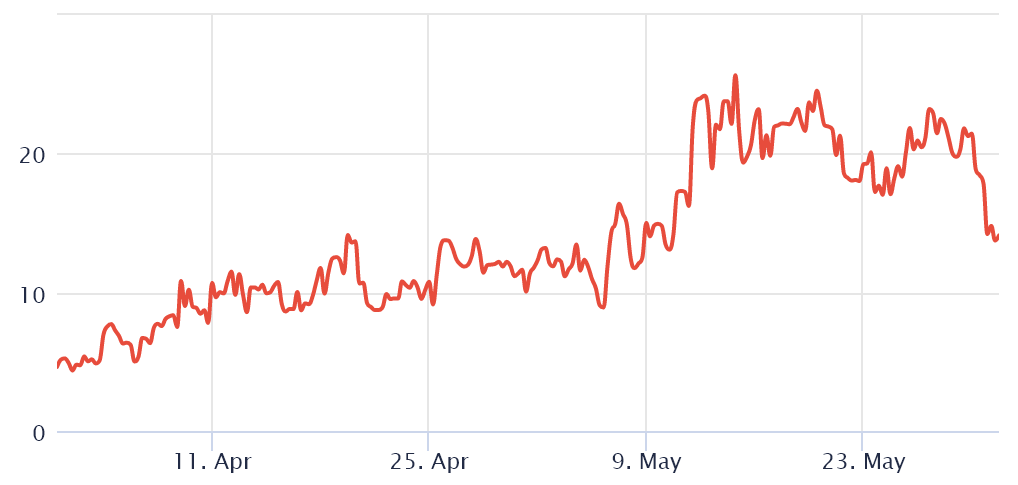

To exclude externalities specific towards the futures instrument, traders should also evaluate the Bitcoin options markets. The 25% delta skew is optimal because it shows when Bitcoin market makers and arbitrage desks are overcharging for upside or downside protection.

During bearish markets, options investors give greater odds for any cost crash, resulting in the skew indicator to maneuver above 12%. However, a bull markets’ generalized excitement induces an adverse 12% or lower skew.

The 30-day delta skew peaked at 25.4% on May 14, the greatest-ever record and usual for very bearish markets. However, the problem improved on May 30 and could 31 because the indicator stabilized at 14%, however it still prices in greater likelihood of a cost crash. Still, it shows an average sentiment improvement from derivatives traders.

The potential risks of the global economic slowdown are most likely the primary reason Bitcoin options financial markets are stressed and why the futures fees are still low. The 30-day correlation of BTC in comparison to the S&P 500 index reaches 89%, meaning traders have less incentives to put bullish bets on cryptocurrencies.

Some metrics claim that the stock exchange might have bottomed a week ago, especially since it’s buying and selling 8.5% over the May 20 intraday low, but weak economic figures are weighing on investor sentiment. This drives the danger-averse momentum and it has an adverse effect on cryptocurrency markets.

Until there is a better definition for traditional finance and also the world’s greatest economies, Bitcoin traders should still avoid building leveraged lengthy positions and keep a bearish stance, an element that’s presently reflected in options markets.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.