On December 11, the Bitcoin cost conjecture remains mixed as BTC consolidates inside a narrow selection of $17,000 to 17,350 despite buying and selling volume shooting to $15 billion. Nj has set an objective to become probably the most crypto-friendly condition within the U . s . States.

For this reason the condition is proposing the “Digital Assets and Blockchain Regulation” Act, that will allow DAOs to include within its limitations, offer tax advantages of digital currency companies, and provide stock certificates to the investors.

Senator Robert Singer, a Republican, introduced the balance hoping it will make the condition more taking companies operating within the emerging field of digital assets. He expressed a wish to determine Nj function as an antithesis to New You are able to, that they claimed was “very restrictive” toward crypto innovation.

This is exactly what he stated inside a recent interview:

You want to become more industry-friendly. I shouldn’t be restrictive. I wish to most probably-minded, however i should also do protection from the consumer.

This really is great news for cryptocurrencies entering US markets, and it will boost the recognition of cryptocurrencies.

Top Bloomberg Analyst States Bitcoin Will Outshine Gold

Bloomberg’s chief commodity expert Mike McGlone predicts that Bitcoin (BTC) will quickly exceed gold in value. Based on a properly-known analyst, the key cryptocurrency is presently four occasions more volatile compared to gold.

Gold is really a “top challenger” to Bitcoin, states McGlone, who also shows that Bitcoin is beginning to change right into a greater-beta form of gold and bonds.

In addition, also, he expressed his concerns concerning the Fed’s hawkish policy decisions, saying:

“The most aggressive Given tightening in 4 decades is a great reason behind the macroeconomic ebbing tide, but 2023 might be about which assets emerge ahead as central banks pivot. When they don’t switch to easing, the planet may tilt deeper into recession, with repercussions for those risk assets. Our base situation is perfect for a stretched out deflationary period, using the crypto market, as measured through the Bloomberg Universe Crypto Index, being released ahead.”

BTC Halving to affect Bitcoin Positively

When the next halving of Bitcoin truly does exist in 2024, it might be advantageous to Bitcoin holders. Messari claims inside a new analysis that the Bitcoin halving event can spark a cost increase for BTC.

Once the incentive for mining Bitcoin transactions is halved, this is whats called a “halving.” As are visible in the tweet below, cost increases and brief rallies adopted every halving.

This halving could have a similar impact on future BTC values, however it might have effects for miners. Cutting Bitcoin’s payouts in two will badly harm the already hurting mining business.

Glassnode reported that miner earnings had dropped to some monthly low before publication. Glassnode also reported the charges compensated to miners had dropped to a different monthly low.

Prior to the halving, miners may face a significant danger from the stop by earnings and charges. A substantial rise in Bitcoin’s cost is needed to help keep mining economically viable.

Let us now consider the technical facets of Bitcoin.

Bitcoin Price

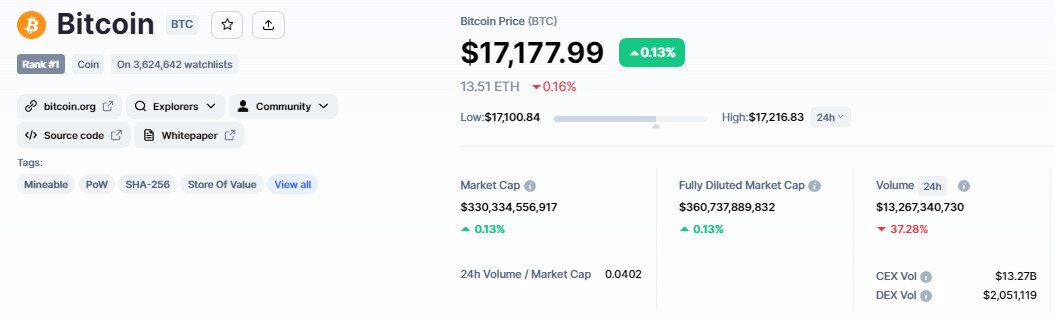

Bitcoin’s current cost is $17,159, and also the 24-hour buying and selling volume is $15 billion. The BTC cost has acquired over .10% since yesterday.

After breaking over the $16,750 barrier, the BTC/USD pair is buying and selling having a positive bias. Around the 4-hour timescale, Bitcoin has created an upward funnel, that is supporting the bullish trend. BTC may face resistance close to $17,400.

A bullish breakout above $17,400 can lead to a cost of $17,650, along with a bullish crossover above this level can lead to a cost of $18,150.

