Following a bearish breakout from the upward funnel on December 12, the Bitcoin cost conjecture switched bearish. It had been supporting Bitcoin close to the $17,000 level, and today, carrying out a bearish breakout, Bitcoin cost is susceptible to the $16,750 level.

Ark Invest’s Chief executive officer Cathie Wood lately tweeted her popularity of Bitcoin’s resiliency, noting the flagship cryptocurrency “did not skip a beat” among a current crisis.

She procedes to state that Bitcoin’s “transparency” and “decentralization” are explanations why disgraced FTX founder Mike Bankman-Fried did not take care of it. He was helpless, the well-known investor stated.

The most recent tweet from Wood is as a result of Ark Invest, an investment management firm she runs.

Now, the market’s attention is centered on our prime-impact economic occasions appearing out of the U . s . States. Let’s have a look.

Approaching FOMC around the Docket

Market participants are worried concerning the next Federal Open Market Committee (FOMC) meeting and policy discussions on December 13. The above mentioned is a result of Bitcoin’s cost still getting a powerful correlation with stocks. Because of the market’s response to this news, the approaching CPI reporting event may lead to elevated volatility for BTC/USD.

The United States Fed will raise rates of interest on December 13. The result is a number of 75 basis point rate of interest increases all year round. The eye rate hike scheduled for tomorrow is anticipated to become smaller sized than previously.

Since the US Fed Chair has established that the Given will reduce the speed hike in December, the marketplace is anticipating a lesser rate of interest increase. When the news of tomorrow’s rate of interest rise is under individuals that came before it, the crypto market could see a relief rally.

When the rate of interest rise is 50 basis points or fewer, the worldwide financial and cryptocurrency markets are experiencing a little to moderate relief rally. However, if rates of interest rise by greater than 50 basis points, all prices will fall considerably more. The discharge from the inflation rates may also modify the cost of BTC/USD.

Bitcoin Smart Contract Functionality

The non-profit DFINITY Foundation produced the web Computer (IC), the very first web-speed, internet-scale public blockchain. The IC’s mainnet announced the combination with Bitcoin, getting cutting-edge smart contract functionality towards the world’s leading cryptocurrency.

The Web Computer are now able to behave as a Bitcoin Layer 2 by permitting smart contracts to carry, transfer, and receive bitcoin without using blockchain bridges or any other intermediaries. It possesses a secure foundation for a number of DeFi and Web3 apps that are looking to code Bitcoin.

The combination from the Internet Computer with Bitcoin offers threshold ECDSA bridges, a far more secure option to centralized bridges (Elliptic Curve Digital Signature Formula).

The ECDSA solution enables Internet Computer’s canister smart contracts to conduct Bitcoin transactions without resorting to a middleman or bridge. It enables IC developers to create native Bitcoin code and offers a trustless foundation for Bitcoin-based DeFi applications.

The combination benefits BTC/USD since the cost elevated following a announcement.

Sank Bitcoin as ‘Everyone Who May Go Bankrupt Went Bankrupt’

Arthur Hayes, the previous Chief executive officer of crypto derivatives platform BitMEX, believes the worst has ended for Bitcoin this cycle. It is because the “largest, most irresponsible entities” have exhausted their BTC supply.

On December 11, podcaster and cryptocurrency proponent Scott Melker mentioned, “searching forward, virtually everybody who may go bankrupt went bankrupt.”

Hayes clarifies his position by proclaiming that because BTC may be the “reserve asset of crypto” and also the “most pristine asset and also the most liquid,” centralized lenders (CELs) frequently get in touch with loans before selling them when they’re experiencing financial hardships.

Inside a blog publish printed on December 10, Hayes designed a similar argument. He mentioned that because of the credit crisis, massive physical bitcoin sales continue to be happening on exchanges, with buying and selling companies and CELs trying to avoid insolvency and liquidating their holdings.

He believes the Given will activate the printer bank, resulting in the BTC/USD and all sorts of other dangerous assets to increase.

Let’s now take a look at Bitcoin’s technical aspects.

