Bitcoin (BTC) is on the right track because of its greatest weekly gains since March, although not everybody thinks the great occasions can last.

Crypto sentiment greatest since early May

Data from Cointelegraph Markets Pro and TradingView implies that during the time of writing, BTC/USD expires over $2,000 now — nearly 12%.

After working a few days held in a narrow range, the happy couple were able to exit towards the upside, increases speeding up overnight into This summer 8 to determine highs of $22,401 on Bitstamp.

#bitcoin nicely bounced to 200WMA and Recognized Cost levels (both at ~$22K). Let us find out if it holds. Btw BTC $24.8K would switch RSI back at 45. pic.twitter.com/62yU8wJtuP

— PlanB (@100trillionUSD) This summer 8, 2022

Individuals highs alone are significant, coinciding with Bitcoin’s 200-week moving average (MA), an essential level in bear markets that has acted as resistance since recently.

While consolidating around $1,000 lower, Bitcoin nevertheless is showing the opportunity of a pattern turnaround. Beating the 200-week MA, however, won’t be any easy task.

“Well, Bitcoin, $22.3K was arrived at and all sorts of highs happen to be taken for the time being,” Cointelegraph contributor Michaël van de Poppe summarized inside a Twitter.

“Some consolidation and make-up is needed (might retest $20.7Kish) before markets will be ready to break above 200-Week MA, which is huge one.”

Van de Poppe formerly recommended that there’s “probably a crazy quantity of liquidity over the 200-Week MA,” which penetrating often see a run up to $30,000.

“And then your sentiment will switch too,” he added.

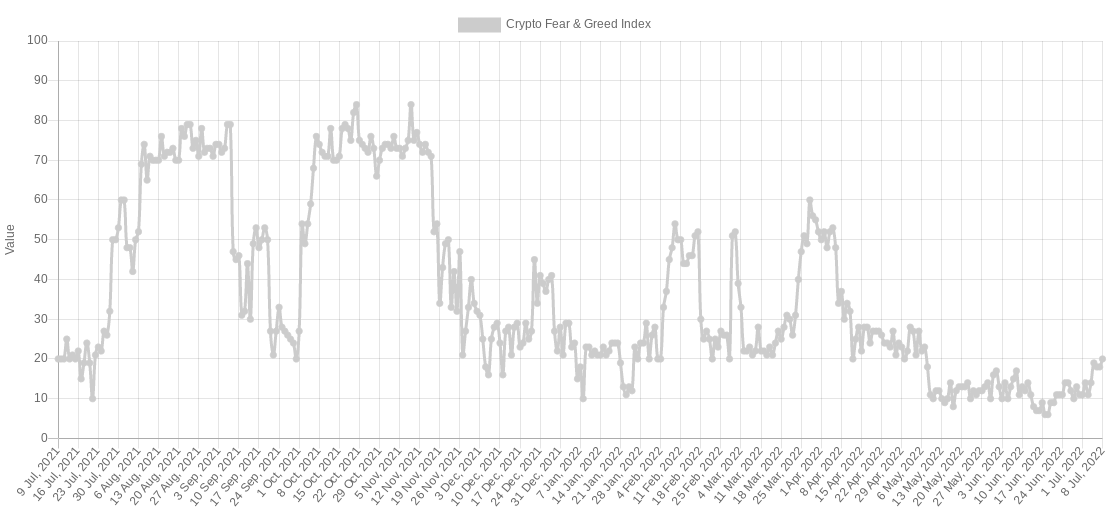

Indications of alternation in the general market mood were already visible at the time, however, using the Crypto Fear & Avarice Index hitting its greatest levels since May 7. At 20/100, the Index remains in the “extreme fear” zone.

A later date, another two-decade DXY high

The most recent cost action is meanwhile not without its naysayers, a number of whom expect much deeper macro lows to go in before any significant recovery.

Related: Bitcoin faces Mt. Gox ‘black swan’ as trustee prepares to unlock 150K BTC

“Lot of individuals expecting 22k-23k. It is the new 52k when cost what food was in 47k-48k or even the new 35k when cost what food was in 31k-32k. 16k comes first imo,” popular trader Il Capo of Crypto contended on This summer 7.

Later, he noted that Bitcoin was growing despite restored strength within the U.S. dollar index (DXY), which “spoofing” on major exchanges was contributing to the likelihood of the most recent move as being a fakeout.

“DXY going parabolic. Bitcoin rising a little and individuals getting euphoric and with 40k. Not really a single bullish sign to aid this progress and cost continues to be at 21k-22k (resistance),” he cautioned Twitter supporters.

“Rejection is going to be strong. Altcoins could drop 45-50%. There won’t be any whim.”

DXY was at 107.3 during the time of writing, marking new twenty-year highs. U.S. dollar strength is typically inversely correlated with cryptoasset performance.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.