A bearish crossover below $17,000, an amount spanned through the 50-day simple moving average, can trigger a selling trend that may extend completely to $16,650.

Coins with Huge Upside Potential

Some coins here are gaining ground regardless of the market’s dismal trend, and they are obtaining the attention of cryptocurrency’s greatest investors.

IMPT (IMPT) – Presale Ends in a Couple of Hours

IMPT is really a carbon-credit marketplace that rewards customers for using the services of eco-friendly companies.

If this launches the coming year, it’ll issue carbon offsets as NFTs around the Ethereum blockchain, with users in a position to purchase such NFT-based offsets while using IMPT tokens they receive in exchange for shopping around the platform.

IMPT has elevated greater than $18.six million since its dpo in October, with 1 IMPT presently buying and selling at $.023.

The purchase will finish in under 2 days, adopted by listings on Uniswap, LBANK Exchange, and Changelly Pro.

Dash 2 Trade (D2T) – Presale within the final stage

Dash 2 Trade is really a buying and selling intelligence platform according to Ethereum that gives investors with real-time analytics and social buying and selling data to assist them to make smarter buying and selling decisions. It’ll go reside in early 2023, and it is D2T token will be employed to pay monthly platform subscription charges (there’s two subscription tiers).

The presale for Dash 2 Trade, that is now in the 4th and final stage, has elevated greater than $9.4 million. It’s also announced listings on Uniswap, BitMart, and LBANK Exchange for early the coming year, implying that early investors will quickly have the ability to secure some profits.

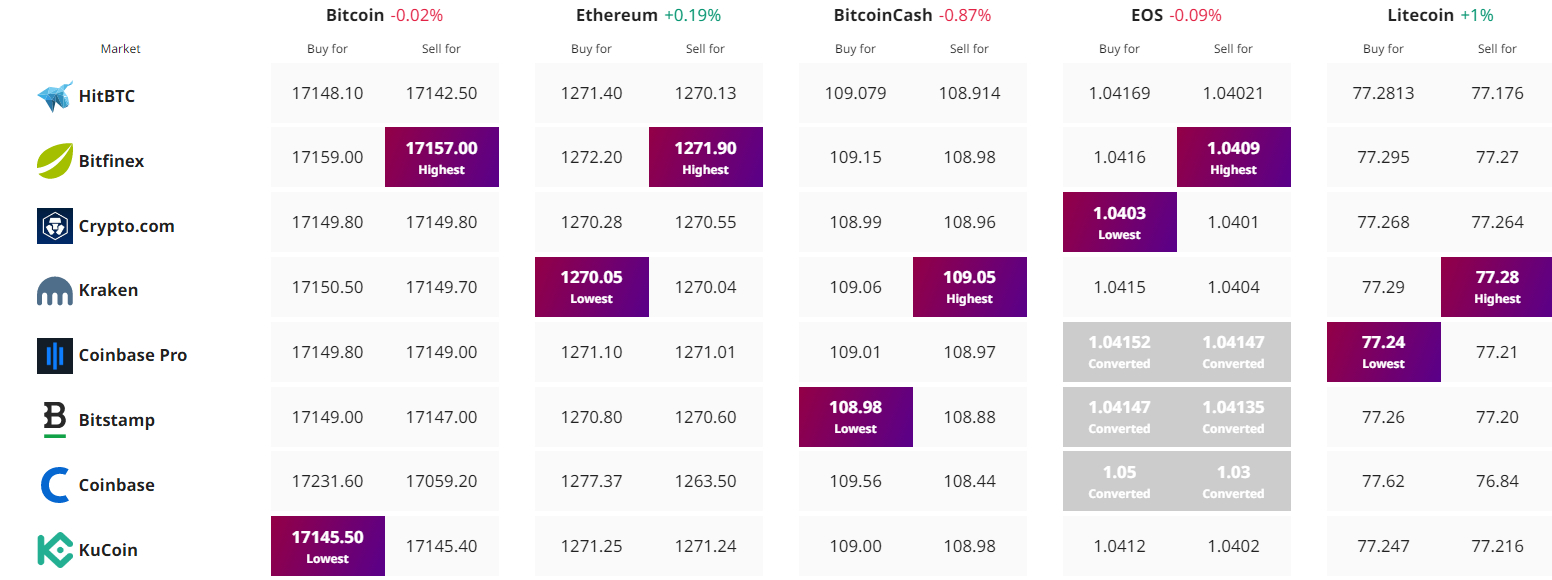

Get The Best Cost to purchaseOrMarket Cryptocurrency