Bitcoin (BTC) fluctuated round the key $20,000 mark into August. 31 because the outlook on U . s . States inflation darkened.

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD again dipping underneath the last halving cycle’s top overnight, simply to get back lost ground to circle $20,300 at the time.

The rangebound moves supported modest recoveries for U.S. stocks, using the S&P 500 and Nasdaq Composite Index up .15% and .6% inside the first hour’s buying and selling, correspondingly.

Concerns within the Federal Reserve’s intentions of tackling inflation after last week’s gloomy speech by Chair Jerome Powell nevertheless lingered.

Despite Powell’s earlier rhetoric, Diane Swonk, chief economist at KPMG, told mainstream media the entire idea of a “soft landing” for that U.S. economy was now shelved.

Powell’s speech been on fact “buried the idea of a gentle landing,” she described to Bloomberg, and demonstrated the Given rather planned to help keep development in check to “grind inflation lower.”

“It is really a torturous process but less torturous and fewer painful than a rapid recession,” Swonk added.

Using the mood thus firmly conservative on risk assets, attention likewise continued to be on the effectiveness of the dollar because it ongoing to circle twenty-year highs.

“For risk-on assets, including Bitcoin, it’s important to possess a stable Dollar or perhaps a weak Dollar, as upwards pressure should be expected around the markets,” Michaël van de Poppe, Chief executive officer of buying and selling firm Eight Global, told Twitter supporters.

“The coming month will probably be essential for the $DXY. Which potential bearish divergence may be the first signal.”

Markets “in the craps table” over Given rate hike

September, typically a “red” candle month for Bitcoin, also guaranteed an important Given decision on key rate hikes, together with August Non-Farm Payrolls (NFP) and Consumer Cost Index (CPI) inflation data.

Related: Bitcoin mining has not been more competitive even while BTC loses 13% in August

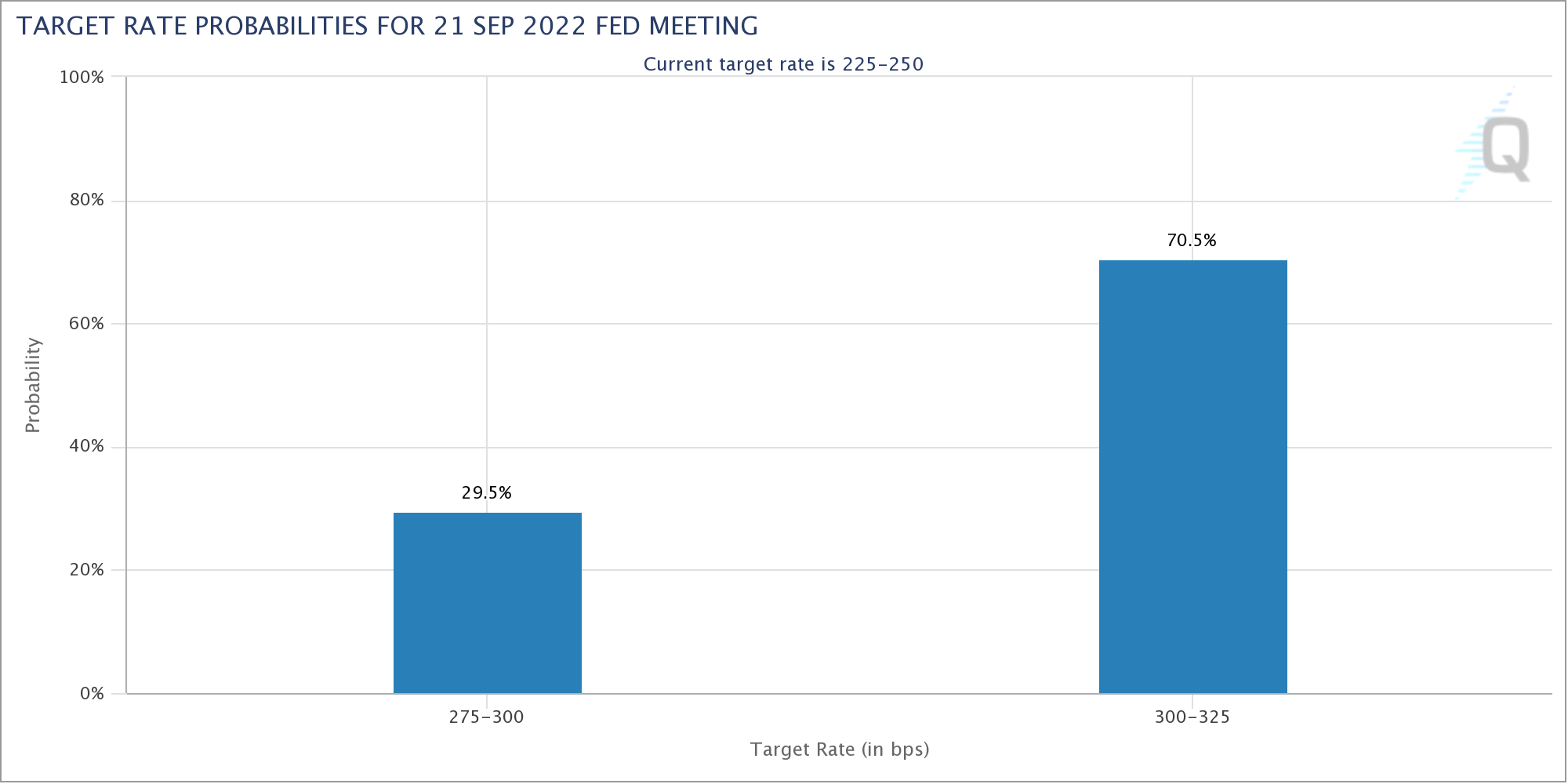

Expectations favored a 75-basis-point hike echoing This summer, CME Group’s FedWatch Tool demonstrated at the time.

“Instead of searching towards the broader rate path, or even the terminal rate, financial markets are to buying and selling the 21 Sep FOMC odds – whether or not they will hike 50bp or 75bp,” buying and selling firm QCP Capital told Telegram funnel subscribers in the latest market update.

“Worse still, Powell has effectively handed this insurance policy decision towards the 2 Sep NFP and also the 13 Sep CPI — which essentially means investors are actually all in the craps table, betting on over or under.”

TAdditional impetus for any bigger rate hike, QCP added, might be because of the longer-than-normal gap between July’s revision and September because of the August lull.

Normally, rate hike decisions are taken monthly.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.