Bitcoin (BTC) staged a welcome comeback following the Sept. 28 Wall Street open as bulls faced served by whale-sized sellers.

Whales reside at $20,000

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD gaining over $1,000 at the time to determine highs of $19,656 on Bitstamp.

The move usually copied an uptick for U . s . States equities, using the S&P 500 and Nasdaq Composite Index up 1.5% and a pair of.2%, correspondingly.

Now, analysis cautioned the section of around $20,000 was still flush with large-volume traders wanting to continue profit-taking.

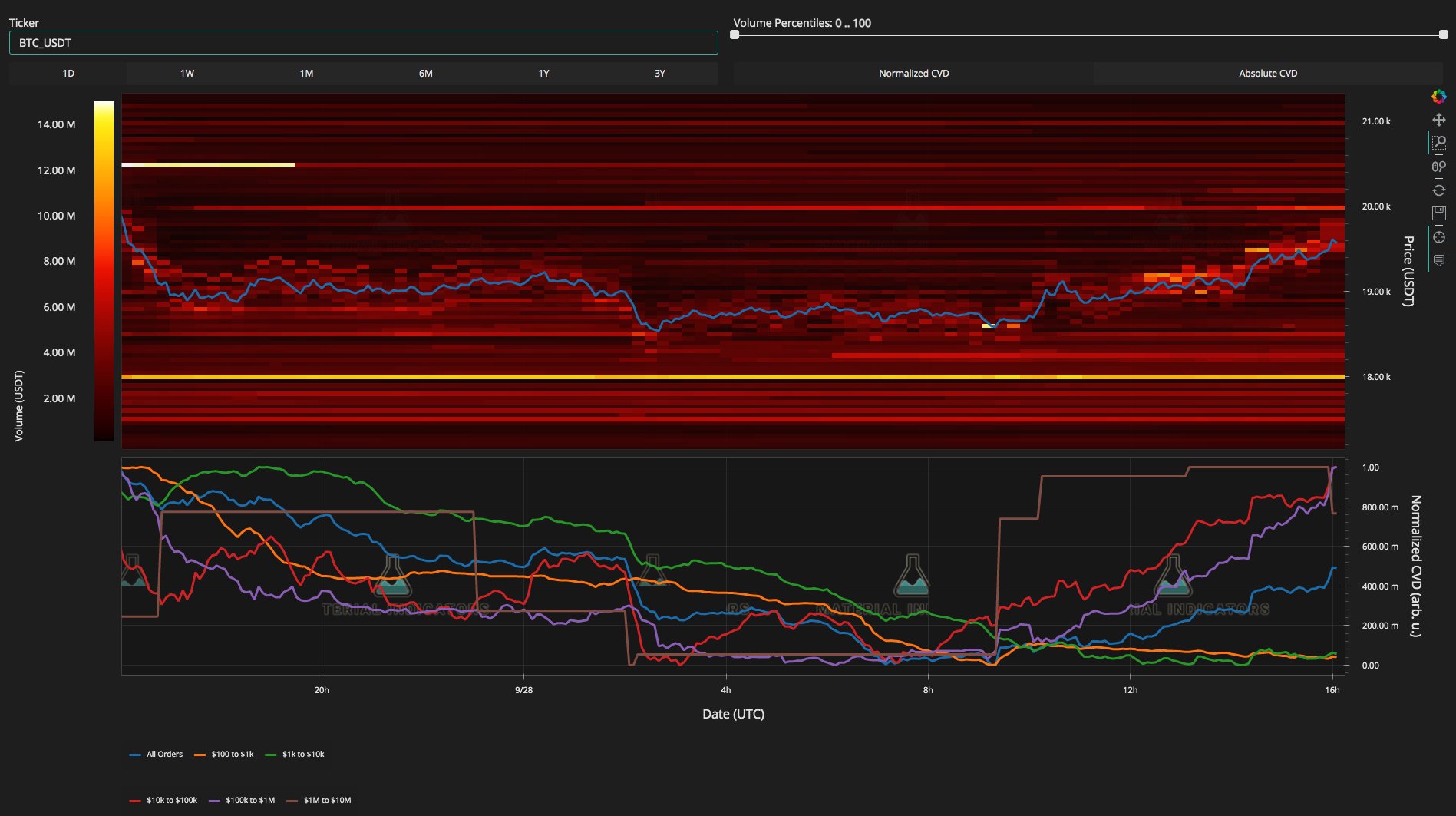

The BTC/USD chart on major exchange Binance “shows brown Mega Whales dumping into BTC support to reduce slippage,” analytics resource Material Indicators commented.

An associated snapshot confirmed the majority of resistance laying in wait just underneath the $20,000 boundary.

“Let’s find out if $19.5k holds to setup another potential run in the R/S switch zone ~$20k,” Material Indicators added.

Towards the downside, meanwhile, analyst Maartunn, a cause of on-chain analytics platform CryptoQuant, noted a sizable section of bid interest between $18,000 and $18,500.

It was worth around $sixty five million by Sept. 28, potentially developing a cushion of support.

As Cointelegraph reported, the region below June’s $17,600 low is on the other hand lacking of bid support, opening the possibility of a cascade toward $12,000.

With regards to the strength of the present bounce, traders were skeptical, with popular Twitter account Cheds cautioning on exposure with “bulls beginning to celebrate.”

During the time of writing, BTC/USD traded round the $19,500 mark.

Related: More ancient Bitcoin leaves its wallet after 10-year hibernation

Dollar slumps after latest two-decade high

On macro, the storyline during the day was the U . s . Kingdom’s central bank coming back to quantitative easing (QE) after financial turmoil hit its currency and bond market.

The Financial Institution of England sparked an immediate recovery for GBP/USD following the pair hit all-time lows.

The U.S. dollar, already coming off twenty-year highs, ongoing to provide back gains.

The U.S. dollar index (DXY) looked set to come back below 113 during the time of writing, lower a complete 1.5 points at the time.

“Looks like we’ll finish a few days out strong for Bitcoin and Stocks once we mind into Pumptober,” a hopeful IncomeSharks reacted.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.