Bitcoin Price

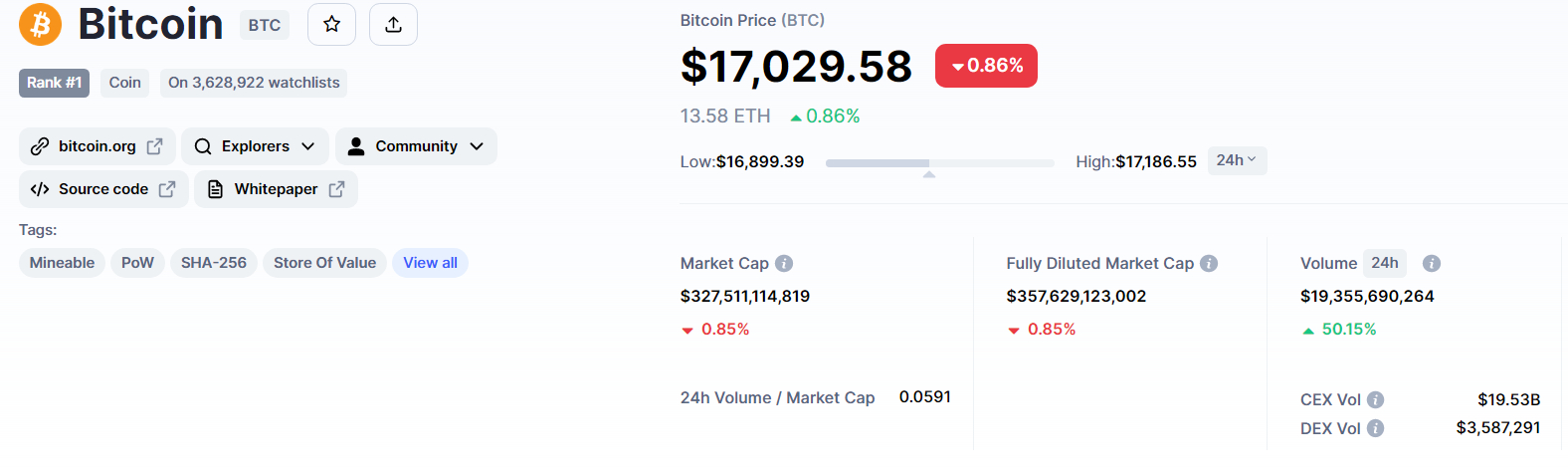

Bitcoin’s current cost is $17,035, and also the 24-hour buying and selling volume is $19 billion. The BTC cost has lost over .50% since yesterday.

Around the technical front, Bitcoin has damaged with an upward funnel at $17,000, and candle closings below this level claim that the selling trend may continue.

Around the downside, BTC may fall until it reaches the following support section of $16,750, and below that, the following support reaches $16,365.

A bearish crossover underneath the 50-day simple moving average (SMA) reinforces the bearish bias, suggesting that BTC may move toward $16,750.

Dash 2 Trade (D2T) – Presale within the final stage

Dash 2 Trade is really a buying and selling intelligence platform according to Ethereum that gives investors with real-time analytics and social buying and selling data to assist them to make smarter buying and selling decisions. It’ll go reside in early 2023, and it is D2T token will be employed to pay monthly platform subscription charges (there’s two subscription tiers).

The presale for Dash 2 Trade, that is now in the 4th and final stage, has elevated greater than $9.5 million. It’s also announced listings on Uniswap, BitMart, and LBANK Exchange for early the coming year, implying that early investors will quickly have the ability to secure some profits.

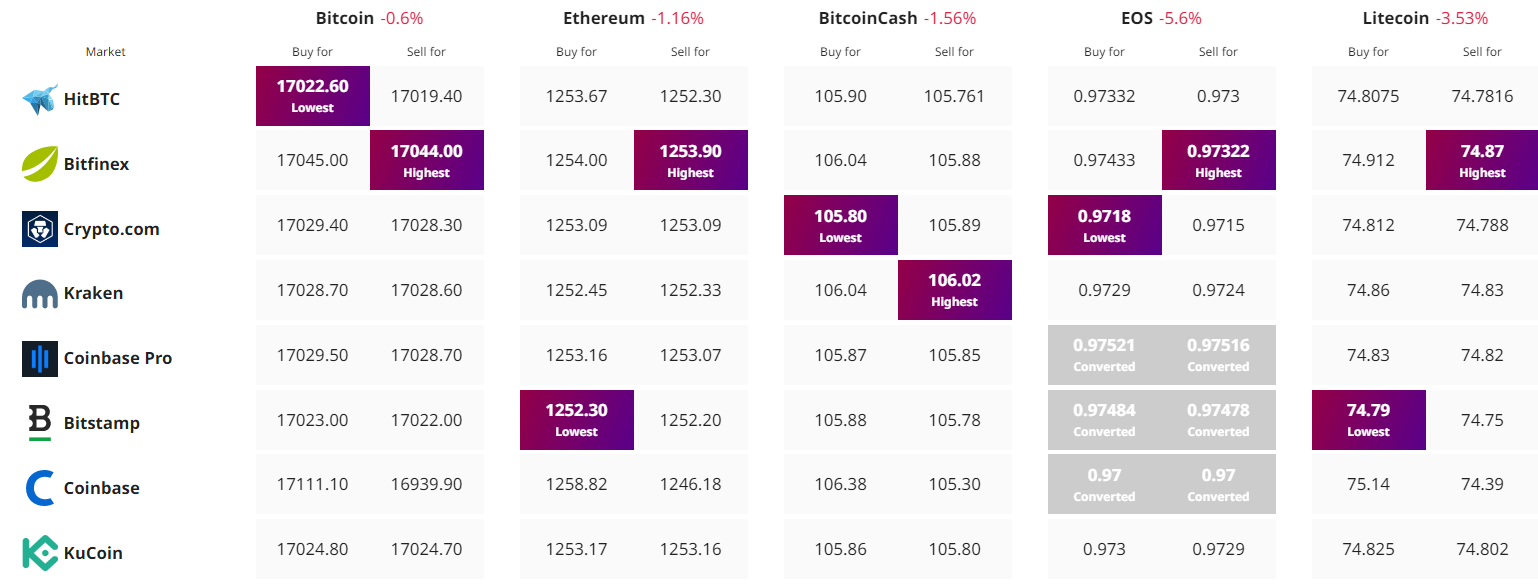

Get The Best Cost to purchaseOrMarket Cryptocurrency